By Travis Christy, White Coat Insurance coverage

By Travis Christy, White Coat Insurance coverageRevenue safety needs to be the muse for any monetary plan. It needs to be the very first thing addressed and brought care of on any working particular person’s listing, whether or not you’re employed as a doctor or in one other vocation. For physicians and medical professionals in federal and state authorities roles, making certain monetary safety within the occasion of incapacity is vital. Accidents and/or sicknesses or different unexpected circumstances can disrupt one’s skill to work, probably jeopardizing revenue streams and monetary stability. In such situations, having sturdy incapacity insurance coverage is not only a luxurious. It is a necessity.

It’s the outdated adage of, “One can’t afford to not have this protection,” that involves thoughts because it pertains to incapacity insurance coverage. That is the monetary parachute permitting for a safer influence when incapacity happens, and it ensures peace of thoughts for professionals and their households.

Inside the scope of presidency employment, two retirement methods are key components in offering incapacity advantages: the Federal Workers Retirement System (FERS) and the Public Workers Retirement Advantages (PERS). Established to help federal and public sector staff, these applications supply important advantages to assist staff deal with disabilities which will impede their skill to work. Understanding the workings of FERS and PERS and their eligibility necessities, advantages, and limitations is essential for medical professionals. It is higher to know the ins and outs earlier than a incapacity happens in case extra revenue safety is required (and it virtually all the time is).

Historical past of FERS and PERS

Earlier than we get into the workings of the applications, let’s delve into the historical past. First, the Federal Workers Retirement System (FERS) traces its origins to the passage of the Federal Workers Retirement System Act of 1986, which took impact on January 1, 1987. FERS aimed to modernize federal worker retirement advantages, integrating parts of the Social Safety system with an outlined profit pension plan and a tax-advantaged Thrift Financial savings Plan.

Equally, Public Workers Retirement Advantages (PERS) differ throughout states and localities, however they often function outlined profit retirement plans for public sector staff, together with medical professionals working inside state and municipal governments. Each of those applications are designed to supply retirement revenue, survivor advantages, and incapacity advantages to eligible public staff, providing monetary safety throughout retirement or within the occasion of incapacity or dying. Whereas the specifics of PERS could differ from state to state, the general aim stays constant: to help public staff by means of their careers and into retirement.

Extra info right here:

A Private Take a look at Incapacity Insurance coverage

How Physicians Are Affected When a Authorities Shutdown Is Looming

FERS Incapacity Eligibility Necessities

To qualify for incapacity advantages below FERS, federal staff should meet particular eligibility standards. Federal staff with at the least 18 months of service who can not carry out their duties at any age are eligible. As well as, the next situations are required:

- You need to have grow to be disabled whereas employed ready topic to FERS, due to a illness or harm, for helpful and environment friendly service in your present place.

- The incapacity should be anticipated to final at the least one 12 months.

- Your company should certify that it’s unable to accommodate your disabling medical situation in your current place and that it has thought of you for any vacant place in the identical company on the similar grade/pay degree, throughout the similar commuting space, for which you’re certified for reassignment.

PERS Incapacity Eligibility Necessities Differ by State and Locality

I reside in Utah, and the listing is kind of intensive to qualify for state incapacity advantages. For physicians working for different state and native governments, the principles may very well be completely different. Listed here are a couple of of the Utah necessities:

- Workers qualifying for incapacity attributable to a work-related bodily goal medical impairment could obtain a month-to-month profit equal to 100% of their common wage, lowered by required reimbursements.

- Successive durations of incapacity are thought of steady if ensuing from the identical or associated causes and separated by lower than six months of steady full-time work.

- The workplace reserves the correct to have any claiming worker examined by a doctor chosen by the workplace to evaluate complete incapacity.

- An worker’s ongoing incapacity is assessed both throughout or after the pilot interval based mostly on bodily or psychological goal medical impairments.

- Different necessities are discovered right here.

How FERS Advantages Are Calculated

For These Underneath Age 62 and Not Eligible for Voluntary Retirement

- For the primary 12 months of incapacity, you obtain 60% of the best three-year common wage; subtract 100% of the Social Safety incapacity obtained.

- For Month 13 and past of incapacity, the profit is lowered to 40% of the best three-year common wage; subtract 60% of the Social Safety incapacity advantages obtained.

As a Federal Doctor Worker, Can You Stay on Half of Your Revenue (or Much less)?

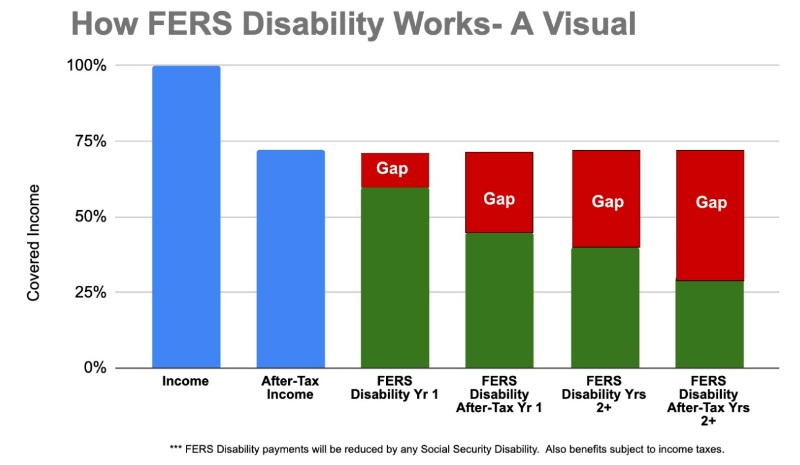

From a visible perspective, the after-tax good thing about FERS may drop a beneficiary’s revenue to lower than half of their wage. There are important revenue gaps when a federal worker is confronted with an harm or illness stopping them from working and so they begin receiving advantages for a protracted time period by means of FERS.

