REIT Efficiency

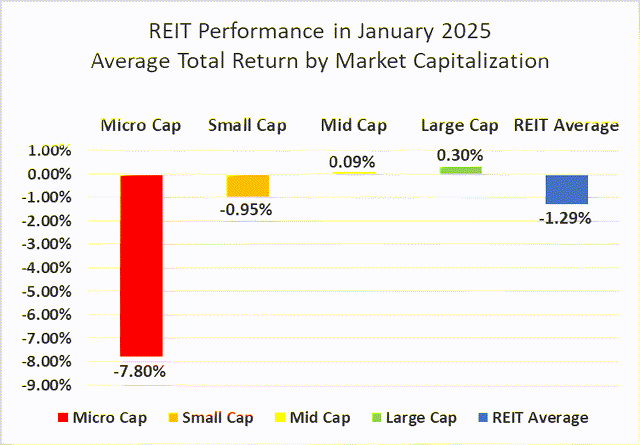

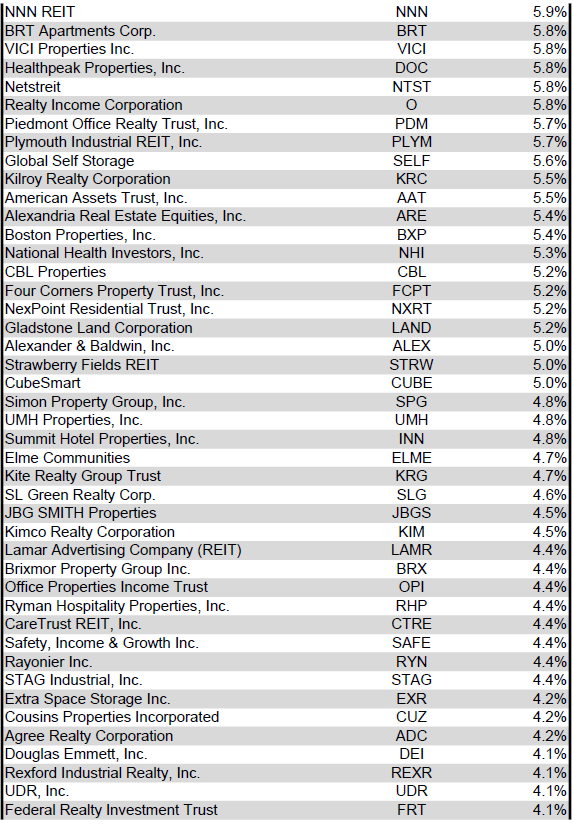

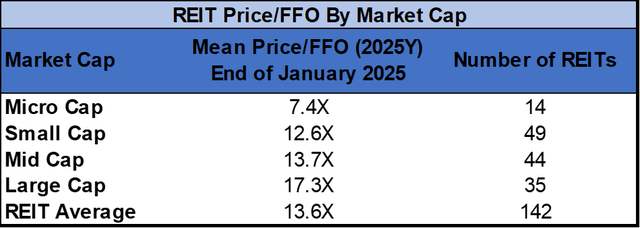

REITs kicked off 2025 with a modestly damaging January common whole return of -1.29%. REITs fell wanting the broader market because the Dow Jones Industrial Common (+4.8%), S&P 500 (+2.8%) and NASDAQ (+1.7%) all noticed positive aspects to begin the 12 months. The market cap weighted Vanguard Actual Property ETF (VNQ) outpaced the common REIT in January (+1.65% vs. -1.29%). The unfold between the 2025 FFO multiples of enormous cap REITs (17.3x) and small cap REITs (12.6x) widened in January, as multiples expanded 0.1 turns for big caps however contracted 0.9 turns for small caps. Traders at present must pay a median of 37.3% extra for every greenback of FFO from massive cap REITs relative to small cap REITs. On this month-to-month publication, I’ll present REIT information on quite a few metrics to assist readers establish which property varieties and particular person securities at present supply the most effective alternatives to attain their funding objectives.

Supply: Graph by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Micro cap REITs (-7.80%), which severely underperformed their bigger friends in 2024, continued their dropping streak in January. Giant caps (+0.30%) and mid caps (+0.09%) eked out slender positive aspects, however small caps (-0.95%) averaged a modest damaging return. After the primary month of 2025, massive cap REITs have outperformed small caps by 126 foundation factors.

