Nickel markets have been underwhelming the previous couple of years as an oversupply of the bottom steel exceeded demand. It was a pattern that continued by means of the final quarter of 2024.

Indonesian provide was the first drive stopping a breakout within the nickel markets. The nation continued to be the most important international supply, with a lot of its nickel destined for Chinese language-owned refineries within the nation.

Nevertheless, oversupply was additionally met with weak demand, as China’s financial system continued to sputter after the COVID-19 pandemic. The Chinese language housing and manufacturing markets are necessary demand drivers for nickel, which is utilized in chrome steel merchandise.

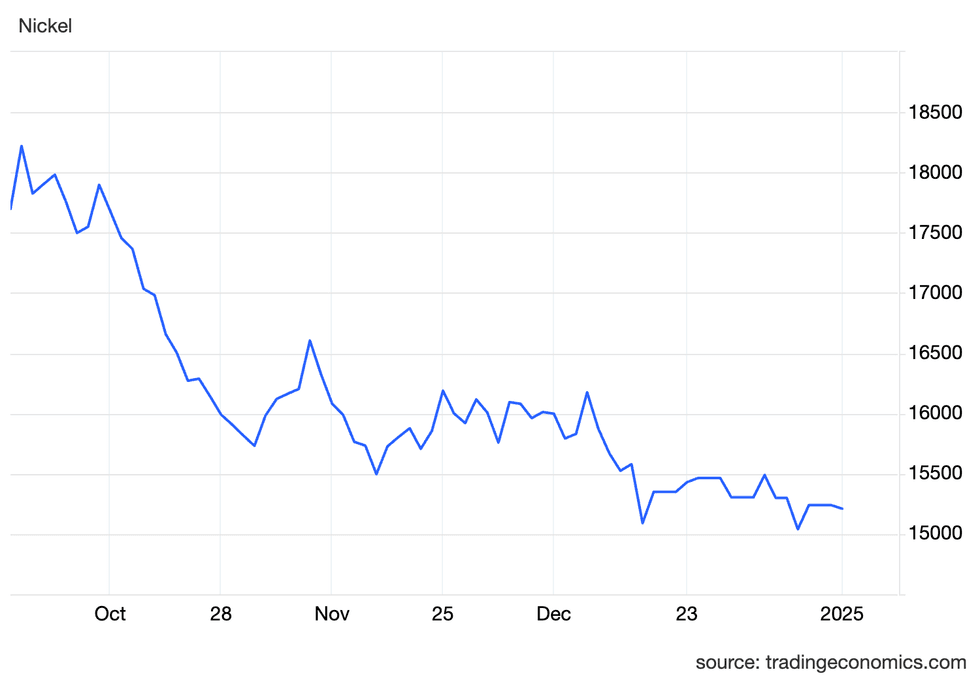

Nickel value in This autumn

Nickel reached its 2024 peak of US$21,615 per metric ton on Might 20, however was again beneath the US$16,000 mark by the top of July. Following some volatility in August and September, the worth of nickel gained momentum on the finish of Q3, reaching US$18,221 on October 2.

Nevertheless, the elevated costs had been to not final, and nickel spent a lot of the ultimate quarter in a downward pattern.

By the top of October, the worth had fallen to US$15,732 earlier than climbing again to US$16,607 on November 7.

Since then, the nickel market has seen some volatility however has continued its downward pattern. On December 19, it slumped to its 2024 low of US$15,090. Nevertheless, it noticed some small positive factors, ending the yr at US$15,300 on December 31.

Nickel value, This autumn 2024.

Chart by way of Buying and selling Economics.

Nickel’s weak costs are largely on account of excessive output from Indonesia and low demand, significantly from Asian markets, as China’s restoration has failed to achieve traction.

Because of this, on December 19, it was reported that Indonesia is contemplating implementing cuts to mining quotas to spice up costs. The transfer would see the nation minimize output by practically half, from 272 million metric tons of ore produced in 2024 to 150 million metric tons in 2025.

