With the tip of 2024 shortly approaching, lively traders could also be seeking to place forward of 2025.

In January, market watchers are sometimes eager to speak in regards to the January impact, which is the concept inventory markets usually rally within the first month of the 12 months. Nonetheless, it has grow to be much less constant because the years go by, and a few think about it a fable at this level.

Discover out extra in regards to the January impact beneath, and study what methods you should use in case you do determine to place forward of a possible January inventory rally.

What’s the January impact?

The January impact is a concept primarily based on a sample that analysts have seen 12 months after 12 months: shares appear to fare higher throughout January than they do throughout different months of the 12 months. Usually, small-cap firms are affected essentially the most by the January impact, as massive shares are sometimes much less risky.

The primary report of the January impact got here in 1942 from Sidney Wachtel, an funding banker from Washington, DC.

Since then, specialists have debated potential causes for this phenomenon. Many consider the January impact is triggered by tax-loss promoting within the month of December. Tax-loss promoting, or tax-loss harvesting as it’s generally known as, is an funding technique through which particular person traders promote shares at a loss with the intention to cut back capital features earned on investments. As a result of capital losses are tax deductible, they can be utilized to offset capital features to scale back an investor’s tax legal responsibility on their tax return.

For example of tax-loss promoting for tax financial savings, think about if an investor purchased 1,000 shares of an organization for US$53 every. They may promote the shares and take a lack of US$3,000 within the occasion that the shares declined in worth to US$50 every. The US$3,000 loss from the sale might then be used to offset features elsewhere within the investor’s portfolio throughout that tax 12 months.

For extra details about the technique, plus the deadlines, try our information to tax-loss promoting.

It’s value noting that tax-loss promoting or tax-loss harvesting is a buying and selling technique that typically includes investments with large losses, and, due to this, these gross sales typically deal with a comparatively small variety of securities throughout the public markets. Nonetheless, if numerous sellers had been to execute a promote order in tandem, the worth of the safety would fall.

Central to the January impact concept is that when promoting season has come to a detailed, shares which have grow to be largely oversold have a possibility to bounce again. For instance, traders who’ve offered shedding shares earlier than the tip of the 12 months could also be pushed to repurchase these shares, though they must watch for 30 days to go, as required by the superficial loss rule.

No matter whether or not you’re shopping for or promoting, Steve DiGregorio, portfolio supervisor at Canoe Monetary, recommends that you simply act swiftly and aggressively throughout this time of 12 months as “liquidity will dry up.” He has earmarked the second and third week of December as the best window to promote or purchase at a low level. That is forward of the “Santa Claus rally,” the buying and selling days across the final week of December when shares are inclined to rise forward of a more healthy market in January.

These circumstances have given rise to the alternate notion that shares get a lift in January as a result of many individuals obtain vacation bonuses in December, offering them with higher funding revenue. Maybe it’s one or the opposite — or maybe, as with most issues, a mixture of drivers produces the January impact.

Is the January impact actual?

Whereas some say that the January impact was as soon as an environment friendly market speculation that is now fading some mutual fund managers, portfolio managers and institutional traders say it isn’t actual in any respect now. Goldman Sachs (NYSE:GS) first heralded the dying of the January impact again in 2017, pointing to twenty years value of research that confirmed returns diminishing within the month of January in comparison with historic figures going again to 1974.

These within the “not actual” camp declare that whereas this occasion might have been tangible again within the twentieth century, current knowledge appears to be like far more random.

