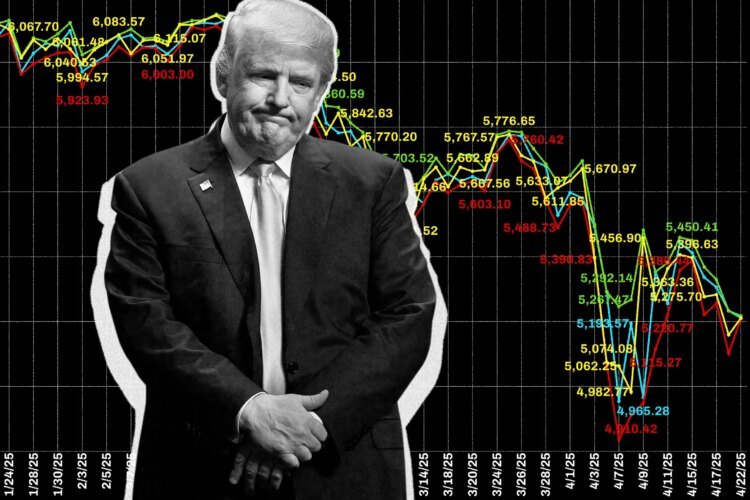

When Donald Trump gained the presidential election final November, the markets reacted positively. His deregulatory platform and perceived enterprise acumen translated into robust performances throughout the board, propelling shares into the brand new yr.

From the election by way of Jan. 21, when the markets reopened after Inauguration Day, the Dow Jones Industrial Common gained 5.34%, S&P 500 gained 5.9%, and the Nasdaq gained 8.67%. The so-called “Trump bump” was grabbing headlines and seemed to be giving the bull market — which started in late 2022 — endurance.

However that rally proved to be short-lived. After his first 100 days in workplace, a dramatic shift in market narrative has occurred, and all post-election positive factors have been reversed. At press time Monday, all three of the key indices had been decrease than they had been at any level between Election Day and the beginning of the president’s second time period. In the meantime, market volatility has registered a five-year excessive, GDP forecasts and the worth of the U.S. greenback have plummeted, and bearish shopper sentiment has surged alongside issues a couple of looming recession.

As traders proceed ready for the president to meet his promise of an financial “growth like no different,” this is how the Trump bump devolved into the Trump hunch.

Tariffs tanked the markets

Final week, the Wall Avenue Journal reported that the S&P 500’s efficiency since Inauguration Day was the worst for any president as much as that time going again to 1928. The Journal additionally reported that the index was on monitor for its worst April — a month that traditionally sees robust inventory performances — since 1932.

After the S&P 500 hit its all-time excessive on Feb. 19, the index went on to lose 10.13% by way of March 13 in anticipation of Trump’s tariff announcement. Then, after a short acquire, these losses accelerated to start with of April.

Because the markets stay rife with uncertainty, traders might wish to begin trying down the street, in response to Chip Rewey, chief funding officer at Rewey Asset Administration, a New Jersey-based registered funding advisor.

“I’d encourage traders to elongate their time horizons, which may make this complete tariff battle just a little simpler,” he says. “Everyday, you’re on the whim of a tweet.”

An instance of that capriciousness in messaging was on full show when the president formally introduced his expanded tariffs on April 2. The market’s response to Trump’s self-proclaimed Liberation Day was excessive: From April 3 to April 4, a record-setting two-day sell-off worn out $6.6 trillion of investor worth. Then, on April 9, Trump walked again his plan by asserting a 90-day pause for brand new tariffs (excluding these levied in opposition to China), inflicting a momentary surge in equities.

The reprieves in downward costs seen over the previous two months have confirmed to be inadequate in offsetting the preliminary losses incurred. Based on fintech knowledge platform Uncommon Whales, the Dow has fallen by 1,000 factors in a single day 11 instances in historical past. 4 of them have occurred since Trump’s Liberation Day tariff bulletins.

In contrast, since he took workplace in 2025, there has solely been in the future that the Dow gained 1,000 factors.

In March, when addressing how the tariffs might influence shares, the president mentioned, “I am not even trying on the market, as a result of long run the US can be very robust with what is going on right here.”

Nonetheless, within the aftermath of the document sell-off, Trump tried to reassure traders on April 6, saying, “I do not need something to go down, however generally you must take medication to repair one thing.”

