Within the newest quarter, 6 analysts supplied rankings for Westinghouse Air Brake WAB, showcasing a mixture of bullish and bearish views.

The desk under supplies a concise overview of current rankings by analysts, providing insights into the altering sentiments over the previous 30 days and drawing comparisons with the previous months for a holistic perspective.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Rankings | 1 | 4 | 1 | 0 | 0 |

| Final 30D | 1 | 0 | 0 | 0 | 0 |

| 1M In the past | 0 | 0 | 0 | 0 | 0 |

| 2M In the past | 0 | 0 | 0 | 0 | 0 |

| 3M In the past | 0 | 4 | 1 | 0 | 0 |

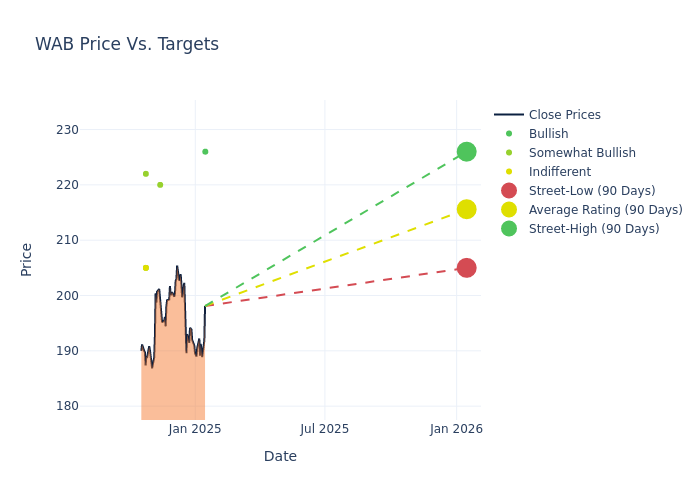

Insights from analysts’ 12-month worth targets are revealed, presenting a median goal of $216.33, a excessive estimate of $226.00, and a low estimate of $205.00. Observing a 7.63% improve, the present common has risen from the earlier common worth goal of $201.00.

Deciphering Analyst Rankings: An In-Depth Evaluation

The evaluation of current analyst actions sheds mild on the notion of Westinghouse Air Brake by monetary specialists. The next abstract presents key analysts, their current evaluations, and changes to rankings and worth targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Ken Hoexter | B of A Securities | Raises | Purchase | $226.00 | $225.00 |

| Steve Barger | Keybanc | Raises | Chubby | $220.00 | $200.00 |

| Justin Lengthy | Stephens & Co. | Raises | Chubby | $205.00 | $190.00 |

| Bascome Majors | Susquehanna | Raises | Constructive | $222.00 | $220.00 |

| Jerry Revich | Goldman Sachs | Raises | Impartial | $205.00 | $181.00 |

| Bascome Majors | Susquehanna | Raises | Constructive | $220.00 | $190.00 |

Key Insights:

- Motion Taken: Analysts incessantly replace their suggestions primarily based on evolving market situations and firm efficiency. Whether or not they ‘Preserve’, ‘Increase’ or ‘Decrease’ their stance, it displays their response to current developments associated to Westinghouse Air Brake. This data supplies a snapshot of how analysts understand the present state of the corporate.

- Ranking: Delving into assessments, analysts assign qualitative values, from ‘Outperform’ to ‘Underperform’. These rankings talk expectations for the relative efficiency of Westinghouse Air Brake in comparison with the broader market.

- Value Targets: Analysts gauge the dynamics of worth targets, offering estimates for the longer term worth of Westinghouse Air Brake’s inventory. This comparability reveals developments in analysts’ expectations over time.

Assessing these analyst evaluations alongside essential monetary indicators can present a complete overview of Westinghouse Air Brake’s market place. Keep knowledgeable and make well-judged choices with the help of our Rankings Desk.

Keep updated on Westinghouse Air Brake analyst rankings.

Get to Know Westinghouse Air Brake Higher

Westinghouse Air Brake Applied sciences Corp is a supplier of value-added, technology-based services and products for the freight rail and passenger transit industries, and the mining, marine, and industrial markets. It supplies its services and products by means of two foremost enterprise segments, Freight and Transit. The corporate generates most income from the Freight phase which manufactures new and modernized locomotives, supplies aftermarket components and providers to present locomotives; supplies elements to new and present freight vehicles; builds new commuter locomotives; provides rail management and infrastructure merchandise together with electronics, constructive practice management tools, sign design and engineering providers. Geographically, it generates a majority of its income from the US.

Understanding the Numbers: Westinghouse Air Brake’s Funds

Market Capitalization Evaluation: The corporate’s market capitalization surpasses business averages, showcasing a dominant measurement relative to friends and suggesting a robust market place.

Income Development: Westinghouse Air Brake’s outstanding efficiency in 3 months is clear. As of 30 September, 2024, the corporate achieved a powerful income progress fee of 4.43%. This signifies a considerable improve within the firm’s top-line earnings. As in comparison with opponents, the corporate surpassed expectations with a progress fee larger than the common amongst friends within the Industrials sector.

Internet Margin: Westinghouse Air Brake’s monetary energy is mirrored in its distinctive web margin, which exceeds business averages. With a outstanding web margin of 10.63%, the corporate showcases sturdy profitability and efficient price administration.

Return on Fairness (ROE): Westinghouse Air Brake’s ROE excels past business benchmarks, reaching 2.73%. This signifies strong monetary administration and environment friendly use of shareholder fairness capital.

Return on Belongings (ROA): Westinghouse Air Brake’s ROA surpasses business requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 1.51% ROA, the corporate successfully makes use of its property for optimum returns.

Debt Administration: Westinghouse Air Brake’s debt-to-equity ratio is under the business common at 0.39, reflecting a decrease dependency on debt financing and a extra conservative monetary strategy.

How Are Analyst Rankings Decided?

Analysts work in banking and monetary techniques and sometimes concentrate on reporting for shares or outlined sectors. Analysts could attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish “analyst rankings” for shares. Analysts sometimes fee every inventory as soon as per quarter.

Some analysts will even supply forecasts for metrics like progress estimates, earnings, and income to supply additional steering on shares. Traders who use analyst rankings ought to notice that this specialised recommendation comes from people and could also be topic to error.

Which Shares Are Analysts Recommending Now?

Benzinga Edge provides you immediate entry to all main analyst upgrades, downgrades, and worth targets. Type by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.