Investor Perception

With a rising checklist of pure assets belongings important to rising international demand within the healthcare and expertise sectors, VVC Sources presents an funding alternative for traders seeking to diversify their portfolios.

Overview

The worldwide helium market is anticipated to extend from $4.45 billion in 2022 to $5.03 billion in 2023 at a compound annual progress fee of 12.9 p.c pushed by the rising demand for helium from the healthcare trade. Helium is essential in medication as a result of this uncommon ingredient is utilized in varied methods, one among which is as a refrigerant able to cooling the superconducting magnets in MRI scanners. This non-reactive, non-corrosive, non-flammable noble fuel will not be solely utilized in analysis tools but in addition as an adjunct remedy for sure illnesses like COPD, bronchial asthma and bronchiolitis.

Though helium is the second most typical ingredient on earth, international helium provides are working low. Useful resource firms that provide industries depending on helium ought to discover potential helium reserves and consider information to provide you with a novel technique for rising helium manufacturing.

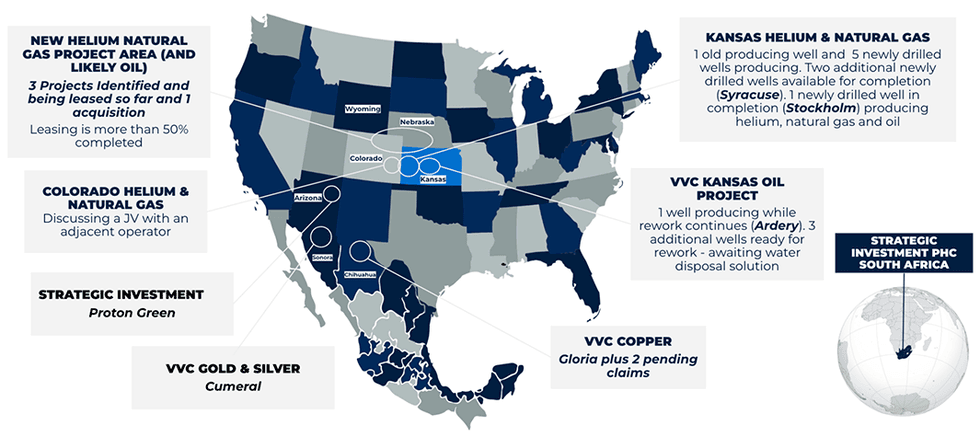

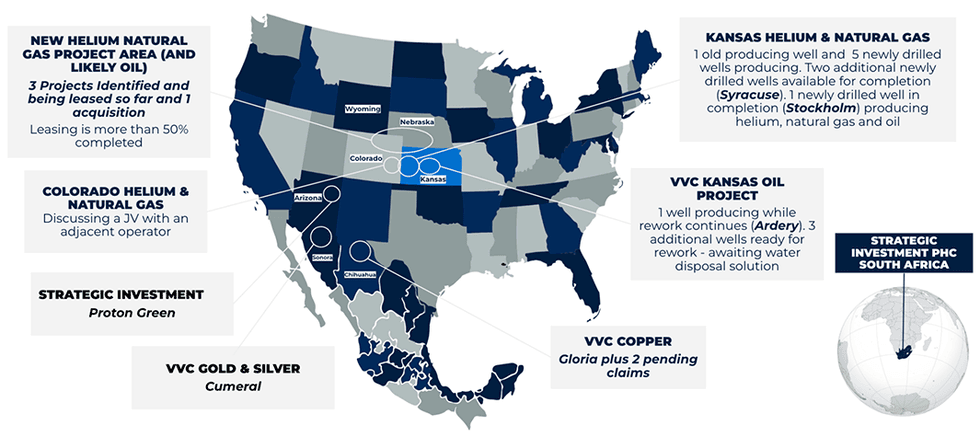

VVC Sources (TSXV:VVC;OTCQB:VVCVF) engages within the exploration, growth and administration of pure assets – specializing in scarce and more and more priceless supplies wanted to fulfill the rising, high-tech calls for of industries corresponding to manufacturing, expertise, medication, house journey and the increasing inexperienced economic system.

The corporate’s portfolio features a various set of belongings and high-growth initiatives, comprising: helium and industrial fuel manufacturing within the western US; copper and related metals operations in northern Mexico; and strategic investments in carbon sequestration and different inexperienced power applied sciences.

