coldsnowstorm

By no means wager in opposition to the American client. That is what so many pundits say, and the December Retail Gross sales report put out by the US Census Bureau final Wednesday underscored energy in spending to wrap up 2023.[1]

Each the headline determine and the “management group,” which backs out some unstable classes, got here in effectively above economists’ estimates.[2]

Later that morning, the Nationwide Retail Federation (NRF) confirmed that buyers had been certainly out and about throughout This fall – whole vacation spending progress verified at +3.8% in comparison with 2022,[3] although that was throughout the NRF’s forecast vary from early November.[4]

Smaller Financial savings, Optimistic Actual Wage Progress

So, all’s effectively on the demand entrance, proper? Nicely, not so quick. We’re nonetheless a number of weeks from listening to how the world’s largest and most necessary retailers carried out across the holidays.

It is cheap to claim, nonetheless, that the bar has been raised in mild of those new information factors. Whereas pandemic-related extra financial savings continues to dwindle, staff are incomes constructive actual wages, maybe to the tune of 1%-plus in 2024 if some forecasters are appropriate.

That might be a major tailwind for discretionary attire and merchandise firms. Shares of stated companies typically rallied over the ultimate two months of final yr.

2024 has been a more durable slog, although, as evidenced by an almost 10% decline within the SPDR S&P® Retail ETF (XRT) since a peak proper after Santa’s huge scene.[5]

However are there clues we are able to glean from a few of the smaller home retailers? Our staff noticed three preliminary earnings stories that paint a combined image as to the state of family spending.

Boot Barn: Blended Steering Replace, Earnings on Faucet

Again on January 5, Boot Barn (BOOT), a $2.2 billion market cap firm within the Attire Retail trade throughout the Client Discretionary sector, jumped following the discharge of an early learn on its Q3 internet earnings per diluted share.

Its administration staff now expects the revenue determine to return in forward of its earlier steering vary of $1.67 to $1.79, although the agency sees Q3 2024 internet gross sales of $520.[4] million, under analysts’ estimates.

Total, quarterly same-store gross sales are forecast to drop 9.7%, based on the corporate press launch forward of the ICR Convention earlier this month.[6]

