7-Eleven: A Main Realty Revenue Tenant RiverNorthPhotography

Realty Revenue Company (NYSE:O) has given buyers a tough trip lately. Having declined 5.8% in worth over the past 5 years, this actual property funding belief, or REIT, has carried out worse than its fundamentals would lead you to foretell. The full return over 5 years has been optimistic, due to the excessive dividend yield, however hasn’t been commensurate with the corporate’s efficiency

This 12 months, it seems to be like Realty Revenue is starting to buck its long-term pattern. Since hitting a low of $46.22 in November 2023, it has risen 24% to $57.21. It has been a formidable rally off the lows, and there’s a good likelihood that it might proceed.

Regardless of O’s ugly long-term chart, the REIT itself is performing fairly effectively. In response to Searching for Alpha Quant, Realty Revenue has skilled considerable will increase in income within the trailing 12 months, in addition to the trailing three 12 months, 5 years, and ten-year intervals. The expansion in earnings hasn’t been as sturdy, though the expansion in free money movement has been above 16% in all time frames. Margins are wholesome: the corporate scores an A+ on profitability in Searching for Alpha’s score system. Lastly, Realty Revenue has a wholesome steadiness sheet, with a debt to fairness ratio of 0.65 and sufficient money to cowl a full 12 months of property bills.

All of this raises an essential query:

Why is Realty Revenue inventory down a lot over 5 years? It seems to be just like the REIT itself is performing effectively, so why the lackluster inventory efficiency?

One purpose is that the REIT took a beating in 2020 as a result of COVID-19 pandemic. It fell 47% high to backside in that interval. In the course of the pandemic, many States had pandemic management insurance policies that included closing down non-essential companies. Mall REITs particularly obtained hit laborious, as a lot of their tenants (film theaters, vogue shops) have been deemed inessential in the course of the pandemic. O, as a business REIT, fell in worth together with its beleaguered mall REIT cousins. Nonetheless, the corporate’s personal fundamentals weren’t a lot affected by the pandemic. Within the second quarter – the quarter that featured the strictest lockdowns of the whole COVID pandemic – O’s income elevated 5.2%, its funds from operations, or FFO, per share elevated 3.7%, and its adjusted FFO, or AFFO, per share decreased simply 2.3%. The REIT had a 98.5% occupancy price within the interval. Whereas these actually aren’t “blowout outcomes,” they weren’t indicative of main injury. In a interval when O declined in worth by practically a half, its FFO elevated 3.7%.

Nonetheless, the injury to REITs basically had its impact on Realty Revenue’s unit worth. Though the O has risen 35.5% off the COVID lows, it’s nonetheless nowhere close to the pre-COVID excessive of $79.83. That is attention-grabbing as a result of all the REIT’s fundamentals have vastly improved in comparison with the 2019 (i.e., pre-COVID) ranges. As you’ll be able to see within the desk beneath (TTM numbers courtesy of Searching for Alpha Quant, 2019 numbers from the 2019 annual report), most of O’s spotlight earnings and money movement numbers are up from the pre-pandemic stage.

|

TTM |

2019 |

Development price |

|

|

Income |

$3.89B |

$1.42B |

173% (22% CAGR) |

|

FFO |

$2.7B |

$1.04B |

159% (21% CAGR) |

|

AFFO |

$2.6B |

$1.05B |

147% (19.8% CAGR) |

|

Web earnings |

$881M |

$426M |

106% (15% CAGR) |

|

Free money movement |

$1.7B |

$722M |

135% (18.6% CAGR) |

So, regardless of O being down from its pre-pandemic inventory worth, its earnings and money movement metrics have improved. Though some macro components which have emerged within the interim interval (e.g., excessive rates of interest) haven’t been sort to Realty Revenue, they have not stopped its earnings development trajectory from being mainly a optimistic one. The REIT has loads of development engines, together with a newly acquired subsidiary that might take its FFO to new heights. For that reason, I think about O a purchase at right this moment’s worth.

