The Santa Claus Rally refers to a traditionally noticed inventory market phenomenon the place U.S. fairness markets are inclined to carry out properly over the last 5 buying and selling days of the yr and the primary two buying and selling days of the brand new yr. Traditionally, the common achieve throughout this seven-day interval is round 1.3%.

As time has gone on, largely because of bullish optimism, the Santa Claus Rally has prolonged in each period and upside. As we speak, the Santa Claus Rally rally begins as early as November 25 and lasts by the top of the yr. Throughout this modern-day model of the Santa Claus Rally, the common S&P 500 return is double at 2.6%.

Origins of the Santa Claus Rally

The time period was popularized by Yale Hirsch, the creator of the Inventory Dealer’s Almanac, within the Nineteen Seventies. Hirsch noticed this recurring sample of market energy in the course of the vacation season and dubbed it the “Santa Claus Rally.”

Whereas the precise origins usually are not tied to any single occasion, the phenomenon has been acknowledged for many years and studied extensively in monetary markets.

Historic Tendencies Of The Santa Claus Rally

- Timing: The rally sometimes spans the ultimate 5 buying and selling days of the calendar yr and the primary two buying and selling days of the brand new yr.

- Efficiency: Traditionally, the S&P 500 has proven common positive aspects of about 1.3% throughout this seven-day interval, which is notably greater than the common weekly efficiency all year long.

- Frequency: Over 70% of the time, the markets have posted optimistic returns throughout this era. It is just like how in any given yr, the S&P 500 closes up 70% of the time for the yr.

Theories Behind the Santa Claus Rally

A number of theories try to elucidate why the Santa Claus Rally happens:

- Optimism and Vacation Cheer: The vacation season typically fosters a way of optimism amongst buyers, resulting in elevated shopping for exercise. As people, most of us are hardwired to count on higher instances forward for our personal survival.

- Tax Issues: Some buyers promote dropping positions earlier than year-end to harvest tax losses, adopted by reinvestments out there. Nonetheless, this promoting must happen earlier than November, often in October, for the Santa Claus Rally to have a better likelihood of occurring. Tax-loss harvesting could also be one motive why October tends to be one of many weakest buying and selling months of the yr.

- Low Buying and selling Quantity: With many institutional buyers and merchants on vacation, retail buyers might exert better affect available on the market, typically skewing it upward.

- Yr-Finish Bonuses: The inflow of year-end bonuses can result in elevated funding exercise.

- Portfolio Rebalancing: Fund managers might alter portfolios to enhance year-end efficiency metrics, including to market positive aspects.

- New Yr Expectations: Buyers place themselves for a robust begin to the brand new yr, contributing to the rally.

Wall Avenue Is Virtually All the time Optimistic In The Fourth Quarter

Once I was engaged on Wall Avenue at Goldman Sachs and Credit score Suisse, the speak of the Santa Claus Rally would start in mid-November. Because the yr wound down, the ambiance turned festive, and anticipation for year-end bonuses grew. These bonuses typically ranged from 20% to 250% of our base salaries, making a palpable buzz all through the workplace.

November by February was arguably the very best time to be an funding banker or Wall Avenue dealer. The tempo of labor slowed, vacation events had been in full swing, and the hefty bonus checks made it all of the extra rewarding. It was a time to have fun the yr’s onerous work and benefit from the fruits of our labor.

As soon as the bonus checks hit by the top of February, hungry staff would typically leap to a competing agency for the next assured pay day. I considerably remorse not taking the cash by leaping ship as properly. I used to be a loyal solider at Credit score Suisse for 11 years, shunning a possibility in New York Metropolis at an upstart financial institution that supplied me a two-year assure for far more cash.

For these of you with full-time jobs, cherish the fourth quarter! When you retire, you’ll miss the posh of getting paid full wages for taking it simple. It’s like being on parental depart whereas nonetheless incomes your full wage. Oh, how I want I had loved these advantages again once I was working!

The Significance of the Santa Claus Rally

The Santa Claus Rally is usually seen as a barometer of short-term market sentiment. When the rally fails to materialize, it could actually sign bearish sentiment or broader financial considerations for the yr forward. Buyers, typically influenced by superstition, are inclined to act on momentum—whether or not optimistic or detrimental.

Unfavourable momentum within the inventory market incessantly persists till a big catalyst shifts sentiment. Equally, optimistic momentum can maintain itself, particularly when uncertainty in regards to the future diminishes, making a suggestions loop that drives additional positive aspects.

For instance, markets typically rally after a brand new president will get elected, constructing on current momentum and sparking a year-end Santa Claus Rally.

