murat4art

Overview

My advice for Woodward (NASDAQ:WWD) is a purchase score, as 1Q24 margin efficiency was higher than I anticipated and the expansion outlook is now significantly better. The content material beneficial properties in each segments ought to assist to realize the long-term progress outlook set out by administration. Observe that I beforehand rated a maintain score for WWD as I used to be not sure about how the margin efficiency was going to be within the close to time period.

Current outcomes & updates

WWD reported whole 4Q23 income of $777 million, exhibiting 21% natural progress. The sturdy progress was pushed by 11% progress in Aerospace income to $455 million and industrial income progress of 39% to $322 million. The margin concern that I had beforehand appeared to not be a giant difficulty, apparently. Phase working margin got here in at 17.1%, a rise of 390 bps vs. final yr. Each Aerospace and Industrial EBIT margins improved y/y as properly, with Aerospace up 170 bps and Industrial up 790 bps on a y/y foundation. Total, efficiency was fairly nice, and with administration revising its long-term monetary goal at its analyst day, I’m now rather more constructive in regards to the outlook.

Touching first on the revised long-term outlook. Administration steering now contains:

- 7 to 9% natural progress CAGR by FY26. Utilizing 8% because the midpoint, it implies that WWD will have the ability to obtain round $3.7 billion in income.

- Earnings to develop at twice the tempo of income, implying 14 to 18% progress (excluding inorganic contributions).

- Free money stream conversion of greater than 100% (implying greater than 4% FCF yield on the present valuation)

The main focus for WWD is its Aerospace section, which administration has focused to develop at an 8–10% CAGR by FY26. Aerospace margin goal was additionally raised barely to twenty to >22% from the >20% goal beforehand. In my opinion, after reviewing the current efficiency and administration feedback, I’m constructive that this steering may be achieved. Crucial issue can be the rise in WWD content material for the latest technology of narrowbody plane in comparison with the earlier technology. These enhancements, for my part, would enhance WWD’s business aftermarket progress charge in the long term. Specifically, administration identified that gadgets with a stronger aftermarket presence had been the first focus of the shipset content material improve. Because of this the engines utilized by the A320neo and 737MAX have a a lot larger aftermarket service worth (5x vs. prior generations), although the shipset worth is 3x larger than earlier generations. For my part, this sizable multiplier ought to greater than maintain above-market progress for the foreseeable future. Administration projected a 12% progress charge for the business aftermarket between 2023 and 2031, exceeding the trade common of 6% progress. Remember the fact that administration is being cautious with the LEAP aftermarket ramp, so progress is predicted to speed up beginning in FY26. As such, the aftermarket progress charge ought to be accelerated by the a number of results past 2026.

Then again, WWD’s Industrial section also needs to drive progress, particularly with the shift towards extra twin gas engines which ought to supply a tailwind. Administration offered an instance of the potential influence by stating that the content material’s worth for these engines may very well be greater than 50% higher than for an engine that makes use of only one gas supply. Because the proportion of marine engines powered by twin gas engines continues to rise, I anticipate that this huge improve in potential demand will propel Industrial to expertise above-market progress within the years forward. Given the relative technical complexity of those twin gas merchandise, I additionally suppose their pricing and margins may very well be larger. This has the potential to spice up Industrial’s revenue margins even additional.

Valuation and threat

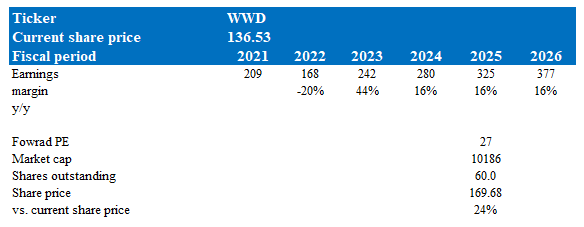

Creator’s valuation mannequin

In accordance with my mannequin, WWD is valued at ~$170 in FY25, representing a 24% improve over 2 years. This goal worth is predicated on administration earnings progress steering by FY26, which I consider is achievable given the rising content material penetration in each the Aerospace and Industrial segments. With the improved progress outlook, I consider WWD’s present 27x ahead PE a number of is rather more justifiable when in comparison with its 5-year buying and selling historical past. Over the previous 5 years, WWD income grew at a CAGR of 5% and was buying and selling at a excessive 20+ ahead PE. Now that the expansion outlook is significantly better, I consider it deserves to commerce in the identical vary.

The prolonged time it takes for engine outlets to finish repairs is a giant drawback for WWD’s aftermarket enterprise because it delays the demand pull for WWD’s elements. The influence on income and earnings has been unfavorable, and it is potential that this may stay so in 2024.

Abstract

I’m now recommending a purchase score for WWD as administration’s revised long-term steering signifies a constructive progress trajectory by FY26. The principle driver is Aerospace progress, notably in content material for newer plane generations. Additionally, the expansion in twin gas engines also needs to drive above-market progress for the Industrial section. My valuation mannequin has a goal worth of $170, pushed by WWD enhanced progress prospects and a ahead PE a number of of 27x.