Investor Perception

As demand for copper continues to rise, pushed by international electrification developments, Los Andes Copper is well-placed to leverage its vital copper place in Chile, pushed on the helm by a bunch of extremely skilled technical and enterprise leaders.

Overview

The electrification transition is already in movement and driving demand for copper, an important steel for manufacturing rising applied sciences. Copper is already present in electronics worldwide, and as clear power applied sciences goal to interchange fossil fuels, demand will solely enhance — it is projected that copper demand will probably attain 50 million metric tons by 2035. A separate evaluation estimates the world copper deficit could hit greater than 8.5 metric tons by 2030.

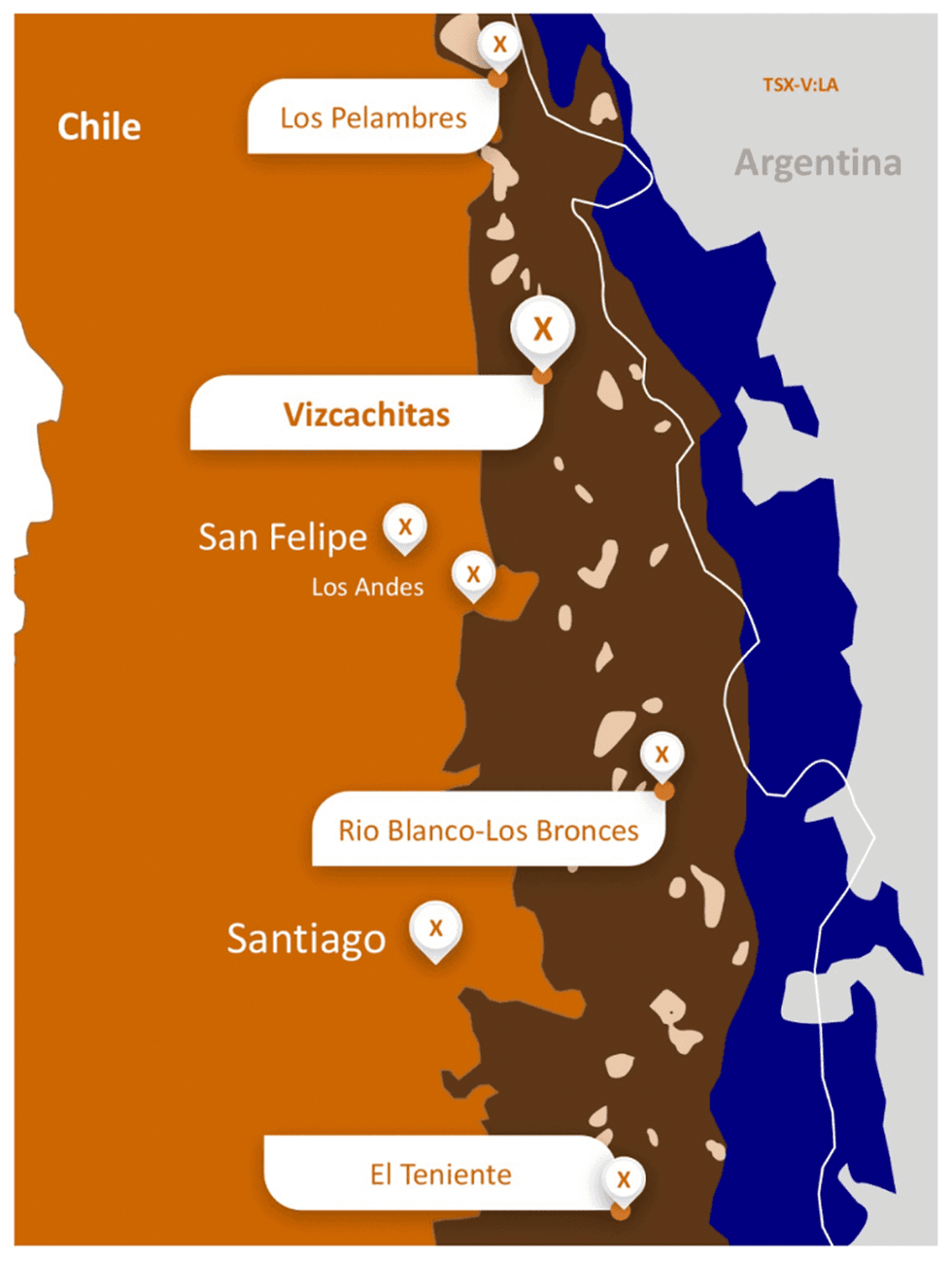

Rising copper demand has put the highlight on Chile which hosts a number of the world’s largest copper deposits. It’s presently the high copper producer on the earth, producing greater than twice the amount of its closest competitor, Peru. The nation is a steady, mining-friendly jurisdiction that has already attracted prolific mining corporations.

