Chip Somodevilla

The Thesis

Given the adjustments round information privateness, I do not see the Meta Platforms, Inc. (NASDAQ:META) advert enterprise going again to what it was in 2020 and 2021 anytime quickly. It appears the market is lacking the implications of this key threat.

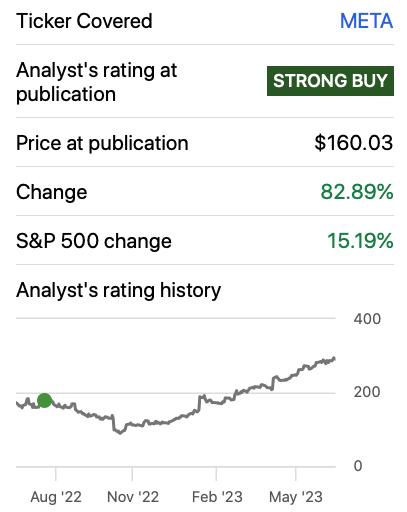

I barely mistimed the underside of Meta’s inventory in 2022:

Meta: This Is The Backside (Searching for Alpha)

Now, I am shifting to a “Maintain.”

Knowledge Privateness – The Elephant In The Room

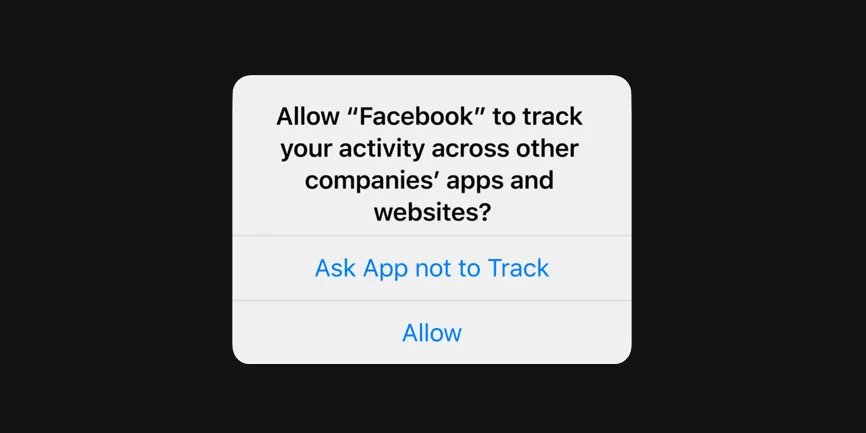

Let’s rewind to 2021. Meta Platforms inventory was booming on the again of its uncanny capacity to ship focused advertisements. If you happen to had been looking out on Apple’s Safari app for a brand new automotive, that very same automotive would usually pop up the following day in your Fb feed. This too-good-to-be-true promoting hit a wall in 2021, when Apple (AAPL) determined to start prompting customers to dam cross-app monitoring on their iPhones:

Apple’s iOS Replace (Vox)

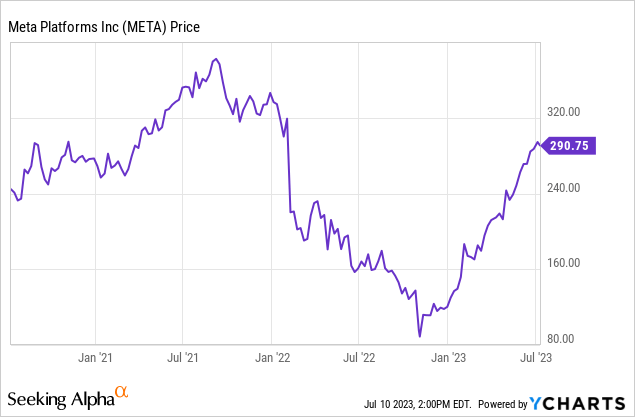

In 2022, Mark Zuckerberg introduced that this might value the corporate as much as $10 billion in income. As a result of Meta had been counting on its cross-app monitoring to create focused commercials, Meta’s inventory collapsed:

Now, Alphabet (GOOG) aka Google is testing out a Beta to do mainly the identical factor Apple did. The supply stated that Android plans to broadly categorize you; for instance, “This consumer is a sports activities fan,” however particular information will not transfer throughout apps. These adjustments could possibly be rolled out to all Android customers throughout the subsequent couple of years. In the meantime, Android has an over 80% market share globally.

With cross-app monitoring on my iPhone turned off, I’ve seen a precipitous decline within the relevancy of advertisements I see on Meta’s apps. Again in 2020, advertisements on Fb had uncanny relevancy. So the underside line is that this might impair Meta’s pricing energy. As advert effectiveness decreases, companies lower their advert spend.

