- 19% enhance in confirmed and possible mineral reserves as in comparison with the 2023 estimate, together with a 24% enhance on the Santo Antônio Vein.

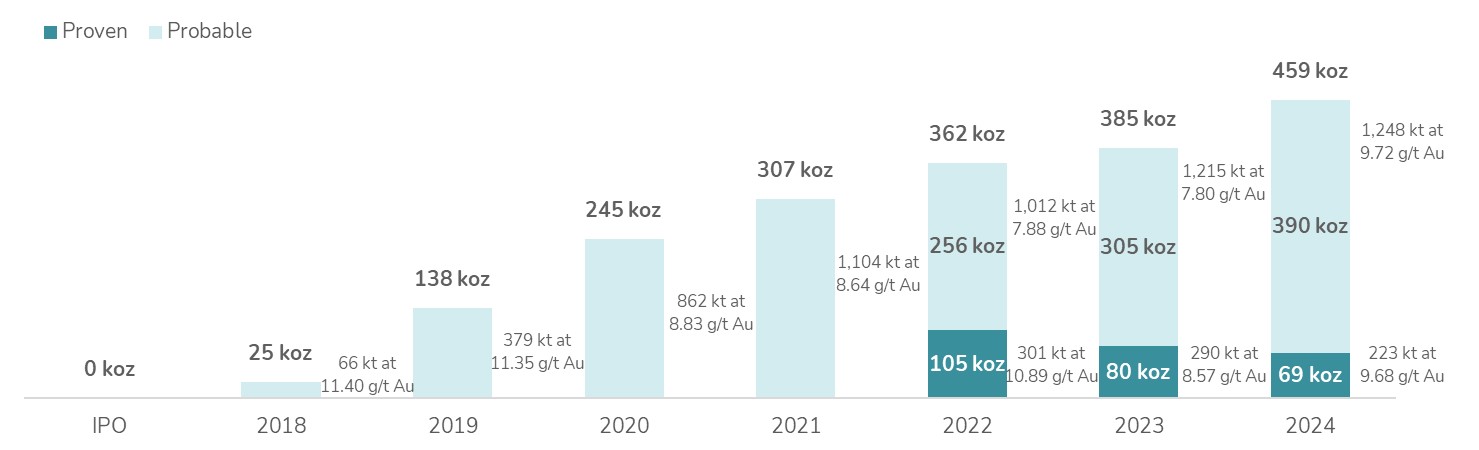

- Confirmed and possible mineral reserve compound annual development charge (“CAGR”) of roughly 62% from 2018 to 2024.

- 26% enhance in measured and indicated mineral sources, inclusive of mineral reserves, as in comparison with the 2023 estimate, together with a 31% enhance on the Santo Antônio Vein.

- Extra mill capability of roughly 25% continues to supply additional growth potential within the near- and medium-term.

“Our ongoing exploration program on the Xavantina Operations continues to ship distinctive outcomes,” said David Strang, Chief Govt Officer. “After we acquired this asset in 2016, it had no mineral reserves, no mine life, and annual manufacturing of simply 25,000 ounces. We’ve got since reworked it into a strong operation with almost 600,000 ounces of measured and indicated sources, together with 459,000 ounces of confirmed and possible reserves. The profitable completion of our NX 60 Initiative in 2023, highlighted by first manufacturing from the Matinha Vein, was a significant milestone, positioning Xavantina to maintain annual manufacturing of roughly 55,000 to 60,000 ounces within the years forward.

“We’re equally enthusiastic about Xavantina’s untapped potential, each close to the mine and regionally. Our twin technique stays centered on extending mine life and discovering new vein constructions to increase mine and mill feed, enabling us to completely make the most of the mill’s put in capability of as much as 300,000 tonnes every year.”

Xavantina Operations Confirmed & Possible Mineral Reserve Evolution Since IPO

Notice: Mineral reserve estimates had been ready in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Requirements for Mineral Sources and Mineral Reserves, adopted by the CIM Council on Could 10, 2014 (the “CIM Requirements”), and the CIM Estimation of Mineral Sources and Mineral Reserves Finest Apply Tips, adopted by CIM Council on November 29, 2019 (the “CIM Tips”), utilizing geostatistical and/or classical strategies, plus financial and mining parameters applicable for the deposit. Please check with the Notes on Mineral Reserves and Mineral Sources part of this press launch for a dialogue on the assumptions, parameters and strategies used to estimate the mineral reserves for 2024. 2024 mineral reserve estimate efficient date of June 30, 2024. Please see the 2018 Xavantina Technical Report, the 2019 Xavantina Technical Report, the 2020 Xavantina Technical Report, the January 2022 Press Launch, the 2022 Xavantina Technical Report and the 2023 AIF, as relevant and as outlined under, for a dialogue on the assumptions, parameters and strategies used to estimate the mineral reserves for 2018, 2019, 2020, 2021, 2022 and 2023, respectively. All figures have been rounded to the relative accuracy of the estimates.

