(Bloomberg) — US fairness futures edged increased whereas the greenback prolonged losses as buying and selling resumed after the Christmas vacation amid investor expectations for earlier and deep rate of interest cuts subsequent 12 months.

Most Learn from Bloomberg

Shares in Asia had been blended in a skinny buying and selling session with markets together with Hong Kong, New Zealand and Australia shut. Rising Asian currencies rose, with South Korea’s received and Taiwan greenback main features towards a weak greenback that fell to its lowest stage in virtually 5 months.

Some on Wall Road are positioning for additional inventory features forward because the session kicked off the beginning of the “Santa Claus rally” — a seasonal pattern the place equities are inclined to climb into the primary few days of the brand new 12 months. The S&P 500 notched an eight-week profitable run on Friday — the longest in additional than 5 years on indicators worth pressures within the US had been easing. Ten-year US Treasury yields slid two foundation factors to three.88%.

“As for rising markets in Asia, ‘silent evening’ says a lot, provided that there isn’t significantly impressed buying and selling, with Wall Road equivocating forward of Christmas,” stated Vishnu Varathan, head of economics and technique at Mizuho Financial institution. “It appears to be like like a case of averting the China drag and hanging on to earlier Santa rallies being the most effective case for Boxing day – boxing in dangers.”

Shares fell in mainland China, with the benchmark CSI 300 Index headed for its first drop in 4 classes, as investor sentiment stays weak even after the authorities softened their stance following a transfer final week to tighten curbs on the videogame business.

Elsewhere, Singapore greenback was little modified after core inflation edged decrease in November, giving the central financial institution room to increase its monetary-policy pause subsequent month to assist the financial system.

Japan’s public sale of two-year sovereign debt noticed tepid investor urge for food, sending a gauge of demand to the weakest in a 12 months, amid hypothesis the central financial institution will finish destructive rates of interest in 2024. Its labor market remained comparatively tight in November, protecting stress on employers to spice up wages to be able to fill positions.

The benchmark Topix index traded inside tight ranges after Financial institution of Japan Governor Kazuo Ueda’s speech on Monday that recommended he’s in no hurry to finish the ultra-easy financial coverage.

“With the Nikkei 225 at excessive ranges, year-end promoting to lock in earnings and losses is prone to weigh on the upside,” says Hideyuki Ishiguro, senior strategist at Nomura Asset Administration.

Within the company world, Chinese language gaming shares outperformed the benchmark after a variety of corporations introduced plans to repurchase their shares following information of the most recent authorities curbs on the sector. Cathie Wooden final week made her first buy of shares in LY Corp. in over a 12 months, indicating a potential shift towards extra constructive sentiment on the operator of Yahoo! Japan and fashionable messaging app Line.

Iron ore futures hit $140 a ton, highest in 18 months as merchants hold a detailed eye on China’s metal outlook for the following 12 months. Oil rose barely after posting the most important weekly achieve in additional than two months, with transport disruptions within the Crimson Sea in focus after a spate of Houthi assaults towards vessels within the very important waterway.

Geopolitical tensions nonetheless stay entrance of buyers minds into the brand new 12 months as tensions within the Center East look set to extend. Iranian President Ebrahim Raisi stated Israel can pay a worth for killing a senior commander of its Revolutionary Guard in air strike in Damascus on Monday. The US accused Iran on the weekend of an assault on a tanker within the Indian Ocean.

READ: Israel Sees Protection Spending Climbing $8 Billion as Conflict Rages

US Progress Resilience

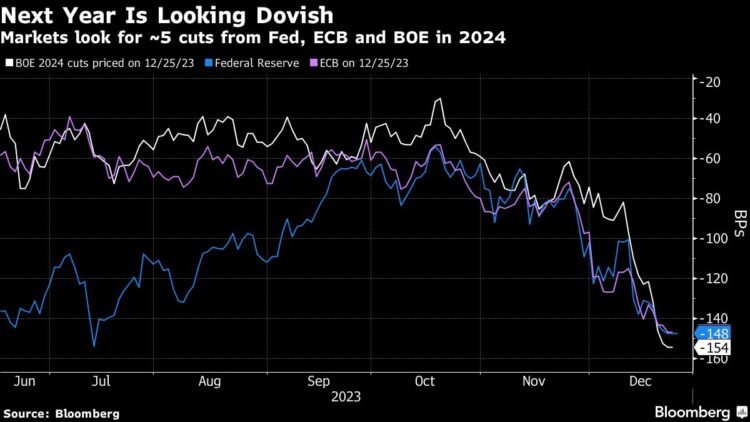

World markets have been buoyed in latest months as merchants guess main central banks together with the Federal Reserve will aggressively minimize rates of interest subsequent 12 months as inflation falls. Bond yields have tumbled whereas the S&P 500 is nearing a contemporary file.

Knowledge launched final week confirmed indicators of resilience in US progress whereas the Fed’s most popular underlying inflation metric barely rose in November. Further studies Friday confirmed shoppers had been additionally gaining conviction that inflation on this planet’s largest financial system was heading in the right direction regardless of a bumpy housing market restoration.

That helped cement investor expectations for earlier and deeper rate of interest cuts subsequent 12 months, regardless of pushback from a number of Fed policymakers. Swaps merchants are betting rates of interest might be eased by greater than 150 foundation factors in 2024, double the Fed’s forecast.

Learn extra: Fed’s Most well-liked Inflation Gauges Cool, Reinforcing Price-Lower Tilt

Key occasions this week:

-

BOJ releases summery of opinions from December assembly, Wednesday

-

China industrial earnings, Wednesday

-

Norway retail gross sales, Wednesday

-

Japan industrial manufacturing, Thursday

-

South Korea industrial manufacturing, Thursday

-

Thailand commerce, Thursday

-

Mexico unemployment, Thursday

-

Financial institution of Portugal releases quarterly report on banking system, Thursday

-

South Korea CPI, Friday

-

Spain CPI, Friday

-

UK nationwide home costs, Friday

-

Brazil unemployment, Friday

-

Chile unemployment, Friday

-

Colombia unemployment, Friday

Some strikes in main markets:

Shares

-

S&P 500 futures rose 0.1% as of 6:30 a.m. London time

-

The Shanghai Composite fell 0.7%

-

Nasdaq 100 futures rose 0.3%

-

Australia’s S&P/ASX 200 was little modified

Currencies

-

The Bloomberg Greenback Spot Index fell 0.1%

-

The euro rose 0.2% to $1.1025

-

The Japanese yen was little modified at 142.25 per greenback

-

The offshore yuan was little modified at 7.1467 per greenback

-

The Australian greenback rose 0.3% to $0.6816

-

The British pound rose 0.1% to $1.2707

Cryptocurrencies

-

Bitcoin fell 2% to $42,674.63

-

Ether fell 1.9% to $2,229.68

Bonds

-

The yield on 10-year Treasuries declined two foundation factors to three.88%

-

Japan’s 10-year yield superior two foundation factors to 0.630%

-

Australia’s 10-year yield was unchanged at 4.01%

Commodities

-

West Texas Intermediate crude rose 0.3% to $73.75 a barrel

-

Spot gold rose 0.5% to $2,064.35 an oz.

This story was produced with the help of Bloomberg Automation.

–With help from Akemi Terukina.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.