martin-dm

I’ve wavered between Purchase and Promote scores on Meta Platforms (NASDAQ:META) through the years. I’ll admit to being overly bearish on the identify since final spring round $200 per share. My final effort right here steered promoting into excellent news earnings beats from the corporate and energy within the inventory. So, the quote of $332 a share right this moment means I’ve missed out on sizable features. My job is to weigh the dangers and rewards of proudly owning a inventory utilizing my 37 years of buying and selling expertise. I then give readers an trustworthy opinion on what I consider will occur sooner or later. I’m not proper 100% of the time; 60% accuracy for income/losses is definitely the statistical quantity that helps you earn buying and selling earnings over time.

My unfavourable long-term view for Meta actually hasn’t modified a lot, that means I’ve not felt a have to replace it on In search of Alpha. Meta’s robust efficiency has been a perform of three variables. #1) Value-cutting on the enterprise (which I steered loudly in late 2022 could be the proper plan of action) has been important to offset its slowing commercial gross sales/pricing and the loopy overspend on Actuality Labs buildout (the metaverse factor). #2) An anticipated recession has been sluggish to materialize during the last 12 months. Such would/will certainly damage on-line advert pricing and spending ranges at Meta, when it seems. 2023’s financial outperformance vs. my forecast has saved gross sales {dollars} rolling within the door. #3) Traders in America have gone bonkers once more for Huge Tech names (akin to 2020-21). The newly nicknamed Magnificent 7, together with Meta, have skilled a swoosh of shopping for curiosity all 12 months lengthy, from admittedly undervalued ranges to start out.

My worries going ahead are all three positives holding up value might reverse rapidly with little discover throughout 2024. #1) There’s not a lot left to chop for bills exterior of Actuality Labs, CEO and founder Mark Zuckerberg‘s pet undertaking. #2) A recession ought to ultimately start from the tightest Federal Reserve banking/credit score coverage because the early Nineteen Eighties, on the biggest debt totals in American historical past right this moment. #3) The Huge Tech growth is overdue to flip the other way up, and transfer right into a bust cycle sample once more, as the additional AI enthusiasm this spring/summer season fades over time.

For my cash, I’m nonetheless avoiding Meta Platforms. Its valuation has turn out to be fairly wealthy in late 2023, particularly vs. excessive short-term rates of interest as funding competitors. As well as, new regulatory pressures/lawsuits by Uncle Sam to curb Meta’s enterprise success (progress and profitability metrics sooner or later) can’t be dominated out subsequent 12 months.

Let me clarify why a bearish stance and Promote score nonetheless make sense to me.

Stretched Valuation

Doubtless, investor pessimism on Meta’s working future in late 2022 has reversed into an uncommon degree of confidence into December 2023. Worth has jumped by nearly +200% over the trailing 12 months, a blistering tempo not remotely sustainable for a enterprise with a market capitalization of $850 billion.

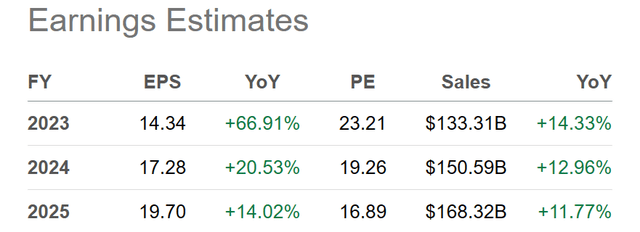

Certain, working outcomes have crushed lowered analyst expectations, however at far weaker progress charges than inventory value features. In truth, analysts are projecting gross sales and earnings advances to say no towards 10% annualized ranges by late 2025. What if a recession is subsequent, and gross sales/earnings stagnate?

