Within the final three months, 9 analysts have printed rankings on SiteOne Panorama Provide SITE, providing a various vary of views from bullish to bearish.

The next desk gives a fast overview of their latest rankings, highlighting the altering sentiments over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Scores | 1 | 1 | 6 | 1 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 0 | 2 | 1 | 0 |

| 2M In the past | 0 | 0 | 0 | 0 | 0 |

| 3M In the past | 1 | 1 | 3 | 0 | 0 |

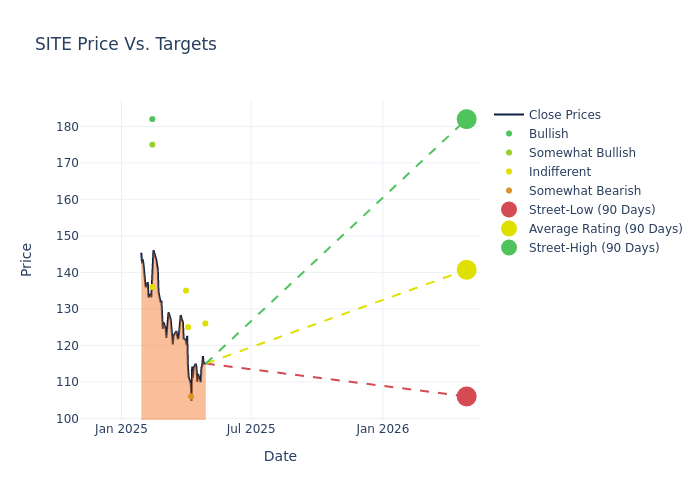

The 12-month value targets assessed by analysts reveal additional insights, that includes a mean goal of $141.11, a excessive estimate of $182.00, and a low estimate of $106.00. Experiencing a 5.69% decline, the present common is now decrease than the earlier common value goal of $149.62.

Deciphering Analyst Scores: A Nearer Look

The standing of SiteOne Panorama Provide amongst monetary specialists turns into clear with a radical evaluation of latest analyst actions. The abstract under outlines key analysts, their latest evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Score |Present Worth Goal| Prior Worth Goal |

|——————–|——————–|—————|—————|——————–|——————–|

|W. Andrew Carter |Stifel |Lowers |Maintain | $126.00|$145.00 |

|Matthew Bouley |Barclays |Lowers |Underweight | $106.00|$120.00 |

|Jeffrey Stevenson |Loop Capital |Lowers |Maintain | $125.00|$150.00 |

|Collin Verron |Deutsche Financial institution |Publicizes |Maintain | $135.00|- |

|W. Andrew Carter |Stifel |Raises |Maintain | $145.00|$140.00 |

|Mike Dahl |RBC Capital |Raises |Sector Carry out | $136.00|$129.00 |

|Damian Karas |UBS |Lowers |Purchase | $182.00|$185.00 |

|David Manthey |Baird |Lowers |Outperform | $175.00|$183.00 |

|W. Andrew Carter |Stifel |Lowers |Maintain | $140.00|$145.00 |

Key Insights:

- Motion Taken: In response to dynamic market circumstances and firm efficiency, analysts replace their suggestions. Whether or not they ‘Preserve’, ‘Elevate’, or ‘Decrease’ their stance, it signifies their response to latest developments associated to SiteOne Panorama Provide. This perception provides a snapshot of analysts’ views on the present state of the corporate.

- Score: Providing insights into predictions, analysts assign qualitative values, from ‘Outperform’ to ‘Underperform’. These rankings convey expectations for the relative efficiency of SiteOne Panorama Provide in comparison with the broader market.

- Worth Targets: Analysts present insights into value targets, providing estimates for the long run worth of SiteOne Panorama Provide’s inventory. This comparability reveals tendencies in analysts’ expectations over time.

Understanding these analyst evaluations alongside key monetary indicators can provide beneficial insights into SiteOne Panorama Provide’s market standing. Keep knowledgeable and make well-considered choices with our Scores Desk.

Keep updated on SiteOne Panorama Provide analyst rankings.

Delving into SiteOne Panorama Provide’s Background

SiteOne Panorama Provide Inc is a provider of instruments and gear. The corporate serves numerous companies which embody wholesale irrigation, outside lighting, nursery, panorama provides, grass seeds, and fertilizers, turf safety merchandise, turf care gear, and golf course equipment for inexperienced business professionals primarily in america and Canada. Its product portfolio contains irrigation provides, fertilizer and herbicides, panorama equipment, nursery items, pure stones and blocks, outside lighting and ice soften merchandise and different merchandise.

SiteOne Panorama Provide: Delving into Financials

Market Capitalization Evaluation: The corporate’s market capitalization is under the business common, suggesting that it’s comparatively smaller in comparison with friends. This may very well be attributable to numerous components, together with perceived development potential or operational scale.

Income Development: SiteOne Panorama Provide displayed constructive leads to 3M. As of 31 December, 2024, the corporate achieved a strong income development price of roughly 4.98%. This means a notable enhance within the firm’s top-line earnings. As in comparison with its friends, the income development lags behind its business friends. The corporate achieved a development price decrease than the typical amongst friends in Industrials sector.

Web Margin: SiteOne Panorama Provide’s web margin lags behind business averages, suggesting challenges in sustaining robust profitability. With a web margin of -2.14%, the corporate could face hurdles in efficient value administration.

Return on Fairness (ROE): SiteOne Panorama Provide’s ROE lags behind business averages, suggesting challenges in maximizing returns on fairness capital. With an ROE of -1.36%, the corporate could face hurdles in reaching optimum monetary efficiency.

Return on Belongings (ROA): The corporate’s ROA is under business benchmarks, signaling potential difficulties in effectively using belongings. With an ROA of -0.7%, the corporate may have to deal with challenges in producing passable returns from its belongings.

Debt Administration: SiteOne Panorama Provide’s debt-to-equity ratio is under business norms, indicating a sound monetary construction with a ratio of 0.6.

The Significance of Analyst Scores Defined

Scores come from analysts, or specialists inside banking and monetary techniques that report for particular shares or outlined sectors (sometimes as soon as per quarter for every inventory). Analysts often derive their data from firm convention calls and conferences, monetary statements, and conversations with essential insiders to succeed in their choices.

Some analysts can even provide forecasts for metrics like development estimates, earnings, and income to supply additional steerage on shares. Buyers who use analyst rankings ought to be aware that this specialised recommendation comes from people and could also be topic to error.

Breaking: Wall Avenue’s Subsequent Huge Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive development. This under-the-radar firm may surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.