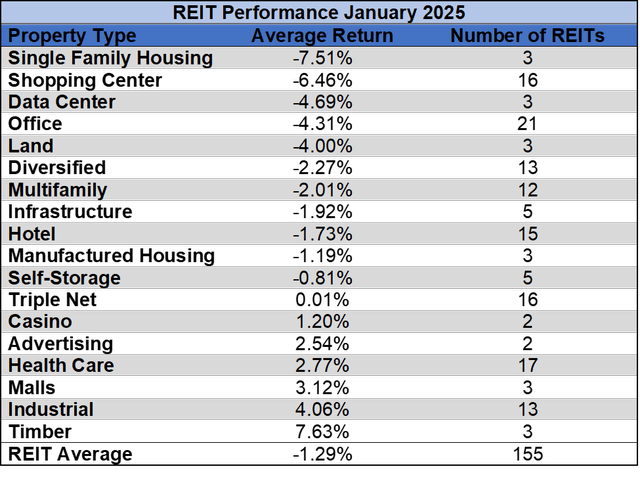

7 out of 18 Property Varieties Yielded Constructive Complete Returns in January

38.9% of REIT property varieties averaged a optimistic whole return in January. There was a 15.14% whole return unfold between the most effective and worst performing property varieties. Timber (+7.63%) and Industrial (+4.06%) had the strongest begin to 2025. Single Household Housing (-7.51%) and Purchasing Middle REITs (-6.46%) began the 12 months deep within the pink.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

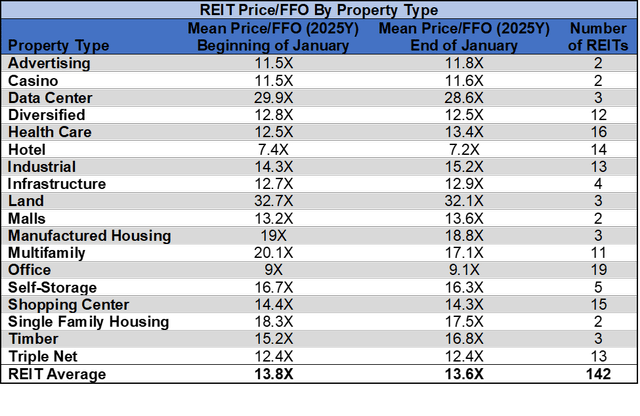

The REIT sector as an entire noticed the common P/FFO (2025Y) lower 0.2 turns in January from 13.8x all the way down to 13.6x. 50% of property varieties averaged a number of contraction, 44.4% averaged a number of growth and 5.6% noticed multiples maintain regular in January. Land (32.1x), Knowledge Facilities (28.6x), Manufactured Housing (18.8x), Single Household Housing (18.3x) and Multifamily (17.1x) at present commerce on the highest common multiples amongst REIT property varieties. Inns (7.2x) and Workplace (9.1x) are the one property varieties that common single digit FFO multiples.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

