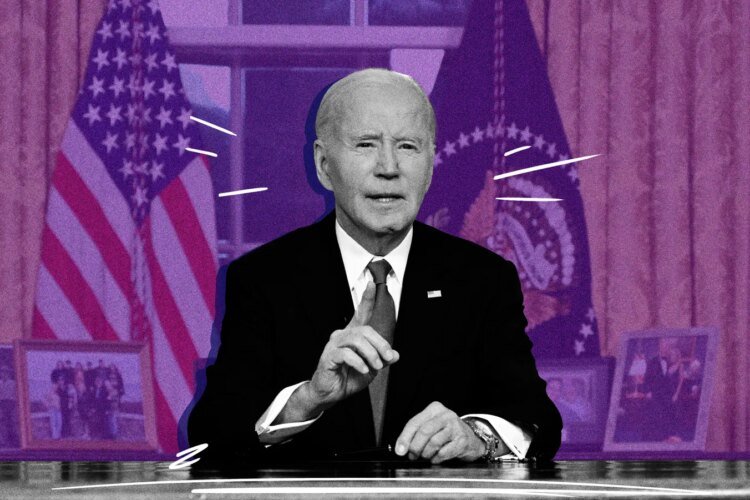

President Joe Biden could have under-delivered on his promise to supply broad pupil mortgage forgiveness, however his administration nonetheless succeeded in wiping out billions of {dollars} of pupil debt.

Simply days earlier than he leaves the White Home, Biden made his ultimate three rounds of focused pupil debt forgiveness, asserting this week that one other 400,000 debtors would have a collective $10 billion of debt canceled.

Biden famous in a press release that these final measures carry the whole variety of debtors who’ve obtained pupil mortgage forgiveness below his administration to over 5 million.

“I’m proud to say we now have forgiven extra pupil mortgage debt than every other administration in historical past,” Biden mentioned.

In whole, the Schooling Division has discharged about $190 billion of pupil debt as a part of 33 focused aid measures since Biden took workplace, the company mentioned Thursday.

Republicans largely balked on the ultimate wave of forgiveness efforts. Schooling and Workforce Committee Chairman Tim Walberg, R-Mi., known as it a “swan tune” that ignores earlier court docket rulings.

“It’s shameful that, in its ultimate days, the Biden-Harris administration is doubling down on efforts to push as a lot forgiveness as doable via the door,” he mentioned, “as soon as once more ignoring the rule of regulation.”

Who advantages from Biden’s final rounds of pupil debt aid

Biden’s ultimate aid efforts are largely tailor-made towards public service staff, debtors who have been misled by their faculties into taking out loans and debtors who’re completely disabled.

These teams certified for pupil debt aid below long-standing packages run by the Schooling Division and weren’t authorized as a part of Biden’s separate, failed makes an attempt at broad forgiveness. That mentioned, Biden’s White Home oversaw a number of modifications that made it less complicated for debtors to really entry forgiveness via these packages.

- About 350,000 debtors authorized for Borrower Protection forgiveness: A whole lot of hundreds of debtors who attended for-profit faculties that the Schooling Division discovered as having engaged in deceptive or misleading practices — together with Ashford College, the Middle for Excellence in Greater Schooling and others — may have their pupil loans forgiven robotically.

- 61,000 debtors to obtain Complete and Everlasting Incapacity Discharge: Due to the Schooling Division’s current potential to robotically pull knowledge from the Social Safety Administration and the Division of Veteran Affairs, this group of disabled debtors is getting their loans forgiven robotically.

- 6,100 qualify for Public Service Mortgage Forgiveness (PSLF): Via PSLF, this newest batch of public-sector staff — i.e. docs, nurses, lecturers and social staff — are getting their remaining loans forgiven after working for 10 years within the subject whereas making mortgage funds. This program requires an utility and certification of funds and work historical past.