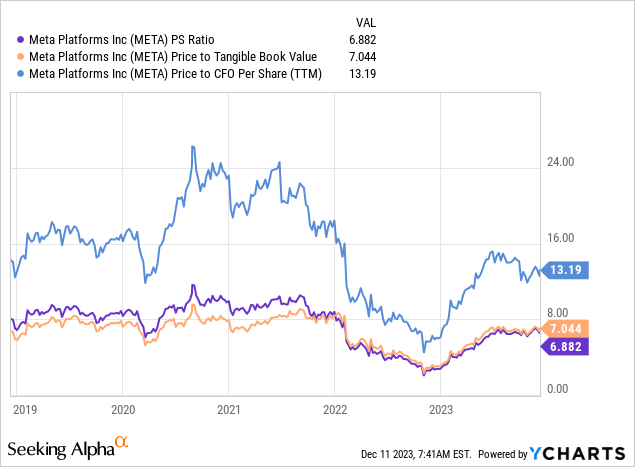

The tip results of the shifting elements is Meta is once more valued at barely above-average ranges vs. the previous 5 years of buying and selling on fundamentals like value to trailing gross sales, tangible e book worth, and money circulate. We’re a distance from the low valuation setup of late 2022.

YCharts – Meta Platforms, Fundamental Elementary Valuation Metrics, 5 Years

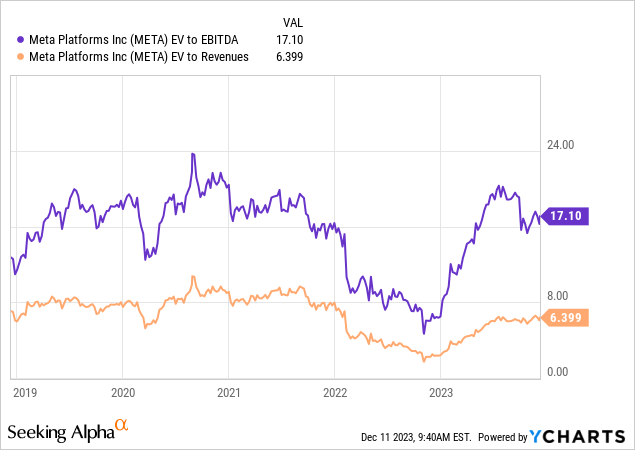

Enterprise valuations (including complete debt to fairness price, whereas subtracting money holdings) look about the identical. On EV to trailing money EBITDA or web gross sales, Meta is not the purchase proposition of late 2022 and early 2023.

YCharts – Meta Platforms, Enterprise Valuations, 5 Years

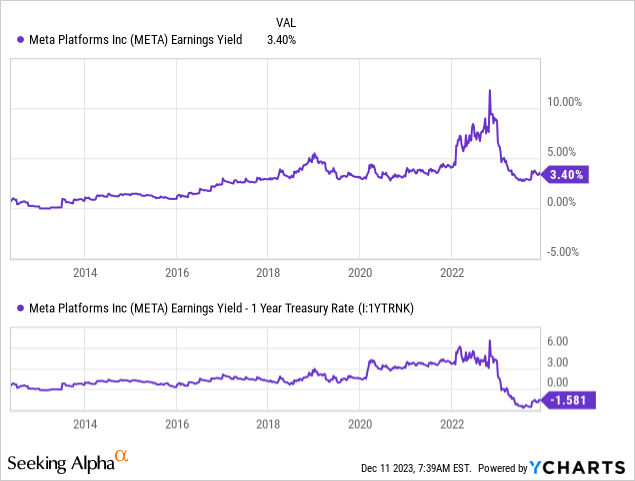

Even worse information for shareholders at $332 in December, the Meta earnings yield is hovering close to all-time “lows” vs. 1-year risk-free money funding charges on devices like Treasury payments (sitting at a unfavourable -1.58% relative yield). If I can seize a assured 5% revenue on high of the assured return of 100% of my upfront capital invested in 12 months, why hassle proudly owning a enterprise with all varieties of working threat, incomes much less return that I can put in my pocket? Utilizing this information, if 2022’s all-time excessive nominal and relative earnings yield to current financial savings charges was a raging purchase, the present setup is a screaming promote.