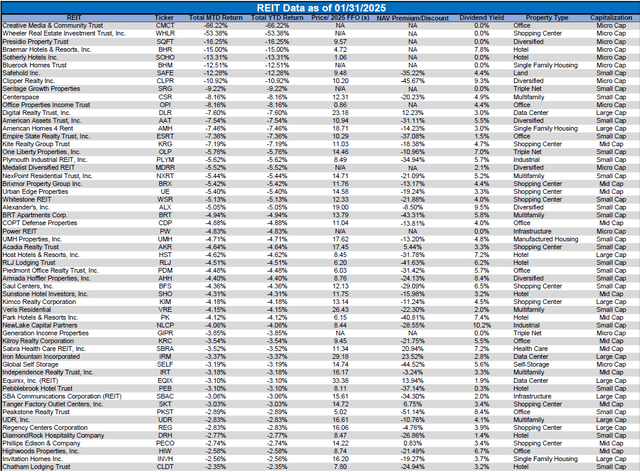

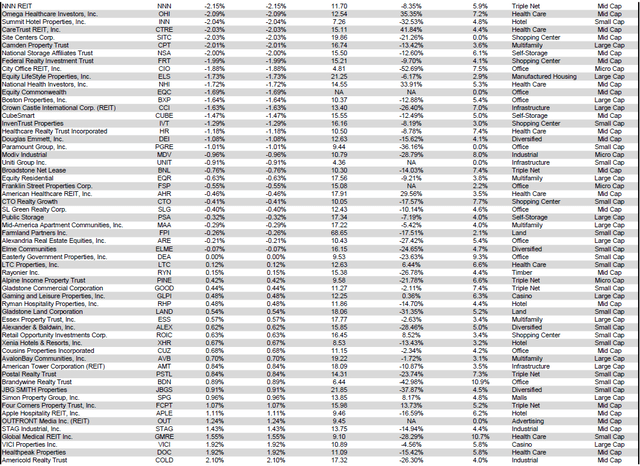

Efficiency of Particular person Securities

Medical Properties Belief (MPW) (+18.73%) outperformed all different fairness REITs in a really event-filled month for the well being care REIT. MPW’s lengthy struggling tenant Prospect Medical Holdings lastly filed for chapter on January 11th and on January 31st MPW refinanced massive loans that will have matured in 2025 and 2026 with new notes maturing in 2032.

Artistic Media & Neighborhood Belief (CMCT) (-66.22%) plummeted in January. CMCT introduced a 1-for-10 reverse inventory break up on the primary buying and selling day of the 12 months, however the share value continued to quickly collapse down towards the pre-split value.

42.58% of REITs had a optimistic whole return in January. REITs averaged a -1.29% whole return in January 2025, which was really a much less painful begin to the 12 months than REITs had the prior January (-5.72%).

For the comfort of studying this desk in a bigger font, the desk beneath is offered as a PDF as properly.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

