The Trump administration is transferring ahead with the thought to switch the federal government’s $1.6 trillion pupil mortgage portfolio to a different authorities company.

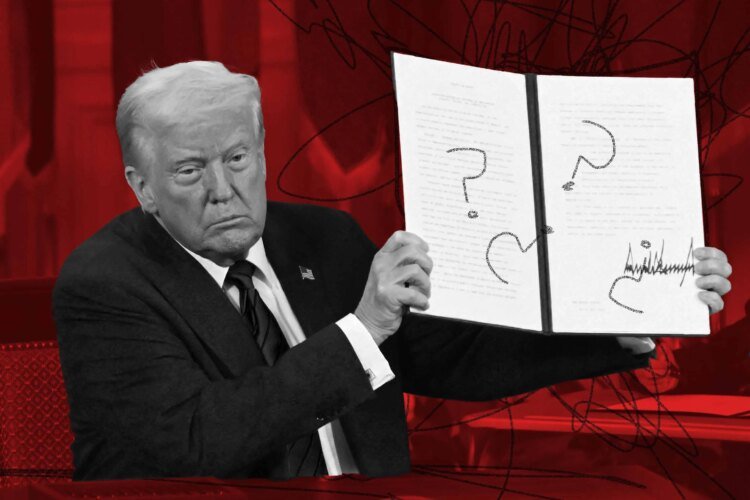

President Donald Trump stated Friday that administration of federal pupil loans would transfer from the Training Division to the Small Enterprise Authority, or SBA, “instantly.” It is possible the transfer will face authorized pushback.

The announcement comes after a chaotic interval on the Training Division, which oversees pupil mortgage compensation for greater than 40 million debtors. On Thursday, the White Home issued an govt order geared toward dismantling the division, and final week the division introduced layoffs that can reduce the company’s employees in half.

Increased training teams and pupil advocates had already expressed deep issues in regards to the plan for redistributing the Training Division’s obligations earlier than Trump made his feedback about transferring the scholar mortgage portfolio — which was a departure from what White Home Press Secretary Karoline Leavitt stated lower than 24 hours prior.

Jessica Thompson, senior vp of The Institute of Faculty Entry & Success, stated in an announcement Friday that the administration has “decimated staffing and oversight capabilities” at each the Training Division and Small Enterprise Authority and has “no clear technique.”

“This could solely lead to debtors experiencing erratic and inconsistent administration of their federal pupil loans. Errors will show expensive to debtors and finally, to taxpayers,” she stated.

There’s nonetheless lots we don’t find out about what may occur, but it surely’s vital for debtors to keep in mind that even when a the portfolio is transferred, the phrases and rates of interest on their loans won’t be altering. An important factor debtors can do proper now could be preserve detailed data. Right here’s what else we do (and don’t) know:

When will pupil loans be moved from the Training Division?

That’s not clear proper now. In chatting with reporters Friday, Trump stated it could occur “instantly.” However authorized challenges may pause any doable modifications.

“I do know he stated speedy however nothing goes to be speedy,” says Betsy Mayotte, president of The Institute of Pupil Mortgage Advisors, which affords free recommendation to debtors on paying again their loans.

The White Home hasn’t offered any particulars about how such a transition would work, together with whether or not staffers on the Training Division who’ve information of the scholar mortgage system would transfer to the SBA to proceed engaged on it.

In its govt order, the administration prompt that the Training Division, and particularly the Federal Pupil Assist workplace, was too small to handle such a big portfolio. It famous that the scale of the scholar mortgage portfolio is roughly the scale of a few of the nation’s largest banks — though the workplace has a much smaller employees than these banks do.

However the SBA can be a comparatively small company. It at present has a employees of about 6,500, and it introduced Friday morning that it could reduce its workforce by 43%.

Do I nonetheless must preserve paying my loans?

Sure — transferring the loans to a different company doesn’t equate to canceling them.

“I can’t emphasize sufficient that this isn’t the time to be making any panicked monetary selections,” Mayotte says.

To whom do I pay my loans?

You must proceed making funds to your servicer till you hear in a different way.

A lot of the work on managing compensation is finished by mortgage servicers and third-party distributors, not the division itself. It is doable that even when a transfer to the SBA occurs, debtors will nonetheless take care of the identical servicers and databases and that the day-to-day expertise will not change, Mayotte says.

What does this imply for income-driven compensation and Public Service Mortgage Forgiveness?

Earnings-driven compensation plans and Public Service Mortgage Forgiveness, or PSLF, are written into regulation. That doesn’t imply there won’t be modifications to these applications — Trump has already messaged with a earlier govt order that he’d prefer to restrict the roles that qualify for PSLF , and the Training Division has paused all purposes to income-driven plans in response to a courtroom injunction.

It’s possible debtors will see modifications to those applications coming down the road. However the doable shift of the portfolio to SBA, by itself, doesn’t have an effect on them.

What else ought to I do know or do proper now?

Log into your servicer account and into your account with Federal Pupil Assist to doc what you owe and the place you might be in your repayments.

Assuming Trump is ready to comply with via and the mortgage portfolio is actually transferred to the SBA, it’s best to stay vigilant all through the interval of transition. Take a screenshot of each fee you make, and obtain paperwork that monitor your fee historical past. It is a good suggestion for all debtors to take these steps, but it surely’s particularly vital for individuals who are working towards forgiveness through income-driven compensation or PSLF.

Sarah Sattelmeyer, the challenge director for training, alternative and mobility on the upper training workforce at New America stated in an electronic mail Friday that she has plenty of unanswered questions. However at a minimal, “a transfer of this magnitude might be extraordinarily messy and inefficient for everybody — together with debtors who depend upon mortgage aid, contractors who administer the applications and employees who handle the applications and supply oversight — and runs the chance of breaking the system within the course of.”

Extra from Cash:

What Will Occur to Monetary Assist if Trump Closes the Training Division?