YCharts – Meta Platforms, Trailing Annual Earnings Yield vs. 1-Yr Treasury Price, Since 2012

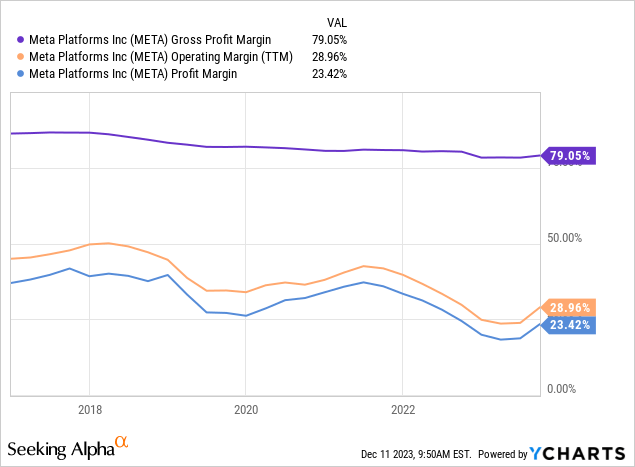

One other fear for shareholders is revenue margins have already been in decline for years. The straightforward and large progress span for the enterprise is gone. Now capital spending on new merchandise, aggressive social media competitors from different Huge Tech gamers, rising authorized payments from client lawsuits and to battle government-mandated change requests, and maybe quickly added authorities laws (with further firm expense to fulfill), are turning margins decrease. What I’m saying is the Meta of 2023 just isn’t the identical funding as the unique Fb enterprise proper after going public in 2012.

YCharts – Meta Platforms, Revenue Margins, 7 Years

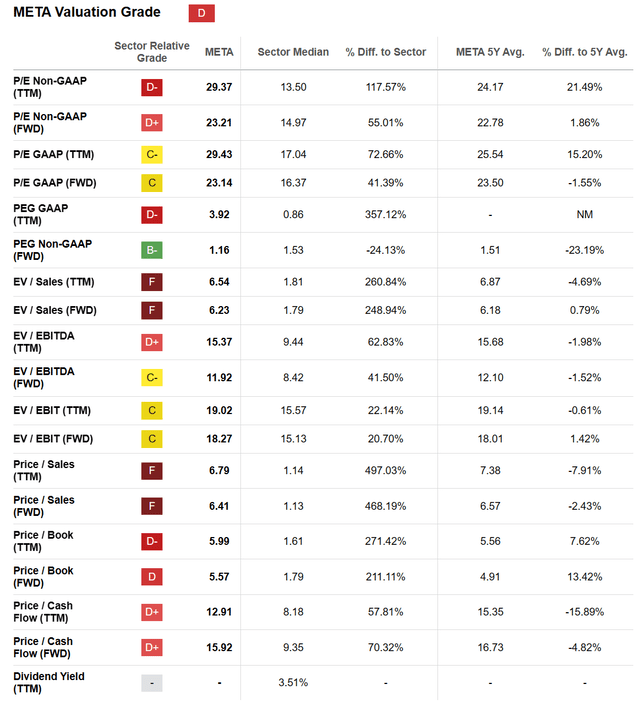

In search of Alpha’s computer-ranking comparability components places a Valuation Grade of “D” on Meta. Taking a look at peer/competitor corporations within the Communication Companies and Web Media area, plus a overview vs. Meta’s 5-year historical past, shares at the moment are sitting on the costly aspect of the underlying basic valuation equation.

In search of Alpha Desk – Meta Platforms, Valuation Grade, December tenth, 2023

Fading Technical Momentum

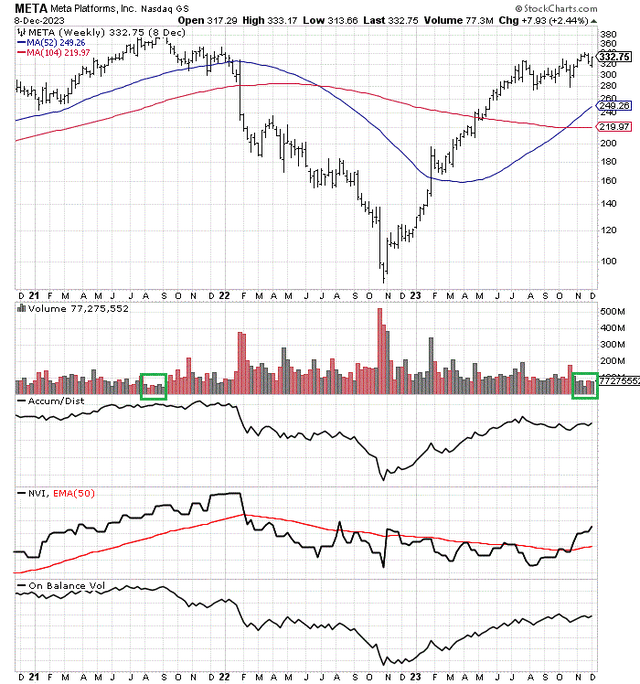

One other level of concern is upside buying and selling momentum has been sliding in latest weeks. On the 3-year chart under of weekly value and quantity adjustments, we will overview how the 2023 upmove nonetheless stays nicely beneath the 2021 peak for scope.