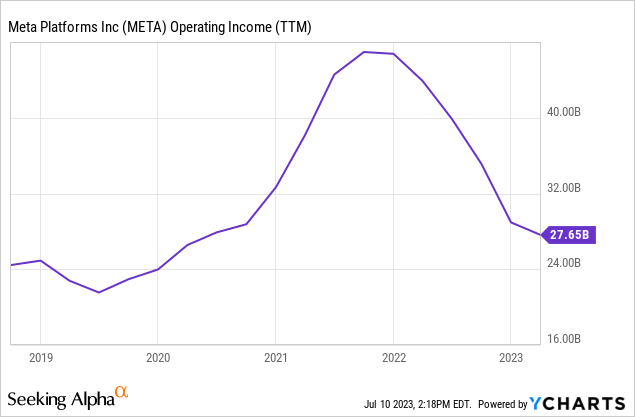

I consider Apple’s privateness adjustments are the primary cause Meta’s working earnings fell off a cliff:

Nonetheless, buyers appear to be lacking what is going on on within the subject of knowledge privateness. Europe, Canada, and China have dramatically elevated regulation round accumulating folks’s information, and I do not see this development reversing; folks like their information non-public.

Meta is reportedly addressing the problem, however they have not shared many particulars prior to now two earnings calls, merely saying:

“We consider our ongoing enhancements to advert focusing on and measurement are persevering with to drive improved outcomes for advertisers.”

Given the developments round information privateness, I might not be shocked if Meta had been to overlook analyst EPS estimates over the following few years. Presently, analysts have Meta making $15 per share in 2024 and greater than $17 in 2025. This appears to be like optimistic to me.

Meta’s Moat Ranking

I consider that Meta has a terrific Moat (aggressive benefit) round its enterprise, however, looking 10 to 50 years, I’ve some considerations.

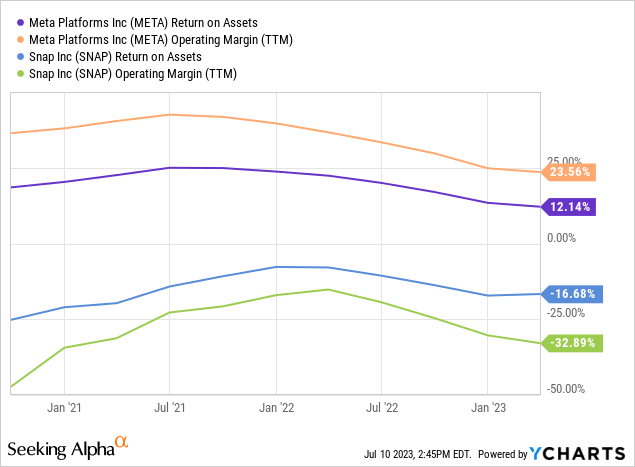

Meta’s moat turns into obvious after we take a look at its aggressive place in opposition to an organization like Snapchat, A.Okay.A. Snap Inc. (SNAP). Meta is simply crushing Snapchat with its returns on property and revenue margins:

Meta’s scale and “Household Of Apps” make it tough to compete with. The corporate’s apps intertwine with each other. You probably use considered one of them each day; whether or not or not it’s Messenger, WhatsApp, Fb, or Instagram, you are most likely within the ecosystem. It additionally helps that Meta has an excellent CEO in Mark Zuckerberg.

The one longer-term challenge I see is that if you purchase shares in a enterprise like Meta and pay 36x earnings, you want the long run to play out favorably. As Warren Buffett as soon as stated, “Funding is the method of placing out cash as we speak to get extra money again in some unspecified time in the future sooner or later.” Meta now trades at a flowery worth.

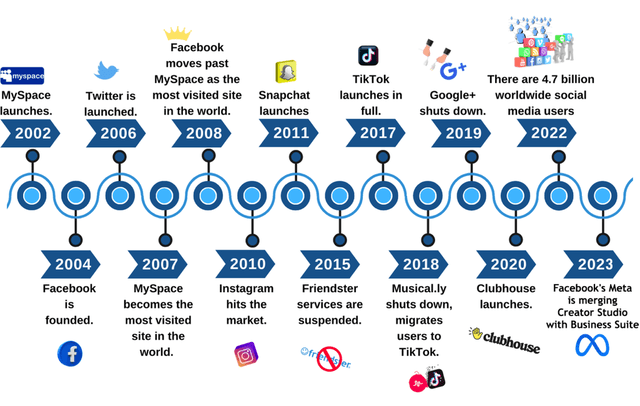

You may consider Meta’s Fb and Instagram companies as being just like that of the newspaper enterprise again within the 70’s and 80’s. If you happen to’re the one newspaper on the town, you’ve tons of pricing energy anytime somebody needs to put an advert in your paper. However Meta hasn’t all the time been the one newspaper on the town:

Social Media Timeline (BroadbandSearch.internet)

Myspace was the king of social media within the early 2000’s. Then, Fb took over. Subsequent, Instagram got here alongside. Fortunately for shareholders of Fb, CEO Mark Zuckerberg made the good transfer to accumulate Instagram in 2012. However, what if Instagram had determined to not promote out? Would Fb have turn into the Myspace of previous? Would Instagram have crushed Mark Zuckerberg? I suppose we’ll by no means know, however you’ll be able to see the danger at play right here. Buyers should ask themselves, who would be the subsequent king of Social Media? This is the reason it’s so tough to foretell the period of Fb and Instagram’s money flows.

Given the comparatively low friction shoppers face when switching from a platform like Fb or Instagram to a different social media platform, I am giving Meta a moat ranking of “C+.”

Development Drivers And Threads

Meta’s Instagram Reels is now firing on all cylinders, and I proceed to see Messenger and WhatsApp as invaluable property which have the potential to be monetized additional. As for the Metaverse, I am not a giant digital actuality fan, however that does not imply it will not attraction to many. And, it could end up to have some attention-grabbing use circumstances. After the continued reset from information privateness impaired advertisements, I believe Meta can have substantial pricing energy for advertisements on Fb and Instagram.

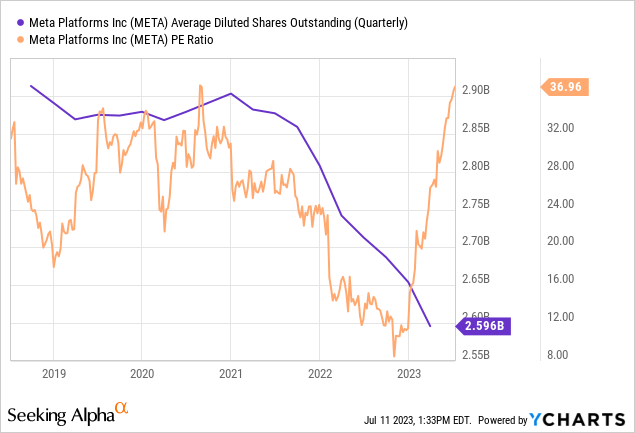

Share buybacks are one other driver of EPS progress, though they are going to be much less efficient now at a $760 billion market cap (36x earnings) than they had been at a sub $300 billion market cap (12x earnings) in 2022. This implies the identical greenback quantity of buybacks will enhance your possession share by a smaller quantity.

Shares excellent vs. P/E ratio:

Shifting on to Threads, Twitter’s struggled with profitability for a very long time, and I do not see rising competitors on this area as a optimistic for near-term profitability. It is spectacular that Threads has rapidly reached 100 million customers vs Twitter’s 238 million (as of final summer time); if Threads is able to stealing Twitter’s consumer base fully and incorporating Meta’s advertisements enterprise, I believe it could possibly be modestly worthwhile within the subsequent 3 to five years (maybe it should surpass Twitter’s 2019 peak earnings of $1.5 billion), however I would not depend on it. Apparently, “Twitter is threatening to sue Meta over ‘systematic, willful and illegal misappropriation’ of Twitter’s commerce secrets and techniques and IP.” We’ll see what occurs.

Lengthy-term Returns

Meta’s inventory has rallied big-time, however its earnings are down. Given my outlook round Meta’s moat, in addition to the business privateness adjustments, I’ve Meta forecasted to return simply 5% every year within the decade forward:

| Present EPS | $8.06 |

| Compound Annual Development Price | 13% |

| Yr 10 EPS | $27.40 |

| Terminal A number of | 17.5x |

| Yr 10 Worth Goal | $480 |

| Annualized Returns | 5% |

I might improve Meta to a “Purchase” at $222 per share, implying returns of 8% every year.

In Conclusion

Up greater than 80% since my first article on Meta, I am now shifting to a “Maintain.” Buyers mustn’t overlook the colossal adjustments occurring around the globe in information privateness. In the meantime, Meta’s inventory has swung wildly from excessive pessimism to optimism. Warren Buffett has described Mr. Market’s swings like so:

“At instances he [Mr. Market] feels euphoric and might see solely the favorable components affecting the enterprise. At different instances, he’s depressed and might see nothing however bother forward for each the enterprise and the world.”

I hope this text helps you see each the favorable and unfavorable components affecting Meta.

Till subsequent time, blissful investing!