NurPhoto/NurPhoto through Getty Photos

Introduction

Nike (NYSE:NKE) is a kind of uncommon corporations that upon listening to their title, virtually everybody (irrespective of how a lot investing expertise they’ve) can perceive who they’re, what they do and the way precisely they generate income. That is due to the formidable model popularity they’ve constructed up over years of working to grow to be the most important vendor of sports activities footwear/garments on the planet – and the enterprise of promoting garments is not inherently laborious to grasp.

What is difficult to grasp nonetheless, is the place precisely Nike is headed in the long run and if their present valuation is smart primarily based on the present monetary place they’re in. This can be a firm I’ve seen pop up a couple of instances on X (previously Twitter) saying it is a whole lot within the present value vary. So after lacing up my monetary evaluation boots, I discovered that Nike’s fundamentals ought to make it a slam dunk in the long run – nonetheless, the sneaky curveball right here is that the valuation would possibly simply not be interesting on the present second relying in your threat tolerance, making Nike a purchase with sure situations.

What’s Nike’s alternative?

In a nutshell, Nike produces and sells athletic associated objects, equivalent to footwear, garments or equipment/tools. They do that by way of their platform they name “NIKE direct operations” – which is a mixture of their retail shops and e-commerce platforms. They use this platform to promote merchandise wholesale or to different distributors.

Due to this fact, their enterprise mannequin has a couple of progress vectors they will leverage. Beginning with the obvious – the rising demand for athletic footwear. That is Nike’s bread and butter and makes up roughly 68% of their whole income. On the finish of 2022, the international athletic footwear market was estimated at $133 billion {dollars} and is predicted to develop at a 4.9% CAGR to succeed in $196 billion by 2030. Whereas this is not the best progress price on the planet, it is positively sufficient to permit Nike to develop its income at a good price every year. What we have to see most on this class nonetheless is innovation. Every year the sneakers must be improved upon to ensure that Nike to remain related, which to their credit score they’re doing very nicely on. Of their Q3 convention name, they talked about their success with their Ultrafly working shoe, their 3 soccer sneakers (the Phantom Boot, the Tempo and the Mercurial) and the expansion of their Jordan model, which is now the quantity 2 model in North America.

The subsequent alternative is with the international athletic clothes market, which makes up 28% of their income. This market has been estimated at $303 billion in 2021 and anticipated to develop at 5.8% CAGR to succeed in $450 billion by 2028.

As soon as once more, this CAGR is not excessive sufficient to warrant an excited celebration, but it surely’s nonetheless robust sufficient to permit Nike to develop its income. What’s extra thrilling nonetheless, is Nike’s deal with the ladies’s facet of their enterprise. Nike has estimated that round $9 billion of their enterprise is because of girls’s merchandise and that 40% of their members are girls prospects – a determine that’s nonetheless rising and can most probably overtake the lads in some unspecified time in the future. Why is that this so thrilling? Firstly the girls’s athletic footwear market is presently rising sooner than the lads’s market – however is definitely predicted to overhaul the lads’s by 2030.

We see an excellent higher state of affairs with the ladies’s athletic clothes market, which isn’t solely the bigger market at 60% of worldwide income, but it surely’s additionally estimated to develop at a considerably increased CAGR than the lads’s facet – a incontrovertible fact that Nike might be benefiting from. The worldwide girls’s athletic clothes market is estimated to develop at a 6.4% CAGR from 2023 up till 2028, in comparison with the lads’s which is just anticipated to develop at a 4.8% CAGR till 2028. Nike additionally acknowledged of their newest convention name that their girls’s enterprise has grown excessive single digits on common over the previous 3 years. Along with this in addition they acknowledged that their leggings, Zenvy, Go, and Universa, are actually above the $100 value level, which they beforehand had not achieved. It is clear that Nike understands their market extraordinarily nicely and is taking steps to develop each the highest and backside line.

Talking of the underside line, I’d anticipate this to enhance by an honest margin sooner or later. This is because of their introduced plan to save lots of a cumulative $2 billion over the following 3 years, which I’ve determined to separate into incremental $333 million compounding financial savings as a measure of simplicity. My expectations are that Nike’s margins start to enhance throughout the board from 2025 FY onwards.