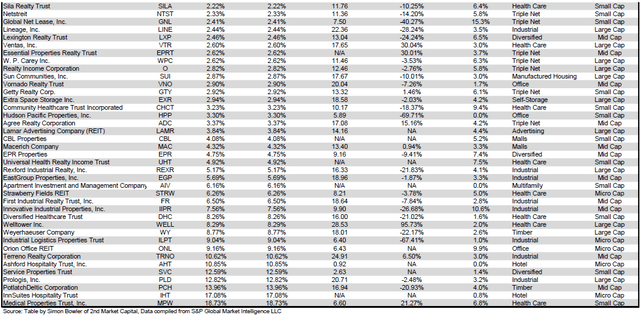

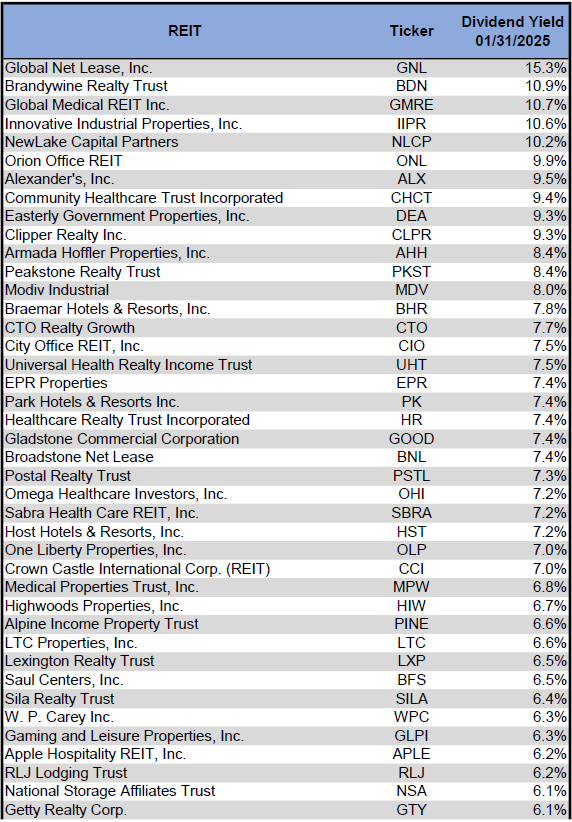

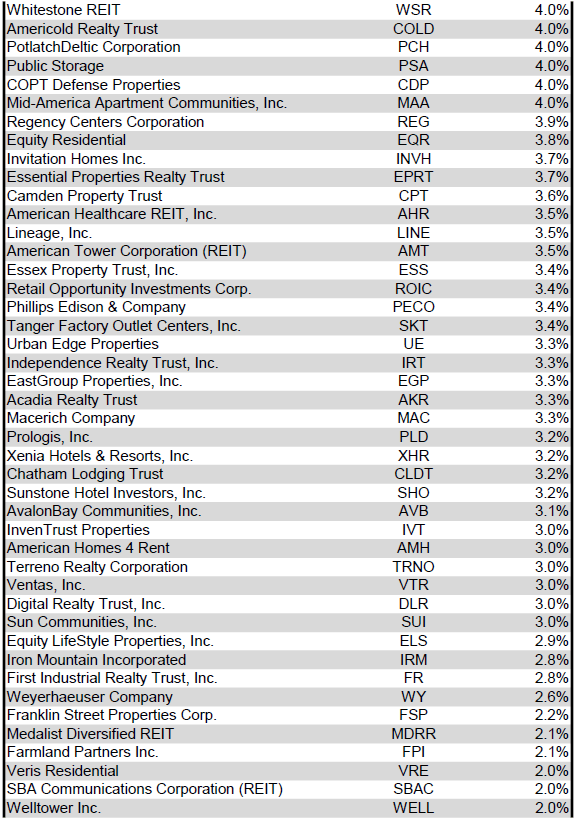

Dividend Yield

Dividend yield is a vital part of a REIT’s whole return. The significantly excessive dividend yields of the REIT sector are, for a lot of buyers, the first motive for funding on this sector. As many REITs are at present buying and selling at share costs properly beneath their NAV, yields are at present fairly excessive for a lot of REITs throughout the sector. Though a very excessive yield for a REIT could generally mirror a disproportionately excessive danger, there exist alternatives in some circumstances to capitalize on dividend yields which might be sufficiently enticing to justify the underlying dangers of the funding. I’ve included beneath a desk rating fairness REITs from the very best dividend yield (as of 1/31/2025) to the bottom dividend yield.

For the comfort of studying this desk in a bigger font, the desk beneath is offered as a PDF as properly.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

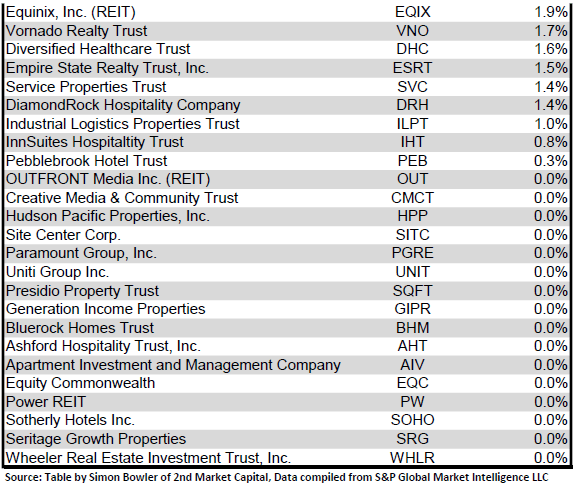

Though a REIT’s resolution concerning whether or not to pay a quarterly dividend or a month-to-month dividend doesn’t mirror on the standard of the corporate’s fundamentals or operations, a month-to-month dividend permits for a smoother money move to the investor. Under is a listing of fairness REITs that pay month-to-month dividends ranked from the very best yield to the bottom yield.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

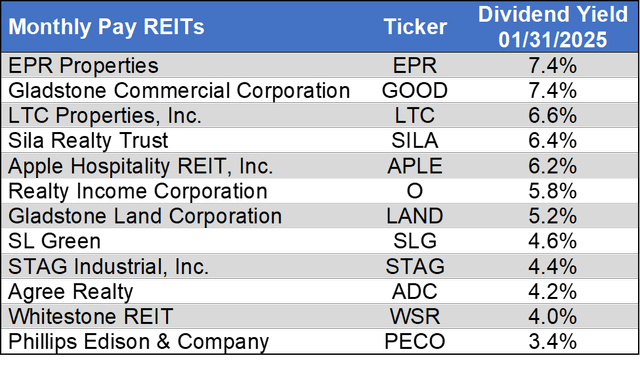

Dividend Information

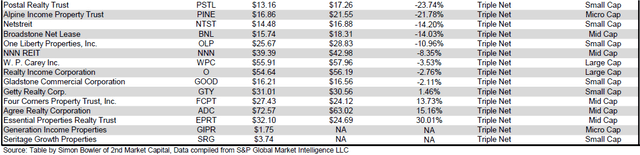

3 REITs introduced dividend hikes in January, 2 of which pay quarterly dividends and 1 of which pays month-to-month. Medalist Diversified REIT (MDRR) (+8.3%) introduced the biggest dividend enhance adopted by Postal Realty Belief (PSTL) (+1.0%) and STAG Industrial (STAG) (+0.7%).

