It might not appear so to some, however many Individuals are struggling.

Whereas the S&P 500 has delivered eye-popping returns over the previous two years, staff have been more and more pinched by inflation, and job losses have gotten more and more widespread.

Consequently, client confidence has plummeted, casting an enormous shadow over what may occur to the U.S. economic system subsequent.

The scenario is not misplaced on Donald Trump’s administration. A lot of our newly elected officers received votes final 12 months due to rising unrest over sky-high rents and residential costs, surging prices for on a regular basis gadgets like eggs, and issues over high-paying working-class jobs.

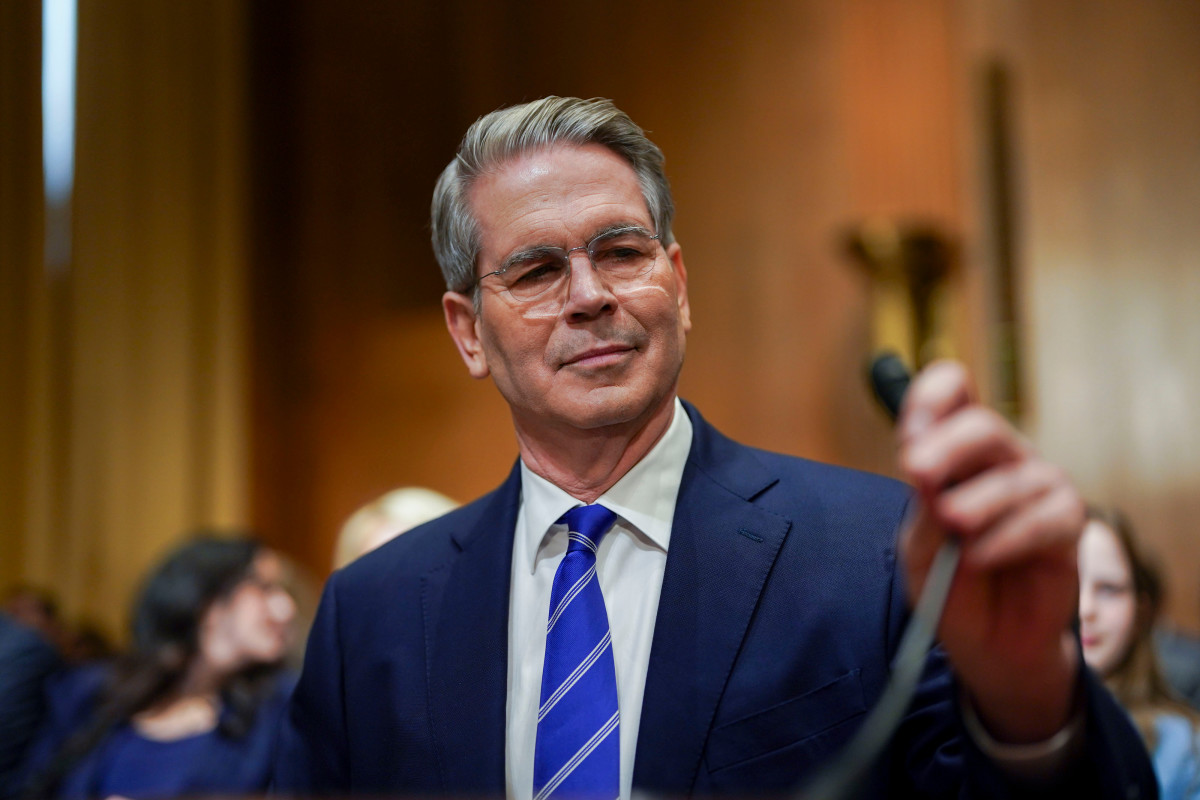

Treasury Secretary Scott Bessent, a inventory market veteran skilled by legendary hedge fund supervisor Stanley Druckenmiller, has watched the economic system’s give-and-takes for many years.

Lately, he supplied up ideas on the U.S. economic system’s future which are more likely to increase eyebrows.

The U.S. economic system is exhibiting indicators of mounting issues

The Federal Reserve’s twin mandate is to maintain inflation and unemployment low. Typically, these are competing targets.

Fed chairman Jerome Powell can increase the Fed Funds Fee, thereby rising rates of interest and making borrowing costlier. This would scale back enterprise and private spending however put jobs in danger.

Associated: Treasury Secretary has blunt 3-word response to inventory market drop

Or, the Fed can reduce rates of interest, boosting spending to extend obtainable jobs however risking sparking inflation.

We have seen this play out over the previous few years. The Fed’s hawkish financial coverage in 2022 and 2023 efficiently diminished inflation from over 8% to about 3%. Nonetheless, this led to a wobbly jobs market, prompting the Fed to pivot to rate of interest cuts in September, November, and December.

Sadly, these cuts have but to stabilize employment. And so they could have lit a fuse for inflation once more.

In January, the Shopper Worth Index confirmed that inflation had risen to three% from 2.4% in September.

In the meantime, Challenger, Grey, & Christmas’s newest report reveals that 172,000 Individuals misplaced their jobs final month, the most important quantity for the month of February since 2009.

It is also problematic that many job losses prior to now 12 months have been amongst high-earners, akin to expertise staff. About 407,000 tech jobs have been misplaced since 2022, making a headwind to discretionary spending.

In the meantime, the Bureau of Labor Statistics stated on March 7 that the U.S. economic system created 151,000 new jobs in February, beneath Wall Avenue’s 163,000 forecast. The unemployment charge elevated to 4.1%, up from 4% in January and three.5% as just lately as 2023.

Scott Bessent has harsh phrases on U.S. economic system

Recession worries have grow to be extra widespread following weak information and poor client sentiment.

Associated: Billionaire Ray Dalio’s blunt message on economic system turns heads

The February Convention Board’s client confidence survey skilled the sharpest one-month decline since 2009. That adopted equally weak findings within the Michigan client sentiment survey, which retreated 16% from one 12 months in the past.

Sadly, it could worsen earlier than it will get higher.

“Might we be seeing that this economic system that we inherited beginning to roll a bit? Positive,” stated Scott Bessent in a CNBC interview. “And look, there’s going to be a pure adjustment as we transfer away from public spending to personal spending.”

Bessent believes this ‘adjustment’ is important following years of overspending which have made America hooked on pleasant fiscal coverage.

“The market and the economic system have simply grow to be hooked. We’ve grow to be hooked on this authorities spending, and there’s going to be a detox interval,” added Bessent.

Extra Financial Evaluation:

- U.S. customers are wilting beneath renewed stagflation dangers

- Jobs experiences present crucial have a look at economic system, may roil markets

- Fed inflation gauge signifies huge modifications in key financial driver

The feedback recommend that the Trump administration understands that slicing fats from the Federal price range, together with through lay-offs that might additional improve unemployment and strain spending, will not be fairly short-term.

Nonetheless, it additionally reveals that Bessent and the crew imagine {that a} reset is essential for America to succeed.

That reset is obvious within the administration’s already-announced strikes to cost tariffs on imported items from Canada, Mexico, and China.

Whereas the 25% tariffs on Canada and Mexico and 20% tariffs on China may trigger corporations to extend costs to offset the additional tax burden, Bessent believes that any adverse influence on costs can be a one-off.

The tariff chew is not nice information for these apprehensive over inflation now, however the administration thinks encouraging corporations to make and supply items domestically will greater than offset the ache over time.

Associated: Veteran fund supervisor unveils eye-popping S&P 500 forecast