2024 MINERAL RESERVE AND RESOURCE ESTIMATE

| 2023 Mineral Reserves & Sources |

2024 Mineral Reserves & Sources |

Change | |||||||||||||||

| Tonnes | Grade | Contained | Tonnes | Grade | Contained | Contained |

% | ||||||||||

| (kt) | (Au gpt) | Au (koz) | (kt) | (Au gpt) | Au (koz) | Au (koz) |

|||||||||||

| Santo Antônio Vein | |||||||||||||||||

| Confirmed Reserves | 290 | 8.57 | 80.0 | 223 | 9.68 | 69.4 | (10.5) | (13) | |||||||||

| Possible Reserves | 1,072 | 7.80 | 268.7 | 1,155 | 9.76 | 362.3 | 93.6 | 35 | |||||||||

| Confirmed & Possible Reserves | 1,362 | 7.96 | 348.7 | 1,378 | 9.75 | 431.8 | 83.1 | 24 | |||||||||

| Measured Sources | 277 | 10.54 | 93.7 | 333 | 9.57 | 102.3 | 8.7 | 9 | |||||||||

| Indicated Sources | 1,042 | 9.92 | 332.2 | 1,222 | 11.57 | 454.6 | 122.3 | 37 | |||||||||

| Measured & Indicated | 1,318 | 10.05 | 425.9 | 1,554 | 11.15 | 556.9 | 131.0 | 31 | |||||||||

| Inferred Sources | 154 | 9.05 | 45.0 | 259 | 13.49 | 112.2 | 67.2 | 150 | |||||||||

| Matinha Vein | |||||||||||||||||

| Confirmed Reserves | — | — | — | — | — | — | — | NA | |||||||||

| Possible Reserves | 144 | 7.81 | 36.1 | 93 | 9.20 | 27.5 | (8.6) | (24) | |||||||||

| Confirmed & Possible Reserves | 144 | 7.81 | 36.1 | 93 | 9.20 | 27.5 | (8.6 ) | (24 ) | |||||||||

| Measured Sources | — | — | — | — | — | — | — | NA | |||||||||

| Indicated Sources | 150 | 9.90 | 47.6 | 130 | 9.59 | 40.1 | (7.5) | (16) | |||||||||

| Measured & Indicated | 150 | 9.90 | 47.6 | 130 | 9.59 | 40.1 | (7.5 ) | (16 ) | |||||||||

| Inferred Sources | 202 | 11.94 | 77.5 | 216 | 11.54 | 80.3 | 2.7 | 4 | |||||||||

| Brás & Buracão Veins | |||||||||||||||||

| Measured Sources | — | — | — | — | — | — | — | NA | |||||||||

| Indicated Sources | 7 | 3.36 | 0.7 | 7 | 3.36 | 0.7 | — | — | |||||||||

| Measured & Indicated | 7 | 3.36 | 0.7 | 7 | 3.36 | 0.7 | — | — | |||||||||

| Inferred Sources | 157 | 4.71 | 23.8 | 157 | 4.71 | 23.8 | — | — | |||||||||

| Whole Xavantina Operations | |||||||||||||||||

| Confirmed Reserves | 290 | 8.57 | 80.0 | 223 | 9.68 | 69.4 | (10.5) | (13) | |||||||||

| Possible Reserves | 1,215 | 7.80 | 304.8 | 1,248 | 9.72 | 389.8 | 85.1 | 28 | |||||||||

| Confirmed & Possible Reserves | 1,505 | 7.95 | 384.7 | 1,471 | 9.71 | 459.2 | 74.5 | 19 | |||||||||

| Measured Sources | 277 | 10.54 | 93.7 | 333 | 9.57 | 102.3 | 8.7 | 9 | |||||||||

| Indicated Sources | 1,198 | 9.88 | 380.6 | 1,359 | 11.34 | 495.4 | 114.9 | 30 | |||||||||

| Measured & Indicated Sources | 1,474 | 10.00 | 474.2 | 1,691 | 10.99 | 597.8 | 123.5 | 26 | |||||||||

| Inferred Sources | 513 | 8.86 | 146.2 | 632 | 10.64 | 216.2 | 70.0 | 48 | |||||||||