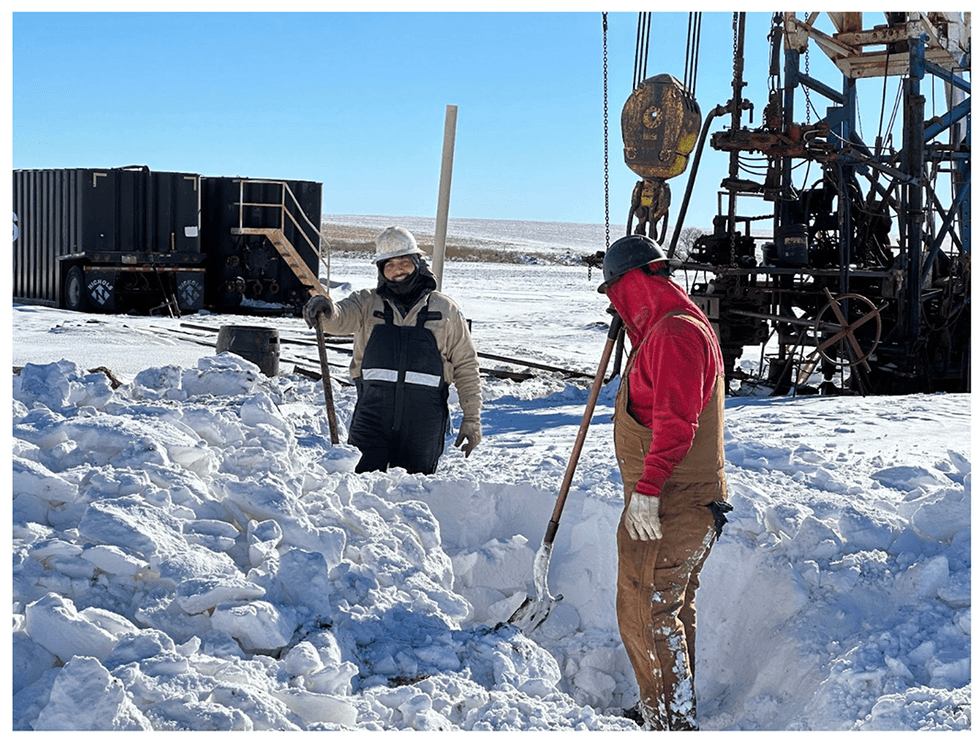

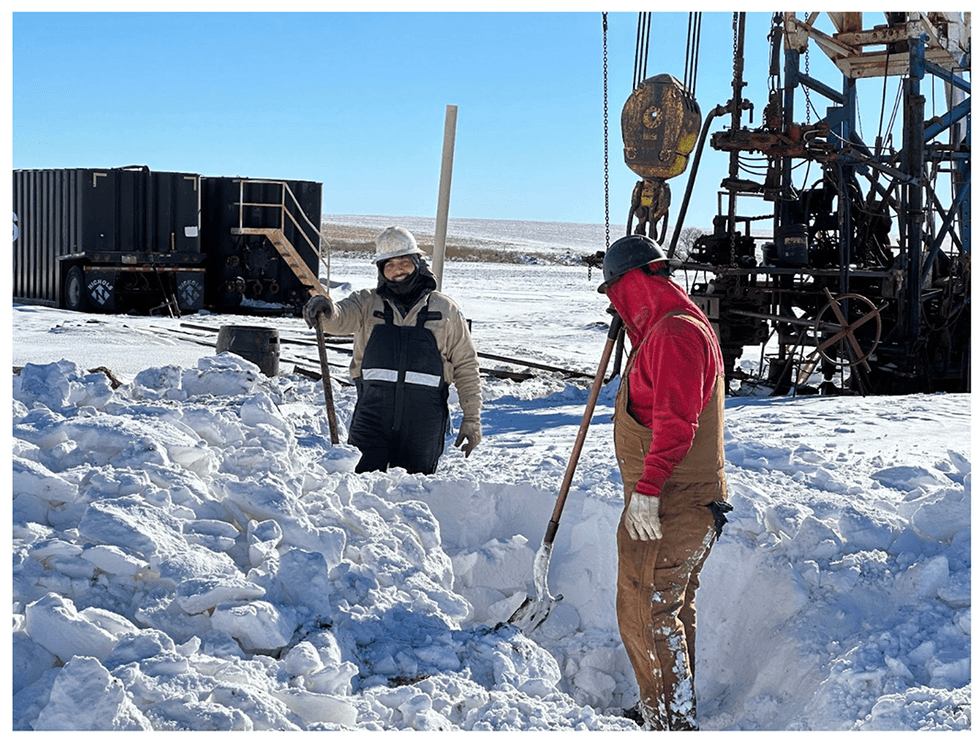

VVC at present targets helium reserves within the US by reactivating outdated fuel wells and drilling new wells. In January 2022, the corporate engaged Foreland Working to handle the day-to-day helium operations going ahead. In March 2022, VVC introduced the profitable completion and connection of its first helium properly within the Syracuse Mission. The properly, generally known as the Levens #2, was related to Tumbleweed Midstream’s Ladder Creek Pipeline, which transports fuel to the Ladder Creek Helium Processing Plant in Cheyenne Wells, Colorado. VVC additional confirmed the presence of helium as much as 1.14 p.c from its second drilled properly within the Syracuse Mission.

VVC additionally acquired the Monarch Mission to additional capitalize on the rising demand for helium as a consequence of elevated international utilization. The Monarch Mission consists of greater than 1,700 acres of fuel leases positioned in Greely County, Kansas with six present wells. Minor repairs had been made to 5 of the six wells, restoring electrical energy service, and started producing income from the pure fuel and helium at low volumes. The main target of this venture is the 14 further potential properly areas that are conveniently positioned for connection to the Tumbleweed pipeline.

VVC’s helium portfolio reached one other vital milestone with the set up of 14 miles of its inside gathering system pipeline within the Syracuse Mission. The most important infrastructure will seamlessly transport fuel produced by the corporate’s helium and pure fuel wells to a close-by processing plant. The milestone will increase the pipeline’s size from 7 to 14 miles and the venture’s capability from 50 to 100 wells.

VVC is advancing its Gloria copper property in Mexico in the direction of manufacturing. The 4,055-acre Gloria property is located within the northern a part of Mexico’s Chihuahua state within the Sierra Madre area 60 kilometers southwest of El Paso, Texas. The venture can also be supported by infrastructure together with an entry street and an obtainable mining workforce.

VVC Exploration is led by a administration workforce with a wealth of mining expertise and is supported by a board of administrators with vital affect in each the mining and monetary industries. The administration and board are additionally notably invested within the firm, with the CEO, members of administration and the board of administrators listed as high traders. As an entire, the corporate has a decent share construction with over 90 million shares held by the highest 25 traders.