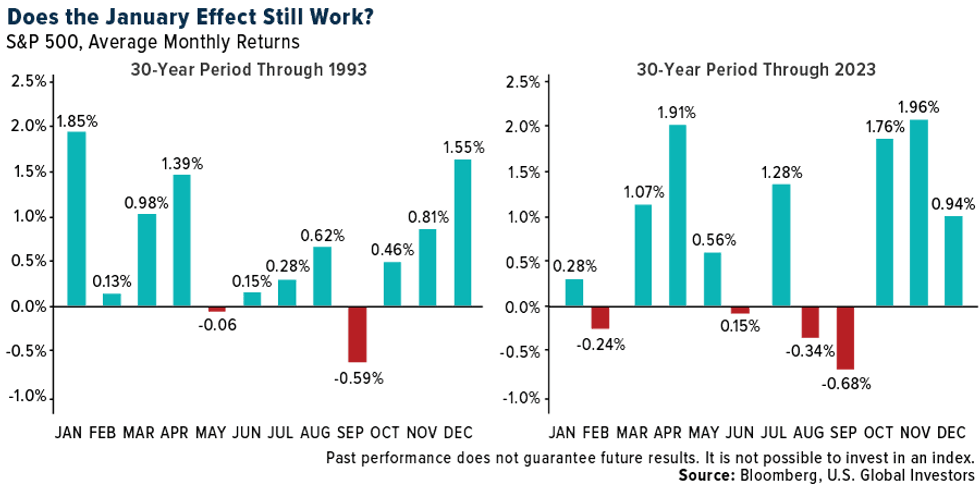

Illustrating this, the graphs beneath from US International Traders examine the S&P 500’s (INDEXSP:.INX) common efficiency by month from the 30 years by 1993 and the 30 years by 2023. Whereas January got here in first in the course of the first interval with common features of 1.85 %, since 1993 it has averaged features of 0.28 %, placing it in eighth place.

Chart through US International Traders.

Investopedia’s more moderen evaluation continues to assist the “January no-effect” place. Trying again three many years because the 1993 inception of the SPDR S&P 500 ETF Belief (ARCA:SPY), funding advisor and international market strategist James Chen factors out that within the final 31 years “there have been 18 profitable January months (58%) and 13 shedding January months (42%), making the percentages of a acquire solely barely greater than the flip of a coin.”

The previous two years, the markets have carried out strongly in January. January 2023 noticed the S&P 500 soar 5.8 % over the course of the month after falling on the finish of December. Nonetheless, markets fell again down by February and March, making the rally quick lived.

In January 2024, the S&P 500 dipped barely initially of the month however finally closed January up 2.12 % greater than its open. Not like the earlier 12 months, the index continued that upward development by the tip of March, at which level it was up 10.73 % from the start of the 12 months.

How can traders capitalize on the January impact?

It may be simple to get swept up in rumour, and with debate nonetheless in play, the January impact is a dangerous enterprise. Use your judgment, or the judgment of an expert, and don’t get sucked into chasing costs. It’s finest to not base your funding technique on the potential of a seasonal market mantra that dependable proof reveals not holds true.

For traders seeking to capitalize on a possible rally as a result of January impact, listed below are a couple of methods to think about.

- Make investments early — One strategy is to put money into This fall of the calendar 12 months with the intention to primarily place your bets in anticipation of the January impact. In case you’re inclined to take part in tax-loss promoting, then you could possibly time your shopping for interval for the tip of December and hope to harness each phenomena.

- Purchase shares with small market caps and micro caps — This is usually a good technique as a result of these are the shares that sometimes see essentially the most motion throughout this era. As famous, bigger firms are sometimes extra secure. Nonetheless, that stability comes paired with decrease threat, so risk-averse traders ought to follow bigger shares.

- Purchase dips in shares properly and really feel assured will return to greater costs — It’s usually a superb plan to go together with what , and it’s potential that shares already in your portfolio will wobble attributable to tax-loss promoting, presenting a profitable shopping for alternative. Simply be sure you keep away from shopping for shares you offered at a capital loss in the course of the prior 30 day interval as mentioned earlier, because the IRS will view that as a wash.

That is an up to date model of an article first printed by the Investing Information Community in 2018.

Don’t overlook to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Lauren Kelly, maintain no direct funding curiosity in any firm talked about on this article.

From Your Website Articles

Associated Articles Across the Internet