Notice: 2024 mineral reserve and useful resource estimates are efficient as at June 30, 2024. 2023 mineral reserve and useful resource estimates are efficient as at December 31, 2023. Introduced mineral sources are inclusive of mineral reserves. All figures have been rounded to replicate the relative accuracy of the estimates. Summed quantities could not add as a consequence of rounding. Mineral sources that aren’t mineral reserves wouldn’t have a demonstrated financial viability. See under notes on mineral reserve and useful resource estimates for added technical and scientific data.

NOTES ON MINERAL RESERVES AND RESOURCES

The 2024 mineral reserve and mineral useful resource estimates are efficient as at June 30, 2024. Mineral sources are offered, together with mineral reserves. All figures have been rounded to the relative accuracy of the estimates. Summed quantities could not add as a consequence of rounding. Mineral sources that aren’t mineral reserves wouldn’t have a demonstrated financial viability.

The 2024 mineral reserve and useful resource estimates for the Xavantina Operations are ready below the supervision of and verified by Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) and Useful resource Supervisor of the Firm who’s a “certified individual” inside the meanings of NI 43-101.

Reference herein of $ or USD is to United States {dollars} and BRL is to Brazilian reais. Mineral Reserves for the Xavantina Operations have been estimated utilizing a gold value of $1,900/oz, and the alternate charge used for mineral reserve and useful resource estimates was USD/BRL 5.10.

Grade shells utilizing a price of 1.20 gpt gold had been used to generate a 3D mineralization mannequin of the Xavantina Operations. Throughout the grade shells, mineral sources had been estimated utilizing extraordinary kriging inside 10 meter by 10 meter by 2 meter block dimension, with a minimal sub- block dimension of 1.0 meter by 1.0 meter by 0.5 meter, and the mineral useful resource estimate was constrained utilizing a minimal stope dimension of two.0 meters by 2.0 meters by 1.5 meters, a cut-off of 1.20 gpt based mostly on underground mining and processing prices of US$72 per tonne and a gold value of US$1,900 per ounce.

The 2024 mineral reserve estimates had been ready in accordance with the CIM Requirements and the CIM Tips, utilizing geostatistical and/or classical strategies, plus financial and mining parameters applicable for the deposit. Mineral reserves are the financial portion of the measured and indicated mineral sources. Mineral reserve estimates embrace operational dilution of 17.4% plus deliberate dilution of roughly 8.5% inside every stope for room- and-pillar mining areas and operational dilution of three.2% plus deliberate dilution of 21.2% for cut-and-fill mining areas. Mining restoration of 92.5% and 94.7% assumed for room-and-pillar and cut-and-fill areas, respectively. Sensible mining shapes (wireframes) had been designed utilizing geological wireframes / mineral useful resource block fashions as a information.

The place relevant, for scientific and technical data on historic mineral useful resource and reserve estimates on the Xavantina Operations, please check with the next stories:

- The “Xavantina Operations – Replace Info with respect to the Xavantina Operations” part inside the Firm’s 2023 Annual Info Type dated March 7, 2024, ready below the supervision of and verified by Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) and Useful resource Supervisor of the Firm (the “2023 AIF”) for technical data and assumptions associated to the 2023 mineral reserve and mineral useful resource estimate, with an efficient date of December 31, 2023.

- The NI 43-101 technical report entitled “Technical Report on the Xavantina Operations, Mato Grosso, Brazil” dated Could 12, 2023 with an efficient date of October 31, 2022, ready by Porfirio Cabaleiro Rodrigues, FAIG, Leonardo de Moraes Soares, MAIG and Guilherme Gomides Ferreira, MAIG, all of GE21 Consultoria Mineral Ltda. (“GE21”) for technical data and assumptions associated to the 2022 mineral reserve and mineral useful resource estimate (the “2022 Xavantina Technical Report”).

- The Firm’s Press Launch dated January 6, 2022, for technical data and assumptions associated to the 2021 mineral reserve and mineral useful resource estimate, with an efficient date of September 30, 2021 ready by or below the supervision of and verified by Mr. Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Fee) and Useful resource Supervisor of the Firm as on the date of the press launch, who was a Certified Individual as such time period is outlined below NI 43-101 (the “January 2022 Press Launch”).

