“[The fiscal theory of the price level] says that costs and inflation rely not on cash alone . . . however on the general liabilities of the federal government — cash and bonds. In different phrases, inflation is at all times and all over the place a financial and financial phenomenon.” — Thomas S. Coleman, Bryan J. Oliver, and Laurence B. Siegel, Puzzles of Inflation, Cash, and Debt

“Financial coverage alone can’t remedy a sustained inflation. The federal government will even have to repair the underlying fiscal downside. Brief-run deficit discount, short-term measures or accounting gimmicks received’t work. Neither will a bout of growth-killing high-tax ‘austerity.’ The U.S. has to influence those that over the lengthy haul of a number of many years it is going to return to its custom of working small main surpluses that progressively repay money owed.” — John H. Cochrane, Senior Fellow, Hoover Establishment, Stanford College

Inflation has set one more 40-year excessive. After rising for the final yr and regardless of a number of price hikes by the US Federal Reserve, the most recent Shopper Worth Index (CPI) figures got here in above estimates, at 9.1%. This means inflation strain is probably not easing up in any respect however could in truth be accelerating.

So, what will be accomplished to tame inflation within the months and years forward? Within the first installment of our interview collection with John H. Cochrane and Thomas S. Coleman, the 2 described how the fiscal idea of the worth degree (FTPL) explains the inflation phenomenon from each a theoretical and historic perspective. Right here they take into account how the present inflation surge is likely to be tapped down. As Cochrane wrote in his latest piece for the Wall Avenue Journal, a financial coverage response alone received’t be ample.

What follows is an edited and condensed transcript of the second installment of our dialog.

John H. Cochrane: What is going to it take to do away with the present inflation?

There’s some momentum to inflation. Even a one-time fiscal shock results in a protracted interval of inflation. So, a few of what we’re seeing is the delayed impact of the large stimulus. That may finally go away by itself, after the worth of the debt has been inflated again to what individuals assume the federal government can repay.

However the US continues to be working immense main deficits. Till 2021, individuals trusted that the US is sweet for its money owed; deficits shall be finally paid again, so individuals have been completely satisfied to purchase new bonds with out inflating them away. However having crossed that line as soon as, one begins to surprise simply how a lot capability there’s for extra deficits.

I fear in regards to the subsequent shock, not simply the common trillion-dollar deficits that we’ve all seemingly gotten used to. We’re in a bailout regime the place each shock is met by a river of federal cash. However can the US actually activate these spigots with out heating up inflation once more?

So, the grumpy economist says we nonetheless have fiscal headwinds. Getting out of inflation goes to take rather more fiscal, financial, and microeconomic coordination than it did in 1980. Financial coverage wants fiscal assist, as a result of larger rates of interest imply larger curiosity prices on the debt, and the US must repay bondholders in additional invaluable {dollars}. And until you possibly can generate a decade’s price of tax income or a decade’s price of ordinary spending reforms — which has to return from financial development, not larger marginal tax charges — financial coverage alone can’t do it.

Rhodri Preece, CFA: What’s your evaluation of central financial institution responses so far? Have they accomplished sufficient to get inflation underneath management? And do you assume inflation expectations are properly anchored at this level? How do you see the inflation dynamic taking part in out the remainder of the yr?

Cochrane: Brief-term forecasting is harmful. The primary piece of recommendation I at all times provide: No one is aware of. What I do know with nice element from 40 years of learning inflation is precisely how a lot no person actually is aware of.

Your method to investing shouldn’t be to seek out one guru, imagine what they are saying, and make investments accordingly. The primary method to investing is to acknowledge the large quantity of uncertainty we face and do your danger administration proper in an effort to afford to take the chance.

Inflation has a lot of the identical character because the inventory market. It’s unpredictable for a motive. If all people knew for positive that costs would go up subsequent yr, companies would increase costs now, and folks would run out to purchase and push costs up. If all people knew for positive the inventory market would go up subsequent yr, they’d purchase, and it could go up now.

So, within the massive image, inflation is inherently unpredictable. There are some issues you possibly can see within the entrails, the small print of the momentum of inflation. For instance, home value appreciation fed its means into the rental value measure that the Bureau of Labor Statistics makes use of.

Central banks are puzzling proper now. By historic requirements, our central banks are means behind the curve. Even within the Seventies, they reacted to inflation rather more than at present. They by no means waited a full yr to do something.

However it’s not apparent that that issues, particularly if the basic supply of inflation is the fiscal blowout. How a lot can the central banks do about that inflation?

Within the shadow of fiscal issues, central bankers face what Thomas Sargent and Neil Wallace referred to as an “disagreeable arithmetic.” Central banks can decrease inflation now however solely by elevating inflation considerably later. That smooths inflation out however doesn’t remove inflation, and might enhance the eventual rise within the value degree.

However essentially, central banks attempt to drain some oil out of the engine whereas fiscal coverage has floored the fuel pedal. So, I believe their potential to manage inflation is so much lower than we expect within the face of ongoing fiscal issues.

