Chinese language automakers missed out on a European rebound in EV demand final month, as more-established producers like Volkswagen AG captured the largest a part of a leap in gross sales.

Article content material

(Bloomberg) — Chinese language automakers missed out on a European rebound in EV demand final month, as more-established producers like Volkswagen AG captured the largest a part of a leap in gross sales.

Article content material

Article content material

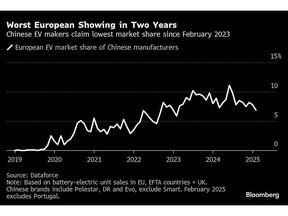

Simply 6.9% of electrical autos registered within the area in February had been made by Chinese language corporations, based mostly on information from automotive researcher Dataforce. That’s nicely beneath January’s 7.8% and the bottom since February 2023.

Commercial 2

Article content material

Carmakers led by BYD Co. and SAIC Motor Corp.’s MG have been working to construct the area into an export stronghold, however hit a wall when the European Union imposed tariffs on Chinese language-made EVs final 12 months. The commerce barrier has induced a leveling-off of Chinese language market share after years of fast development.

Whereas particular person manufacturers together with BYD and Xpeng grew strongly in Europe final month, the Chinese language trade’s total end result within the area represents a step backward. The EV market jumped 26% in February, in response to information this week from the European Car Producers’ Affiliation.

The EU duties are a part of a world upswing in protectionism. US President Donald Trump this week moved to slap a 25% tariff on imported vehicles and key components, threatening Canada and the EU with additional measures. The US had already imposed steep tariffs on Chinese language EVs.

Article content material

Commercial 3

Article content material

China, for its half, hit EU brandy with an anti-dumping tax and launched probes into dairy and pork merchandise. It has additionally imposed added tariffs on some US agricultural imports.

European Demand

In Europe, electric-car demand has been stimulated this 12 months by producer incentives aimed toward assembly regulatory EV gross sales targets, in addition to the introduction of latest fashions, notably VW’s ID.7, Renault SA’s R5 and Kia Corp.’s EV3, mentioned Julian Litzinger, an analyst with Dataforce.

Chinese language carmakers, he mentioned, have been held again by the brand new duties, which may attain as excessive as 45% together with current import charges.

Shopper backlash towards Tesla Inc. represented one other misplaced alternative for Chinese language manufacturers. Tesla’s European gross sales have plummeted in response to Chief Govt Officer Elon Musk’s unwelcome intrusion into German politics.

Commercial 4

Article content material

That supplied a gap for others to take up some gross sales left up for grabs, however for essentially the most half, Chinese language producers did not capitalize.

“The traditional manufacturers have soaked up the amount from Tesla,” Litzinger mentioned. “We see a transparent impact from the tariffs” on Chinese language automakers.

BYD has been much less affected than MG, the previous British sports-car maker whose state-owned guardian SAIC was hit by the EU’s highest tariffs at 45.3% in complete. BYD’s EU tariff is 27%, together with the usual 10% import levy. Non-Chinese language corporations together with Tesla and BMW AG that import vehicles made in China are additionally topic to the added duties.

Over the previous 12 months, China’s largest producer of electrical vehicles has cemented its place atop the pack in Europe, whereas MG has borne the largest a part of the setback.

BYD EV registrations throughout Europe, the UK and EFTA nations almost doubled to 4,436 vehicles in February from a 12 months earlier, based mostly on information from Jato Dynamics, which tracks car gross sales.

Commercial 5

Article content material

One key cause for BYD’s success has been its broad lineup overlaying the mainstream and premium segments, mentioned Felipe Munoz, senior analyst at Jato.

“This explains why it has been capable of enhance its volumes in each the wealthier northern Europe and less-wealthy south,” Munoz mentioned.

BYD is rolling out the inexpensive and standard Atto 2 compact sport utility car throughout Europe, giving the area one other recent mannequin.

In combination, Chinese language manufacturers outsold Tesla in European markets together with Germany and Italy in February, Munoz mentioned. That could be partly as a result of US carmaker’s growing older lineup.

“We should always wait some months till the up to date Mannequin Y is totally accessible throughout the area to raised perceive the state of affairs,” he mentioned.

Article content material