Firm Highlights

Helium, Pure Fuel & Different Industrial Gases

- A rising portfolio of helium and NG initiatives with the acquisition of Plateau Helium, at present comprising 69 leases protecting 16,400 acres generally known as the Syracuse Kansas venture, 1,600 acres within the Monarch property, Stockholm venture (3,000 acres), Johnson-Moore venture (6,000 acres), LF venture (5,000 acres) and State Line venture (6,000 acres).

- The Colorado venture, positioned in Jap, Colorado, includes 23,000 acres of fuel leases and leasing persevering with, with a complete of 26 historic wells that had been beforehand drilled flowing fuel that examined helium above 3 p.c.

- Six wells related and producing, two prepared to finish within the Syracuse KS venture (as of December 2024).

- One properly drilled and accomplished, producing into tanks within the Stockholm KS venture. Connection line to processing plant in course of. Helium, pure fuel and oil gross sales anticipated in January 2025, further properly websites recognized (as of December 2024).

- The preliminary properly of the Kansas Oil venture has begun producing. The corporate is at present within the planning section for extra wells within the space.

- Put in 14 miles of inside gathering system pipeline to move helium and pure fuel wells to a close-by processing facility.

- Put in a 15-mile water disposal system.

Copper, Base & Treasured Metals

- VVC’s near-production Gloria copper property, positioned in Mexico, has an indicated copper useful resource of 59.4 million kilos and 89.33 million kilos of inferred copper.

Investor Perception

With a rising checklist of pure assets belongings important to rising international demand within the healthcare and expertise sectors, VVC Sources presents an funding alternative for traders seeking to diversify their portfolios.

Overview

The worldwide helium market is anticipated to extend from $4.45 billion in 2022 to $5.03 billion in 2023 at a compound annual progress fee of 12.9 p.c pushed by the rising demand for helium from the healthcare trade. Helium is essential in medication as a result of this uncommon ingredient is utilized in varied methods, one among which is as a refrigerant able to cooling the superconducting magnets in MRI scanners. This non-reactive, non-corrosive, non-flammable noble fuel will not be solely utilized in analysis tools but in addition as an adjunct remedy for sure illnesses like COPD, bronchial asthma and bronchiolitis.