Their ultimate alternative is with their e-commerce platform. It is clear that the patron is trending in direction of on-line procuring, with worldwide e-commerce income projected to develop at an 8.95% CAGR till 2028. Nike is presently benefiting from this pattern. Living proof, Nike Model digital gross sales accounted for about 25% of their whole income for his or her 2023 FY, and grew at a whopping 24% y/y. I’d anticipate the digital gross sales for 2024 FY to be weaker because of the aforementioned powerful comps typically, nonetheless from 2025 onwards we must be seeing wholesome progress on this metric because of the increasing market.

One factor I actually like about Nike is their capability to acquire athletic endorsements and partnerships. Simply within the final quarter, Kelvin Kiptum attained the Marathon World File and LeBron James led his workforce to the NBA match championship – each carrying Nike merchandise and the well-known Nike tick icon. These are the type of sponsorships which can be priceless and can in fact increase income. On the alternative facet to this nonetheless, is the dangerous publicity when a well-known athlete decides to publicly half with Nike. A current instance of this was when Tiger Woods parted methods with Nike just some weeks in the past. Whereas this parting was amicable, it actually would not have completed Nike any favors – particularly to any hardcore Tiger Woods followers. Total nonetheless, this upside of Nike capitalizing on this chance far outweighs the draw back threat.

What about Nike’s administration workforce?

Nike has a well-seasoned and constant administration workforce. John Donahoe has been the president and CEO of Nike since 2020 and has served on the board of administrators since 2014. The earlier CEO and president Mark Parker nonetheless serves on the board of administrators and serves as the manager chairman. Talking of the board of administrators, there are some very massive names equivalent to Tim Cook dinner – who most individuals would acknowledge because the CEO of Apple. Total, the expertise is unquestionably there to steer Nike in the suitable route.

What about Nike’s monetary place?

Nike’s monetary place is sweet. For his or her 2023 FY, they’ve printed about $4.9 billion in FCF and $3.23 of GAAP EPS. I consider they need to beat each these metrics this yr, though by how a lot stays to be seen. I’d anticipate the underside line to extend round 10%, give or take a bit, for his or her 2024 FY. I do assume income progress might be significantly weaker, because of the 9.65% high line progress final yr being an extremely troublesome comp for them – contemplating that is bigger than the CAGR of their market (as proven earlier).

The subsequent quarter will even not be too sizzling, contemplating they’ve introduced pre-tax restructuring costs of roughly $400 million to $450 million as a consequence of their plans to streamline their enterprise – a sensible transfer contemplating they will be saving $2 billion in the long run. Nonetheless the quick time period will sadly take a success. Their current quarter nonetheless was positively good so far as effectivity goes. They reported GAAP EPS of $1.03, a rise of 21% y/y. It was additionally nice to see enlargement of their gross margin by 170bps, displaying they imply what they’ve mentioned about turning into a extra environment friendly enterprise.

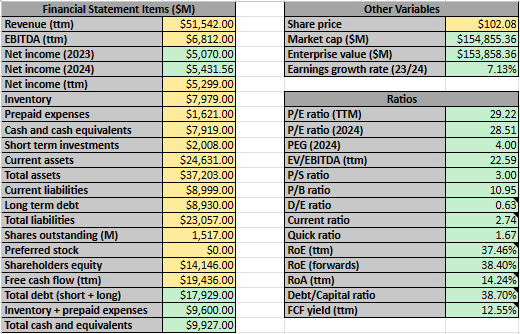

Nike’s steadiness sheet can be first rate, with roughly $9.9 billion in money and money equivalents and $8.9 billion in long run debt. Relating to the monetary ratios within the under screenshot, they’re… fascinating to say the least. Nike is producing some actually good metrics, equivalent to the wonderful RoE, FCF yield, present/fast ratios and D/E yield. Nonetheless there are some metrics which can be really not that nice, such because the very excessive PEG and P/B ratios. It is a combined bag for certain, however total there are not any obtrusive pink flags – just a few issues to concentrate on:

Writer’s calculations

Taking a look at their trailing P/E ratio, that is presently sitting round honest worth at 29.2. To place issues in perspective, this sometimes trades between 25 and 35. This may very well be a lovely ratio for the time being contemplating the upcoming price financial savings ought to enhance Nike’s backside line over the following few quarters.