With FERS, a incapacity profit would depart safety gaps. This is able to be one thing to think about when wanting into buying supplemental revenue safety as a federal worker.

For These Age 62 or Older, or Eligible for Voluntary Retirement

- One % of your highest three-year common wage multiplied by years and months of service

- If 20+ years of service at age 62, it’s 1.1% of your highest three-year common wage multiplied by years and months of service

Here is how the best three-year common wage is outlined:

- Common of highest fundamental pay over any three consecutive years of service

- Often the ultimate three years, however it may be an precedent days

- Contains wage will increase topic to retirement deductions (e.g., shift charges)

- Excludes time beyond regulation, bonuses, and many others.

Different FERS Advantages to Know About

The FERS survivor profit gives monetary help to the spouses and youngsters of deceased federal staff and retirees. A surviving partner can obtain a Fundamental Worker Loss of life Profit and a month-to-month annuity if the worker had at the least 18 months of service. Youngsters can also obtain advantages till age 18 (or 22 in the event that they’re full-time college students) and indefinitely in the event that they’re disabled earlier than age 18.

How PERS Advantages Are Calculated

It is determined by the state.

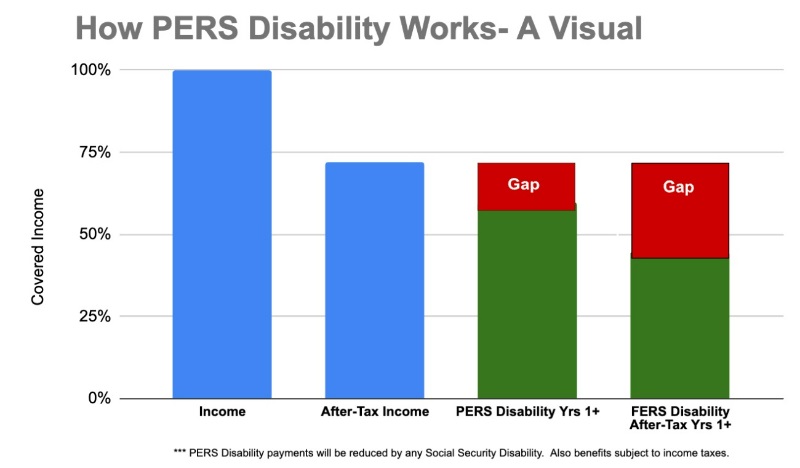

PERS advantages can differ considerably from state to state, however usually, incapacity protection is 60% of an worker’s revenue. There are variations in components, similar to ultimate common wage calculations, service necessities, and profit calculations. Every state’s PERS is tailor-made to its legal guidelines and rules, which might have an effect on all the pieces from vesting durations to retirement age.

Some states could supply outlined profit plans, whereas others present outlined contribution plans. The pension alternative fee, or the share of a employee’s pre-retirement revenue that the pension replaces, additionally differs throughout states and inside completely different tiers of state retirement methods.

FERS and PERS Physicians Overlaying ‘The Hole’

Right here’s what to search for when making an attempt to cowl that revenue hole if it’s a must to use FERS or PERS.

For FERS, the Huge 5 insurance coverage carriers usually assume that this system will cowl 40% of the worker’s revenue. This implies if an worker earns a specific amount, the FERS incapacity profit would offer them with 40% of that revenue throughout their interval of incapacity. The utmost quantity that may be supplied as a profit to cowl the hole this creates, nevertheless, is capped by all insurance coverage carriers. Guardian Life and Ameritas set it at $10,000-$12,000, whereas Principal and The Normal supply as much as $15,000. MassMutual didn’t supply its cap, as of this writing.

Equally, for PERS—which incorporates state, native, and municipal staff—the carriers usually assume a incapacity protection of 60% of the worker’s revenue. Once more, there’s a cap on the utmost profit quantity, which varies among the many 5 carriers however can go as much as $15,000.

It is very important word that these percentages signify the portion of the worker’s revenue that might get replaced by the incapacity profit. The precise quantity a person would obtain is determined by their wage and the precise phrases of their insurance coverage coverage.

Extra info right here:

What You Must Know In regards to the Thrift Financial savings Plan (TSP)

The Backside Line

Whereas FERS and PERS present a foundational layer of incapacity protection for these in public service, buying a person incapacity insurance coverage coverage is one thing that needs to be thought of. Such a coverage not solely gives enhanced monetary safety and peace of thoughts but additionally ensures continuity of protection ought to one transition to the personal sector. It affords policyholder management, customization, and a safeguard in opposition to any modifications to authorities advantages.

For physicians and medical professionals whose livelihoods rely upon their specialised expertise, this extra protection isn’t just a security internet—it’s an funding of their future, securing the life-style and schooling they’ve labored arduous to attain and providing a layer of ironclad help when confronted with life’s ups and downs. As you navigate these vital selections, do not forget that the correct protection is vital to sustaining each your monetary well being {and professional} well-being.

Acquiring high quality incapacity insurance coverage is a should for any doctor, so you may make sure you defend your hard-earned revenue. Get a quote from one in all our beneficial insurance coverage brokers and cross this job off your to-do listing immediately!

What was your expertise with incapacity insurance coverage as a federal or state worker? Did it’s a must to complement it with a person coverage? Did you ever have to make use of it?

The White Coat Investor could obtain compensation from White Coat Insurance coverage Companies, LLC; licensed in all states together with MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2025); Registered handle: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This doesn’t have an effect on the fee or protection of insurance coverage.