Test again for updates all through the buying and selling day

U.S. fairness futures had been blended in early Wednesday buying and selling, whereas tech shares appeared to rebound from yesterday’s late-session stoop, as buyers continued to defend the market’s strong autumn rally heading into the beginning of the third-quarter-earnings season.

Up to date at 6:41 AM EDT

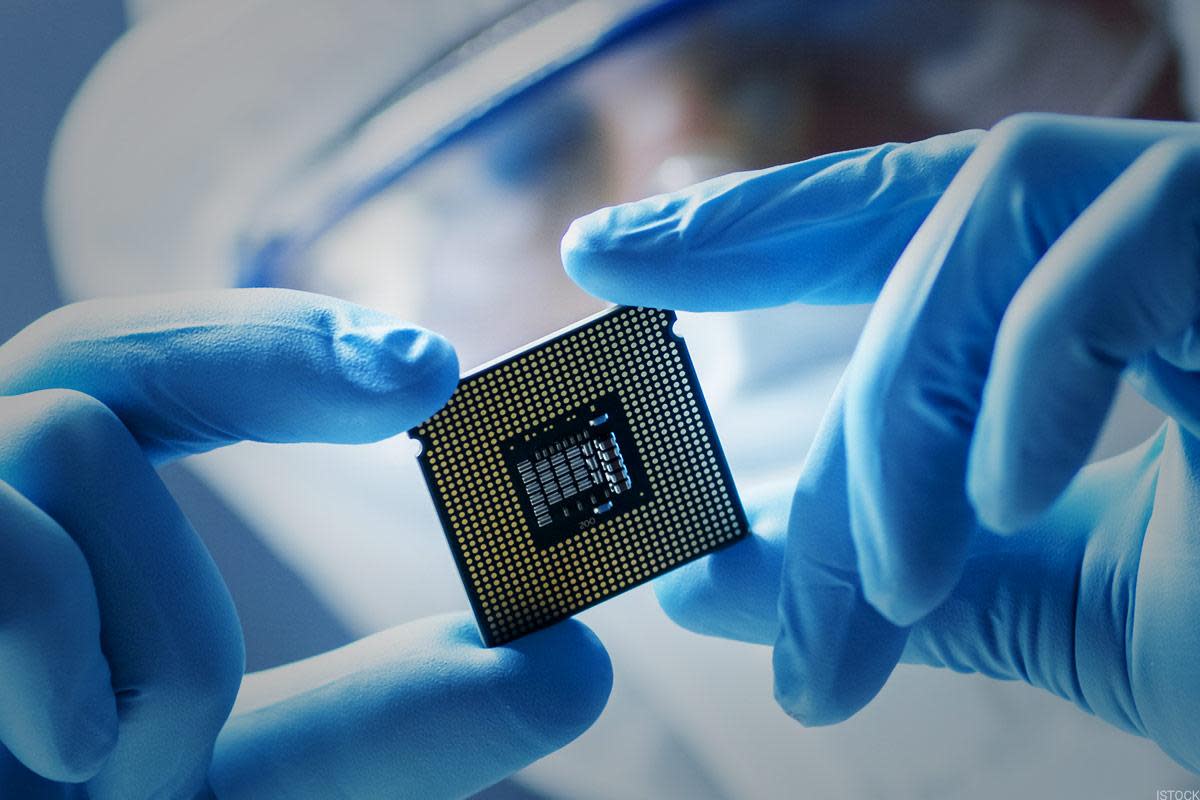

Intel evaluation

Intel (INTC) shares moved decrease in early buying and selling after China’s tech watchdogs known as on the federal government to think about the tech group’s merchandise a risk to nationwide safety.

The Cyber Safety Affiliation stated Intel chips needs to be topic to an intense evaluation to be able to “safeguard China’s nationwide safety and the reliable rights and pursuits of Chinese language customers” within the newest tit-for-tat transfer in a broader commerce conflict with the U.S.

Intel shares had been final marked 2% decrease in premarket buying and selling to point a gap bell value of $22.17 every.

CHINA CYBERSECURITY ASSOCIATION CALLS FOR REVIEW OF $INTC PRODUCTS

The China Our on-line world Safety Affiliation recommends a cybersecurity evaluation of Intel’s merchandise offered in China, citing frequent vulnerabilities, reliability points, and hidden backdoors.

Intel’s CPUs have…

— iTradeOptions (@iTrade_Options) October 16, 2024

Inventory Market In the present day

Shares ended decrease on Tuesday, with the Nasdaq falling greater than 1% within the late hours of the session following a grim third quarter replace from European chip tools maker ASML (ASML) , which warned that the demand heading into 2025, exterior of AI, would stay muted.

“It now seems the restoration is extra gradual than beforehand anticipated,” Chief Government Christophe Fouquet stated. “That is anticipated to proceed in 2025, which is resulting in buyer cautiousness.”

A Bloomberg report suggesting the Biden administration is looking for to cap abroad chip gross sales to sure nations deemed to be a nationwide safety danger added to the drawdown, with the Van Eck Semiconductor ETF (SMH) falling 5.4% by the shut of buying and selling.

Nvidia (NVDA) , which tumbled round 4.5% yesterday, is a modest early acquire, alongside Intel and Superior Micro Units (AMD) .

iStock

That is serving to the Nasdaq in premarket buying and selling, which is priced for a modest 20 level opening bell acquire, in addition to the S&P 500, which is a 2 level advance.

The Dow Jones Industrial Common, in the meantime, is named round 24 factors decrease.

Away from equities, world oil costs steadied following yesterday’s stoop, which took WTI futures to a two-week low, as buyers stay involved about the potential for an Israeli strike on Iranian vitality services because the conflict within the Gulf area continues to escalate.

Associated: What’s subsequent for S&P 500 returns as rally enters third yr

Brent crude futures contacts for December supply, the worldwide benchmark, had been final seen buying and selling 11 cents larger at $74.37 per barrel whereas WTI contracts for November supply, that are tightly linked to U.S. gasoline costs, rose 18 cents to $70.76 per barrel.

In abroad markets, Britain’s FTSE 100 rose 0.57% in early London buying and selling following information displaying inflation final month fell under the two% mark for the primary time since 2021, permitting for an easing of the pound in opposition to the greenback on overseas change markets.

Extra Wall Road Analysts:

- Analysts replace Meta inventory value goal with Q3 earnings in focus

- Analysts replace outlook for Nvidia’s Blackwell chips amid AI increase

- Analyst reboots Reddit inventory value goal forward of earnings

The regionwide Stoxx 600, in the meantime, was marked 0.35% decrease amid one of many largest slumps in ASML shares in additional than three many years and a pointy pullback in luxurious items firm LVMH. (LVMUY)

In a single day in Asia, Japan’s Nikkei 225 was marked 1.83% decrease following final evening’s selloff on Wall Road, whereas the regional MSCI ex-Japan benchmark fell 0.62% into the shut of buying and selling.

Associated: Veteran fund supervisor sees world of ache coming for shares