Though helium is the second most typical ingredient on earth, international helium provides are working low. Useful resource firms that provide industries depending on helium ought to discover potential helium reserves and consider information to provide you with a novel technique for rising helium manufacturing.

VVC Sources (TSXV:VVC;OTCQB:VVCVF) engages within the exploration, growth and administration of pure assets – specializing in scarce and more and more priceless supplies wanted to fulfill the rising, high-tech calls for of industries corresponding to manufacturing, expertise, medication, house journey and the increasing inexperienced economic system.

The corporate’s portfolio features a various set of belongings and high-growth initiatives, comprising: helium and industrial fuel manufacturing within the western US; copper and related metals operations in northern Mexico; and strategic investments in carbon sequestration and different inexperienced power applied sciences.

VVC at present targets helium reserves within the US by reactivating outdated fuel wells and drilling new wells. In January 2022, the corporate engaged Foreland Working to handle the day-to-day helium operations going ahead. In March 2022, VVC introduced the profitable completion and connection of its first helium properly within the Syracuse Mission. The properly, generally known as the Levens #2, was related to Tumbleweed Midstream’s Ladder Creek Pipeline, which transports fuel to the Ladder Creek Helium Processing Plant in Cheyenne Wells, Colorado. VVC additional confirmed the presence of helium as much as 1.14 p.c from its second drilled properly within the Syracuse Mission.

VVC additionally acquired the Monarch Mission to additional capitalize on the rising demand for helium as a consequence of elevated international utilization. The Monarch Mission consists of greater than 1,700 acres of fuel leases positioned in Greely County, Kansas with six present wells. Minor repairs had been made to 5 of the six wells, restoring electrical energy service, and started producing income from the pure fuel and helium at low volumes. The main target of this venture is the 14 further potential properly areas that are conveniently positioned for connection to the Tumbleweed pipeline.

VVC’s helium portfolio reached one other vital milestone with the set up of 14 miles of its inside gathering system pipeline within the Syracuse Mission. The most important infrastructure will seamlessly transport fuel produced by the corporate’s helium and pure fuel wells to a close-by processing plant. The milestone will increase the pipeline’s size from 7 to 14 miles and the venture’s capability from 50 to 100 wells.

VVC is advancing its Gloria copper property in Mexico in the direction of manufacturing. The 4,055-acre Gloria property is located within the northern a part of Mexico’s Chihuahua state within the Sierra Madre area 60 kilometers southwest of El Paso, Texas. The venture can also be supported by infrastructure together with an entry street and an obtainable mining workforce.

VVC Exploration is led by a administration workforce with a wealth of mining expertise and is supported by a board of administrators with vital affect in each the mining and monetary industries. The administration and board are additionally notably invested within the firm, with the CEO, members of administration and the board of administrators listed as high traders. As an entire, the corporate has a decent share construction with over 90 million shares held by the highest 25 traders.

Firm Highlights

Helium, Pure Fuel & Different Industrial Gases

- A rising portfolio of helium and NG initiatives with the acquisition of Plateau Helium, at present comprising 69 leases protecting 16,400 acres generally known as the Syracuse Kansas venture, 1,600 acres within the Monarch property, Stockholm venture (3,000 acres), Johnson-Moore venture (6,000 acres), LF venture (5,000 acres) and State Line venture (6,000 acres).

- The Colorado venture, positioned in Jap, Colorado, includes 23,000 acres of fuel leases and leasing persevering with, with a complete of 26 historic wells that had been beforehand drilled flowing fuel that examined helium above 3 p.c.

- Six wells related and producing, two prepared to finish within the Syracuse KS venture (as of December 2024).

- One properly drilled and accomplished, producing into tanks within the Stockholm KS venture. Connection line to processing plant in course of. Helium, pure fuel and oil gross sales anticipated in January 2025, further properly websites recognized (as of December 2024).

- The preliminary properly of the Kansas Oil venture has begun producing. The corporate is at present within the planning section for extra wells within the space.

- Put in 14 miles of inside gathering system pipeline to move helium and pure fuel wells to a close-by processing facility.

- Put in a 15-mile water disposal system.

Copper, Base & Treasured Metals

- VVC’s near-production Gloria copper property, positioned in Mexico, has an indicated copper useful resource of 59.4 million kilos and 89.33 million kilos of inferred copper.

