)

Mark Mobius | Photograph: Bloomberg

By Selcuk Gokoluk and Joumanna Bercetche

Rising-market equities shall be boosted by stimulus measures in China because of the nation’s massive weightings in indices and shut financial ties with different creating nations, in accordance with veteran investor Mark Mobius and Goldman Sachs strategists.

Click on right here to attach with us on WhatsApp

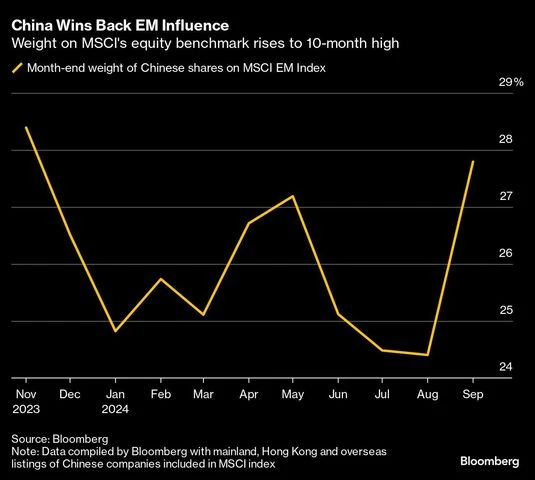

China accounts for one quarter of the benchmark MSCI EM fairness index and it means when China markets rally, the index additionally strikes up. Stimulus measures, coupled with a Federal Reserve interest-rate reduce, helped emerging-market equities leap 10% from mid-September lows.

China’s easing has broadened the emerging-market fairness rally and it has been powered by outsized beneficial properties in heavy-weight Chinese language equities, Goldman strategists together with Kamakshya Trivedi wrote in an emailed be aware. These have risen almost 40% from their lows, with China’s outperformance in opposition to the remainder of the rising markets prior to now three weeks at its widest prior to now 25 years.

They stated they anticipate additional upside in emerging-market equities, with spillovers from China’s progress in a number of nations reminiscent of South Korea, Malaysia and South Africa.

)

Goldman Sachs has raised China to chubby from the market weight in its Asia methods.

Rising-market shares funds had their highest weekly inflows with $41 billion by way of Oct. 9, Financial institution of America stated, citing EPFR World information. China equities had document inflows of $39.1 billion within the week.

Mobius, chairman of Mobius Rising Alternatives Fund, stated he believes the Chinese language authorities will attempt to stimulate the market extra as a result of they need international capital to return. “The Chinese language wish to see the market going a lot better than it has been going even now,” he stated in an interview on Bloomberg TV. “In fact there shall be corrections alongside the best way.”

Fund Allocation

Mobius stated round half of emerging-market buyers might be monitoring the index, which implies they need to allocate further funds to China on account of its massive weighting.

“It’s going to be an accelerating growth, with increasingly folks submitting in,” he stated. With India, which has the second largest weighting within the EM index, emerging-market equities may have higher prospects of outperformance in opposition to US shares.

To date, many buyers have been in opposition to China however now that’s altering, Mobius stated.

“They didn’t wish to hear something about China as a result of they have been harm so badly” he stated. “Now that’s altering. As the cash is available in, the entire pool of cash coming into rising markets will increase. You will notice this entire market transfer.”

© 2024 Bloomberg L.P.

First Revealed: Oct 11 2024 | 11:19 PM IST