Mortgage charges broke out of their months-long holding sample this week — simply not within the route homebuyers had hoped. Charges rose, dampening the expectations of people that had been primed to leap into the housing market early this spring, spurred by decrease borrowing prices.

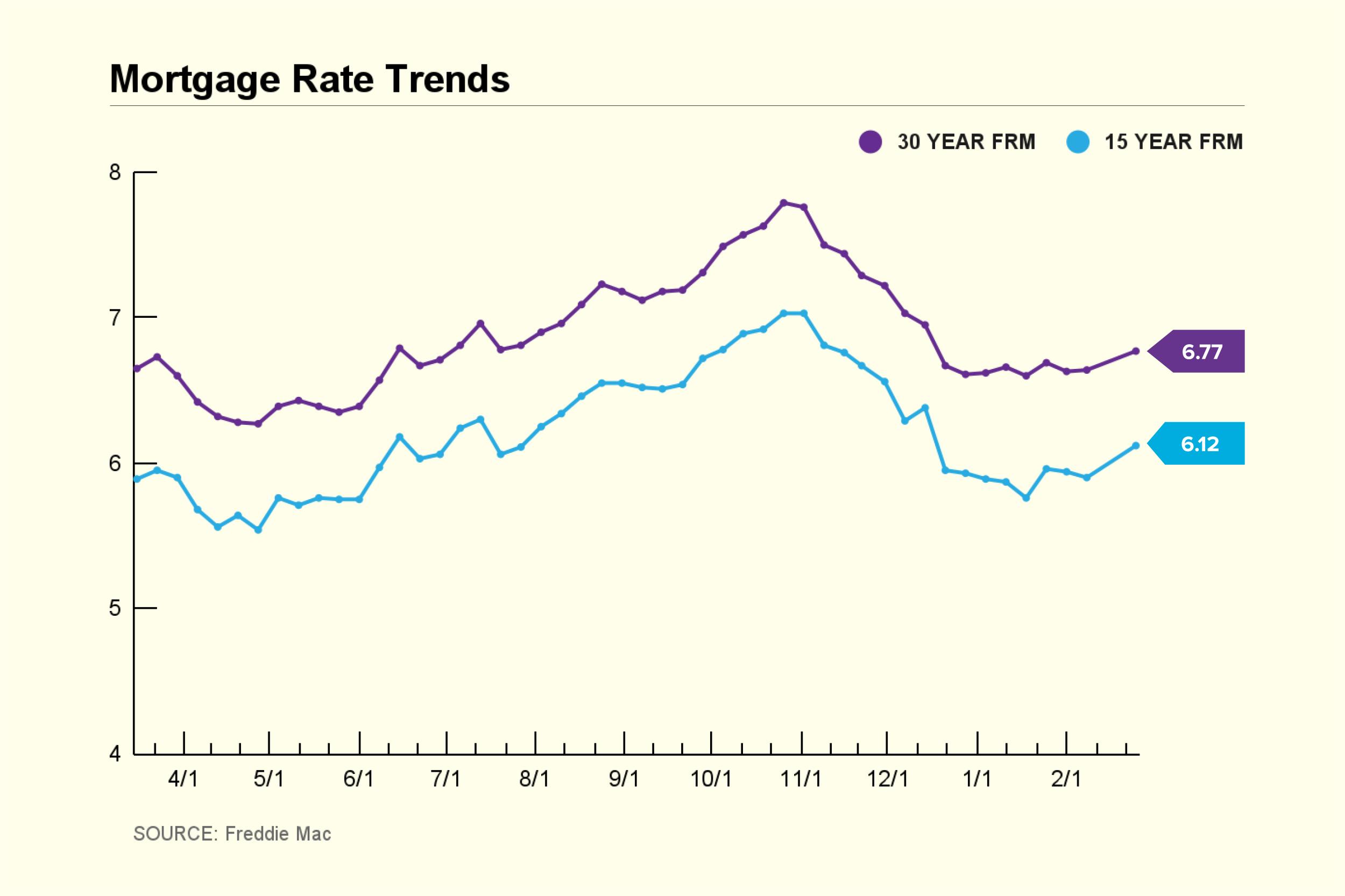

The common price on a 30-year fixed-rate mortgage jumped as much as 6.77% for the week ending February 15, in keeping with Freddie Mac’s benchmark survey — a rise of 0.13 share factors over the previous seven days. The common for a 15-year fixed-rate mortgage was above 6% for the primary time since mid-December, growing by 0.22 share factors to six.12%.

