frantic00/iStock through Getty Photographs

The iShares MSCI Germany ETF (NYSEARCA:EWG) will get buyers publicity to a price weighted portfolio overlaying the German economic system. Whereas many of those shares are conglomerates with worldwide footprints, there may be nonetheless numerous express German exposures, and we predict that Germany, along with the remainder of Europe, shouldn’t be the sort of geographic publicity you need particularly in a non-selective approach and with an industrial focus. German inflation continues to be somewhat uncontrolled, and the economic system has already been hit with demand destruction and fallen into recession, as has its main buying and selling companions. We see little purpose to be enthusiastic about EWG, and the 12.9x PE on the ETF is not modest sufficient.

EWG Breakdown

The expense ratio is 0.5%, which is a bit of on the upper facet in comparison with 0.47% FactSet averages, however extra importantly appears excessive contemplating the extent of improvement of German monetary markets, that ought to be fairly simply accessible.

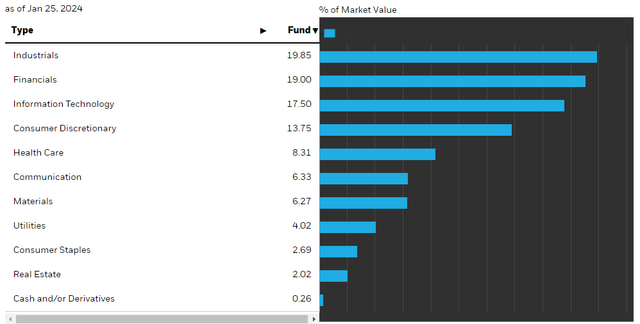

Sectors (iShares.com)

The exposures are unsurprisingly skewed in direction of industrials, with fairly a little bit of it being centered on heavy, commodity trade and client durables. The opposite main publicity is financials, primarily Allianz (OTCPK:ALIZF) and Munich Re, so insurance coverage exposures, which we have a tendency to love within the present surroundings with Europe additionally holding its price coverage. SAP (SAP) is almost all of the corporate’s publicity in data know-how. All the main exposures have substantial German gross sales, a minimum of between 10-20% of gross sales, regardless of being worldwide firms. PE is 12.9x.

Backside Line

The monetary exposures are considerably enticing. The German inflation scenario is not nice, stunning to the upside on meals and in addition on vitality costs which proceed to inflate and drive total figures. As a significant pole in Europe the German inflation image will affect price choices by the ECB. Charges are staying excessive, and there is not actually any indication in Europe which runs with the one mandate that there will likely be price chopping quickly. With significant insurance coverage exposures inside EWG financials’ allocation, that is of some profit, nevertheless it might restrict efficiency in banking, notably in price based mostly banking, because the European economies are seeing weaker development which might begin hitting transaction velocity by corporates and households. Germany is in a recession, as is Netherlands its principal buying and selling associate. So not all financials are going to be performing that effectively, even when insurance coverage reserve portfolios will see increased yields.

Whereas the IT exposures are high quality albeit costly, there may be a whole lot of client discretionary and industrial publicity centered on extra cyclical markets with extra commodity economics. Client discretionary is dominated by the German automotive trade. The shoe hasn’t actually dropped but on automotive as a result of notably weak COVID-19 years and a nonetheless fairly gradual restoration, nevertheless it might as increased charges and a weaker economic system threaten these leverage-dependent finish markets. The mix of upper curiosity and inflation charges in Europe as a result of proximity and ache from disintegration of commerce whereas additionally having an economic system that’s in recession can trounce hopes of development for a while and drive EWG into constant underperformance as a result of cyclical weight. Political upheaval in Germany particularly does not assist both because the funds requires subsidy cuts on agri-diesel and common welfare, and any optimism from final yr is now dissipated.

Structural points stay in Europe. Unions dominate, making inflation extra sticky downward. There may be already recessionary pressures in most European economies, but inflation is lots increased. Europe may be very non-competitive, and it’s by geopolitical design. With Europe, Germany ought to be averted, and solely extremely selective exposures are acceptable the place development can in some way be assured at ranges that may outpace that of the overall economic system.

An excessive amount of cyclical publicity for a 12.9x complete PE is not very enticing. Even among the many cyclical exposures that are driving down the PEs for EWG, we nonetheless have excellent considerations at these compressed costs resulting from mounting Chinese language competitors, massive excellent funding burdens into EV for lots of automotive gamers, and the continued inexperienced agenda push that’s threatening an necessary limb of the German economic system and of allocations in EWG. We aren’t optimistic, and do not see the place outperformance would are available in EWG particularly the place macro elements look structurally weak.