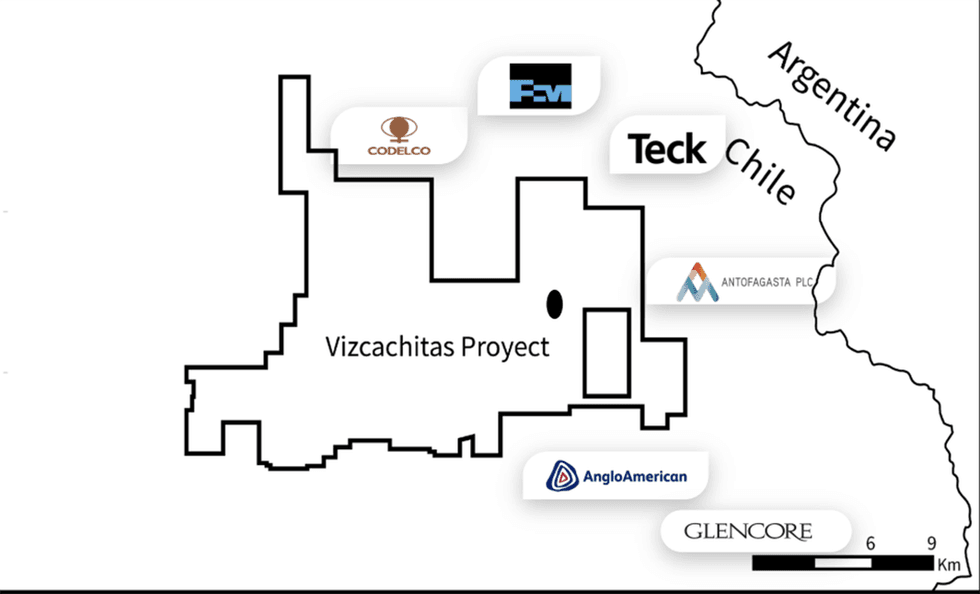

Los Andes Copper (TSXV:LA,OTCQX:LSANF) is a Vancouver-based mining firm specializing in creating its one hundred pc owned, Vizcachitas copper-molybdenum porphyry challenge in Chile. Vizcachitas is without doubt one of the largest superior copper tasks not owned by a serious mining firm and has the potential to turn out to be a world-class mine. An skilled administration workforce with many years of assorted expertise within the pure sources trade gives confidence within the firm’s capacity to achieve its objectives.

The corporate filed a constructive pre-feasibility research in 2023 indicating US$2.78 billion after-tax internet current worth (NPV) utilizing an 8 p.c low cost charge and an inner charge of return (IRR) of 24.2 p.c at US$ 3.68/lb copper, US$12.90/lb molybdenum and US$21.79/oz silver, with an estimated preliminary capital price of US$2.44 billion. The PFS additionally highlighted a development interval of three.25 years and a payback interval of two.5 years from preliminary manufacturing.

The Vizcachitas challenge is surrounded by mining majors

Los Andes works intently with the local people to assist the event of native companies and social organizations. The corporate has joined the Affiliation of Small Miners of Putaendo and has established a number of applications to assist social organizations, native technical excessive colleges and feminine entrepreneurs. Los Andes can also be environmentally conscious and strives to take care of a superb ESG ranking.

The corporate’s administration workforce is skilled within the pure sources trade, together with consultants in geology, neighborhood affairs, and company finance.

Firm Highlights

- Los Andes Copper is a Vancouver-based mining firm centered on creating its world-class Vizcachitas copper challenge in Chile.

- To assist the challenge, the corporate has acquired a mixed US$14 million in investments from Queen’s Street Capital and US$ 20 million from Ecora Assets.

- The Vizcachitas challenge has large blue-sky potential and is the most important superior copper challenge within the Americas owned by a junior miner.

- The corporate launched the outcomes of its pre-feasibility research (PFS) in 2023 with a US$2.8 billion post-tax NPV8 and 24 p.c IRR at US$3.68 copper.

- The corporate strives to take care of a superb ESG ranking and works intently to assist the local people and decrease the challenge’s environmental affect.

- An skilled administration workforce leads Los Andes Copper with a spread of expertise all through the mining trade.