Realty Revenue – Latest Traits and Future Trajectory

Earlier than valuing Realty Revenue, I have to develop a thesis about the place the corporate is more likely to be sooner or later. I will begin by trying on the firm’s current traits, then transfer on to components that can affect its future efficiency, comparable to its just lately acquired properties, natural development, and rates of interest.

We will begin with the corporate’s current trajectory. A few of this was coated within the introduction (see the desk above), right here I will get into a bit of extra element on particular accounts that make up the earnings metrics coated already. During the last 5 years, Realty Revenue’s key metrics that go into working earnings elevated on the following charges:

-

Income: 159% (21% CAGR).

-

Property bills: 343%.

-

Promoting, common and admin bills: 216%.

-

Depreciation: 212%.

Lastly, we now have internet curiosity bills, which elevated 124%.

Generally, working bills that go into calculating earnings earlier than curiosity and taxes elevated quicker than income did. Curiosity bills elevated slower than income, which is a considerably shocking consequence. The Federal Reserve hiked rates of interest at an extraordinarily quick tempo in 2022, which led to rising curiosity bills at many firms. O’s curiosity bills elevated in 2022 and 2023, however not at an particularly quick tempo in comparison with income, which was a optimistic growth.

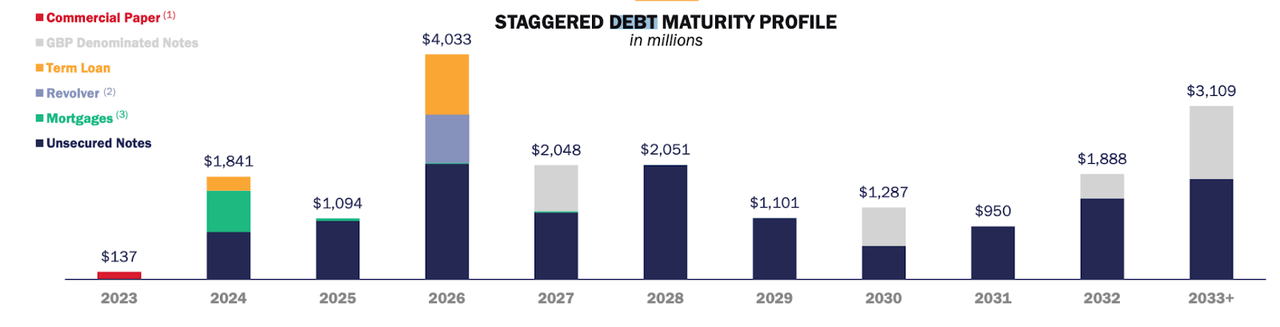

In 2024, that may change. This 12 months, the corporate has $1.8 billion in debt maturing, which is able to probably should be refinanced. As soon as it’s refinanced, it would most likely be at larger charges, so that might take a chew out of Realty Revenue’s earnings going ahead. Because the chart beneath exhibits, the corporate has plenty of maturities developing within the subsequent few years, and with $344 million in steadiness sheet money, it will possibly’t merely pay for them utilizing cash that it has available. So, curiosity bills are more likely to improve extra going ahead than they did in 2023, when hardly any debt (simply $137 million value) got here up for refinancing.

O maturity profile (Realty earnings)