Moreover, Indonesia is seeking to tighten environmental regulation compliance for miners within the new yr and will introduce elevated volatility into metals markets, together with nickel. The transfer comes not lengthy after it signed a number of new agreements in November with Chinese language firms that may see billions invested in nickel operations in Indonesia.

Indonesia had beforehand labored to distance itself from China’s partnerships because it sought to enhance relations with the USA and be included beneath the US Inflation Discount Act (IRA).

The brand new agreements emerged shortly after Donald Trump received the US presidential election on November 7. Trump’s return to the Oval Workplace is unlikely to bode effectively for Indonesian officers looking for to safe a commerce deal with the USA. Nevertheless, a loosening of guidelines within the IRA may create new inroads for Indonesian nickel producers.

How did nickel carry out for the remainder of the yr?

Nickel value in Q1

The story for the reason that begin of the yr has been excessive output from Indonesian operations.

Low costs noticed some nickel producers, together with First Quantum Minerals (TSX:FM,OTC Pink:FQVLF) and Australia’s Wyloo Metals, minimize manufacturing. Nevertheless, New Caledonia was most affected. The nation is extra depending on the nickel sector, with trade giants like Glencore (LSE:GLEN,OTC Pink:GLCNF), Eramet (EPA:ERA) and uncooked supplies dealer Trafigura proudly owning important stakes in nickel producers within the nation.

Finally, cuts there led to a 200 million euro bailout bundle from the French authorities, which exacerbated tensions over New Caledonia’s independence from France. Opponents of the settlement argued it dangers the territory’s sovereignty and that the mining firms aren’t contributing sufficient to bail out the mines, which make use of hundreds.

Nickel value in Q2

The second quarter was outlined by a surge in nickel costs.

Constructive momentum started to work its approach into the market on the finish of Q1, as Indonesia skilled delays in approving mining output quotas and hypothesis grew that Russian nickel may very well be sanctioned by the US and UK.

On April 12, information broke that Washington and London had banned US and UK steel exchanges from admitting new aluminum, copper and nickel from Russia. Taking instant impact, the prohibitions additionally halted the import of these metals inflicting the worth to soar to a year-to-date excessive of US$21,615 on Might 20.

On the time Joe Mazumdar, editor of Exploration Insights, instructed this transfer would have little impression on the sector.

“That nickel remains to be going to make it into the market, it’s simply going to go to a special alternate, in all probability Shanghai … So I may nonetheless see that nickel transferring and getting consumed within the international market — it’s simply not coming to the west,” he defined to the Investing Information Community in an interview.

Finally, by the top of the quarter, the worth was trending towards US$17,000.

Nickel value in Q3

Nickel noticed a robust finish to the third quarter with the worth rising above the US$18,000 mark.

Nickel discovered pricing assist in September because the Chinese language authorities launched a raft of stimulus measures meant to spice up financial development within the nation. Among the many measures had been a 0.5 p.c rate of interest minimize on current mortgages and a discount within the downpayment required to buy a house to fifteen p.c from 25 p.c.

The announcement got here alongside cuts at Chinese language smelters as they had been pressured to take care of a scarcity in feeder provide on account of extra delays to Indonesia’s allowing and quota system.

Investor takeaway

The nickel market is anticipated to stay oversupplied for a while.

With China’s financial system on a sluggish path to restoration, demand will stay weak. In the meantime, provide will seemingly hinge on if Indonesia chooses to make important cuts to provide output.

Whereas demand for nickel in electrical automobile batteries is anticipated to be up 27 p.c year-on-year in 2024, producers have additionally been seeking to alternate options that don’t require as a lot nickel. Moreover, extra customers need to plug-in hybrid autos with smaller batteries that require much less nickel.

Even with the elevated demand from the battery sector, nickel is primarily utilized in chrome steel merchandise, that are nonetheless dominated by the Chinese language manufacturing and actual property sectors.

Maybe probably the most important elements to contemplate are political. A brand new administration in the USA and a shift within the IRA’s method to sourcing important metals like nickel may alter the panorama for nickel producers in 2025.

Don’t overlook to comply with us @INN_Resource for real-time information updates.

Securities Disclosure: I, Dean Belder, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Net