It is a comparable story with their EV/EBITDA ratio, which is presently at 22.6. That is on the decrease finish of the historic vary which Nike tends to commerce at – between 20 and 30, nonetheless the upcoming price financial savings means this may very well be a bit decrease as soon as the upcoming quarters start to print.

What’s Nike’s intrinsic worth?

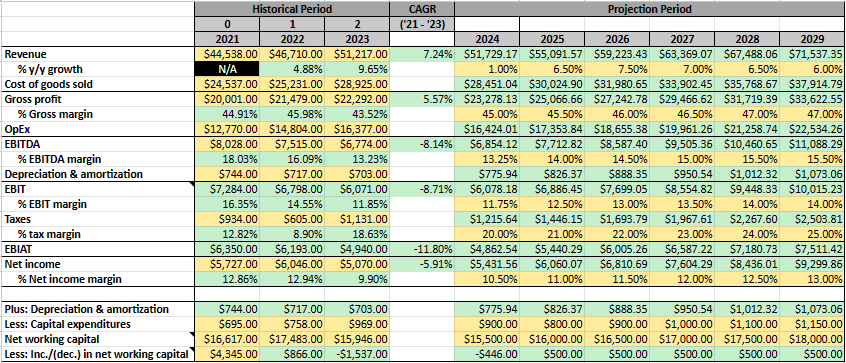

As normal, I’ve determined to undertake 3 completely different approaches to find out the honest worth per share of Nike’s inventory: A internet revenue evaluation, a EV/EBITDA evaluation and a DCF evaluation. However firstly, please see the under monetary projections, which I am going to present a short dialogue on:

Historic financials and projections

Writer’s calculations

As acknowledged earlier, I anticipate income progress to be put on for 2024 FY, however then reaccelerate heading into 2025 FY. I consider this can begin to decelerate in direction of the top of the last decade to be extra in keeping with the CAGR of their market. I additionally assume we should always see continuous margin enlargement as the associated fee financial savings measures begin to take impact over the following few years. Nike has guided for $2 billion in cumulative financial savings, so I’ve determined to interrupt this down into $333 million blocks that accumulate every year – as a matter of simplicity. Both manner nonetheless, Nike has traditionally hit a 13% margin on the underside line, however has bother sustaining this constantly and has by no means had 2 consecutive quarters within the 14% vary. Due to this fact, whereas their effectivity mission might result in historic profitability, I feel it could be a mistake to forecast it with out proof first.

CapEx will most probably decline/stay stagnant over the following few years as a part of Nike’s plan to cut back prices, however will choose up once more quickly after. I additionally assume we should always see a gentle enhance in internet working capital as Nike will increase their money readily available.

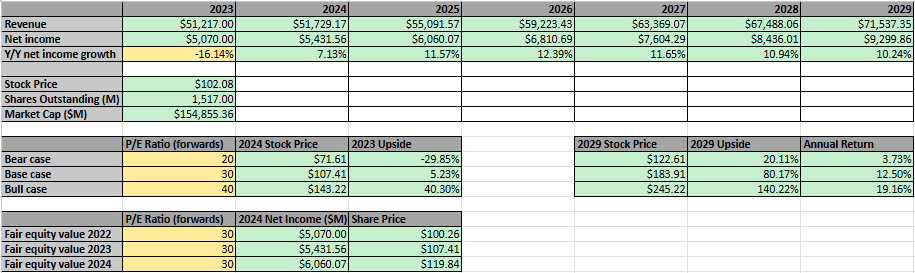

Internet revenue evaluation

I’ve put collectively the under internet revenue evaluation primarily based on the above projections:

Writer’s calculations

Based mostly on the analysis I’ve completed, Nike ought to have a base case ahead P/E ratio of round 30. Though that is inside the 25 to 35 vary I acknowledged earlier, I consider that is positively a premium valuation – however there are a pair causes for this. Firstly, Nike will most positively enhance its backside line over the following few years as a consequence of its elevated effectivity and secondly, corporations which have confirmed they will function nicely are inclined to commerce at a premium.