Key Mission

Vizcachitas Copper Mission

https://investingnews.com/shares/tsxv-la/los-andes-copper/

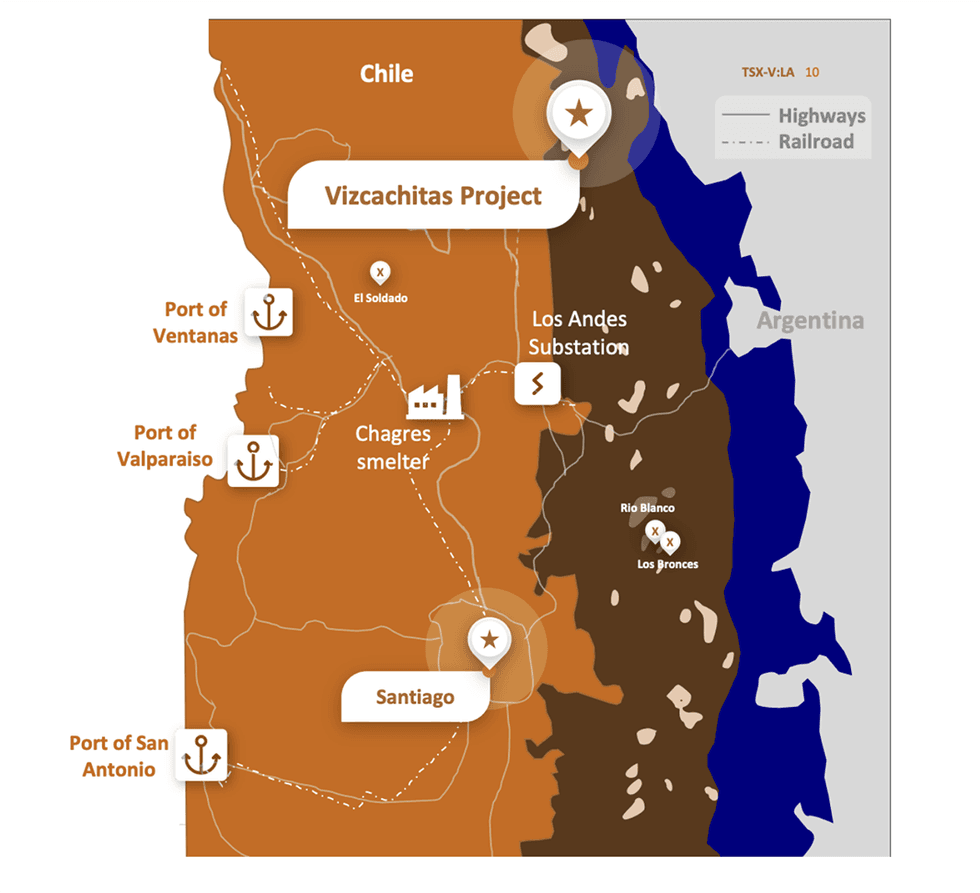

The 100-percent-owned Chilean Vizcachitas copper challenge is without doubt one of the largest superior copper deposits within the Americas and the most important deposit owned by a junior miner. The challenge is positioned within the Rio Rocin Valley, roughly 150 kilometers northeast of Santiago.

Mission Highlights:

- Sturdy Current Infrastructure: The challenge is accessed by a 124-kilometer paved freeway, a close-by railway and transport ports. Because of the presence of present copper mines, smelting amenities are accessible by railway. Moreover, there are a number of massive energy substations close to the challenge.Accomplished PFS: 2023 Pre-Feasibility Research outcomes indicated:

- US$2.78 billion after-tax NPV utilizing an 8 p.c low cost charge and an IRR of 24.2 p.c at US$ 3.68/lb copper, US$12.90/lb molybdenum, and US$21.79/oz silver, with an estimated preliminary capital price of US$2.44 billion.

- A development interval of three.25 years and a payback interval of two.5 years from preliminary manufacturing.

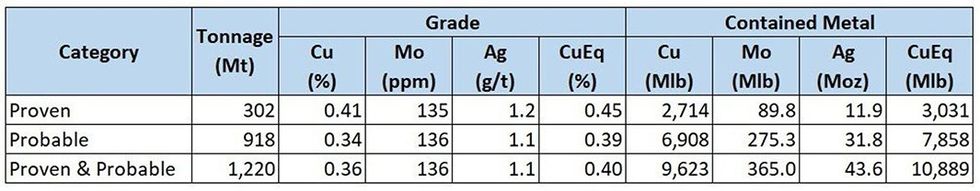

- A 16-percent enhance in measured and indicated sources from the preliminary financial evaluation dated June 13, 2019, to 14.8 billion kilos (lbs) copper equal grade (CuEq).

