Traders with some huge cash to spend have taken a bearish stance on Amgen AMGN.

And retail merchants ought to know.

We observed this right now when the positions confirmed up on publicly out there choices historical past that we observe right here at Benzinga.

Whether or not these are establishments or simply rich people, we do not know. However when one thing this large occurs with AMGN, it usually means anyone is aware of one thing is about to occur.

At the moment, Benzinga’s choices scanner noticed 11 choices trades for Amgen.

This is not regular.

The general sentiment of those big-money merchants is break up between 27% bullish and 63%, bearish.

Out of all the choices we uncovered, there was 1 put, for a complete quantity of $306,375, and 10, calls, for a complete quantity of $382,064.

Predicted Value Vary

Analyzing the Quantity and Open Curiosity in these contracts, evidently the large gamers have been eyeing a value window from $220.0 to $300.0 for Amgen through the previous quarter.

Insights into Quantity & Open Curiosity

When it comes to liquidity and curiosity, the imply open curiosity for Amgen choices trades right now is 1857.57 with a complete quantity of 1,376.00.

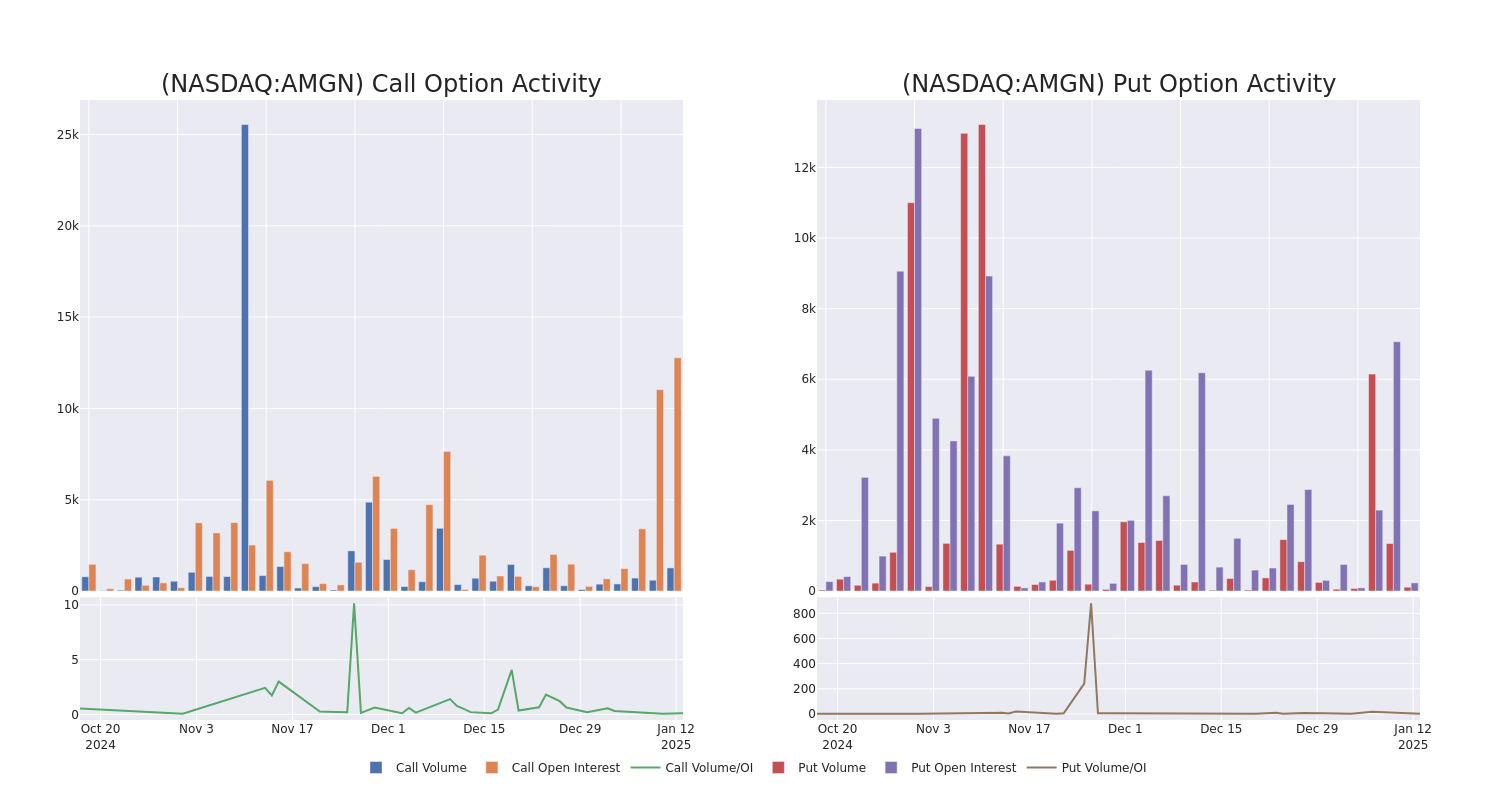

Within the following chart, we’re capable of observe the event of quantity and open curiosity of name and put choices for Amgen’s large cash trades inside a strike value vary of $220.0 to $300.0 over the past 30 days.

Amgen Choice Quantity And Open Curiosity Over Final 30 Days

Vital Choices Trades Detected:

| Image | PUT/CALL | Commerce Sort | Sentiment | Exp. Date | Ask | Bid | Value | Strike Value | Whole Commerce Value | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | SWEEP | BEARISH | 05/16/25 | $14.25 | $14.2 | $14.25 | $260.00 | $306.3K | 231 | 109 |

| AMGN | CALL | SWEEP | BULLISH | 01/17/25 | $46.0 | $44.15 | $46.0 | $220.00 | $73.6K | 239 | 9 |

| AMGN | CALL | SWEEP | BULLISH | 09/19/25 | $14.7 | $14.35 | $14.7 | $290.00 | $63.2K | 60 | 43 |

| AMGN | CALL | TRADE | BULLISH | 04/17/25 | $3.3 | $3.15 | $3.3 | $300.00 | $40.9K | 493 | 129 |

| AMGN | CALL | TRADE | BEARISH | 06/20/25 | $10.25 | $9.85 | $9.85 | $290.00 | $35.4K | 158 | 94 |

About Amgen