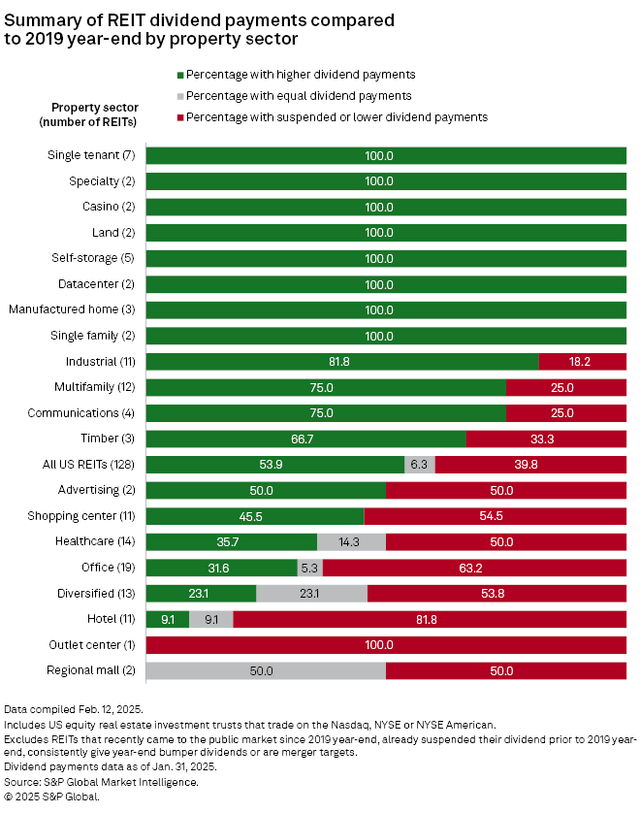

Supply: S&P World Market Intelligence

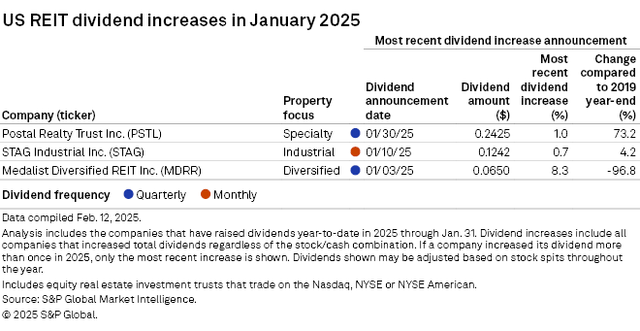

A majority (53.9%) of REITs at present pay the next dividend than they did pre-COVID (the top of 2019). 6.3% have the identical dividend they did pre-COVID and 39.8% have a lowered or suspended dividend.

Supply: S&P World Market Intelligence

A variety of REIT property varieties noticed throughout the board dividend will increase because the finish of 2019. 100% of REITs have elevated their dividend throughout the Single-tenant Triple Web, On line casino, Land, Self-storage, Knowledge Middle, Manufactured Housing and Single Household Housing property varieties. Nevertheless, not one of the Mall or Outlet Middle REITs have the next dividend right now than they did on the finish of 2019.