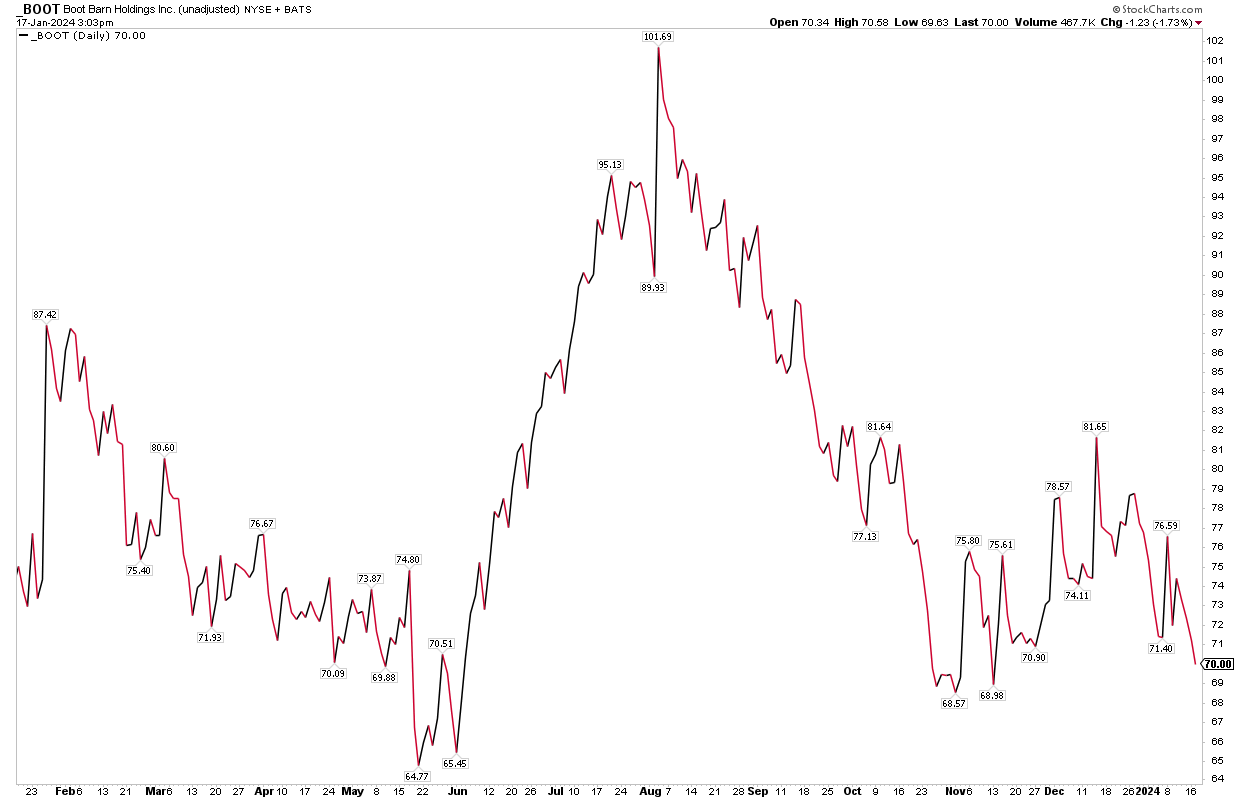

BOOT has taken it on the chin for the reason that inventory notched a multi-month excessive above $100 final August.

With shares now about 30% decrease, buyers hope that continued respectable client spending in 2024 can carry each income and the inventory. We’ll discover out extra when the ultimate Q3 numbers cross the wires on Wednesday, January 31 AMC.

BOOT 1-12 months Inventory Value Historical past: Bears Kicking Shares Down Since August

Supply: Stockcharts.com

5 Beneath: Upbeat Earnings Outlook, Favorable CEO Feedback

Only a few days later, one other retail-related agency issued preliminary earnings. 5 Beneath (FIVE) has emerged as a family title for bargain-hunting buyers.

The $10.5 billion market cap Specialty Retailer, identified for providing novelty merchandise and sensible knickknacks, additionally offered operational updates on the January ICR Convention.

Its administration staff stated it expects This fall and full-year 2023 outcomes inside its beforehand given steering ranges. Internet gross sales are estimated to be within the higher half of steering with comp-store gross sales progress close to 3%.