Amgen is a frontrunner in biotechnology-based human therapeutics. Flagship medication embrace purple blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory illnesses. Amgen launched its first most cancers therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (accredited 2010) and Evenity (2019). The acquisition of Onyx bolstered the agency’s therapeutic oncology portfolio with Kyprolis. Latest launches embrace Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung most cancers), and Tezspire (bronchial asthma). The 2023 Horizon acquisition brings a number of rare-disease medication, together with thyroid eye illness drug Tepezza. Amgen additionally has a rising biosimilar portfolio.

Having examined the choices buying and selling patterns of Amgen, our consideration now turns on to the corporate. This shift permits us to delve into its current market place and efficiency

Present Place of Amgen

- With a buying and selling quantity of 1,552,050, the worth of AMGN is down by -0.1%, reaching $261.96.

- Present RSI values point out that the inventory is could also be approaching overbought.

- Subsequent earnings report is scheduled for 22 days from now.

What Analysts Are Saying About Amgen

Over the previous month, 3 trade analysts have shared their insights on this inventory, proposing a mean goal value of $296.0.

Flip $1000 into $1270 in simply 20 days?

20-year professional choices dealer reveals his one-line chart approach that exhibits when to purchase and promote. Copy his trades, which have had averaged a 27% revenue each 20 days. Click on right here for entry.

* Sustaining their stance, an analyst from Wells Fargo continues to carry a Equal-Weight ranking for Amgen, concentrating on a value of $280.

* Constant of their analysis, an analyst from Truist Securities retains a Maintain ranking on Amgen with a goal value of $298.

* An analyst from Piper Sandler persists with their Obese ranking on Amgen, sustaining a goal value of $310.

Buying and selling choices entails higher dangers but in addition provides the potential for greater earnings. Savvy merchants mitigate these dangers by way of ongoing schooling, strategic commerce changes, using numerous indicators, and staying attuned to market dynamics. Sustain with the newest choices trades for Amgen with Benzinga Professional for real-time alerts.

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.