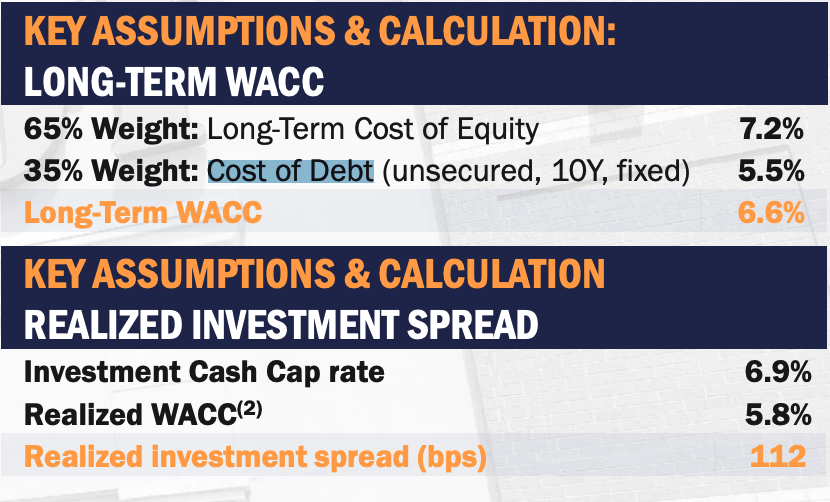

Primarily based on the chart above, I predict that Realty Revenue’s curiosity bills will improve over the following 5 years. Within the trailing 12 month interval, O had $653 million in curiosity expense on $20.99 billion in debt, for a 3.12% value of debt. The corporate expects its value of debt to common 5.5% over the following 10 years, and the schedule of refinancings mixed with the present excessive rate of interest setting argues that they’re proper about that. So, I would anticipate curiosity bills to achieve about $1 billion per 12 months by the tip of the following five-year interval.

O value of capital (Realty Revenue)

Subsequent up we now have the corporate’s development drivers. Its high 5 purchasers are Greenback Common, Walgreens, Greenback Tree, 7-11 and EG Group. All of those firms have funding grade credit score rankings, and that exhibits up in Realty Revenue’s personal leads to the type of a near-100% assortment price. So, I would anticipate O’s income to be a minimum of secure. On high of that, the corporate simply accomplished the acquisition of Spirit Realty Capital (SRC), a deal that it says will improve AFFO by 2.5% over the following 12 months. Lastly, business workplace lease is predicted to rise by 1.2% per 12 months within the coming years. That is not plenty of development coming from lease hikes alone, however however, O has an excellent steadiness sheet, which argues that it has room for extra offers within the years forward.

For these causes, I agree with the analyst consensus of 10% annual income development and 9.9% annual earnings development within the close to time period. Sadly, O has diluted its fairness previously, together with on the Spirit Realty deal. For that reason, I would anticipate the expansion price in EPS to be slower than the expansion in internet earnings, at about 5% per 12 months.

Valuation

Having executed a ahead trying evaluation of Realty Revenue as an organization, it is now time to worth the shares. In response to Searching for Alpha Quant, O trades at:

-

44 instances earnings.

-

14 instances FFO.

-

14.5 instances AFFO.

-

14.93 instances working money movement.

-

1.33 instances e-book worth.

-

10 instances gross sales.

These figures are blended. 10 instances gross sales and 44 instances earnings are each fairly excessive for a REIT, however the FFO multiples are quite low. FFO and AFFO predict dividend-paying means higher than GAAP earnings do, so I would put extra weight on these, and say that Realty Revenue is a reasonably valued REIT.

We will additionally worth Realty Revenue when it comes to discounted money flows. O had $4.23 in free money movement per share within the TTM interval. If it grows at 5% annualized over the following 5 years (in step with the speed that I forecast EPS would develop at), then it slows to a 0% sustainable development price after that, we find yourself with a $75 truthful worth estimate utilizing a 7% low cost price. The 7% low cost price right here is 4% (the 10-year treasury yield) plus a 3% threat premium. The comparatively low threat premium right here is justifiable as a result of I am assuming a free money movement (“FCF”) development price far beneath the corporate’s historic norms, whereas the corporate has recognized development drivers within the type of a current accretive acquisition and reasonable projected natural development in business workplace rents.

The Backside Line

The underside line on Realty Revenue is that it’s a beaten-down REIT whose efficiency is a lot better than its inventory worth would have a tendency to point. During the last 5 years, it has grown its FCF per share by 25%, but its inventory worth has fallen in the identical interval. O’s declining worth has resulted in it having a modest valuation of simply 14 instances FFO, 14.5 instances AFFO and 1.3 instances e-book worth.

To make sure, the O REIT is topic to sure risks-chief amongst them, the chance of unexpectedly excessive rates of interest within the years forward. If inflation begins rising and the Fed has to renew climbing charges, then O’s earnings will endure. Other than that, although, Realty Revenue Company inventory has plenty of components in its favor whereas buying and selling at an inexpensive worth. On steadiness, it seems to be definitely worth the funding.