Valuation

REIT Premium/Low cost to NAV by Property Kind

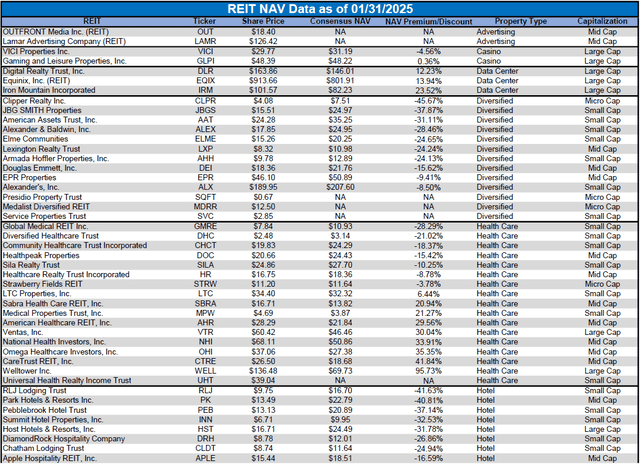

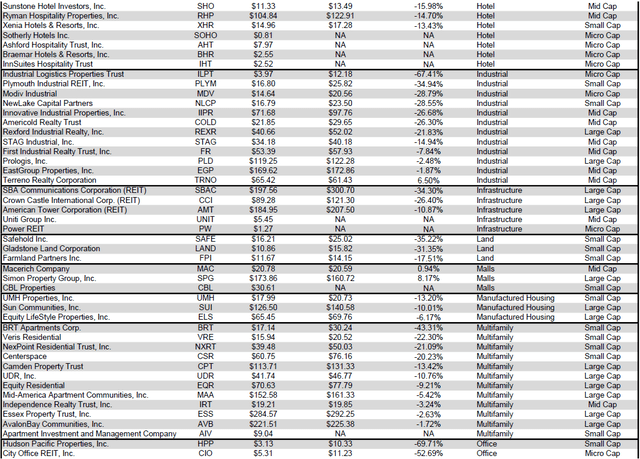

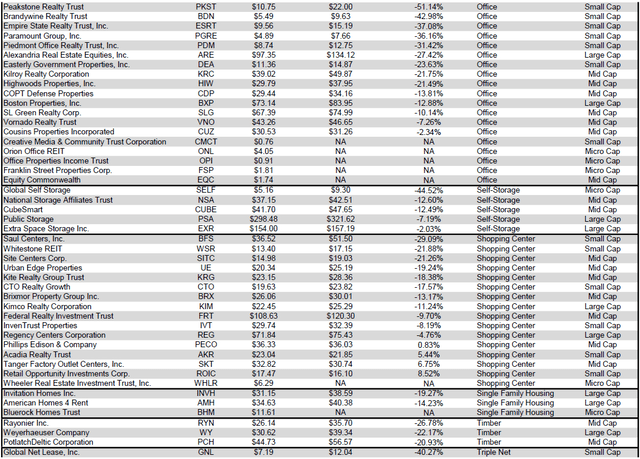

Under is a downloadable information desk, which ranks REITs inside every property sort from the biggest low cost to the biggest premium to NAV. The consensus NAV used for this desk is the common of analyst NAV estimates for every REIT. Each the NAV and the share value will change over time, so I’ll proceed to incorporate this desk in upcoming problems with The State of REITs with up to date consensus NAV estimates for every REIT for which such an estimate is offered.

For the comfort of studying this desk in a bigger font, the desk beneath is offered as a PDF as properly.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Takeaway

The big cap REIT premium (relative to small cap REITs) widened in January and buyers are actually paying on common about 37% extra for every greenback of 2025 FFO/share to purchase massive cap REITs than small cap REITs (17.3x/12.6x – 1 = 37.3%). As will be seen within the desk beneath, there’s presently a powerful optimistic correlation between market cap and FFO a number of.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

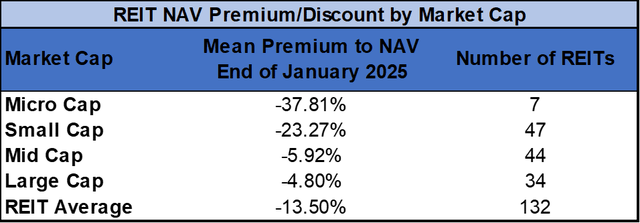

The desk beneath reveals the common NAV premium/low cost of REITs of every market cap bucket. This information, very like the info for value/FFO, reveals a powerful, optimistic correlation between market cap and Value/NAV. The typical massive cap REIT (-4.80%) and mid cap REIT (-5.92%) commerce at mid single-digit reductions to NAV. Small cap REITs (-23.27%) commerce at slightly over 3/4 of NAV and micro caps (-37.81%) commerce at lower than 2/3 of their respective NAVs.