- The NI 43-101 technical report entitled “Mineral Useful resource and Mineral Reserve Estimate of the NX Gold Mine, Nova Xavantina” dated January 8, 2021, with an efficient date of September 30, 2020, ready by Porfirio Cabaleiro Rodriguez, MAIG, Leonardo de Moraes Soares, MAIG, Bernardo Horta Cerqueira Viana, MAIG, Paulo Roberto Bergmann, FAusIMM, all of GE21 for technical data and assumptions associated to the 2020 mineral reserve and mineral useful resource estimate (the “2020 Xavantina Technical Report”).

- The NI 43-101 technical report entitled “Mineral Useful resource and Mineral Reserve Estimate of the NX Gold Mine, Nova Xavantina” dated February 3, 2020 with an efficient date of September 30, 2019, ready by Porfirio Cabaleiro Rodrigues, FAIG, Leonardo de Moraes Soares, MAIG and Paulo Roberto Bergmann, all of GE21 for technical data and assumptions associated to the 2019 mineral reserve and mineral useful resource estimate (the “2019 Xavantina Technical Report”).

- The NI 43-101 technical report entitled “Mineral Useful resource and Mineral Reserve Estimate of the NX Gold Mine, Nova Xavantina” dated January 21, 2019 with an efficient date of August 31, 2018, ready by Porfirio Cabaleiro Rodrigues, FAIG, Leonardo Apparicio da Silva, MAIG and Leonardo de Moraes Soares, MAIG, all of GE21 for technical data and assumptions associated to the 2018 mineral reserve and mineral useful resource estimate (the “2018 Xavantina Technical Report”).

QUALIFIED PERSONS

Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) has reviewed, verified and accredited the scientific and technical data contained on this press launch, together with the sampling, analytical and check information underlying the knowledge contained on this press launch. Mr. Monteiro is Useful resource Supervisor of the Firm and is a “certified individual” inside the meanings of NI 43-101.

QUALITY ASSURANCE & QUALITY CONTROL

Present QA/QC Program

On the Xavantina Operations, the Firm is presently drilling underground with third-party contracted core drill rigs. Through the interval from October 2022 to June 2024, third social gathering drill rigs had been operated by Belief Drilling Options and Servitec Foraco Sondagem S.A. who’re impartial of the Firm. Drill core is logged, photographed and break up in half utilizing a diamond core noticed at our safe core logging and storage services. Half of the drill core is retained on web site and the opposite half-core is used for evaluation, with samples collected on a minimal of 0.2 meters and a most of two.0 meters with a mean size of 0.5 meters. Sampling commences at the least 1.0 meter earlier than the beginning of the mineralized zone and continues at the least 1.0 meter past the restrict of the mineralized zone. Pattern assortment is carried out at our core logging services with all pattern preparation carried out at ALS Brasil Ltda.’s laboratory or SGS Geosol – Laboratórios Ltda’s laboratory, each of that are situated in Goiânia, Brazil. Samples are analyzed by the licensed laboratories of ALS Peru S.A. or SGS Geosol – Laboratórios Ltda, each of whom are impartial of the Firm. Gold content material is preferentially decided utilizing display screen fireplace assay. If the pattern is not sufficiently weighted, fireplace assay is used. All pattern outcomes used within the preparation of the 2024 up to date mineral useful resource and reserve estimate have been monitored by a high quality assurance and high quality management (“QA/QC”) program that features the insertion of licensed requirements, blanks and area duplicates at a charge of 1 normal, one clean, and one area duplicate pattern per each 20 samples for a blended charge of roughly 5%.

QA/QC Validation

The QA/QC validation course of undertaken for the 2024 up to date mineral useful resource and reserve estimates for the Xavantina Operations is in step with the method set out within the 2022 Xavantina Technical Report.