The S&P 500 has usually carried out properly underneath the Biden/Harris administration, apart from the bear market in 2022. Trying forward, with Donald Trump’s return to workplace, there’s optimism tied to his insurance policies favoring decrease taxes and decreased regulation—each of which may enhance company earnings and inventory costs.

If Harris had gained, inventory market momentum would seemingly have continued, as her victory would have eliminated uncertainty in regards to the subsequent 4 years. Her insurance policies would seemingly have been just like Biden’s, probably with a extra reasonable method.

Make investments For The Lengthy Time period

Whereas the Santa Claus Rally has usually held up over time, its predictive energy is much from sure, particularly in risky markets. Occasions like geopolitical tensions, surprising financial information, or Federal Reserve coverage shifts can simply overshadow this seasonal development. Nonetheless, some short-term merchants could be tempted to capitalize on the rally, trying to day commerce throughout this time interval.

The Santa Claus Rally stays an interesting and much-discussed phenomenon, underscoring the psychological and behavioral patterns that affect market actions. It serves as a reminder of how custom and sentiment can drive investor habits, even in refined monetary markets.

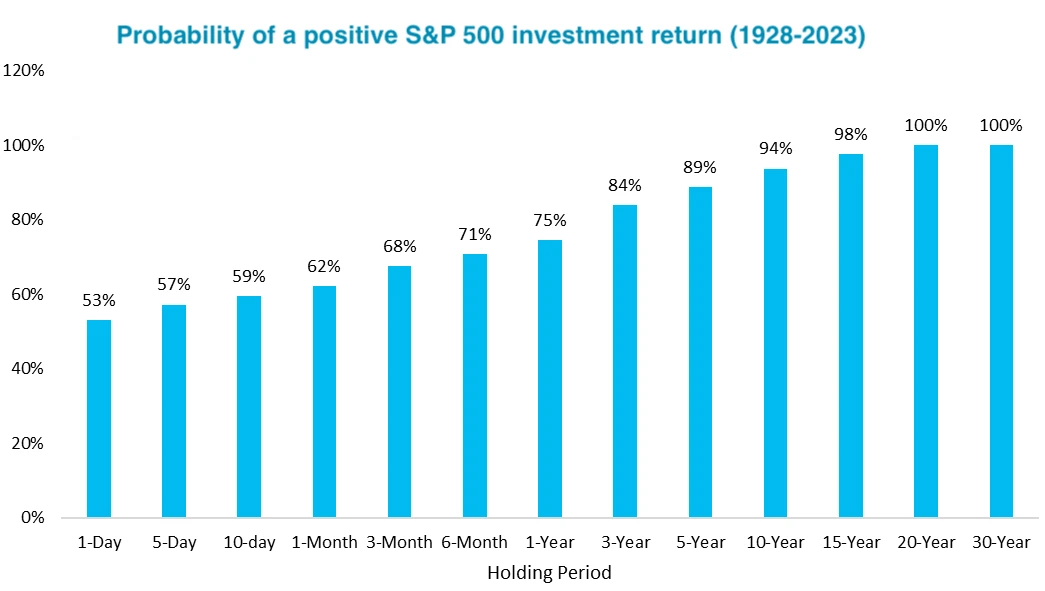

That stated, getting too emotional in both path isn’t useful for buyers. The very best method is to remain disciplined—dollar-cost averaging into the market together with your accessible money circulation and sustaining a long-term funding perspective. Over time, consistency tends to beat chasing seasonal tendencies.

Readers, what do you concentrate on the probabilities of a Santa Claus Rally this yr, given the sturdy efficiency of the S&P 500 to date? Do you have interaction in any further buying and selling or year-end rebalancing that may contribute to market momentum?

Diversify Into Non-public Actual Property

With shares performing so strongly, chances are you’ll wish to diversify into actual property. It’s an funding that mixes the earnings stability of bonds with better upside potential. The Fed is on a multi-year rate of interest reduce cycle, and I count on actual property demand to develop within the coming years.

Take into account Fundrise, a platform that permits you to 100% passively spend money on residential and industrial actual property. With over $3 billion in non-public actual property belongings underneath administration, Fundrise focuses on properties within the Sunbelt area, the place valuations are decrease, and yields are usually greater.

I’ve personally invested over $270,000 with Fundrise, and so they’ve been a trusted companion and long-time sponsor of Monetary Samurai. With a $10 funding minimal, diversifying your portfolio has by no means been simpler.

Be a part of 60,000+ others and subscribe to my free weekly publication right here. Monetary Samurai was based in 2009 and is the main private finance web site right this moment. The whole lot is written primarily based on firsthand expertise as cash is just too essential to be left as much as pontification.