Supply: Desk by Simon Bowler of 2nd Market Capital, Knowledge compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Financial Well being

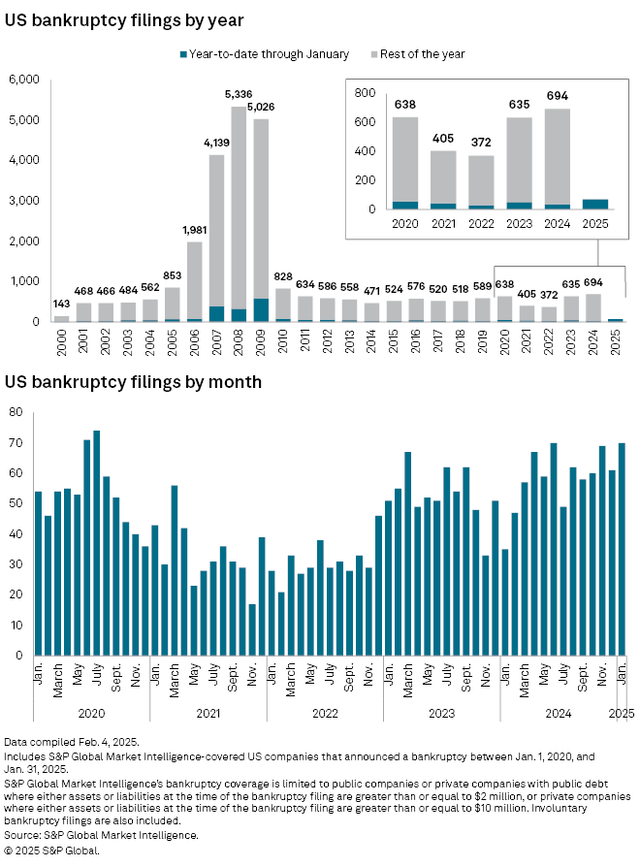

2024 had the very best variety of company bankruptcies in 14 years and January 2025 continued that painful upward development. January 2025 had twice the variety of bankruptcies as January 2024 (70 vs. 35) as excessive rates of interest proceed to take a toll on closely indebted corporations.

Supply: S&P World Market Intelligence

REITs General Noticed a Slight Lower in Quick Curiosity in January, However Quick Curiosity Stays Very Excessive for Some REITs

Supply: S&P World Market Intelligence

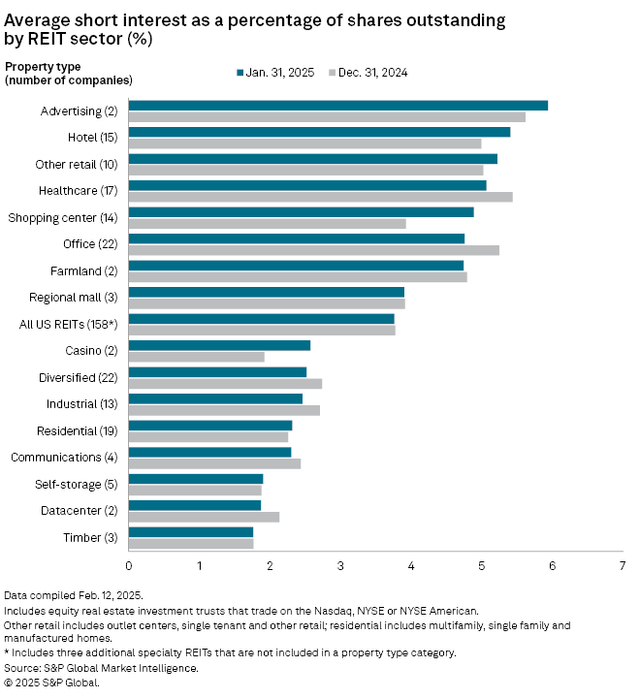

Common REIT quick curiosity remained largely flat in January because it declined by simply 1 foundation level to three.8% of shares excellent. Promoting REITs proceed to common the very best quick curiosity (5.9%) adopted by Inns (5.4%). Timber (1.8%) and Knowledge Facilities (1.9%) had the bottom common quick curiosity on the finish of January. Purchasing Middle REITs noticed the very best enhance in common quick curiosity (+96 bps) in January, whereas Workplace REITs averaged the biggest lower (-65 bps).