Whether or not speaking about value or actions within the Accumulation/Distribution Line, Detrimental Quantity Index, and On Stability Quantity, this 12 months’s sharp rebound solely seems to be a retracement of 2022’s main losses.

Of specific be aware, shopping for volumes have all however disappeared during the last 5 weeks vs. the sturdy and outsized bullish curiosity in the course of the 12 months. I’ve boxed in inexperienced the low quantity state of affairs could also be mirroring the all-time value peak for Meta in August 2021.

StockCharts.com – Meta Platforms, 3 Years of Weekly Worth & Quantity Adjustments, Writer Reference Factors

Ultimate Ideas

Decrease rates of interest and a mushy touchdown at the moment are the “necessities” to carry Meta’s share quote above $300 throughout 2024, for my part. If we get a recession, whereas rates of interest remaining elevated, a correction of its giant 2023 acquire is all however assured.

I’m modeling a good worth variety of $275 for the corporate in 12 months, to higher match increasing earnings and money flows with rates of interest remaining stubbornly larger. A 5% earnings yield sooner or later would convey the relative yield nearer to risk-free money returns. The optimistic Wall Avenue analyst view is corporate progress charges will keep within the 10% to twenty% vary throughout 2024-25, assuming we keep away from a critical recession.

In search of Alpha Desk – Meta Platforms, Analyst Estimates for 2023-25, Made December tenth, 2023

Nonetheless, if we do expertise a recession or rates of interest shock and rise additional (for instance, on Center East turmoil spiking crude oil, or hassle with China inflicting imported-goods pricing to rise at irregular charges quickly), Meta shares might commerce again into the $225 to $250 space (utilizing a P/E projection of 16x EPS of $15). Granted this may not be the top of the world for shareholders, however an prolonged correction in Meta stays my baseline forecast.

In a worst-case situation, U.S. antitrust actions might be introduced that require both a breakup of the corporate or the imposition of recent laws that damage earnings era (by means of better mandated bills). Given excessive rates of interest, a recession, and main authorities assaults on the enterprise mannequin, concentrating on a $200 quote just isn’t out of the realm of potentialities. If long-term working progress charges flip unfavourable, a P/E of 14x on EPS of $13 is totally justifiable with rates of interest between 5% and seven%.

If you wish to be the optimist within the room, the absence of any financial downturn, with a moderation in rates of interest, after assuming no new authorities proposals to divide Fb and Instagram (as one chance of many) by the Biden administration in an election 12 months, might assist value within the $325 to $350 vary throughout 2024. However, such would imply Meta Platforms stays on the excessive aspect of what I’d think about a good long-term valuation, for a enterprise this massive present process a fabric deceleration in compound progress charges (an actual math challenge for long-term possession). A P/E projection round 20x EPS of $17+ could be focused a 12 months from now.

Pulling all of the concepts collectively, I provide you with upside potential of +5% vs. draw back of -40%, with a midpoint complete return forecast over the subsequent 12 months of -15% as my present projection. Bear in mind, Meta pays no dividend, which is usually an enormous investor turnoff/unfavourable in periods of excessive rates of interest.

Mr. Zuckerberg determined to liquidate nearly $190 million in inventory throughout November, his first promote determination in 2 years. The inventory plan has included nearly day by day promoting since November sixteenth. If he’s prepared to lock in features over $300 per share, maybe now is not the neatest time to contemplate a purchase order.

I proceed to charge shares a Promote and Keep away from for merchants and short-term traders. As well as, the long-term funding story turns into way more problematic if authorities intervention in enterprise operations ultimately exhibits up (which I consider is inevitable).

Thanks for studying. Please think about this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is advisable earlier than making any commerce.