Costco Wholesale (COST), popularly known as simply Costco, is a widely known big-box retail retailer chain that sells gadgets in bulk and provides family merchandise and groceries at a reduction.

When shoppers anticipate unfavorable world occasions that may hinder supply-chain exercise, such because the COVID-19 pandemic, they’ll steadily panic-shop at Costco. The corporate has evidently benefited from some unlucky latest developments on the planet, and that may probably restrict future upside potential. Costco has a excessive valuation and a low dividend yield. I’m impartial on COST, and it doesn’t appear like a great month for buyers to buy groceries on Costco inventory.

Costco and the Dock Staff’ Strike

Dock employees on America’s East and Gulf Coasts formally walked off their jobs and commenced hanging on October 1. Nonetheless, their contracts with employers resulted in late September, and shoppers used this as a chance to fill up on important items. Many individuals bear in mind what occurred close to the onset of the COVID-19 pandemic, when residents rushed to buy massive provides of merchandise like bathroom paper out of concern they may encounter empty cabinets in a while.

Whereas the dock employees’ strike has already been resolved, and can undoubtedly take a toll on the U.S. economic system, it actually gave a lift to Costco gross sales in September. The early a part of October probably featured a lot of the identical. Buyers ought to maintain this in thoughts as they assess Costco’s outcomes.

Costco Acknowledges “Irregular” Buying Exercise

Amidst the panic procuring that probably occurred in anticipation of the dock employees’ strike, Costco administration acknowledged a procuring exercise enhance in September as a result of onset of Hurricane Helene. Particularly, Costco’s administration cited “irregular shopper exercise related to Hurricane Helene and port strikes.” Hurricane Milton may “make it rain” once more for Costco’s high line in October, however that is additionally one other one-time occasion. Buyers in all probability shouldn’t depend on such occasions offering a lift to Costco indefinitely.

Breaking down Costco’s gross sales numbers for the ‘retail’ month of September (the 5 weeks ended October 6, 2024), the corporate’s web gross sales jumped 9% year-over-year to $24.62 billion. Furthermore, throughout that very same timeframe, Costco’s U.S. comparable-store gross sales elevated 6.5% and the corporate’s e-commerce gross sales surged 22.9%.

The spike in e-commerce gross sales is eye-catching, but it surely’s straightforward to think about customers ordering important family items on-line as quickly as they heard in regards to the port strike and hurricane developments. I can’t count on that Costco will preserve a ~23% progress fee in e-commerce gross sales for for much longer.

Costco’s Excessive Valuation and Low Dividend Yield

Costco buyers could have already gotten forward of themselves, for my part, as COST inventory’s valuation is kind of excessive. Alarmingly, Costco’s trailing 12-month adjusted (non-GAAP) P/E ratio is 55.1x. In distinction, the sector median P/E ratio is 17.8x and Costco’s five-year common P/E ratio is 41.2x. It’s solely potential that each one present and anticipated advantages of the aforementioned occasions have been priced into COST inventory.

Earnings-focused buyers additionally aren’t served very properly by Costco inventory on the present market value. The common ahead annual dividend yield for the Client Cyclical Sector is round 1%, versus about 0.5% for COST. Buyers gained’t be getting wealthy from Costco’s quarterly dividend distributions. No matter whether or not you’re a value-focused investor or a excessive yield seeker, Costco inventory in all probability doesn’t look engaging proper now.

Digging Deeper into Costco’s Gross sales Efficiency

Drilling down into Costco’s latest gross sales efficiency, we will observe that the corporate reported fourth-quarter Fiscal 12 months web gross sales of $78.2 billion. That’s solely a 1% enhance when in comparison with the $77.4 billion in web gross sales that Costco generated within the year-ago quarter.

As we’ll focus on beneath, analysts are typically solely lukewarm about COST inventory. This evaluation, regardless of Costco’s impressive-looking September efficiency, makes logical sense to me. In gentle of the corporate’s lackluster fourth-quarter web gross sales progress, one may suspect that September was simply an outlier.

Yellow Flags in Costco’s Financials

Furthermore, after checking the TipRanks’ Financials web page for Costco, we are going to uncover some potential cautionary alerts. Costco’s money and money equivalents place dwindled from $15.23 billion within the year-earlier interval to $11.14 billion within the quarter ended August 2024. Throughout that timeframe, Costco’s free money movement decreased from $2.17 billion to $1.38 billion, which is a notable decline. The deteriorating money image additional helps my impartial place on COST inventory.

The corporate can be up in opposition to powerful comps, and will probably be attention-grabbing to see how buyers react to considerably decrease sequential outcomes. Per TipRanks’ earnings web page for Costco, we will see an EPS expectation of solely $3.78 for the present quarter. That represents a big drop from the latest quarter’s $5.29 EPS consequence. That’s one more reason to be cautious on COST inventory on the present time, for my part.

Is Costco Inventory a Purchase, In response to Analysts?

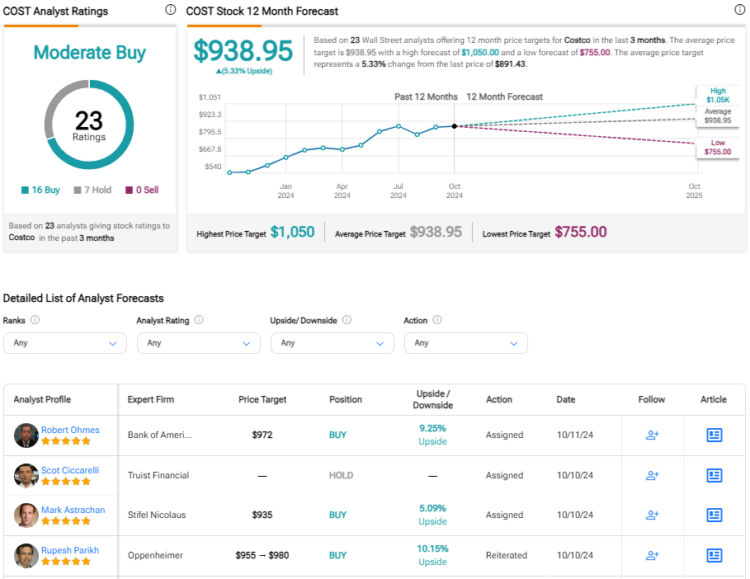

On TipRanks, COST is available in as a Reasonable Purchase primarily based on 16 Buys and 7 Maintain rankings assigned by analysts previously three months. There aren’t any present Promote rankings. The common COST inventory value goal is $938.95, implying about 5% potential upside.

In the event you’re questioning which analyst you must observe on COST inventory, probably the most worthwhile analyst overlaying the inventory (on a one-year timeframe) is Laura Champine of Loop Capital Markets, with a median return of 30.09% per score and a 96% success fee.

Conclusion: Ought to Buyers Think about Costco Inventory?

At present, COST inventory doesn’t appear very interesting primarily based on worth or dividend yield measures. The corporate’s September retail revenues had been very spectacular, but it surely’s onerous to think about that the market hasn’t already factored the optimistic numbers into the present valuation. Future outcomes are additionally vulnerable to a dearth of one-time occasions which have boosted Costco’s enterprise these days.

As a shopper, I’d store at Costco to fill up on important gadgets, however as an investor I don’t really feel any draw to investing on COST inventory proper now. In the interim, I’m staying impartial on shares of Costco.