Supply: S&P World Market Intelligence

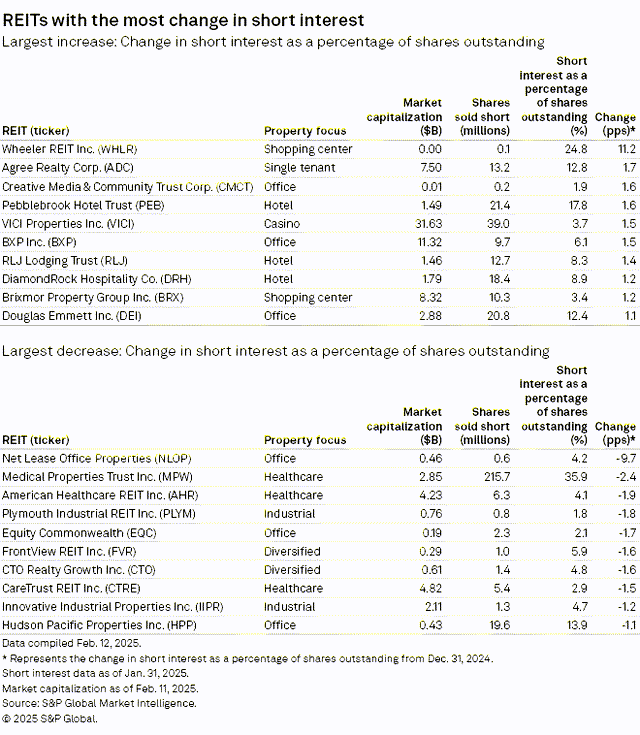

Wheeler REIT (WHLR) noticed the most important enhance (+11.2%) in brief curiosity in January because the share value continues a multi-year freefall. Agree Realty (ADC) (+1.7%) and Artistic Media & Neighborhood Belief (CMCT) (+1.6%) rounded out the highest 3 quick curiosity will increase. The ten REITs that noticed the most important declines in brief curiosity have been concentrated in 4 property varieties: Workplace, Healthcare, Industrial and Diversified. Web Lease Workplace Properties (NLOP) noticed the most important decline in brief curiosity (-9.7%) adopted by Medical Properties Belief (MPW) (-2.4%) and American Healthcare REIT (AHR) (-1.9%).

Supply: S&P World Market Intelligence

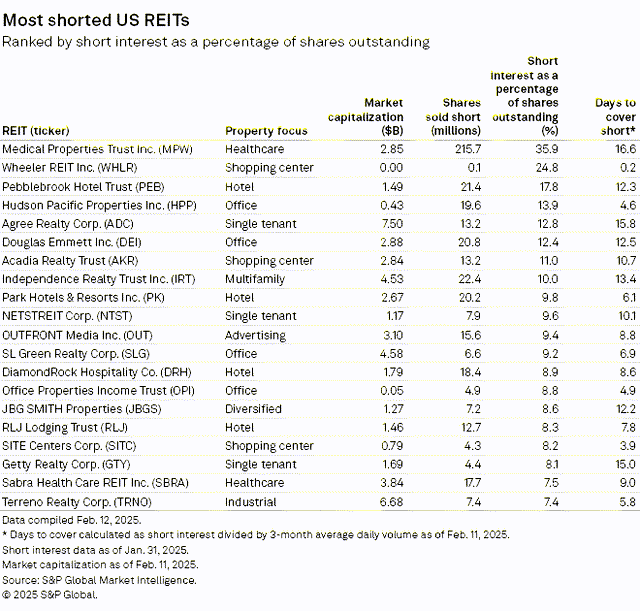

Closing a brief place requires shopping for again shares within the place that was shorted. Because of this corporations with very excessive quick curiosity can probably expertise sturdy upward stress on share value when the quick thesis materially weakens. A 2.4% discount within the quick curiosity of MPW helped propel the healthcare REIT to the very best whole return within the REIT sector in January. With 35.9% of shares of MPW nonetheless held quick and a whopping 16.6 days to cowl, this heavy quick curiosity might show to be a powerful tailwind if the quick thesis fails to play out. Different REITs with excessive days to cowl are Agree Realty Belief (ADC) (15.8 days), Getty Realty (GTY) (15.0 days) and Independence Realty Belief (IRT) (13.4 days). Heavy quick curiosity can usually be warranted by materials dangers and/or declining fundamentals, so you will need to totally perceive these points previous to initiating both a protracted or quick place in any REIT. Nevertheless, there’s a potential for outsized positive aspects when an investor appropriately identifies which extremely shorted REITs is not going to see the quick thesis come to fruition.

Editor’s Notice: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.