I am bullish on actual property. But I just lately bought one other rental property. This kind of incongruence between thought and motion can really feel unsettling and even counterproductive to wealth creation. However it doesn’t should be.

As a result of whereas maximizing returns is an enormous aim in your highway to monetary independence, it’s not the one aim. Generally, promoting a property, regardless of being optimistic in regards to the market, is the correct transfer to your life general.

In my case, letting go of a rental simplified issues. I’ve all the time felt managing three rental properties in a single metropolis was my restrict. However once I purchased a brand new dwelling in 2023 and determined to hire out the outdated one, I crossed that threshold. It was like shopping for a big inventory place on margin, one thing I don’t love to do.

When the tenants gave discover a 12 months later, I noticed it as a window to reset.

Why Promoting Is OK Even If You Assume Costs Will Nonetheless Go Up

Listed below are eight the explanation why it’s OK to promote your property, even should you consider actual property costs will proceed to rise.

1) It’s Higher to Promote in a Bull Market Than a Bear Market

Promoting actual property is irritating. Even should you get into contract, any variety of points can delay or derail the closing. However if you’re promoting into energy, the chances of a easy transaction go up. A purchaser in a sizzling market is aware of there are others ready in line. Therefore, they attempt to observe via.

In a bull market, bidding wars are widespread and have a tendency to reset costs greater via a step-up perform. In distinction, a bear market can really feel like a liquidity entice—no patrons, falling comps, and painful worth cuts. Costs don’t all the time fall regularly; oftentimes, they hole down. In the event that they do, your own home fairness may get worn out in case you are pressured to promote.

On the west aspect of San Francisco, it is a bull market now. Native financial catalysts are drawing in jobs and households, creating stronger demand. So I selected to promote into energy moderately than danger being pressured to promote later when the market is perhaps weaker.

2) You Could Already Have Too A lot Actual Property Publicity

Generally, I don’t suggest having greater than 50% of your web price in a single asset class. Focus danger is actual. Please see my really helpful web price asset allocation for monetary freedom. After buying one other dwelling in 2023, my actual property publicity briefly ballooned to round 55%.

At one level, I had a main residence and 5 rental properties—4 of which had been in San Francisco. When devastating fires swept via Los Angeles County and worn out whole neighborhoods, I used to be reminded how shortly actual property wealth could be destroyed.

When my tenants gave discover, I noticed an opportunity to cut back publicity and rebalance in the course of the strongest promoting season of the 12 months: spring.

3) You’ve Tried Being a Landlord and Didn’t Like It

Holding actual property long-term is likely one of the greatest methods to construct wealth. Renting out your property helps you experience the inflation wave, whereas hopefully generate constructive money move.

However being a landlord isn’t for everybody, and that’s OK. If proudly owning a rental property lowers your high quality of life or consumes psychological bandwidth you’d moderately make investments elsewhere, promoting is an inexpensive alternative.

I gave it a 12 months. The tenants had been tremendous, other than a yanked faucet nozzle that prompted it to leak and a uncared for entrance yard. However even small points really feel magnified if you’ve mentally moved on.

I felt like I used to be lucky the house confronted no main issues for the 12 months, like a leak. So I selected to not press my luck additional as soon as they gave discover. Though, in the event that they hadn’t given their discover, I’d have fortunately stored renting out the house to them.

4) You Can Doubtlessly Earn a Higher Return Elsewhere

With the 10-year Treasury yield above 4%, I may earn virtually as a lot risk-free as I did from the rental. The effort and danger of being a landlord didn’t justify the modest yield premium.

For me to carry the property, I wanted confidence in attaining at the very least an 8% return—roughly a 4% premium above the risk-free price. Given a 43% loan-to-value ratio, it was actually potential. However I wasn’t greater than 80% assured it could occur.

Should you can redeploy the fairness into comparable or better-performing property—or just diversify your danger—it’s price contemplating. And even should you can’t match the return, liberating up time and power for different priorities has actual worth too.

Along with Treasury bonds, I discover residential industrial actual property and non-public AI firms interesting, giving me at the very least three compelling choices for reinvesting the proceeds. I hadn’t anticipated a 20% correction within the S&P 500 quickly after the home sale, which created a fourth engaging funding alternative.

