Some buyers took one take a look at The Commerce Desk‘s (NASDAQ: TTD) fourth-quarter outcomes and slammed the promote button. The digital promoting knowledgeable missed Wall Road’s consensus income goal for the primary time for the reason that firm went public in 2016. The inventory closed 33% decrease the subsequent day, erasing a yr’s price of market-beating positive aspects. Proper now, The Commerce Desk’s inventory is down 50% from its annual peak.

In my eyes, that is a wide-open invitation to purchase this top-quality development inventory. It is nonetheless not an inexpensive inventory, buying and selling at 90 instances trailing earnings and 14 instances gross sales. However that is method down from current peaks, with price-to-earnings (P/E) ratios typically hovering above 200 and price-to-sales (P/S) figures briefly peeking above 30. So, from a historic viewpoint, The Commerce Desk’s shares look fairly reasonably priced proper now.

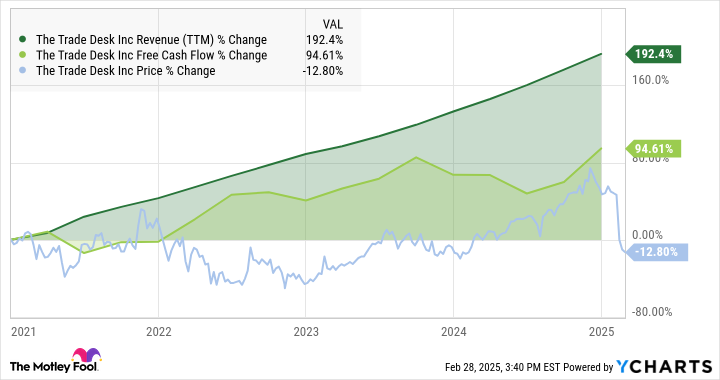

And you’ll’t overlook in regards to the firm’s huge development potential. Bear in mind the inflation disaster that led to a bear market in 2022? The Commerce Desk’s inventory adopted the market decrease, however you would not have guessed that when you have been wanting on the firm’s enterprise outcomes. The blue worth chart within the graph under reveals you the market motion, however do you even see a slowdown in The Commerce Desk’s gross sales development? In the meantime, its money earnings continued to development upward:

So, The Commerce Desk’s annual free money flows have roughly doubled in 4 years, whereas revenues have practically tripled. The inventory is 12% cheaper over the identical span.

Sure, the corporate dissatisfied buyers with gradual gross sales development and modest forward-looking steerage within the final earnings report. The brutal market response appears misplaced, although. The uncommon income miss was a 22.3% year-over-year income leap, falling simply wanting a 25.2% development goal.

Administration did precisely the appropriate factor. CFO Laura Schenkein took “full possession” of the income miss on the This autumn earnings name. It wasn’t a missed alternative however a interval of comparatively weak execution. In response, The Commerce Desk laid out an in depth 15-point plan to kick the stalled gross sales development into greater gear. The factors of motion embrace partnerships, audio adverts, hirings within the gross sales division, and a tweaked course of for product growth.

The Commerce Desk isn’t taking this slowness in stride. The corporate is taking resolute motion to get again on observe.

I am unable to promise that The Commerce Desk’s challenges will fade out in 2025, and a few buyers would say the inventory stays too costly even now. Nonetheless, you are paying a premium for a high-octane development inventory. This one earns an additional gold star for its constructive earnings and money flows — many companies with the pedal to the metallic are likely to accumulate bottom-line losses till they’re able to decelerate and acquire earnings.