The remainder of their 2024 FY might be a bit rocky as acknowledged earlier, however they will most probably hit round $5.4 billion or so, that means the honest value for this yr might be $107.41 – a 5.23% upside from the present value.

As well as, if my projections are appropriate, a 30 P/E will permit the inventory value to succeed in $183.91 by 2029 – implying a 80.17% return in 5 years.

EV/EBITDA evaluation

I’ve put collectively the under EV/EBITDA evaluation primarily based on the sooner projections:

Writer’s calculations

I’ve determined that an EV/EBITDA of 25 must be honest for Nike. That is proper in the midst of the 20 to 30 vary I acknowledged earlier. As soon as once more, I consider that is buying and selling at a premium for a purpose – you are buying a strong firm that may proceed to carry out into the long run.

As such, the honest worth for Nike must be round $113.69 per share primarily based on the projected EBITDA for 2024. I’ve additionally carried out a mini-sensitivity evaluation for the EV/EBITDA, which I feel could be cheap to make use of when you assume this must be nearer to twenty. Personally I’d discover it laborious to justify going nearer to 30 except you are anticipating a large ramp up in profitability.

Moreover, assuming my projections are appropriate, there may be an implication the inventory value will attain $183.92 by 2029, which is sort of similar to the 2029 quantity I’ve forecast in my earlier internet revenue evaluation.

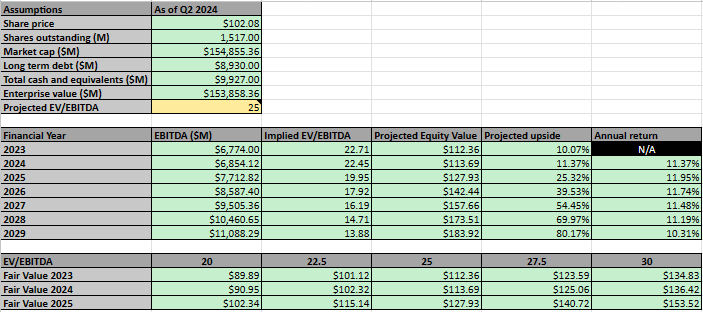

DCF evaluation

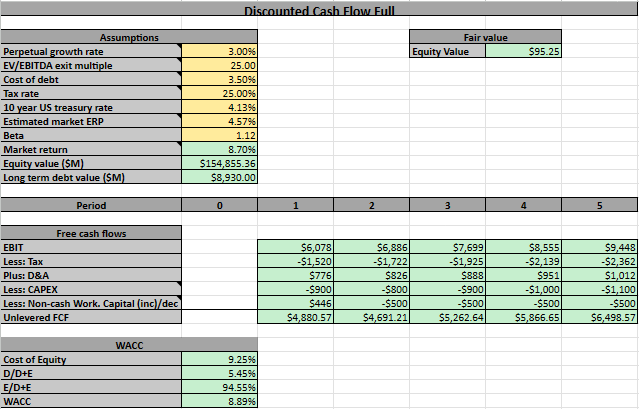

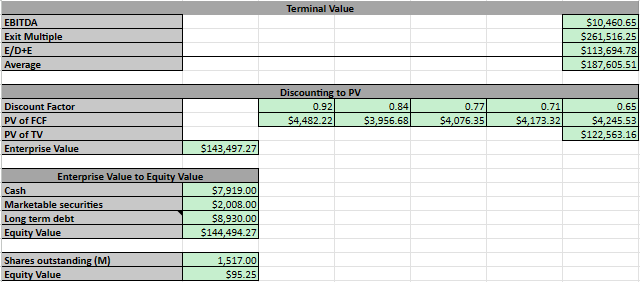

I’ve put collectively the under DCF evaluation primarily based on the sooner projections. Please notice that I’ve calculate the terminal worth utilizing the common of the EV/EBITDA exit a number of technique and WACC technique:

Writer’s calculations Writer’s calculations

I’ve determined to make use of a 3% perpetual progress price for Nike – which is between the common inflation price and GDP progress price of two.9% and three.2%. I additionally consider a 25 EV/EBITDA exit a number of is acceptable, primarily based totally on the identical reasoning I acknowledged in my EV/EBITDA evaluation. I calculated the price of debt from Nike’s newest 10-Okay after which added an approximate 0.5% margin of security, because of the 2 additional quarters. I used an efficient tax price of 25% as a conservative assumption and selected the ten yr US treasury price as the danger free price, which was 4.13% on the time of writing.