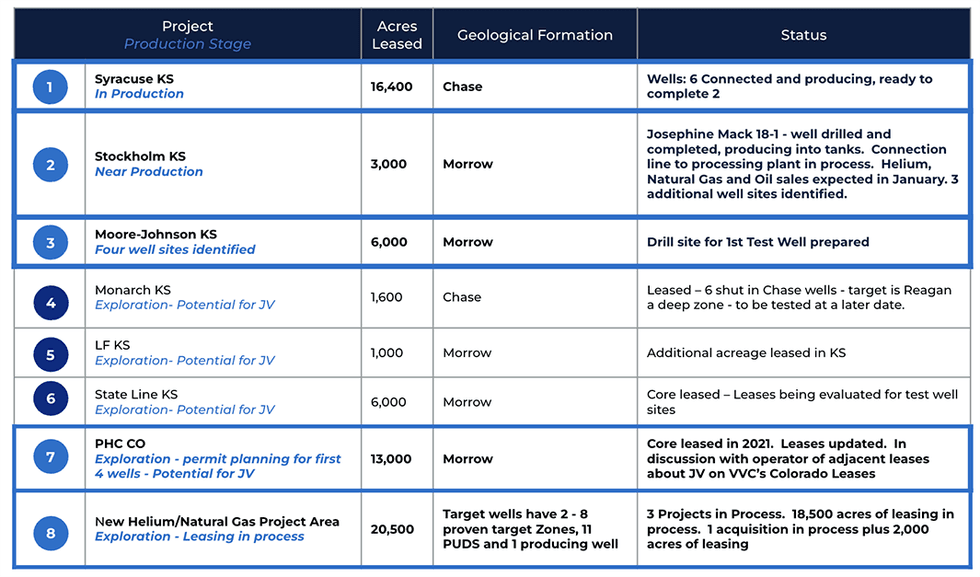

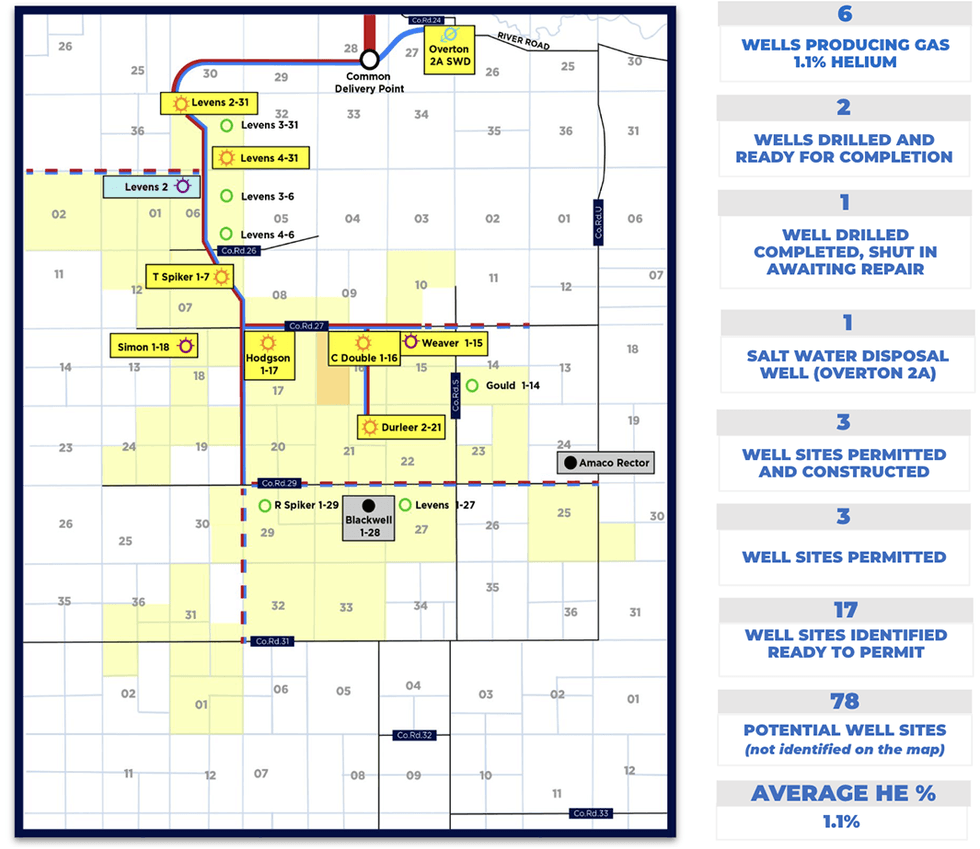

Key Initiatives

Helium Portfolio

As of Dec 2024

Plateau Helium Company

In January 2021, VVC Exploration acquired Plateau Helium Company (PHC), a Wyoming Company targeted on helium exploration and growth, primarily within the western US. PHC’s preliminary goal venture is positioned in Kansas and at present includes 69 leases protecting 16,371 acres generally known as the Syracuse Helium Mission.