ABOUT ERO COPPER CORP

Ero Copper is a high-margin, high-growth copper producer with operations in Brazil and company headquarters in Vancouver, B.C. The Firm’s major asset is a 99.6% curiosity within the Brazilian copper mining firm, Mineração Caraíba S.A. (“MCSA”), 100% proprietor of the Firm’s Caraíba Operations, that are situated within the Curaçá Valley, Bahia State, Brazil, and the Tucumã Operation, an open pit copper mine situated in Pará State, Brazil. The Firm additionally owns 97.6% of NX Gold S.A. (“NX Gold”) which owns the Xavantina Operations, an working gold and silver mine situated in Mato Grosso State, Brazil. In July 2024, the Firm signed a definitive earn-in settlement with Vale Base Metals for a 60% curiosity within the Furnas Copper-Gold Undertaking, situated within the Carajás Mineral Province in Pará State, Brazil. For extra data on the earn-in settlement, please see the Firm’s press releases dated October 30, 2023 and July 22, 2024. Extra data on the Firm and its operations, together with technical stories on the Caraíba Operations, Xavantina Operations, Tucumã Operation and the Furnas Copper-Gold Undertaking, might be discovered on the Firm’s web site ( www.erocopper.com), on SEDAR+ ( www.sedarplus.ca/landingpage/) and on EDGAR ( www.sec.gov). The Firm’s shares are publicly traded on the Toronto Inventory Alternate and the New York Inventory Alternate below the image “ERO”.

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, SVP, Company Improvement, Investor Relations & Sustainability (604) 335-7504

data@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press launch accommodates “forward-looking statements” inside the which means of the USA Non-public Securities Litigation Reform Act of 1995 and “forward-looking data” inside the which means of relevant Canadian securities laws (collectively, “forward-looking statements”). Ahead-looking statements embrace statements that use forward-looking terminology akin to “could”, “might”, “would”, “will”, “ought to”, “intend”, “goal”, “plan”, “anticipate”, “finances”, “estimate”, “forecast”, “schedule”, “anticipate”, “consider”, “proceed”, “potential”, “view” or the damaging or grammatical variation thereof or different variations thereof or comparable terminology. Ahead-looking statements could embrace, however should not restricted to, statements with respect to the Firm’s anticipated manufacturing on the Xavantina Operations; the estimation of mineral reserves and mineral sources; the invention of further mineralized veins and the related optimistic affect on throughput charges; the importance of any specific exploration program or end result and the Firm’s expectations for present and future exploration plans together with, however not restricted to, deliberate areas of further exploration and the potential to transform any portion of the inferred mineral useful resource base to economically viable mineral reserves; and another assertion which will predict, forecast, point out or indicate future plans, intentions, ranges of exercise, outcomes, efficiency or achievements.

Ahead-looking statements should not a assure of future efficiency. There might be no assurance that forward-looking statements will show to be correct, as precise outcomes and future occasions might differ materially from these anticipated in such statements. Ahead-looking statements contain statements concerning the future and are inherently unsure, and the Firm’s precise outcomes, achievements or different future occasions or situations could differ materially from these mirrored within the forward-looking statements as a consequence of a wide range of dangers, uncertainties and different components, together with, with out limitation, these referred to herein and within the Firm’s most up-to-date Annual Info Type below the heading “Danger Elements”.

The Firm’s forward-looking statements are based mostly on the assumptions, beliefs, expectations and opinions of administration on the date the statements are made, lots of which can be tough to foretell and past the Firm’s management. In reference to the forward-looking statements contained on this press launch and within the AIF, the Firm has made sure assumptions about, amongst different issues: beneficial fairness and debt capital markets; the flexibility to boost any essential further capital on affordable phrases to advance the manufacturing, growth and exploration of the Firm’s properties and property; future costs of copper, gold and different steel costs; the timing and outcomes of exploration and drilling applications; the accuracy of any mineral reserve and mineral useful resource estimates; the geology of the Caraíba Operations, the Xavantina Operations, the Tucumã Operation and the Furnas Copper-Gold Undertaking being as described within the respective technical report for every property; manufacturing prices; the accuracy of budgeted exploration, growth and development prices and expenditures; the worth of different commodities akin to gas; future foreign money alternate charges and rates of interest; working situations being beneficial such that the Firm is ready to function in a secure, environment friendly and efficient method; work pressure persevering with to stay wholesome within the face of prevailing epidemics, pandemics or different well being dangers, political and regulatory stability; the receipt of governmental, regulatory and third social gathering approvals, licenses and permits on beneficial phrases; acquiring required renewals for current approvals, licenses and permits on beneficial phrases; necessities below relevant legal guidelines; sustained labour stability; stability in monetary and capital items markets; availability of apparatus; optimistic relations with native teams and the Firm’s skill to satisfy its obligations below its agreements with such teams; and satisfying the phrases and situations of the Firm’s present mortgage preparations. Though the Firm believes that the assumptions inherent in forward-looking statements are affordable as of the date of this press launch, these assumptions are topic to important enterprise, social, financial, political, regulatory, aggressive and different dangers and uncertainties, contingencies and different components that might trigger precise actions, occasions, situations, outcomes, efficiency or achievements to be materially completely different from these projected within the forward-looking statements. The Firm cautions that the foregoing record of assumptions shouldn’t be exhaustive. Different occasions or circumstances might trigger precise outcomes to vary materially from these estimated or projected and expressed in, or implied by, the forward-looking statements contained on this press launch. There might be no assurance that forward-looking statements will show to be correct, as precise outcomes and future occasions might differ materially from these anticipated in such statements. Accordingly, readers shouldn’t place undue reliance on forward-looking statements.

