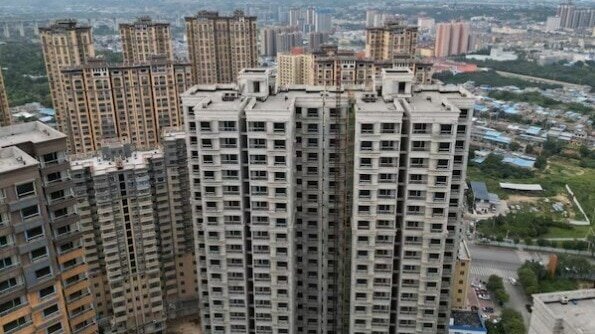

In India’s scorching actual property market, homeownership is slipping additional out of attain. From Mumbai’s gleaming high-rises to the far-flung outskirts of Bengaluru, costs are ballooning — fuelled by swelling demand, rising development prices, and shrinking provide. Luxurious initiatives are mushrooming whereas affordability is quick eroding, leaving middle-class consumers scrambling. A rising variety of residents are actually questioning the sustainability — and ethics — of this actual property increase.

A current Reddit submit stirred dialogue across the hovering property prices, particularly focusing on Non-Resident Indians (NRIs), typically seen as prime consumers out there.

“To all of the NRIs, please maintain off shopping for flats in Indian huge cities for some time. I used to be checking the price of flats in Bangalore and Hyderabad. I used to be stunned to note that price of three bhk is round 2-2.5 crores in outer components of the town (metropolis border). Then, I checked the associated fee in cities like London and Newyork and located them to be the identical price. These guys are getting extraordinarily grasping. They’re anticipating NRIs to purchase these. So, please don’t purchase with out negotiating it downwards. Make investments your cash in shares,” the person wrote.

The sentiment struck a chord with a number of others, who chimed in with comparable considerations about inflated valuations and eroding infrastructure.

“I am not wealthy however I needed to purchase one small plot in Bengaluru, however trying on the costs and crumbling infrastructure, I held again. Yesterday I noticed they’ve uprooted all of the century previous timber that are as broad as 10m all alongside the street to develop it. This was the final paradise of greenery street within the outer limits of Bengaluru. The greed is aware of no limits,” one individual shared.

“I used to be planning to purchase one, so I made a decision to go for one in Dubai. Nonetheless WIP. Indian actual property is tremendous bloated and it is a corrupt cash sink,” mentioned one other.

A 3rd person pointed to poor returns on investments in metros. “Greatest determination I’ve taken in previous 5 years is to not make investments on Bangalore actual property. All my companions who invested have internet misplaced cash or barely broke even on any property purchased submit 21 added inflation. I invested the identical on a land growth in tier 2 metropolis outskirts and made 5x on my funding. Except there’s 20-30% correction on present value it’s safer to remain outdoors. There’s plenty of useless stock on the outskirts.”

Others highlighted how worldwide comparisons don’t inform the total story. “London, NY city costs have additionally shot up after covid. They’re undoubtedly greater than Bangalore/Mumbai/Gurgaon. However your fundamental level is legitimate. Persons are shopping for like loopy. As a result of Trump is focusing on visa holders, extra NRIs are going to want shopping for in India quite than in USA. I am afraid your well-intentioned recommendation will likely be largely ignored.”

Nonetheless, the idea that actual property costs won’t ever really fall appears deeply entrenched. “In final 40 years, property costs virtually by no means got here down. in the event that they got here down for someday, it was 10% or stagnant for few years. that’s the unlucky actuality all on account of our rising inhabitants and financial system. Costs aren’t justified however there are people who find themselves able to pay and therefore value won’t ever come down.”