Plateau Helium Company engaged Foreland Working to handle the corporate’s helium manufacturing. Foreland Working is a Texas-based upstream oil and fuel working firm with a long-tenured workforce that has been working in most of the premiere US basins together with the Barnett Shale, the Marcellus Shale and the Permian Basin.

Syracuse

Syracuse is VVC’s helium venture with 16,400 acres of contiguous oil and fuel leases. The corporate has recognized 16 recognized properly websites within the space with inside estimates of a future useful resource of 75 Bcf of fuel. At present, Syracuse has 22 properly websites permitted or at present being permitted, every with the potential to provide over 1 billion cubic ft of fuel.

In 2022, the corporate introduced it efficiently accomplished and related its first helium properly to the venture. The properly is called the Levens #2 and was related to Tumbleweed Midstream’s Ladder Creek Pipeline permitting the transport of fuel to the Ladder Creek Helium Processing Plant in Cheyenne Wells, Colorado. The Levens #2 was efficiently drilled to a depth of two,478 ft and encountered a number of fuel zones.

As of Dec 2024

Monarch Lease

VVC bought the Monarch Lease in April 2021, bolstering VVC’s capability to capitalize on the rising demand for helium, pushed by elevated international utilization. The Monarch Lease is a 1,720-acre property that’s positioned within the Byerly Subject in Greely County, Kansas and contains six previously producing fuel wells which might be nonetheless related to the Tumbleweed Midstream pipeline. All wells produced each methane and helium. There may be further potential within the deeper zones of this property which VVC will discover.

Stockholm Mission

The Stockholm venture is VVC’s high drilling precedence venture in Wallace Kansas in an space with vital pure fuel potential. Stockholm spans 3,000 acres of permitted jurisdiction focused for helium, pure fuel and hydrogen. VVC has commenced drilling actions on the Josephine Mack 1-18 properly, marking the initiation of the corporate’s first take a look at properly inside the Stockholm venture.The Josephine Mack 1-18 properly is VVC’s strategic entry into this geologically promising area which evaluates the hydrocarbon potential of the Morrow Zone. The Stockholm venture exhibits potential for oil manufacturing as properly.

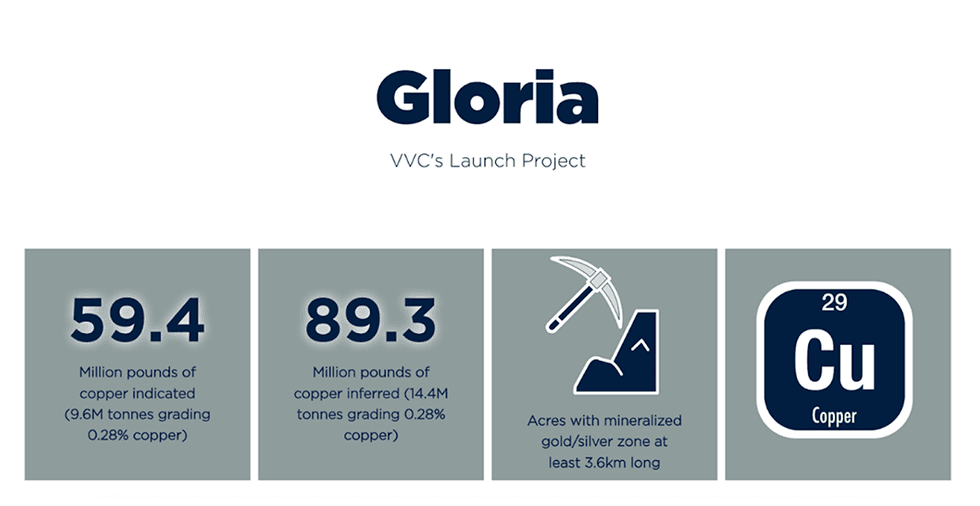

Copper and Related Metals

VVC’s present copper focus venture is Gloria in Northern Mexico which is a number to oxide copper mineralization with a copper useful resource of 59.4 million kilos, indicated (9.6 million tonnes grading 0.28 p.c copper) and 89.33 million kilos, inferred (14.4 million tonnes grading 0.28 p.c copper). The property spans 4,055 acres in Chihuahua State and drilling over the previous two years has outlined a big copper mineralized zone over a 15-kilometer strike.