Furthermore, their one instrument is to create a little bit of recession and work down the Phillips curve, the historic correlation that larger unemployment comes with decrease inflation, to attempt to push down inflation. You possibly can inform why they’re reluctant to do this, how a lot strain they are going to be underneath to surrender if it does trigger a recession, and the conundrum that any recession will spark an inflationary fiscal blowout.

Thomas L. Coleman: If the fiscal idea is correct, then plenty of it has to do with authorities borrowing and debt. And so it’s taking a look at what’s the projections, what’s the trail of future debt.

Olivier Fines, CFA: The time period we like is a gentle touchdown.

Preece: The Financial institution of England has been fairly express. They’re saying, “Inflation’s going to surpass 10% later this yr, and there’s going to be a recession.” There’s plenty of ache that’s coming, however I’m not listening to the identical form of messaging from the Fed.

We’ve had, within the phrases of a central financial institution official some years again, the financial coverage accelerator pressed to the ground however with the fiscal coverage handbrake on. We’ve had an period of fiscal austerity mixed with very unfastened and accommodative financial insurance policies. Does that specify why inflation didn’t take off within the UK and in Europe within the final decade?

Cochrane: Truly, I’d disagree with that characterization. The 2010s have been a interval of immense deficits by earlier requirements throughout an growth. The “austerity” was a brief interval of high-tax-rate financial strangulation, but it surely by no means produced substantial and sustained fiscal surpluses. And I’m not persuaded financial coverage was that unfastened. Fiscal coverage bought actually fortunate in that for a decade buyers have been keen to carry and roll over debt at absurdly low rates of interest. The curiosity prices on the debt have been low, making all of it appear sustainable. That’s about to alter in a giant means.

The sudden hanging emergence of inflation is beautiful intellectually, nevertheless. There’s an entire class of theories that flowered within the late 2010s. Trendy financial idea [MMT] mentioned that deficits don’t matter and debt doesn’t matter. It’ll by no means trigger inflation. We simply threw that out the window, I hope.

Fines: MMT would exactly demand that the central financial institution turn out to be the financing arm of the Treasury. That might be one thing.

Cochrane: There’s a giant conceptual shift that should occur all through macroeconomics. Now we have hit the availability limits. So, should you thought there was “secular stagnation” and that every one the financial system wanted to develop was extra demand, should you thought the central downside of all of our economies was the truth that central banks couldn’t decrease rates of interest under zero and financial coverage simply may by no means get round to the large deficits that might restore inflation-free development, properly, that’s simply over. We at the moment are producing at and past the availability capability of the financial system. The financial downside now’s to manage inflation and get to work on the availability facet of the financial system.

Coleman: Rhodri, again to your query about fiscal restraints. The US really didn’t have almost the fiscal restraint within the 2010 by means of 2015 interval that both the UK or Europe did. However there have been efforts and substantive efforts to stability the finances, enhance earnings, lower spending — and definitely, substantive efforts in that interval relative to what we see these days. So, I believe there have been within the US fewer fiscal restraints than in Europe, however definitely greater than now.

Cochrane: Europe did undergo “austerity” within the early 2010s. Within the wake of the European debt disaster, many nations did notice that they needed to get debt-to-GDP ratios again underneath management. In lots of circumstances, they did it by means of sharp and short-run tax will increase, which harm financial development and have been thus counterproductive. Nations that reformed spending did so much higher (Alberto Alesina, Carlo Favero, and Francesco Giavazzi’s Austerity is excellent on this). However the effort at the least confirmed a bit extra concern with debt than we see within the US. Europe particularly is in higher long-run form than the US in that European nations have largely funded their entitlements, charging middle-class taxes to pay for middle-class advantages. The US is heading in the direction of an entitlement cliff.

The value degree seems at debt relative to the lengthy future trajectory of deficits.

Keep in mind that tax income isn’t the identical as tax charges. Elevating already excessive marginal tax charges simply slows down the financial system and finally produces little income. Furthermore, it’s particularly damaging to the long term, and it’s the long term the place we have to repay money owed. When you increase tax charges, you get income within the first yr, however then it progressively dissipates as development slows down.

So, Europe nonetheless has a giant fiscal downside, as a result of development has actually slowed down. Progress may even go backwards, because it appears to be doing in Italy. Austerity, within the type of excessive marginal tax charges, that reduces development, in truth, is unhealthy for long-run authorities revenues. At greatest, you’re climbing up a sand dune. At worst, you’re really sliding down the facet.

Earlier, you mentioned the central banks within the 2010s have been doing all the things they might to stoke inflation. However it’s very fascinating that in our political methods, central banks are legally forbidden to do the one factor that almost all reliably stokes inflation, which is to drop cash from helicopters — to put in writing checks to voters. Fiscal authorities simply did that and shortly produced inflation!

There’s a motive that central banks should not allowed to put in writing checks to voters: as a result of we dwell in democracies. The very last thing we would like is non-elected central bankers doing that. Central bankers at all times have to soak up one thing for something they offer. So, this type of wealth impact of additional authorities debt is the one factor they’re not allowed to do.

