Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary knowledge and sample recognition to showcase 5 shares which might be just below the floor and deserve consideration.

Buyers are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies out there to retail merchants, the problem typically lies in sifting via the abundance of knowledge to uncover new alternatives and perceive why sure shares must be of curiosity.

Learn Additionally: EXCLUSIVE: High 20 Most-Searched Tickers On Benzinga Professional In 2024 — The place Do Tesla, Nvidia, GameStop, Trump Media Shares Rank?

Here is a take a look at the Benzinga Inventory Whisper Index for the week ending Jan. 31:

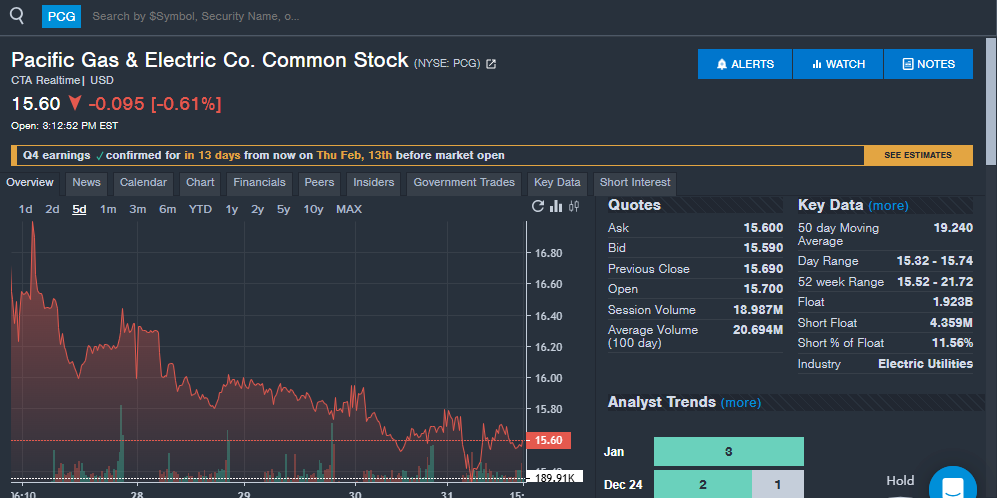

Pacific Fuel & Electrical Co PCG: The utility firm noticed robust curiosity from readers through the week, which comes as fourth-quarter monetary outcomes are approaching. The corporate is about to report This autumn outcomes on Feb. 13. Analysts count on the corporate to report earnings per share of 31 cents, down from 47 cents within the prior yr’s fourth quarter and income of $7.11 billion, up from $7.04 billion within the comparable interval. The corporate has crushed analyst earnings per share estimates in 4 straight quarters. On the income facet, the corporate has crushed analyst estimates in solely 4 of the final 10 quarters. A number of analysts stored bullish rankings on the inventory whereas decreasing value targets.

The inventory was down over 5% for the week and shares are down over 7% over the past yr.

Interactive Brokers Group IBKR: The net buying and selling firm noticed robust curiosity from readers, which might be associated to a number of analyst rankings in latest weeks. UBS maintained a Purchase score and raised the value goal from $225 to $265. Interactive Brokers will even be presenting at the usFinancial Companies Convention on Feb. 10. Goldman Sachs analyst James Yaro maintained a Purchase score on Interactive Brokers and raised the value goal from $214 to $226. The analyst stated Interactive Brokers’ fourth-quarter monetary outcomes confirmed the corporate was “well-rounded.”

“Wanting forward, the corporate expects to conduct quite a few new programming tasks, and plans to extend the advertising funds, each of which ought to assist robust account progress, round which administration sounded a constructive tone,” Yaro stated.

