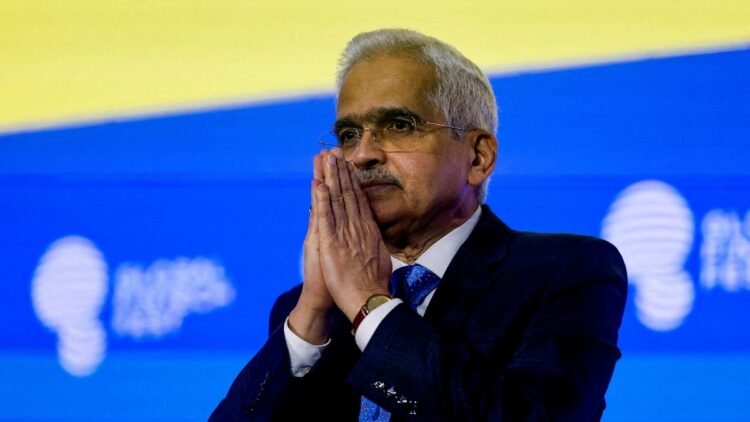

RBI MPC bulletins: Reserve Financial institution of India Governor Shaktikanta Das lowered GDP development estimate for FY25, whereas growing inflation forecast. Das saved the repo charges unchanged whereas adopting a impartial stance. Das, within the final financial coverage committee assembly of the yr, highlighted the challenges Indian in addition to the worldwide financial system confronted within the present yr.

Governor Das, in his announcement additionally minimize the money reserve ratio (CRR) by 50 foundation factors to 4 per cent.

He additionally agreed that the GDP development charge of the second quarter at 5.4 per cent was a lot decrease than anticipated. The RBI MPC had estimated the second quarter to develop at 7 per cent.

Right here’s a lowdown of what RBI Governor Shaktikanta Das introduced:

1. The repo charge was saved unchanged by the RBI at 6.5 per cent. The RBI will proceed with a impartial financial coverage stance, he stated.

2. GDP development estimate for 2024-25 was lowered to six.6 per cent from the sooner estimates of seven.2 per cent. GDP development in Q3 is estimated to be 6.8 per cent, and This autumn 7.2 per cent. Development within the Q1 of subsequent yr is estimated to be 6.9 per cent, and Q2 at 7.3.

3. Das acknowledged that the Q2 development of 5.4 per cent was far lower than what was estimated resulting from weaknesses within the manufacturing sector. The MPC had estimated Q2 development to be at 7 per cent.

4. The RBI pegged CPI inflation at 4.8 per cent for FY25 from the sooner estimate of 4.5 per cent. He underlined persistent challenges in balancing inflation and development.

5. Das introduced that the CRR has been slashed by 50 foundation factors to 4 per cent which can inject Rs 1.16 lakh crore into the banking system. He stated that the discount will likely be carried out in two tranches of 25 foundation factors every beginning December 14.

6. The apex financial institution additionally determined to extend the rate of interest ceilings on International Forex Non-Resident Financial institution [FCNR(B)] deposits. Banks have been permitted to boost recent FCNR(B) deposits of 1 yr to lower than 3 years maturity at charges not exceeding ARR plus 400 bps. For maturity between 3-5 years, charges may be hiked to not exceeding ARR plus 500 bps.

7. The RBI proposed the linking of FX-Retail platform with Bharat Join, enabling customers to register and transact on the platform by way of apps of banks and non-bank fee system suppliers.

8. The central financial institution proposed creating a benchmark based mostly on the secured cash markets (each basket repo and TREP) – the Secured In a single day Rupee Price (SORR).

9. RBI has determined to boost the restrict for collateral-free agriculture loans from Rs 1.6 lakh to Rs 2 lakh per borrower.

10. The apex financial institution proposed allowing small finance banks (SFBs) to increase pre-sanctioned credit score traces by way of the UPI, for which the rules could be issued shortly.