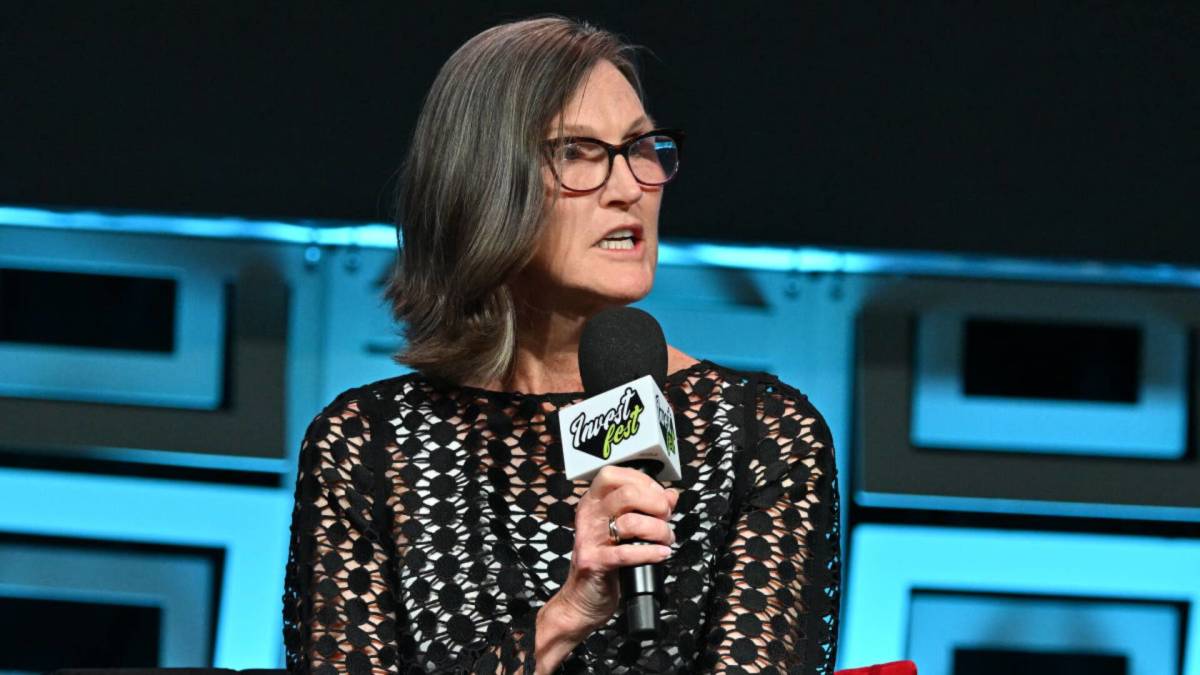

ARK Make investments CEO Cathie Wooden has boldly sought tech shares that might have a “disruptive” future impression, even when the inventory is unprofitable.

Her ARK funds lately had a major purchase on Tempus AI. She purchased 732,873 shares from Dec. 6 by way of Dec. 12, with a complete worth of roughly $30 million as of Dec. 13’s shut.

Tempus AI (TEM) is a well being know-how firm based in 2015. It makes use of synthetic intelligence to make diagnostics extra exact.

The corporate states that its objective is to combine AI, together with generative AI, into each side of diagnostics, serving to physicians and researchers make customized and data-driven choices.

“The flexibility to deploy AI in precision drugs at scale has solely lately develop into attainable,” Tempus AI mentioned in an SEC submitting.

“Advances in cloud computing, imaging applied sciences, giant language fashions, and low-cost molecular profiling, together with the digitization of huge quantities of healthcare knowledge, have created a panorama that we imagine is lastly ripe for AI.”

Tempus AI went public on June 14, 2024, with its preliminary public providing priced at $37 a share. Wooden initiated a purchase shortly after the market debut.

Tempus AI’s Q3 income beat estimates, pushed by knowledge providers

Tempus AI has not but turned a revenue. It reported losses of $290 million and $214 million for 2022 and 2023, respectively.

In November, Tempus AI reported a Q3 loss per share of 46 cents, falling wanting the consensus estimate lack of 31 cents.

Income for the quarter elevated by 33% to $180.9 million, barely above analyst expectations of $179.52 million.

Associated: Analyst resets value goal on key AI inventory after runup

This was partly pushed by robust efficiency in its knowledge providers phase, which noticed a year-over-year income progress of 64.4%.

“The general enterprise carried out properly within the quarter, as demonstrated by accelerating quantity progress in our genomics enterprise and accelerating income progress in our knowledge and providers enterprise, particularly inside Insights,” mentioned Eric Lefkofsky, founder and CEO of Tempus AI.

The corporate additionally introduced the $600 million acquisition of Ambry Genetics, a genetic testing firm, aiming to broaden its testing portfolio and broaden illness protection.

“Ambry is uniquely positioned on condition that its revenues are at present rising at north of 25% a 12 months and it generates significant EBITDA and money stream,” Lefkofsky mentioned.

Tempus reaffirmed its FY24 income steerage of roughly $700 million, in step with the consensus estimate of $698.09 million.

The outlook represents 32% year-over-year progress and contains an anticipated $50 million enchancment in adjusted EBITDA.

Analyst units increased inventory value goal for Tempus AI

Wooden shouldn’t be alone. Whereas Tempus AI inventory has misplaced a 3rd of its worth this month, a number of different analysts imagine in its potential for future upside.

Financial institution of America raised Tempus AI’s inventory value goal to $54 from $52 with a impartial ranking, thefly.com reported on Dec. 13.

The analyst says the Life Sciences Instruments sector underperformed in FY24 as Pharma and Biotech prospects reined in spending after overspending throughout the pandemic.

Associated: This is what a veteran dealer who forecast Palantir’s inventory rally says now

Getting into 2025, “the setup is nearly similar,” says BofA. Nonetheless, the analyst provides, “There are lastly some encouraging indicators on the horizon.”

In October, BofA downgraded Tempus AI to impartial from purchase, citing valuation and softness which can be more likely to persist within the first half of 2025.

Wolfe Analysis analyst Doug Schenkel lately initiated protection of Tempus AI with an outperform ranking and a $60 value goal.

Tempus AI has been “best-in-class” within the diagnostic knowledge class as measured by monetization, the analyst says.

Schenkel expects Tempus to generate a 30% income compound annual progress fee by way of 2028 because it expects extra market penetration and database monetization.

Guggenheim analyst Subbu Nambi additionally initiated protection of Tempus AI with a purchase ranking and $74 value goal, thefly.com reported on Dec. 9.

Extra Tech Shares:

- Tremendous Micro’s inventory value surges after key ruling

- Veteran dealer takes a recent have a look at Sofi Applied sciences

- Druckenmiller predicted Nvidia’s rally, now has new AI goal

Nambi desceibes Tempus as a “pioneer” in clever diagnostics. It operates in “high-growth, enticing” oncology markets, with its distinctive knowledge and complete diagnostics menu seen as “key aggressive benefits.”

Tempus AI closed at $41 per share on Dec.13. The inventory is up solely 2.5% this 12 months since its June IPO.

Associated: Veteran fund supervisor delivers alarming S&P 500 forecast