Fines: We have a tendency to think about coverage coordination as a destructive, the tip of central financial institution independence. While you talked about coordination, you really talked about countercyclical results between fiscal and financial coverage. Might you say just a few phrases about that?

Coleman: Inside the fiscal idea of the worth of degree, coordination simply signifies that financial authorities and financial authorities work collectively in a method or one other. They might be working in the identical path, or they might be working reverse, however in idea and in the true world there at all times is a few type of coordination. So, Olivier, you and, I believe, individuals within the markets are utilizing coordination as a destructive time period, because the financial authority validating or monetizing debt in assist of the fiscal authority. And it’s actually vital to acknowledge that when John and I exploit it, we’re very impartial and that the coordination could also be of that type, with the financial authorities validating and monetizing the fiscal habits, or possibly what John was simply speaking about, which is coordinating to cut back the deficit, enhance future surpluses, and many others.

Cochrane: Sure, coordination is sweet and essential. For instance, suppose that the central authorities needs to run a deficit and doesn’t wish to borrow cash, so it needs the central financial institution to print cash to finance the deficit. It’s pleased with the inflation. That wants coordination. That Treasury must say, “We’re spending cash like a drunken sailor,” and the central financial institution must say, “And we are going to print it for you, sir. We’re dancing collectively.”

Within the different path, if you wish to do away with inflation coming from massive deficits, and the central financial institution is printing cash to finance these deficits, it’s not sufficient for the central financial institution to simply say, “We’re not going to print cash anymore.” How is the federal government going to finance its spending? It has to chop spending, increase tax income, or borrow. You want that coordination to cease the inflation. And it’s not at all times simple. Typically the federal government bought right here within the first place as a result of it didn’t wish to, or couldn’t, do any of those.

Central financial institution independence is kind of helpful. It’s a pre-commitment of a authorities that wishes to coordinate its actions on a coverage that doesn’t inflate, a coverage that efficiently borrows or taxes to finance its spending. A central financial institution that tries arduous to refuse to spend cash is an effective kick within the pants to run a sound fiscal coverage. So, independence is a means of attaining productive coordination.

Fines: You appear to imagine that central financial institution and authorities would have a joint curiosity in maintaining inflation at affordable ranges.

Cochrane: Nicely, sure, they usually do. However that’s a long-run want, and each authorities and central banks are generally tempted. Expensive Lord, give us low inflation, however not fairly but — after the election, or as soon as the recession is over.

Additionally, don’t assume that central bankers at all times hate inflation and Treasuries at all times need it. Plenty of our central bankers have been for inflation.

However ideally, central bankers should not presupposed to need inflation, and their mandates inform them in the beginning to maintain a lid on inflation. Our governments created central banks as a pre-commitment mechanism. Governments need low inflation, however they perceive that there’s a robust political temptation to goose inflation forward of elections.

So, an impartial central financial institution with an anti-inflation bias is a means for a authorities to pre-commit itself to a superb long-term coverage. It’s like Odysseus who tied himself to the mast so he couldn’t observe the sirens’ track. It’s a part of the various establishments of excellent authorities that pre-commit to good long-run insurance policies, commitments to respect property rights, to pay again money owed (to allow them to borrow within the first place), to respect a structure, and so forth.

Keep tuned for the following installment of our interview with John H. Cochrane and Thomas S. Coleman. Within the meantime, take a look at Puzzles of Inflation, Cash, and Debt and “Inflation: Previous, Current, and Future,” amongst different analysis from JohnHCochrane.com.

When you appreciated this submit, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the writer’s employer.

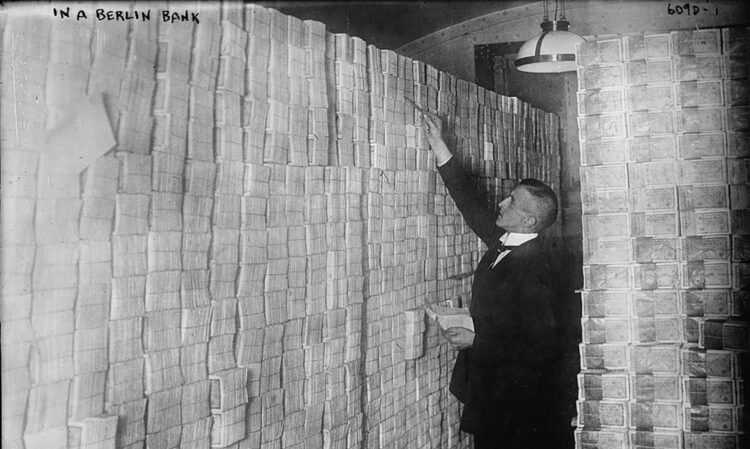

Picture courtesy of Library of Congress, Prints & Pictures Division, [reproduction number, e.g., LC-B2-1234]

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can file credit simply utilizing their on-line PL tracker.