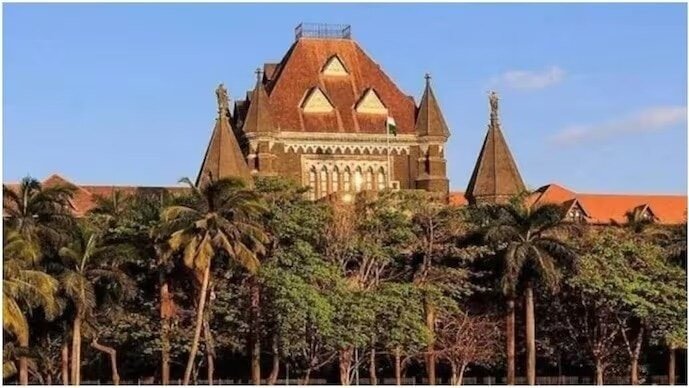

In a case that’s seen to have a major influence on restaurant chains and bakery companies in addition to a number of industries that depend on the classification of meals companies beneath the products and companies tax, the Bombay Excessive Courtroom has mentioned that for now no coercive motion will probably be initiated in opposition to Mad Over Donuts by the tax authorities on the disputed classification.

The Bombay Excessive Courtroom has additionally granted the petitioner –Mad Over Donuts (Himesh Meals), the freedom to method the bench in case any restoration actions are taken by the GST division. In its current listening to, the Courtroom has additionally directed the tax division to file its response by March 17. The matter is scheduled for additional listening to on March 24.

The case pertains to notices for GST despatched to Himesh Meals in addition to a number of different donut and bakery chains looking for 18% GST on sale of donuts and bakery gadgets. The problem arose as these chains contend that GST is to be paid at 5% because the sale of those merchandise fall beneath restaurant companies.

The case is being heard by a bench comprising Justice BP Colabawalla and Justice FP Pooniwalla on whether or not the provision of donuts falls throughout the ambit of restaurant companies beneath Service Accounting Code (SAC) 9963 or must be categorised as a bakery product topic to separate tax therapy beneath the Items and Companies Tax (GST) framework.

Representing the petitioner, Mad Over Donuts (Himesh Meals), Abhishek A Rastogi contended that the provision of meals or different edible articles qualifies as a composite provide of companies beneath the Central GST Act. He additionally identified that the related GST charge notifications explicitly outline restaurant companies to incorporate meals equipped at eating places, consuming joints, messes, and canteens, whether or not for consumption on the premises or as takeaway. He additionally argued that official round helps this interpretation by confirming that takeaway companies must be labeled as companies and taxed at 5%.

The Bombay Excessive Courtroom can also be wanting into one other essential facet as a part of the case on the

difficulty of multiplicity of proceedings throughout completely different territorial jurisdictions. The bench examined whether or not a centralized show-cause discover (SCN) issued by the Directorate Normal of GST Intelligence (DGGI) suffices or whether or not separate notices must be issued for every GST registration.