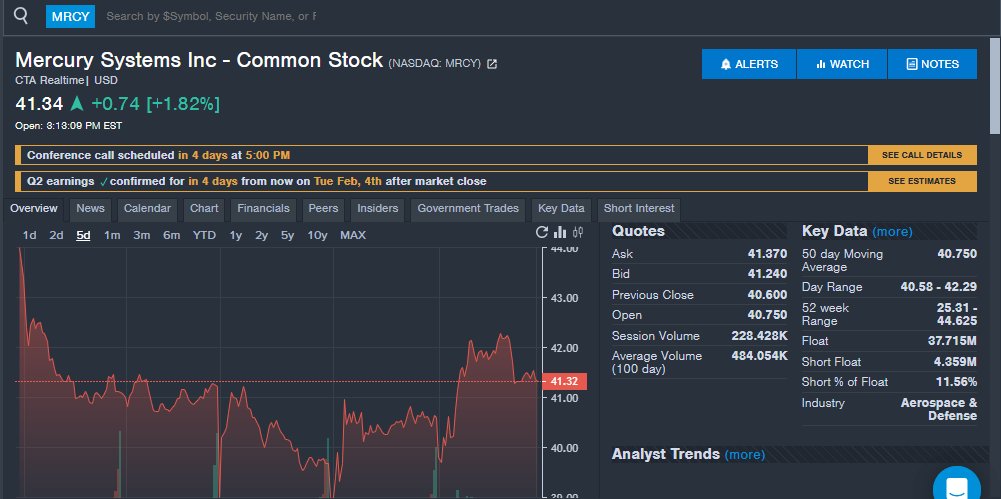

Mercury Techniques MRCY: The aerospace and protection inventory noticed robust curiosity from readers, which comes forward of second-quarter monetary outcomes set for Feb. 4. Analysts count on the corporate to report a lack of 4 cents per share and income of $182.4 million within the quarter. After struggling in previous quarters, the corporate has crushed analyst estimates for each income and earnings per share within the final two quarters. The inventory could have seen elevated curiosity from readers as the corporate introduced a brand new $24.5 million contract for knowledge processing within the U.S. Satellite tv for pc Program.

“We’re proud to assist this important U.S. nationwide safety mission,” Mercury Techniques Vice President of Mercy’s Superior Ideas Group Joe Plunkett stated. “The Mercury Processing Platform has an unbelievable breadth of capabilities that may be built-in in just about limitless methods to allow mission-critical processing on the edge.”

The inventory was down 2% on the week and is up round 40% over the past yr.

Xometry Inc XMTR: The AI-enabled manufacturing firm noticed robust curiosity from readers through the week. The curiosity comes as a number of analysts have shared updates on the small-cap inventory in latest weeks and with a brand new government announcement. The corporate added Sanjeev Singh Sahni, a former Wayfair government, within the newly created President position. Within the position, Sahni will lead international operations, product, know-how and provider companies. JMP Securities maintained a Purchase score on the inventory with a $42 value goal lately. Earlier this month, JPMorgan analyst Cory Carpenter shared a $45 value goal on the inventory, highlighting the corporate as a small-cap darling.

“We like XMTR in 2025 as a play on manufacturing below Trump,” Carpenter stated.

The analyst stated the corporate has catalysts that embrace worldwide growth and a “variety of methods to win in 2025.”

Costco Wholesale Company COST: Rounding out this week’s Inventory Whisper Index is retailer Costco, which continues to see robust curiosity from readers with shares close to all-time highs. The corporate reported robust December web gross sales of $27.52 billion, up 9.9% year-over-year lately. Costco additionally made headlines for changing Pepsi fountain drinks in its shops with Coca-Cola whereas committing to maintain the value of the well-known $1.50 sizzling canine combo in place. The corporate can be making headlines for defending its DEI insurance policies and rising non-union employee wages to $30 per hour for many U.S. retailer employees.

Keep tuned for subsequent week’s report, and observe Benzinga Professional for all the newest headlines and high market-moving tales right here.

Learn the newest Inventory Whisper Index studies right here:

Learn Subsequent:

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.