- measured sources of two.61 billion lbs copper, 84 million lbs molybdenum, and 11 million ounces (Moz) silver;

- indicated sources of 10.42 billion lbs of copper, 442 million lbs of molybdenum, and 43 Moz of silver;

- and enhance inferred sources by 130 p.c to fifteen.4 billion lbs CuEq (13.75 billion lbs copper, 495 million lbs molybdenum, 55 Moz silver).

- Devoted to a robust ESG ranking: The PFS centered on using the newest sustainable mining strategies which resulted in a 50 p.c discount in water consumption, and a 25 p.c discount in power use and confined the challenge to at least one valley, lowering the challenge footprint. The corporate has additionally dedicated to utilizing desalinated water, making certain a sustainable water provide. Moreover, the corporate works intently with native communities to enhance the information and understanding of the longer term Vizcachitas Mission and of the a number of alternatives {that a} sustainable mining challenge like Vizcachitas will convey to the neighborhood.

- Royalty Settlement with Ecora Assets: Los Andes closed a royalty settlement with Ecora Assets, a number one royalty and streaming firm centered on investing in future-facing commodities. The settlement features a $20 million money consideration paid to Los Andes in return for royalty funds equal to 0.25 p.c internet smelter return royalty on minerals offered on open pit operations and 0.125 p.c NSR on underground operations.

- Allow to Restart Drilling: The Second Environmental Court docket in Chile dominated that Los Andes has complied with all of the situations imposed on July 20, 2022 and is now approved to restart drilling.

Administration Staff

Santiago Montt – CEO

With 11 years of expertise within the mining sector, Santiago Montt has a regulation diploma from the College of Chile, a J.S.D. regulation diploma (PhD) from Yale College, and a Grasp’s in Public Coverage from Princeton College. He has labored for BHP from 2011 to 2021 in numerous roles: vice-president of company affairs for the Americas, VP of ligation (World), VP of authorized Brazil, and VP of authorized copper. He’s an skilled skilled within the areas of stakeholder administration, danger administration, disaster administration, challenge administration and business and authorized affairs

Antony Amberg – Chief Geologist

Anthony Amber is a chartered geologist with 32 years of various expertise working in Asia, Africa, and South America. Amberg is a certified particular person beneath NI 43-101. He has managed numerous exploration tasks starting from grassroots by means of to JORC-compliant feasibility research. In 2001, he returned to Chile the place he began a geological consulting agency specializing in challenge analysis and NI 43-101 technical stories. He started his profession in 1986 working with Anglo American in South Africa earlier than shifting on to work for the likes of Severin-Southern Sphere, Bema Gold, Rio Tinto and Kazakhstan Minerals Company.

Ignacio Melero – Director of Company Affairs and Sustainability

Ignacio Melero is a lawyer with a level from Pontificia Universidad Católica de Chile with huge expertise in company and neighborhood affairs. Earlier than Los Andes, Ignacio was accountable for neighborhood affairs at CMPC, having managed neighborhood and stakeholder affairs for numerous its pulp and forestry divisions all through the nation. Ignacio has labored for the Authorities of Chile, within the Ministry Basic Secretariat of the Presidency. He was accountable for the inter-ministerial coordination of the ChileAtiende challenge, a multi-service community linking communities, regional governments and public companies.

Gonzalo Saldias – Geologist Marketing consultant

Gonzalo Saldias is a geologist with a level from the Universidad Católica del Norte, Chile, with greater than 35 years of expertise working inside Chile and internationally. He labored for Antofagasta Minerals from 2007 to 2015, and for Placer Dome Latin America for ten years. He additionally labored for Codelco as head of exploration geology for the El Salvador Division.

Harry Nijjar – Chief Monetary Officer

Harry Nijjar holds a CPA CMA designation from the Chartered Skilled Accountants of British Columbia and a Bachelor of Commerce from the College of British Columbia. He’s a managing director of Malaspina Consultants. Nijjar has been working with private and non-private corporations for the previous 10 years in numerous roles. He’s additionally presently the CFO of Darien Enterprise Improvement and Clarmin Explorations.

Manuel Matta – Senior Mining and Mission Marketing consultant

Manuel Matta is a mining engineer from the College of Chile, with greater than 30 years of expertise in operations, planning and tasks. He labored for Falconbridge and Xstrata as vice-president of tasks and improvement the place he led the enlargement of the Collahuasi mine. He was additionally the overall supervisor of Altonorte Smelter in Chile. Matta additionally labored for Barrick Gold in Chile and the Dominican Republic and was the overall supervisor of Las Cenizas copper mines in Chile.