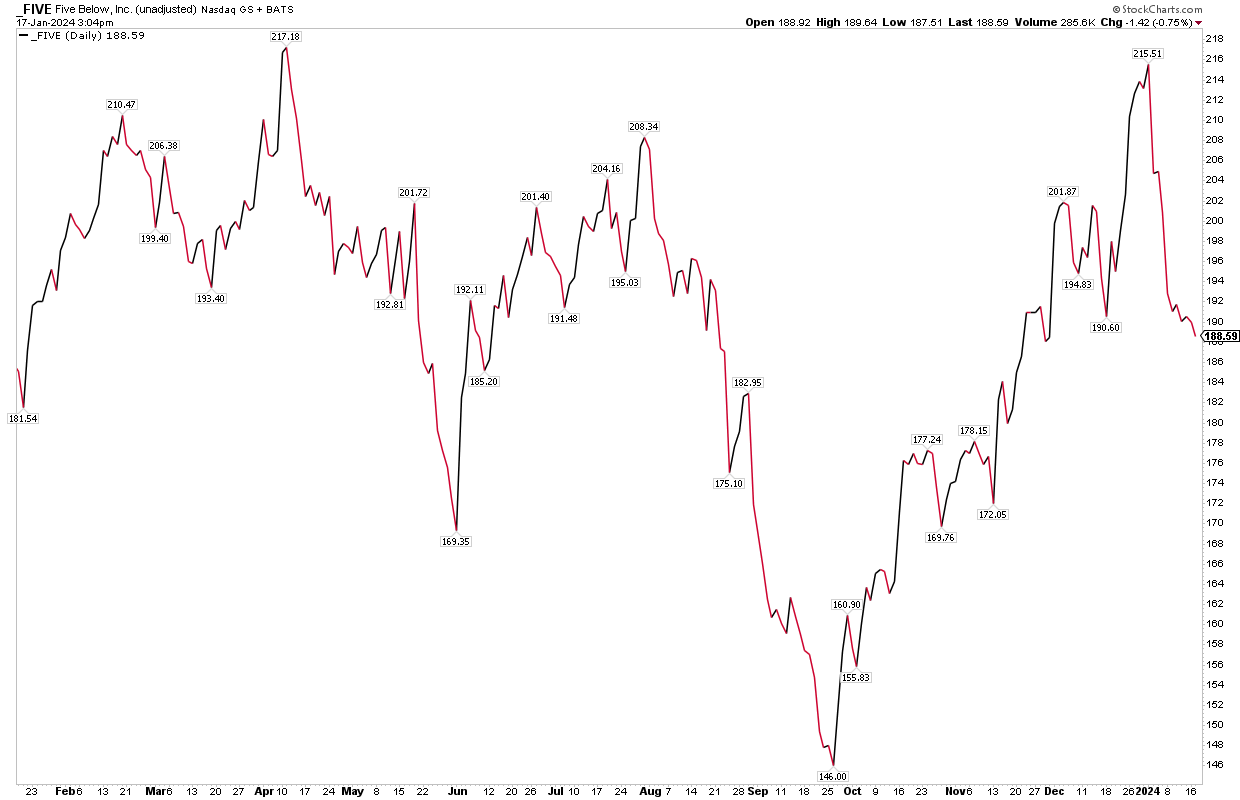

Shares did not catch a lot of a bid regardless of CEO Joel Anderson citing broad-based energy throughout segments.[7]

We’ll should be affected person relating to the total This fall 2023 revenue report – FIVE’s subsequent reporting date is unconfirmed to happen on Wednesday, March 13 AMC.

An analyst at Craig-Hallum was skeptical about what the final merchandise firm may ship in a be aware final month because of, amongst different components, provide chain points, stock shrink, and inflation.[8]

FIVE 1-12 months Inventory Value Historical past: A 2024 Pullback Following a This fall Rally

Supply: Stockcharts.com

Zumiez: Decrease EPS Outlook

Lastly, let’s flip to the unstable small-cap house. Zumiez (ZUMZ), a $354 million market cap Attire Retail trade agency primarily based in Washington state, caters to younger of us.