The 90-day tariff pause is additional contributing to an already clouded outlook. The American Affiliation of Particular person Traders’ sentiment survey exhibits that bullishness has now been under its historic common for 15 out of the previous 17 weeks, whereas bearish sentiment has elevated 101.66% since Trump gained the election.

In the meantime, quite a few Wall Avenue companies have just lately downgraded their year-end worth targets for the S&P 500, citing uncertainty about tariffs, subsequent inflation and potential financial contraction. Funding financial institution and monetary providers agency Jefferies, for instance, reduce its S&P forecast to five,300 from 6,000. That is 3.4% decrease than the place the index sits at the moment. (Traditionally, the S&P grows by a mean of 10% yearly.)

With the president’s actions being magnified, traders are trying to find trigger and impact.

“The markets have change into very short-term centered,” Rewey says. “However the long run is a collection of brief phrases, and what we’re seeing now’s how the sausage is made.”

Fed assaults gasoline uncertainty

Tariffs alone should not accountable for elevated investor fears and a downward worth development. The president’s phrases carry super weight, as was demonstrated final week when he lashed out at Federal Reserve Chairman Jerome Powell on social media.

On April 21, a further $1.4 trillion was worn out from the market as Trump took to Reality Social to criticize Powell, whom the president nominated in 2017, stating that he was in favor of the chairman being faraway from his submit earlier than his time period ends in 2026.

The social media submit riled the markets. The main indices buckled underneath promoting stress with traders fleeing U.S. property as Trump once more pushed for the Fed to chop rates of interest amid an already weakened U.S. greenback and subsequently climbing Treasury charges.

The president’s makes an attempt to stress the Fed’s financial coverage noticed the S&P 500 fall by almost 3% on April 21. However within the wake of the market’s response, Trump once more walked again his statements. Tuesday, the president softened his tone, telling reporters he had “no intention” of firing the Fed chairman regardless of experiences that White Home was trying into authorized choices to take action. Shares rebounded in response, however once more the preliminary market injury has outweighed the restoration.

The rising sample of threats and ensuing retractions have fueled uncertainty and unfavorable sentiment — one thing Rewey straight hyperlinks to the present market correction.

“When [Trump] has launched a lot uncertainty within the brief time period,” he says, “I believe the market has gone down due to that.”

Anticipate extra muddled markets

Due to present uncertainty, the market’s correction and any potential timeline for restoration are troublesome to gauge in opposition to different historic cases.

“That is self-inflicted,” Rewey says. “In that sense, it is totally different than the COVID disaster or from the 2007-2009 monetary disaster. As a result of this may be undone with backtracking.”

However within the absence of readability, the fallout from Trump’s tariffs and his lambasting of Powell have resulted in fallout that has led economists to regulate the chance of a recession this yr. Torsten Sløk, chief economist at Apollo World Administration, has said that the chance of a self-induced voluntary commerce reset recession, or VTRR, now stands at 90%.

Based on Sløk, in a single day tariffs may have an outsized opposed influence on small companies, which presently account for greater than 80% of U.S. employment.

In a submit on the corporate’s web site, Sløk wrote that though “the administration inherited an economic system with robust progress, 4% unemployment, optimistic hiring and a considerable tailwind from investments … count on ships to take a seat offshore, orders to be canceled and well-run generational retailers to file for chapter.”

He additionally pointed to eight elements that, if not addressed, will proceed presenting headwinds for the U.S. economic system. Amongst them are increased tariffs, uncertainty about their permanence, retaliatory tariffs, decrease tourism, decrease shopper confidence and decrease company confidence.

Sløk isn’t alone in his downward revision. The Worldwide Financial Fund now forecasts the U.S. economic system will develop simply 1.8% this yr, down 0.9% from its pre-tariffs estimate. As these impacts are realized, they may trickle down into the equities market resulting in further volatility and ongoing bearish worth motion.

Due to the unpredictability of Trump’s messaging, Rewey believes that traders can be topic to a wait-and-see method earlier than understanding how something develops.

“Time will convey readability,” he says. “Be prepared to commit capital opportunistically to these long-term concepts, and make time your funding ally. Do not be a sufferer of the brief time period.”

Extra from Cash:

S&P 500, Nasdaq Show Ominous ‘Demise Cross’ Patterns

‘Something Works in a Bull Market.’ However What A couple of Bear Market?

Can Skipping Avocado Toast and Lattes Actually Assist You Purchase a Home?