Gloria offers VVC with a novel publicity to the copper market. Roughly 100,000 tons of artisanal ore piles on website which have been excessive graded, hand cobbed (sorted), and might be utilized for pilot/take a look at mining.

Positioned in Central Sonora Mexico is VVC’s 16,622-acre Cumeral gold/copper exploration venture. Cumeral covers an epithermal fashion, mineralized gold/silver zone no less than 3.6 kilometers lengthy with geological construction and floor sampling counsel the potential for multi-million ounce gold deposit.

Carbon Seize

Proton Inexperienced

VVC not too long ago made a strategic funding in Proton Inexperienced, an power transition firm poised to turn out to be one of many main helium producers and carbon sequestration hubs in North America.

Proton Inexperienced, LLC, is a producer of helium and hydrogen and is constructing out its place as a big carbon sequestration operator in North America. With working management over the St. Johns Subject, a 152,000-acre property in Apache County, Arizona, Proton Inexperienced controls a helium reservoir and carbon storage basin.

Proton Inexperienced’s preliminary venture is the St. Johns Subject. The St. Johns Subject is a large helium reservoir and immense carbon storage basin positioned in Apache County, Arizona. Intensive third-party geological research carried out on the property point out reserves of as much as 33 billion cubic ft of helium in shallow, simply accessible reservoirs. Able to producing one billion cubic ft of helium per 12 months, it is going to be among the many most prolific helium manufacturing websites on the planet.

It’s also projected to be among the many largest carbon seize firms in North America, with 22 million metric tons of carbon sequestration per 12 months, and a complete storage capability of over 1 billion metric tons.

Administration Staff

Terrence Martell – Chairman of the Board

Dr. Terrence Martell is the director of the Weissman Middle for Worldwide Enterprise at Baruch Faculty and the Saxe Distinguished Professor of Finance the place he oversees a myriad of worldwide teaching programs and initiatives. He’s additionally the chairperson of the College College Senate and an ex-officio member of the board of trustees at The Metropolis College of New York. His space of experience and analysis is worldwide commodity markets.

He’s a director of the Intercontinental Alternate (ICE) the place he serves on the audit committee and has many roles. He serves on the board of the Manhattan Chamber of Commerce and is a member of their govt committee. He’s additionally a member of the New York Metropolis District Export Council of the US Division of Commerce and a member of the Reuters/Jefferies CRB Index Oversight Committee. Dr. Martell acquired his BA in Economics from Iona Faculty and his PhD in Finance from the Pennsylvania State College.

James (Jim) Culver – President, CEO and Director

Dr. James Culver has spent over 40 years within the fields of commodities, worldwide commerce and commerce finance, holding posts in authorities, academia and the non-public sector. For the final 20 years, he has targeted on commodity finance and commodity venture finance, primarily in mining and metals and agricultural merchandise. He spent 22 years working in New York Metropolis the place he most not too long ago managed two non-public commodity asset-based lending firms and developed hedge funds to help their lending actions.

Beforehand, Dr. Culver served as chief economist and director of the Economics and Training Division for the Commodity Futures Buying and selling Fee. He was chargeable for market surveillance and new product approvals. He additionally served for 5 years on the employees of the Committee on Agriculture of the US Home of Representatives. As well as, Culver has been an lively participant in a family-owned and operated enterprise, The Parsons Group Worldwide Training Inc., a for-profit academic companies firm. He earned his B.Sc. on the College of Tennessee Martin and his MSc. and PhD levels from the College of Tennessee Knoxville.

Andre St-Michel – Senior Guide, Mexican Operations

A Canadian mining engineer and geologist residing in Chihuahua, Mexico, Andre St-Michel has over 30 years of expertise within the mining enterprise with a concentrate on mine growth, mill operation, administration and finance. He has spent the final 10 years working in Mexico the place he at present serves as President and CEO of Freyja Sources.

From 2003 to 2008, he was a senior govt of Dia Bras (now Sierra Metals), chargeable for its exploration packages and the start-up of its Bolivar copper and zinc mine. From the preliminary start-up of the mine in 2005, manufacturing reached 450 tons per day in 2006 with annual projected revenues of roughly $27 million and money flows of roughly $10 million. Previous to 2003, he served as president of ECU Silver Mining, creating packages and properties within the US, Brazil and Mexico. He holds a level from the Laval College Engineering Faculty and a Grasp’s diploma in Mission Administration from College du Quebec. He’s knowledgeable engineer.