- Over 4,500 to obtain aid through Earnings-Based mostly Reimbursement (IBR): After many years of creating funds via the IBR plan, one among a number of income-driven reimbursement plans that bases one’s month-to-month mortgage funds on their earnings, 4,550 debtors are getting their remaining balances forgiven, the Schooling Division mentioned Thursday.

Based on the division, these discharge measures cannot be reversed by the incoming Trump administration.

“It is a ultimate company dedication,” an official mentioned on a press name Monday.

A take a look at mortgage forgiveness below Biden

When Biden took workplace in 2021, he had massive pupil mortgage forgiveness plans, after campaigning on a promise to forgive no less than $10,000 of pupil mortgage debt per borrower. Broad debt aid by no means panned out — although it wasn’t for lack of attempting.

In 2022, he unveiled his first main forgiveness plan, a proposal to cancel as much as $20,000 per borrower, a measure that was slated to profit upwards of 40 million federal pupil mortgage debtors. After all, that by no means occurred. The U.S. Supreme Courtroom struck the plan down, stating the president didn’t have the authorized authority to broadly cancel pupil debt.

The Biden administration went again to the drafting board, making a narrower forgiveness plan that underwent an official rulemaking course of. It was geared toward offering aid to debtors who’re struggling financially or have been repaying their loans for many years. This plan, too, confronted main authorized challenges. Proper earlier than the Presidential Election, his administration pared down the plan even additional, primarily crafting a Plan C that it considered as adhering to the courts’ earlier rulings.

On condition that Vice President Kamala Harris misplaced her presidential bid to President-elect Donald Trump, Biden in the end deserted his broad forgiveness efforts and formally withdrew the measures.

Because the bigger authorized battles have been enjoying out, Biden made many piecemeal modifications to the scholar mortgage reimbursement system — enhancing the applying and approval processes for the Division of Schooling’s handful of present aid packages.

He additionally reformed income-driven reimbursement by creating a brand new plan known as SAVE, brief for Saving on a Worth Schooling. This program was in the end halted by the courts as properly, however not earlier than forgiving debt for about 1 million debtors.

All of the whereas, Biden utilized a number of long-standing forgiveness packages (comparable to PSLF and others talked about above) to supply aid to tens of millions extra.

Right here’s a tally of the assorted packages Biden used to forgive pupil loans in lieu of his broader plans being struck down:

- Earnings-Pushed Reimbursement (IDR) plans: $57.1 billion for 1.45 million debtors

- PSLF: $78.5 billion for over 1 million debtors

- Incapacity discharge: $18.7 billion for over 630,000 debtors

- Borrower Protection: $34.5 billion for almost 2 million debtors

What pupil mortgage debtors can count on below Trump

Whereas Trump has so far saved mum on pupil mortgage forgiveness, debtors mustn’t get their hopes up.

His cupboard and different advisors in his orbit — together with some conservative agenda-setters of Mission 2025 and the America First Coverage Institute — are strongly towards pupil mortgage forgiveness.

Extra broadly, Trump has mentioned he desires to dismantle the Schooling Division as one among his first acts in workplace. Doing so requires Congressional approval. Within the unlikely occasion that the division is dismantled, it’s not precisely clear what would occur to the estimated $1.5 trillion of federal pupil loans it oversees.

One risk, as outlined in Mission 2025, is that the loans are transferred over to the U.S. Division of the Treasury (and not unintentionally forgiven, as some wishful theories are suggesting).

Michael Itzkowitz, an training coverage marketing consultant and founding father of HEA Group, lately instructed Cash that debtors ought to count on a continuation of Trump’s first time period: That’s, a scaling again of Obama and Biden-era aid insurance policies.

“It’s seemingly that the incoming administration will abandon forgiveness packages,” he mentioned, “at any time when and wherever doable.”

Extra from Cash:

New Federal Rule Removes All Medical Debt From Credit score Studies

This is Who Truly Obtained Pupil Mortgage Forgiveness — and How They Benefited