Ahead-looking statements contained herein are made as of the date of this press launch and the Firm disclaims any obligation to replace or revise any forward-looking assertion, whether or not because of new data, future occasions or outcomes or in any other case, besides as and to the extent required by relevant securities legal guidelines.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Except in any other case indicated, all reserve and useful resource estimates included on this press launch and the paperwork integrated by reference herein have been ready in accordance with Nationwide Instrument 43-101, Requirements of Disclosure for Mineral Tasks (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Requirements on Mineral Sources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Requirements”). NI 43-101 is a rule developed by the Canadian Securities Directors that establishes requirements for all public disclosure an issuer makes of scientific and technical data regarding mineral tasks. Canadian requirements, together with NI 43-101, differ considerably from the necessities of the USA Securities and Alternate Fee (the “SEC”), and reserve and useful resource data included herein is probably not similar to comparable data disclosed by U.S. corporations. Specifically, and with out limiting the generality of the foregoing, this press launch and the paperwork integrated by reference herein use the phrases “measured sources,” “indicated sources” and “inferred sources” as outlined in accordance with NI 43-101 and the CIM Requirements.

Additional to current amendments, mineral property disclosure necessities in the USA (the “U.S. Guidelines”) are ruled by subpart 1300 of Regulation S-Ok of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) which differ from the CIM Requirements. As a international non-public issuer that’s eligible to file stories with the SEC pursuant to the multi-jurisdictional disclosure system (the “MJDS”), Ero shouldn’t be required to supply disclosure on its mineral properties below the U.S. Guidelines and can proceed to supply disclosure below NI 43-101 and the CIM Requirements. If Ero ceases to be a international non-public issuer or loses its eligibility to file its annual report on Type 40-F pursuant to the MJDS, then Ero can be topic to the U.S. Guidelines, which differ from the necessities of NI 43-101 and the CIM Requirements.

Pursuant to the brand new U.S. Guidelines, the SEC acknowledges estimates of “measured mineral sources”, “indicated mineral sources” and “inferred mineral sources.” As well as, the definitions of “confirmed mineral reserves” and “possible mineral reserves” below the U.S. Guidelines are actually “considerably comparable” to the corresponding requirements below NI 43-101. Mineralization described utilizing these phrases has a higher quantity of uncertainty as to its existence and feasibility than mineralization that has been characterised as reserves. Accordingly, U.S. buyers are cautioned to not assume that any measured mineral sources, indicated mineral sources, or inferred mineral sources that Ero stories are or can be economically or legally mineable. Additional, “inferred mineral sources” have a higher quantity of uncertainty as to their existence and as as to if they are often mined legally or economically. Underneath Canadian securities legal guidelines, estimates of “inferred mineral sources” could not type the idea of feasibility or pre-feasibility research, besides in uncommon circumstances. Whereas the above phrases below the U.S. Guidelines are “considerably comparable” to the requirements below NI 43-101 and CIM Requirements, there are variations within the definitions below the U.S. Guidelines and CIM Requirements. Accordingly, there isn’t any assurance any mineral reserves or mineral sources that Ero could report as “confirmed mineral reserves”, “possible mineral reserves”, “measured mineral sources”, “indicated mineral sources” and “inferred mineral sources” below NI 43-101 could be the identical had Ero ready the reserve or useful resource estimates below the requirements adopted below the U.S. Guidelines.

A photograph accompanying this announcement is out there at https://www.globenewswire.com/NewsRoom/AttachmentNg/e58950c7-9d23-4393-8b31-68d25a1628f6