Michael Lafrance – Director and Secretary-Treasurer

Michael Lafrance has been VVC Exploration’s secretary and treasurer and geological marketing consultant since December 2012. Since 1980, he has served in comparable roles with many different publicly-traded exploration firms. He’s additionally the company secretary of POET Applied sciences Inc. (previously Opel Applied sciences), a pioneer within the discipline of built-in circuits. He’s a graduate of the College of Ottawa.

Kevin Barnes – CFO

Kevin Barnes has served as the company controller and CFO of varied private and non-private firms over the past 12 years. He additionally served within the function of IT supervisor and senior accountant with Duguay and Ringler Company Providers, a agency which offers company accounting and secretarial companies to publicly-traded firms. He served because the controller of Canada’s Alternative Spring Water, one among Canada’s first publicly traded bottled water firms.

He at present serves as CFO of Poet Applied sciences, a pioneer within the discipline of built-in circuits and Controller of a world coaching institute with revenues of $100 million. Barnes acquired a pc operations diploma from the Careers Improvement Institute and has a Licensed Administration Accountant designation from the ICMA Australia. In 2006, he turned a member of the Institute of Chartered Secretaries and Directors of Canada.

Peter Dimmell – Director

Peter Dimmell is a geologist and prospector who has been concerned in mineral exploration in Canada, the US and abroad for 38 years. He’s skilled in all facets of the mining trade and has guided on-site operations from exploration by means of to manufacturing. He’s a previous president of the Prospectors and Builders Affiliation of Canada (PDAC), a director and former chairman of the Newfoundland and Labrador Chamber of Mineral Sources and a councilor and member of the Geological Affiliation of Canada. He sits on the Board of Administrators of 4 different public firms: Arehada Mining, Linear Gold, Pele Mountain Sources and Silver Spruce Sources, for which he additionally serves as CEO.

Bruno Dumais – Director

Bruno Dumais is vice-president of finance, for BroadSign Worldwide, a Montreal-based supplier of digital signage options. He possesses over 20 years of expertise in monetary, forecast and strategic planning and is chargeable for overseeing international monetary actions. Earlier than becoming a member of BroadSign, he was the chief monetary officer, vice-president of finance and a marketing consultant at Mitec Telecom for seven years. He has additionally held senior stage positions in firms crossing quite a lot of sectors, corresponding to Gestion Exponent, Nortel Networks and Premier Tech. Dumais is a chartered skilled accountant and holds each a Bachelor in Enterprise Administration from the College of Quebec in Rimouski and an Worldwide MBA from the College of Ottawa.

Patrick Fernet – Director

Patrick Fernet is a authorized, operations, and company governance skilled with greater than twelve years’ expertise in Canadian small-cap public companies. He serves as a marketing consultant to VVC on quite a lot of company issues. He has greater than 15 years of governance expertise with small-cap Canadian companies.

Scott Hill – Director

Scott Hill has served as chief monetary officer of Intercontinental Alternate Inc (ICE) since Could 2007. He’s chargeable for all facets of ICE’s finance and accounting features, treasury, tax, audit and controls, enterprise growth, human assets and investor relations. Hill additionally oversees ICE’s international clearing operations. Previous to becoming a member of ICE, Hill was assistant controller for Monetary Forecasts and Measurements at IBM, the place he oversaw worldwide monetary efficiency and labored with all international enterprise models and geographies. Hill started his profession at IBM and held varied accounting and monetary positions within the US, Europe, and Japan, together with vice-president and controller of IBM Japan, and assistant controller, monetary technique and budgets..

Leon Vijay Shivamber – Director

Leon Shivamber is a metamorphosis chief with greater than three many years of profitable transformations underneath his belt. He realized about technique and enterprise integrity throughout his years at McKinsey & Firm, change administration, and speedy transformation throughout his New York Consulting Companions years and high-performance acquisitions throughout his years at Arrow Electronics. He spent 5 years main the prize-winning provide chain and operations transformation on the then Harris Company (now L3 Harris Applied sciences). For 3 years after that function, Leon prolonged and utilized his transformation expertise as a frontrunner and basic supervisor constructing a world three way partnership within the Center East.

Thereafter, Leon spent three years as CEO main the colourful UAE headquartered Atlas Group with strategic companies in communications, protection, power, meals, healthcare, hospitality, public security, and safety. He additionally spent two further years advising Atlas Group and different Center-East-based companies on their transformation efforts. Since that point, Leon has returned to the US and has been performing as a senior advisor to a number of company transformations. He’s a fellow, Life Administration Institute (FLMI), and a trustee of the board of administrators of Baruch Faculty Fund.