Actual property can tie up a big quantity of fairness, particularly in high-cost markets. Should you establish a greater use of funds, it might make sense to unlock that capital and put it to extra productive use.

5) You Qualify for the Tax-Free Residence Sale Exclusion

Should you’ve lived in your house for at the very least 2 of the previous 5 years earlier than promoting, you may exclude as much as $500,000 in capital good points if married, or $250,000 if single. That is the Part 121 capital good points exclusion rule. Renting the property for one 12 months earlier than promoting nonetheless met the 2-out-of-5-year use check, so we certified for the complete exclusion—minus depreciation recapture.

Not having to pay capital good points tax on as much as $500,000 is a big profit, particularly should you’re in a high-income bracket. Should you’re approaching the top of the 5-year window or tax-free appreciation restrict, it might make sense to promote and lock on this tax benefit.

6) You’ve Discovered a Higher Residence and Moved On Emotionally

Some properties serve their goal for a interval of your life—and that’s sufficient. We purchased the property we bought as our “ceaselessly dwelling” in the course of the pandemic. It was a sanctuary that dramatically improved our lives for 3 years.

However deep down it was all the time a rung on the property ladder. After transferring out and renting it for a 12 months, we had been now not emotionally hooked up. We had been making new recollections in our new dwelling and now not missed the outdated one. That emotional detachment made promoting simpler.

7) You Need to Scale back Legal responsibility and Complications

Proudly owning rental property exposes you to potential authorized, monetary, and security dangers. These can embrace tenant accidents, discrimination claims, habitability lawsuits, or metropolis ordinance violations. Even with good insurance coverage and property managers, the legal responsibility and stress can put on on you.

After years of being a landlord, you would possibly determine the peace of thoughts that comes from decreasing legal responsibility is price greater than the additional money move. A clear exit now may stop a future authorized or monetary mess.

In my 22 years as a landlord, I’ve by no means had a difficulty with a tenant—a report I attribute to thorough screening and a stable lease settlement. That stated, I acknowledge that every new tenant brings a brand new set of dangers. On this case, the home we bought was rented to a number of roommates moderately than a single family, which added one other layer of complexity.

8) You are Getting ready for a Way of life or Profession Change

Should you’re planning a serious shift—resembling retiring early, relocating to a brand new metropolis, downsizing, touring extra, or altering careers—you could need to simplify your funds and cut back asset administration obligations. Having our first child in 2017 was the first cause why we bought a property again then.

In contemplating this newest sale, I prioritized time freedom and placement flexibility. Promoting two or three rental properties earlier than relocating to Honolulu in 2032 might be a problem, particularly if the market turns. By promoting one now, I cut back the strain to promote a number of properties later.

This step has already lightened my psychological load and improved my general happiness and way of life.

It is OK To Not At all times Optimize For Most Returns

Promoting a property even whereas bullish on actual property doesn’t make you irrational. It makes you a realist who understands that non-public finance is private. Generally the correct determination is about simplifying life, rebalancing danger, or simply reclaiming peace of thoughts.

We don’t all the time have to squeeze each final greenback out of each asset, particularly if we have achieved sufficient wealth to be glad. Generally, locking in a win is the neatest transfer you can also make.

Readers, have you ever ever bought a property though you believed costs would proceed rising? If that’s the case, what motivated your determination? And are there some other causes for promoting that I have never coated on this publish?

