The S&P 500 Index, as tracked by SPDR S&P 500 ETF Belief NYSEARCA: SPY, and the Nasdaq-100 Index, as tracked by the Invesco QQQ NASDAQ: QQQ, have each triggered a widely-followed bearish chart sample often called the Demise Cross.

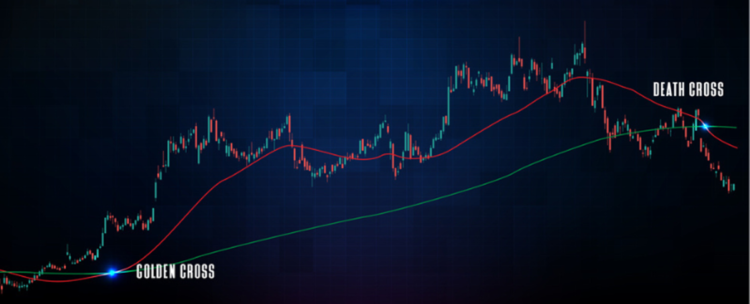

A Demise Cross happens when a 50-day easy shifting common (SMA) trendline crosses beneath the 200-day SMA trendline.

However does this ominous-sounding sample actually imply a bear market is inevitable?

Demise Cross: Sign or Noise?

The sample, when shaped, is an omen of types predicting an upcoming bear market. This perception is rooted in historical past: a Demise Cross preceded many bearish occasions, together with recessions, previously quarter century.

- March 2000: The Dot-Com crash occurred after the Demise Cross ushered in a bear market and recession.

- December 2007: The World Monetary Disaster occurred after the Demise Cross ushered in a bear market and recession.

- December 2018: The Federal Reserve (Fed) began tightening rates of interest because the Demise Cross shaped.

- April 2020: The COVID-19 pandemic occurred, however the April 2020 Demise Cross shaped simply after markets bottomed.

- March 2022: The Fed began mountaineering rates of interest, triggering a market correction because the Demise Cross shaped, previous the bear market in June 2022.

The present Demise Cross occurred on April 14, 2025. The large query is, the place can we go from right here?

What’s Driving the Market Promoting?

This 2025 Demise Cross doesn’t exist in a vacuum.

The first cause for the market selloff has stemmed from President Trump’s tariffs, which have reignited commerce tensions with China and proceed to stir up recession fears.

First-quarter 2025 earnings season is underway, however firms within the client staples sector—just like the nation’s largest importer Walmart Inc. NYSE: WMT and main air service Delta Air Strains Holding NYSE: DAL—have each withdrawn their steering to brace for financial uncertainty brought on by tariffs.

As well as, the Financial institution of Atlanta has a real-time GDP estimate tracker that traders can monitor.

The S&P 500 Index Demise Cross Has Begun

SPDR S&P 500 ETF Belief At the moment

As of 11:54 AM Japanese

- 52-Week Vary

- $481.80

▼

$613.23

- Dividend Yield

- 1.34%

- Belongings Underneath Administration

- $551.39 billion

On April 14, 2025, the S&P 500 Index formally triggered the Demise Cross because the 50-day short-term SMA crossed beneath the 200-day longer-term SMA. As soon as these kind, they will take a while to reverse. The final Demise Cross shaped simply over three years in the past on March 14, 2022, and took 11 months to reverse again right into a Golden Cross in February 2023.

A key ground value stage to concentrate to is the $490.58, which is the 20% bear market pullback from the highs. The bulls have been in a position to instantly deflect a breakdown try there on April 7, 2025. If the SPY falls beneath $490.58, then control the calendar as an official bear market confirms after 60 days beneath the bear market value stage.

Additional pullback assist ranges are at $441.33, $409.91, $380.65 and $355.71 close to the final Demise Cross backside.

The Nasdaq-100 Index Demise Cross Follows

Invesco QQQ At the moment

As of 11:52 AM Japanese

- 52-Week Vary

- $402.39

▼

$540.81

- Dividend Yield

- 0.65%

- Belongings Underneath Administration

- $281.05 billion

The Demise Cross shaped concurrently for the Nasdaq-100 Index and the S&P 500 index on April 14, 2025. The promoting on the Nasdaq-100 was very sharp and pronounced because it collapsed beneath the Bear Market pullback stage at $432.65 for 3 days, surging again up and over it on the fourth day.

The pc and know-how sector heavy Nasdaq-100 gained considerably with its Magnificent 7 shares on the way in which up and collapsed sharper than the S&P 500 Index on the way in which down.

Key assist ranges beneath the Bear Market value stage of $432.65 are $413.07, $402.54, $382.55, $354.71 and $342.35.

Not All Demise Crosses Finish in Doom

Demise Crosses should not the tip of the world.

All markets want a breather, and these sell-offs have at all times resulted in increased markets after the Demise Cross reverses again to a Golden Cross when the 50-day SMA crosses again up by the 200-day SMA.

Historical past has confirmed that some Demise Cross formations might be short-lived. Two examples of four-month Demise Crosses are the December 2018 Demise Cross that reversed again to a Golden Cross in April 2019 and the March 2020 COVID-19 pandemic Demise Cross that reversed to a Golden Cross simply 4 months later in July 2020.

The important thing factor is panic. Each Demise Crosses shaped a very sharp drop {followed} by a pointy bounce, forming a V-bottom. The pandemic Demise Cross truly shaped because the market was placing in a backside.

The sharper and sooner the drop, the faster and sooner the reversal can occur.

Catalysts for this could embrace the conclusion of the commerce battle, rate of interest cuts, constructive financial studies, falling inflation, robust earnings season, synthetic intelligence (AI) ramp-up close to the tip of 2025, and constructive geopolitical outcomes.

Earlier than you contemplate SPDR S&P 500 ETF Belief, you may need to hear this.

MarketBeat retains monitor of Wall Road’s top-rated and greatest performing analysis analysts and the shares they suggest to their shoppers every day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and SPDR S&P 500 ETF Belief wasn’t on the record.

Whereas SPDR S&P 500 ETF Belief presently has a Maintain score amongst analysts, top-rated analysts imagine these 5 shares are higher buys.

Nearly everybody loves robust dividend-paying shares, however excessive yields can sign hazard. Uncover 20 high-yield dividend shares paying an unsustainably massive proportion of their earnings. Enter your e mail to get this report and keep away from a high-yield dividend lure.