Nike’s present agreed beta is 1.12 in line with varied monetary providers and I used a market return of 8.7%, which is a mixture of the danger free price and market ERP (presently round 4.57%)

Utilizing these numbers, I’ve calculated a justifiable share value of roughly $95.25. I feel that is cheap and does not appear out of the extraordinary – albeit it does suggest a draw back from the present value.

I’ve additionally carried out the under sensitivity evaluation if you wish to transfer the numbers a bit, nonetheless I am comfortable conserving issues as they’re:

Writer’s calculations

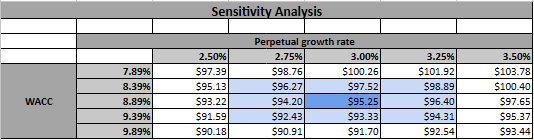

Common share value

As per the under screenshot, the common of those 3 strategies provides us a justifiable share value of $105.45 – marking a 3.30% upside from the present share value. This due to this fact implies that Nike is barely undervalued and is due to this fact a purchase.

Writer’s calculations

What are the dangers?

The obvious threat is Nike’s effectivity prices not working as deliberate. They’ve promised us $2 billion in financial savings over the following 3 years, in the event that they fail to ship on this or worse – do not ship on any effectivity efforts, then the inventory won’t carry out as predicted.

The subsequent fundamental threat is Nike not innovating and dropping floor to competitors. I discover this a bit laborious to consider as Nike has already confirmed throughout the previous few a long time they do know how one can innovate and keep related.

The opposite most blatant threat is because of my evaluation – the three.3% upside has no margin of security. Usually I like shares to have a minimal 10% upside to mitigate towards any unexpected circumstances – something better than 30% is de facto after I begin to get . 3.3% then again actually does not go away a lot room for error. If Nike drops the ball on just some numbers, that upside might simply flip right into a draw back.

Conclusion

This one was difficult to determine a score on. I used to be deciding between maintain and purchase, however finally the purchase score received the battle. The primary causes for this resolution is that Nike has a strong enterprise mannequin and a historical past of being a dependable firm. In addition they pay a dividend, so when you’re on the lookout for a dividend play that will not see any excessive drops in your capital, then Nike is unquestionably an choice because of the valuation not being too excessive. All of that is much more true in case you have a long run outlook and are not fearful about quick time period fluctuations.

Nike must be value round $105.45, nonetheless you want a margin of security in your shares or simply need some upside potential, I might advocate ready a little bit bit – however provided that you are comfy doing so. For instance, I do not personal any Nike, but when we see any significant pullback near the low 90’s, I am going to think about choosing some shares up. Nonetheless, if we do not see that pullback and Nike’s inventory solely goes up from right here – I am additionally okay with that. In different phrases, when you’re okay with probably not proudly owning the inventory, then ready for a potential retracement stands out as the clever resolution right here.

The primary threat to Nike’s enterprise mannequin is that they fail to stay revolutionary and lose market share to rivals. As acknowledged within the dangers part, I do assume that is unlikely. Nike have proven use they are often trusted to function and carry out nicely over time. I do not see why the long run could be any completely different proper now.

If you happen to’re on the lookout for a spot to park your cash and earn some dividends over the approaching years – Nike is an efficient place to begin trying. They have been growing their dividend cost every year since 2004 and I feel it is unlikely they’d need to break this streak and hurt their popularity as a strong dividend payer going ahead. As for me, I will be watching this one intently and seeing if an honest entry level arises for me to “simply do it” and begin taking part in ball with Nike.