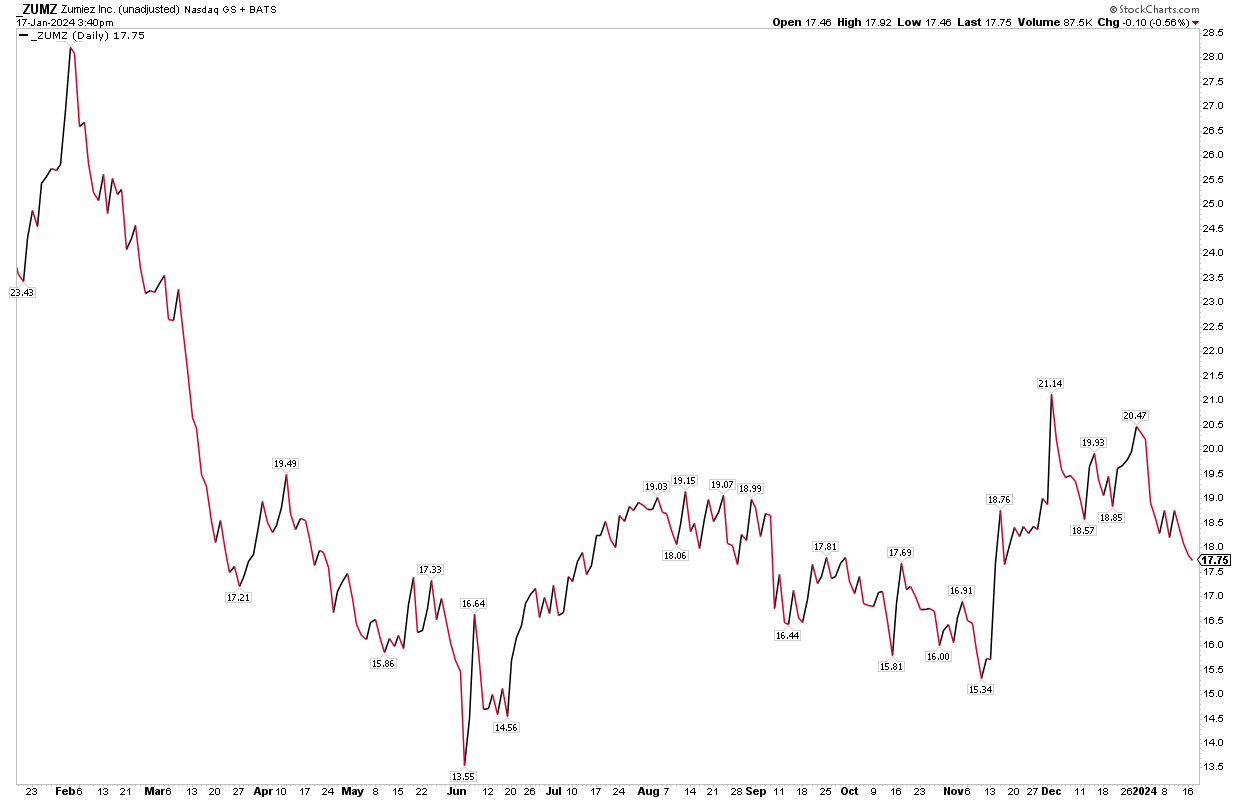

The corporate introduced in an interim report that internet gross sales declined 4.4% for the 9 weeks ending December 30, 2023, on a year-over-year foundation.

Comp-store gross sales dipped 5.9% throughout the identical stretch, with explicit weak point in its North America section.

ZUMZ now anticipates This fall ‘23 income to return in on the low finish of its steering vary, and the identical goes for its quarterly EPS, now anticipated to be $0.24 to $0.34.[9]

The following volatility catalyst might come about on March 7, 2024, when the agency stories This fall outcomes together with same-store gross sales numbers for that quarter.

ZUMZ 1-12 months Inventory Value Historical past: Struggling Following a Weak January Preliminary Earnings Announcement

Supply: Stockcharts.com

The Backside Line

Client spending traits seem wholesome as the brand new yr is effectively underway. Retailers’ This fall earnings stories are nonetheless a number of weeks down the road, however can we scoop up breadcrumbs being left by small-firm executives?

That could be parsing the info fairly a bit, however inventory costs amongst home client firms have been unimpressive these days regardless of sturdy macro spending traits. Hold your eye out for extra preliminary revenue updates that might provide further clues.

1 Advance Month-to-month Gross sales for Retail and Meals Providers, United States Census, January 17, 2024

2 U.S. Retail Gross sales, Buying and selling Economics, January 19, 2024, U.S. Retail Gross sales

3 Sturdy US vacation gross sales in 2023 underline client resilience, Yahoo Finance, Reuters, January 17, 2024

4 2023 Vacation to Attain File Spending Ranges, Nationwide Retail Federation, November 2, 2023

5 XRT SDPR S&P Retail ETF, StockCharts, January 19, 2024

6 Boot Barn Holdings, Inc. Declares Preliminary Third Quarter Outcomes and Participation within the 2024 ICR Convention, Boot Barn Holdings, Inc., January 5, 2024

7 5 Beneath, Inc. Declares Vacation Gross sales Outcomes for Quarter-To-Date Via January 6, 2024, 5 Beneath, Inc., January 8, 2024

8 Fewer procuring days subsequent vacation season nets 5 Beneath a downgrade – analyst, Looking for Alpha, Amy Thielen, January 16, 2024

9 Zumiez Inc. Stories Vacation 2023 Gross sales Outcomes, Zumiez Inc., January 8, 2024