Interval following the Nice Monetary Disaster was an ‘aberration,’ says analyst

Article content material

Article content material

Article content material

Bear in mind the “new regular” after the nice monetary disaster? One analyst thinks it’s over and we’re heading again to the “previous regular,” which in the end means a world with extra volatility and greater rates of interest and a decrease Canadian greenback, however with some silver linings, suggests Karl Schamotta, chief market strategist at Corpay Inc.

“The surplus world liquidity that was beforehand suppressing rates of interest and elevating asset values is now starting to shrink, and in order that signifies that rates of interest ought to settle nearer to their long-term averages” within the vary of about 4.82 per cent, he stated, basing that quantity on 10-year United States Treasury yield information going again to 1790.

Commercial 2

Article content material

The Financial institution of Canada has at the moment set its benchmark lending price at 3.25 per cent, with the market anticipating one other lower when policymakers meet on Jan. 29.

Most economists are betting on charges falling to the decrease finish of the Financial institution of Canada’s impartial vary of two.25 per cent to three.25 per cent, however Schamotta reminds us that it’s the U.S. Treasury markets that set lending charges for issues similar to mortgages.

“The truth is that though the Financial institution of Canada does set benchmark coverage charges in Canada, the worldwide value of borrowing is about in the USA,” he stated. “It wouldn’t be a shock if we had been to oscillate across the long-term common for 10-year Treasury yields.”

So, what was the brand new regular and may we be unhappy that it’s over?

The time period, resurrected from the early 1900s by McKinsey & Co., was reportedly popularized by well-known bond investor Invoice Gross of Pacific Funding Administration Co.

It was used within the wake of the worldwide monetary disaster to explain a worldwide economic system of sluggish demand, weak productiveness in Western nations and “a glut of financial savings” flooding into monetary markets from China and different creating nations.

Article content material

Commercial 3

Article content material

“After which, after all, you had the central banks being actually interventionist, repeatedly form of reaching for these unconventional coverage instruments and driving rates of interest down,” Schamotta stated.

U.S. Federal Reserve and Financial institution of Canada charges fell to 0.25 per cent within the aftermath. Because of this, the brand new regular wound up pushing down inflation and financial volatility as properly.

From Schamotta’s perspective, the pandemic was the primary occasion in a collection to shake the foundations of the brand new regular, adopted by rate of interest hikes to fight a large surge in inflation and the battle in Ukraine.

“All (that) mixed elevated stage of geopolitical instability (to) convey that period to an finish,” he stated. “And I don’t assume traders have totally included a extra risky future into their forecasts or into their underlying assumptions but, however I believe it’s turning into so.”

Schamotta sees a extra fragmented world economic system forward, the place the motion of products is interrupted on account of geopolitical occasions in addition to authorities insurance policies similar to tariffs, subsidies that favour home over overseas corporations and restrictions on the motion of cash.

Commercial 4

Article content material

Because of this, traders could possibly be taking a look at extra volatility and inflation, however he doesn’t assume it’s all dangerous information, particularly for the Canadian greenback and householders.

Schamotta stated the Canadian greenback will stay “weak” — it’s at the moment round 69.5 cents U.S. — however a weak loonie is “traditionally regular,” and “so we could also be correcting a interval of overvaluation within the Canadian greenback now.”

He stated that’s good for Canada since an elevated forex encourages folks to spend greater than they’ll afford, and a “Canadian greenback in keeping with Canadian fundamentals is a lift to the remainder of the economic system.”

Schamotta additionally stated greater rates of interest are extra probably, which means “asset costs aren’t outstripping” financial development, so, for instance, the price of housing shouldn’t be wildly outpacing the rise in folks’s pay.

“I’m not going to sing Kumbaya right here and say that it’s all brighter days,” he stated. “However the broad level is that the aberration in human historical past might need been the interval between the worldwide monetary disaster and the pandemic. I see what we could be getting again to is far more regular.”

Commercial 5

Article content material

Join right here to get Posthaste delivered straight to your inbox.

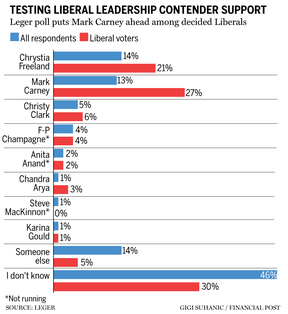

Final month, former Financial institution of Canada governor Mark Carney appeared poised to change into the nation’s subsequent finance minister. Now, he has a good larger submit in his sights.

On Thursday, Carney introduced he’ll run to succeed Justin Trudeau as chief of the Liberal Get together Canada, a contest that would elevate him inside weeks to the submit of prime minister — if solely till a extensively anticipated federal election.

Carney’s official entry into the Liberal race will come after months of hypothesis about his political ambitions following a notable profession in finance and central banking. — Naimul Karim, Monetary Submit

Maintain studying to search out out extra in regards to the man who could possibly be Liberal king.

- Financial institution of Canada publishes report on distinctive coverage actions taken in response to the COVID-19 pandemic

- Immediately’s information: U.S. housing begins and buildings permits, plus industrial manufacturing and capability utilization. Statistics Canada releases worldwide securities transactions for November

- Earnings: Lithium Americas Argentina, Schlumberger NV

Commercial 6

Article content material

Kelley Keehn, co-founder of Moneywise Institute, talks with the Monetary Submit’s Larysa Harapyn about how Canadians can keep on with their monetary resolutions for 2025. Watch the video right here.

Calling Canadian households with youthful children or teenagers: Whether or not it’s budgeting, spending, investing, paying off debt, or simply paying the payments, does your loved ones have any monetary resolutions for the approaching 12 months? Tell us at wealth@postmedia.com.

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Submit column may also help navigate the advanced sector, from the most recent developments to financing alternatives you gained’t need to miss. Learn them right here

Monetary Submit on YouTube

Go to Monetary Submit’s YouTube channel for interviews with Canada’s main specialists in economics, housing, the power sector and extra.

Immediately’s Posthaste was written by Gigi Suhanic, with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? Electronic mail us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material