The speed hikes resulted from sturdy financial information over the previous few weeks. Larger ranges of employment than anticipated within the federal jobs report, together with greater inflation than many analysts had predicted, pushed up the yields on Treasury payments. These hikes, in flip, despatched mortgage charges up as nicely.

Consequently, the spring residence shopping for season might begin extra sluggishly than was anticipated. Late final 12 months and early in 2024, purchaser curiosity had revived as mortgage charges edged downward, stated Lisa Sturtevant, chief economist at Brilliant MLS, in a press release. However “with the latest volatility in charges, some potential patrons could also be pondering of ready to purchase till later this spring when charges are decrease,” she added.

When you’re provided the next price than anticipated, be certain to ask why and examine provides from a number of lenders. (Cash’s record of the Greatest Mortgage Lenders is an efficient place to start out. Owners contemplating a mortgage refinance ought to take into account our record of the Greatest Mortgage Refinance Corporations.)

Use Cash’s mortgage calculator to get an estimate of your month-to-month fee, taking totally different price eventualities into consideration.

What’s been taking place within the housing market

Here is what’s taking place within the housing market this week:

- People had been extra optimistic about the place mortgage charges are heading this 12 months — at the very least earlier than this week’s price hikes. In line with a latest survey by Fannie Mae, 36% of respondents consider mortgage charges will transfer decrease in 2024. In case you are questioning, that is the best share ever within the survey’s historical past.

Mortgage rates of interest for the week ending February 15, 2024

Mortgage price tendencies

This week’s mortgage charges had been greater:

- The present price for a 30-year fixed-rate mortgage is 6.77%, up by 0.13 share factors week-over-week. This time final 12 months, the 30-year price averaged 6.32%.

- The present price for a 15-year fixed-rate mortgage is 6.12%, a rise of 0.22 share factors over the previous week. A 12 months in the past, the 15-year price averaged 5.51%.

For its weekly price evaluation, Freddie Mac seems to be at charges provided for the week ending every Thursday. The common price represents roughly the speed a borrower with sturdy credit score and a 20% down fee can anticipate to see when making use of for a mortgage proper now. Debtors with decrease credit score scores will usually be provided greater charges.

Cash’s common mortgage charges for February 15, 2024

Charges continued to rise yesterday. The speed on a 30-year fixed-rate mortgage elevated by 0.102 share factors to a mean of seven.96%.

- The newest price on a 30-year fixed-rate mortgage is 7.96% ⇑ 0.102%

- The newest price on a 15-year fixed-rate mortgage is 6.87% ⇑ 0.087%

- The newest price on a 5/6 ARM is 7.756%. ⇑ 0.046%

- The newest price on a 7/6 ARM is 7.826%. ⇑ 0.066%

- The newest price on a ten/6 ARM is 7.779% ⇑ 0.076%

Cash’s day by day mortgage charges are a nationwide common and replicate what a borrower with a 20% down fee, no factors paid and a 700 credit score rating — roughly the nationwide common rating — may pay in the event that they utilized for a house mortgage proper now. Every day’s charges are based mostly on the typical price 8,000 lenders provided to candidates the earlier enterprise day. Your particular person price will differ relying in your location, lender and monetary particulars.

These charges are totally different from Freddie Mac’s charges, which characterize a weekly common based mostly on a survey of quoted charges provided to debtors with sturdy credit score, a 20% down fee and reductions for factors paid.

At this time’s mortgage charges and your month-to-month fee

The speed in your mortgage could make an enormous distinction in how a lot residence you may afford and the scale of your month-to-month funds.