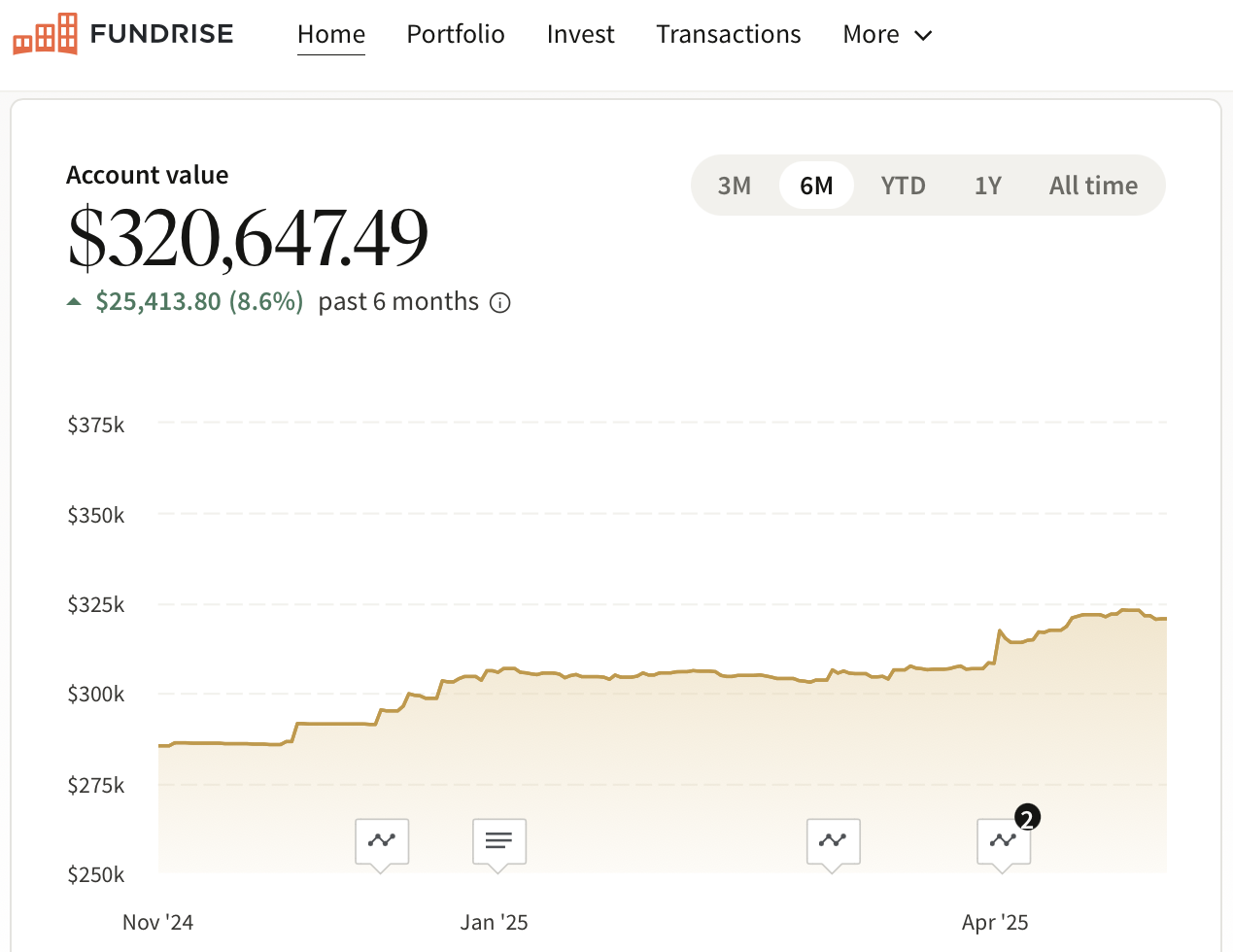

Should you’re trying to put money into actual property passively, take a look at Fundrise—my most popular non-public actual property platform. Fundrise focuses on high-quality residential and industrial properties within the Sunbelt, the place valuations are decrease and yields are greater.

Some industrial actual property valuations have dropped to ranges close to the 2008 monetary disaster lows, regardless of at present’s stronger economic system and more healthy family stability sheets. Seeing this as a possibility, I’m dollar-cost averaging into the sector with my home-sale proceeds whereas costs stay engaging.

Fundrise is a long-time sponsor of Monetary Samurai and I’ve invested $300,000+ with them to this point. About half of my put money into Fundrise is of their enterprise capital product as I need to construct a good quantity of publicity to non-public AI firms.

“Why Promote When You are Bullish on Actual Property Costs” is a Monetary Samurai unique. All rights reserved.

Be a part of over 60,000 readers and join my free weekly e-newsletter. Every little thing I write relies on firsthand expertise. Based in 2009, Monetary Samurai is likely one of the main independently-owned private finance websites at present. I’m the writer of the brand new USA As we speak bestseller, Millionaire Milestones: Easy Steps To Seven Figures.