(Bloomberg) — Some buyers are betting the great occasions are solely simply starting for rising markets as worries over the US economic system enhance the attract of the long-suffering asset class.

Most Learn from Bloomberg

Fueling the shift are expectations that President Donald Trump’s tariff insurance policies will weigh on US progress and pressure merchants to look overseas, a wager that has portfolio managers scooping up every part from Latin American currencies to Jap European bonds.

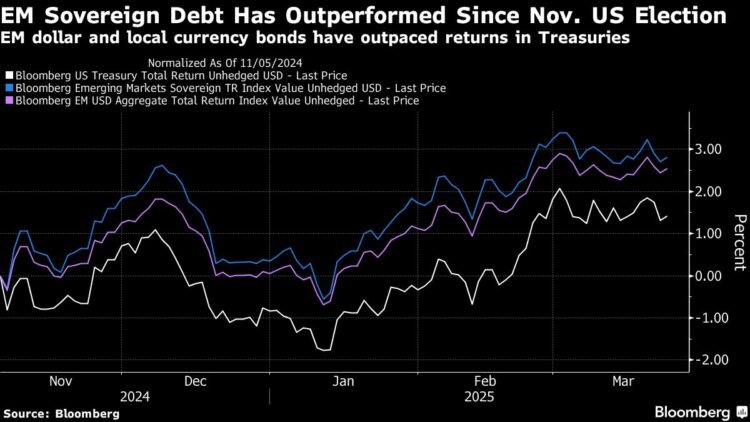

The strikes have already sparked a run in EM equities, with a gauge set for its finest first quarter since 2019. A weaker greenback has helped elevate an index of growing currencies almost 2% this yr, whereas native bonds have additionally climbed.

“For the previous few years, buyers have piled into US belongings and more-developed markets,” stated Bob Michele, international head of fastened earnings at JPMorgan Asset Administration. “Now, once you take a look at valuations, rising markets look low-cost.”

Rising-market buyers have seen their share of false dawns previously decade, as surging US shares left rivals within the mud repeatedly. Extra just lately, the best Treasury yields in many years gave buyers little purpose to enterprise outdoors the US and sparked a surge within the greenback that rattled currencies throughout the globe.

The present rally’s destiny might be tied to the trajectory of US progress. A tariff-induced cooling of the world’s largest economic system that pulls down Treasury yields and the greenback can be ultimate — supplied it doesn’t snowball right into a extra pronounced slowdown that kills the market’s urge for food for threat, buyers stated. Many are additionally relying on an enormous enhance in European spending and additional stimulus in China to take up the slack if the US sputters.

Bullish buyers additionally level out that the belongings of many international locations are cheap on varied metrics, with developing-world shares close to their lowest stage relative to the S&P 500 because the late Nineteen Eighties. Internet asset inflows into devoted funds are but to show constructive in 2025, and rising markets are underrepresented in lots of portfolios following years of weak efficiency. That might give shares, bonds and currencies room to rise if the shift accelerates.

“The top-of-US-exceptionalism-trade has an extended option to run,” Ashmore Group analysts wrote earlier this month. “This asset allocation shift is more likely to be a decade-long development, contemplating the large overexposure by international buyers to US equities.”

Scouring the Globe

Edwin Gutierrez, head of EM sovereign debt at aberdeen group plc, stated buyers over the past decade-and-a-half have been “hoping in useless” for a state of affairs the place US progress slows — however not sharply sufficient to spark a risk-off temper.

Nonetheless, he has been shopping for the bonds and currencies of rising European international locations, after years of maintaining allocations to the area beneath the agency’s benchmark weightings.

“Trumponomics most likely presents essentially the most real problem to US exceptionalism that we’ve seen” previously 15 years, Gutierrez stated.

BlackRock Inc.’s strategist Axel Christensen and portfolio supervisor Laurent Develay stated Latin America provides brilliant spots, because the pullback in US shares narrows the efficiency hole with the remainder of the globe. “Any momentary weak spot as a result of commerce uncertainty” can be a possibility to purchase native EM bonds, they added.

Funds together with TCW Group and T. Rowe Value have scooped up sovereign notes in Colombia and South Africa, touting their larger liquidity and market entry. Franklin Templeton’s new low volatility international bond fund has purchased exhausting forex debt from Indonesia, Philippines and South Korea.

“The unwind of US exceptionalism, together with a weaker greenback, is nice for EM,” stated Carmen Altenkirch, an analyst at Aviva Traders in London. She identified that the additional yield buyers demand to personal EM exhausting forex debt over US Treasuries has remained comparatively steady, in comparison with the identical measure for a lot of developed-market friends.

Most rising currencies are up versus the greenback this yr, with Brazil, Chile and Colombia among the many greatest gainers. Even the Mexican peso — which is especially susceptible to tariff headlines — is attracting consumers. The forex is up greater than 2% year-to-date, and hedge funds are essentially the most bullish since August.

The $83 billion Vanguard FTSE Rising Markets ETF, recognized by its ticker VWO, rose 0.5% as of two:00 p.m. New York Thursday, extending its month-to-month achieve.

What Bloomberg strategists say:

“As worth makes a comeback in opposition to progress in equities, at the least on a selective foundation, the identical dynamic could transition into FX, notably when there are low-cost currencies that supply excessive actual yields, comparable to COP, PHP and INR”

— Mark Cudmore, macro strategist

Loads of elements may derail these trades, together with a US economic system that proves resilient within the face of a commerce battle or tariffs which can be much less extreme than feared. Some buyers seem like betting on such an end result: international inventory funds recorded about $43.4 billion in inflows within the week by way of March 19, the most important of the yr, in accordance with a Financial institution of America report citing EPFR knowledge.

Eric Souders, portfolio supervisor at Payden & Rygel, isn’t taking any possibilities. Whereas his fund holds positions comparable to Vietnamese and Mongolian bonds, it has additionally lifted money holdings to the best stage since 2022, simply in case the US roars again.

For now, nevertheless, “we expect EM seems to be fairly good,” he stated.

–With help from Carolina Wilson and Philip Sanders.

(Updates returns all through, provides emerging-market ETF in paragraph 16.)

Most Learn from Bloomberg Businessweek

©2025 Bloomberg L.P.