(Bloomberg) — Chinese language shares fell, underperforming their Asian friends as warning grows forward of a key weekend briefing that will shed extra mild on Beijing’s fiscal stimulus.

Most Learn from Bloomberg

The CSI 300 Index dropped as a lot as 2.4%, reversing Thursday’s beneficial properties. Elsewhere in Asia, shares rose in Japan and South Korea, sidestepping losses on Wall Avenue following hotter-than-expected core inflation that heightened the concentrate on the Federal Reserve’s subsequent transfer. Equities slipped in Australia.

All eyes are on a Saturday briefing, the place China’s finance minister will doubtless announce extra help measures to revive a slowing economic system. Buyers and analysts count on Beijing to deploy as a lot as 2 trillion yuan ($283 billion) in recent fiscal stimulus as authorities search to spice up progress and restore confidence.

The declines in Chinese language shares partly replicate “the chance of one other disappointment with tomorrow’s Ministry of Finance briefing,” mentioned Kieran Calder, head of fairness analysis for Asia at Union Bancaire Privee in Singapore. “The MOF doesn’t approve additional finances or bond quota so there may be uncertainty whether or not Saturday’s briefing can ship new particulars on extra stimulus.”

US fairness futures additionally edged increased, after the S&P 500 fell 0.2% and the Nasdaq 100 dropped 0.1% Thursday. Hong Kong markets are closed Friday for a vacation.

Treasuries have been regular in early Asian buying and selling after the two-year yield fell six foundation factors and its 10-year counterpart dropped by one foundation level Thursday.

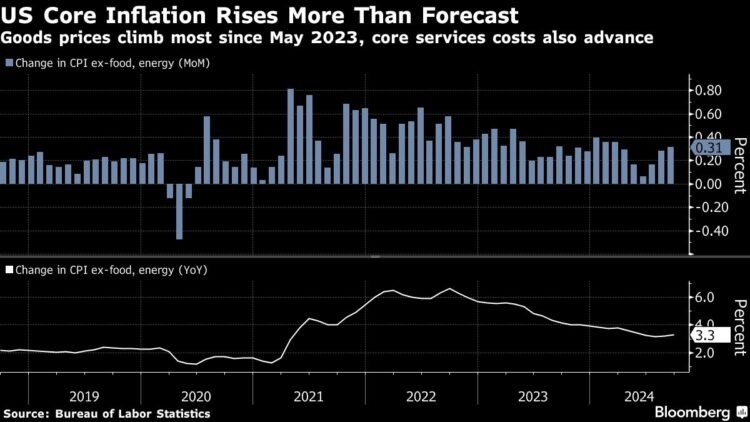

Information launched Thursday underscored the problem going through the Fed. Underlying US inflation rose greater than forecast in September in an indication of stalling progress within the struggle to deliver costs to focus on. Separate knowledge confirmed functions for US unemployment advantages rose final week to the very best in over a 12 months.

“The Fed mentioned the final mile getting towards their inflation goal goes to be robust, and that’s what we’re seeing,” mentioned David Donabedian at CIBC Personal Wealth US “However we nonetheless count on the Fed to chop charges by 1 / 4 level in November, and certain an analogous lower on the December assembly.”

Swaps market pricing indicating a possible Fed price lower subsequent month was little modified. Merchants are pricing in a roughly 80% probability that the Fed will lower by 25 foundation level when it meets in November. That in contrast with a completely priced-in transfer previous to final week’s robust US jobs knowledge.

Fed policymakers John Williams, Austan Goolsbee and Thomas Barkin have been unfazed by the higher-than-forecast shopper value index, suggesting officers can proceed decreasing charges. The outlier was Raphael Bostic of the Atlanta Fed who indicated in an interview with the Wall Avenue Journal that in projections launched in September he had referred to as for one extra quarter-point lower throughout the Fed’s two remaining conferences in 2024.

“One barely hotter-than-expected CPI studying doesn’t imply a brand new wave of inflation has been unleashed, however the truth that it accompanied a bounce in weekly jobless claims might add to short-term market uncertainty,” mentioned Chris Larkin at E*Commerce from Morgan Stanley.

“These weren’t good numbers — however that doesn’t imply they upended the bigger outlook for strong financial progress and reasonable inflation,” Larkin added.

In foreign money markets, the yen was little modified at round 148 per greenback after strengthening on Thursday whereas an index of the greenback was regular. The South Korean received held beneficial properties towards the greenback after the Financial institution of Korea lower its key rate of interest by 25 foundation factors to three.25%, as anticipated.

Oil edged decrease, trimming a few of its beneficial properties from Thursday when West Texas Intermediate futures climbed 3.6% as merchants awaited Israel’s response to Iran’s missile assault.

Buyers are additionally gearing up for third-quarter US earnings later Friday from JPMorgan Chase & Co., Wells Fargo & Co and Financial institution of New York Mellon Corp.

JPMorgan’s outlook for internet curiosity revenue might be a serious focus, after firm executives tried to tamp down expectations for the important thing income supply. As for Wells Fargo, traders might search for updates on its asset cap. BNY Mellon’s income doubtless grew 4% final quarter, the quickest tempo in additional than a 12 months, in accordance with Bloomberg Intelligence.

Key occasions this week:

-

JPMorgan, Wells Fargo kick off earnings season for the large Wall Avenue banks, Friday

-

US PPI, College of Michigan shopper sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman converse, Friday

A few of the most important strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 11:54 a.m. Tokyo time

-

Japan’s Topix rose 0.2%

-

Australia’s S&P/ASX 200 fell 0.1%

-

The Shanghai Composite fell 1.5%

-

Euro Stoxx 50 futures rose 0.3%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0937

-

The Japanese yen was little modified at 148.68 per greenback

-

The offshore yuan was little modified at 7.0797 per greenback

Cryptocurrencies

-

Bitcoin rose 1.3% to $60,494.85

-

Ether rose 1.4% to $2,399.27

Bonds

-

The yield on 10-year Treasuries was little modified at 4.06%

-

Japan’s 10-year yield declined one foundation level to 0.945%

-

Australia’s 10-year yield was little modified at 4.22%

Commodities

-

West Texas Intermediate crude fell 0.3% to $75.64 a barrel

-

Spot gold rose 0.5% to $2,643.39 an oz.

This story was produced with the help of Bloomberg Automation.

–With help from Winnie Hsu.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.