Every week earlier than Federal Reserve officers collect to mirror on the suitable tempo of interest-rates cuts, three high-profile stories are set to point out underlying resilience within the US economic system and a brief hiccup in job progress.

Article content

(Bloomberg) — A week before Federal Reserve officials gather to reflect on the appropriate tempo of interest-rates cuts, three high-profile reports are set to show underlying resilience in the US economy and a temporary hiccup in job growth.

Friday’s employment report, expected to show a modest 110,000 increase in payrolls — about half this year’s average gain of 200,000 — will reflect hits to the labor market from two hurricanes as well as a work stoppage at aircraft maker Boeing Co. The unemployment rate is forecast to hold at 4.1%.

Advertisement 2

Article content material

Economists anticipate Fed policymakers to low cost these short-term elements and decrease charges 1 / 4 share level at their Nov. 6-7 assembly. Whereas officers are assured that worth pressures are typically abating, a separate report is forecast to point out the central financial institution’s most well-liked gauge of underlying inflation accelerated on the finish of September.

The private consumption expenditures worth index, excluding risky meals and vitality prices, is seen rising 0.3%, probably the most in 5 months. The report on Thursday can be anticipated to point out client spending and private earnings strengthened in September from a month earlier, indicating momentum within the largest a part of the economic system.

What Bloomberg Economics Says:

“We anticipate October’s US payrolls report to point out the primary adverse jobs print since December 2020, effectively beneath the consensus forecast of 120k. A lot of the weak spot is because of weather-related disruptions, however we additionally see a slowdown in cyclical sectors.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins. For full evaluation, click on right here

On Wednesday, the federal government can even challenge its first estimate of third-quarter gross home product, and forecasts name for a stable 3% annualized tempo that will match progress seen within the earlier three months. Along with strong client spending, GDP was probably bolstered by a pickup in enterprise outlays for gear.

Article content material

Commercial 3

Article content material

Different stories this week embrace September job openings, third-quarter employment prices and October client confidence. The Institute for Provide Administration can even launch its October manufacturing index.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

In Canada, GDP knowledge will present if the economic system is on monitor to hit the Financial institution of Canada’s forecast of 1.5% annualized progress within the third quarter. Officers beforehand estimated 2.8% progress however revised that down as they reduce charges by 50 foundation factors on Oct. 23. Amongst appearances, Financial institution of Canada Governor Tiff Macklem and his colleague Carolyn Rogers will communicate to lawmakers about that call.

Elsewhere, the UK’s carefully watched funds announcement, euro-zone inflation and progress numbers, the Financial institution of Japan’s charge resolution and buying supervisor indexes exhibiting the well being of China’s economic system will likely be among the many highlights.

Click on right here for what occurred final week and beneath is our wrap of what’s developing within the international economic system.

Asia

China’s PMIs loom massive within the coming week, with policymakers, economists and traders eager to gauge the present power of the underperforming economic system.

Commercial 4

Article content material

It’s most likely too quickly to see if latest stimulus measures are having any preliminary influence, but when companies and building exercise joins the manufacturing facility sector in declining, requires extra efforts from Beijing are prone to mount.

The BOJ meets Thursday and is extensively anticipated to maintain rates of interest unchanged. With renewed weak spot within the yen probably on the thoughts of policymakers, market gamers will likely be searching for any hawkish alerts that counsel that the following hike is within the pipeline for December or not.

Elsewhere, Australia stories on worth progress on Wednesday, with costs anticipated to gradual, however probably not by sufficient to reignite near-term charge reduce speak.

Indonesia and Pakistan additionally launch inflation figures, whereas Hong Kong and Taiwan report on GDP.

PMIs from round Asia out Friday will give a sign of how the area’s economic system is performing past China, as will commerce figures from Thailand, Hong Kong, and South Korea.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

The primary glimpses of onerous knowledge that the European Central Financial institution will use to tailor its subsequent easing transfer in December will likely be launched this week, at a time when traders have more and more priced within the likelihood of a half-point charge discount.

Commercial 5

Article content material

Whereas indicators of weakening are rising, third-quarter GDP numbers on Wednesday are anticipated to point out the economic system sustained a 0.2% tempo of progress, after buoyancy in Spain and regular growth in France and Italy made up for a German recession.

Euro-zone inflation on Thursday is predicted by economists to have quickened barely to 1.9%, slightly below the ECB’s 2% goal, with Germany’s final result even exceeding the purpose.

Such outcomes would conform to policymakers’ forecasts of a brief pickup earlier than worth progress then settles across the purpose within the first half of subsequent 12 months.

Elsewhere in Europe, Swiss inflation is predicted to have stayed regular at 0.8%, effectively beneath the central financial institution’s ceiling. Economists forecast an additional charge reduce in December.

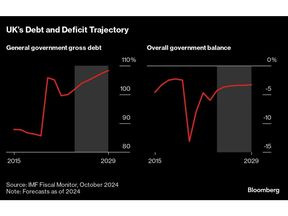

Within the UK, Chancellor of the Exchequer Rachel Reeves will unveil the primary funds of the newly elected Labour authorities on Wednesday, probably one in every of Britain’s most vital fiscal bulletins for years to come back.

She faces a good balancing act, with the Worldwide Financial Fund advising a ramp-up in public funding, but in addition a push to restore its funds in the long term.

Commercial 6

Article content material

Reeves is poised to overtake fiscal guidelines that might enable far more borrowing for capital spending, whereas she can be prone to goal traders to lift the tax take.

South African Finance Minister Enoch Godongwana will current his personal annual mid-term funds on Wednesday.

This would be the first since a multi-party authorities was shaped with the centrist Democratic Alliance and eight different smaller rivals after the African Nationwide Congress misplaced its outright majority in Might 29 elections.

Godongwana’s speech will likely be carefully watched for information on efforts to rein in runaway state debt, new financial progress targets and the way the federal government with again President Cyril Ramaphosa’s pledge to show the nation right into a building website — together with particulars on a credit-guarantee facility to spice up personal sector involvement within the plan.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

The flash third-quarter financial output knowledge from Mexico could be anticipated to point out Latin America’s No. 2 economic system is downshifting into year-end.

The consensus of analysts is that progress will gradual for a 3rd 12 months in 2024 and sure but once more in 2025.

Commercial 7

Article content material

Unemployment knowledge for September will probably present a sixth straight rise. Even so, at simply round 3%, joblessness remains to be effectively beneath its long-term common.

Against this, September knowledge ought to present Chile’s labor market remains to be working with a point of slack whereas copper output within the top-producing nation will probably present that restoration from 20-year lows pushed forward.

Peru watchers will likely be eager to see the core prints in October’s inflation report. Talking after policymakers’ shock Oct. 10 charge maintain, central financial institution Chief Economist Adrian Armas cited core inflation, inflation expectations and financial progress as causes to pause.

In Brazil, industrial output in September most likely cooled from 2024’s torrid tempo, the temperature of an already tight labor market ticked larger whereas funds figures headed deeper into the pink.

Colombian policymakers on Thursday are all however sure to increase their present easing cycle to a longest-ever eighth straight assembly, trimming borrowing prices to as little as 9.5%. Analysts surveyed by the central financial institution don’t see a pause earlier than 4Q 2025.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Paul Jackson, Robert Jameson, Monique Vanek, Laura Dhillon Kane, Tom Rees and Shiyin Chen.

Article content material