When you purchased a $250,000 residence and made a 20% down fee — of $50,000 — you’d find yourself with a beginning mortgage steadiness of $200,000. On a $200,000 residence mortgage with a hard and fast price for 30 years, here is what you’d pay:

- At a 3% rate of interest = $843 in month-to-month funds (not together with taxes, insurance coverage, or HOA charges)

- At a 4% rate of interest = $955 in month-to-month funds (not together with taxes, insurance coverage, or HOA charges)

- At a 6% rate of interest = $1,199 in month-to-month funds (not together with taxes, insurance coverage, or HOA charges)

- At an 8% rate of interest = $1,468 in month-to-month funds (not together with taxes, insurance coverage, or HOA charges)

You’ll be able to experiment with a mortgage calculator to learn how a lot a decrease price or different adjustments might affect what you pay. A residence affordability calculator can even provide you with an estimate of the utmost mortgage quantity you might qualify for based mostly in your earnings, debt-to-income ratio, mortgage rate of interest and different variables. The Client Monetary Safety Bureau can even present a variety of charges being provided by lenders in every state.

Different elements decide how a lot you will pay every month, that are detailed within the mortgage disclosures offered by your lender. These elements embrace:

Mortgage Time period:

Selecting a 15-year mortgage as a substitute of a 30-year mortgage will enhance month-to-month mortgage funds however cut back the quantity of curiosity paid all through the lifetime of the mortgage.

Fastened vs. ARM:

With a fixed-rate mortgage, funds stay the identical all through the lifetime of the mortgage. The mortgage charges on adjustable-rate mortgages reset often (after an introductory interval) and month-to-month funds change with it.

Taxes, HOA Charges, Insurance coverage:

Owners’ insurance coverage premiums, property taxes and householders affiliation charges are sometimes bundled into your month-to-month mortgage fee. Verify along with your actual property agent to get an estimate of those prices.

Mortgage Insurance coverage:

Mortgage insurance coverage can price as much as 1% of your property mortgage’s worth per 12 months. Debtors with typical loans can keep away from non-public mortgage insurance coverage by making a down fee of at the very least 20% or reaching 20% of the house’s fairness. FHA debtors pay a mortgage insurance coverage premium all through the lifetime of the mortgage.

Closing Prices:

Some patrons finance their new residence’s closing prices into the mortgage, which provides to the debt and will increase month-to-month funds. Closing prices usually run between 2% and 5% of the worth of the mortgage.

Present Mortgage Charges Information

Mortgage charges are an vital a part of the homeownership puzzle. Our information solutions a number of the most typical questions surrounding mortgage charges and the way they have an effect on the housing market.

How are mortgage charges impacting residence gross sales?

Dwelling gross sales took a step again in December, the most recent month for which full information is on the market.

Current residence gross sales — a measure of recently-closed contracts for single-family residences, condos, townhomes and co-ops — had been 1% decrease than the earlier month, in keeping with the Nationwide Affiliation of Realtors. Yr-over-year, gross sales had been 6.2% decrease.

Stock continues to be main problem, too. There have been 1 million properties out there on the market, down by 11.5% from November’s tally. On the present tempo of sale, there’s a 3.2 month provide of for-sale properties, nicely beneath the 6-month provide thought-about “regular” for a balanced market.

What credit score rating do mortgage lenders use?

Most mortgage lenders use your FICO rating — a credit score rating created by the Truthful Isaac Company — to find out your mortgage eligibility.

Lenders usually request a merged credit score report that mixes info from all three of the most important credit score reporting bureaus — Experian, Transunion and Equifax. This report will even comprise your FICO rating as reported by every credit score company.

Every of the three credit score bureaus is more likely to have a unique FICO rating, and your lender will usually use the center rating when evaluating your creditworthiness. In case you are making use of for a mortgage with a associate, the lender might base their choice on the typical credit score rating of each debtors.

Lenders may use a extra thorough residential mortgage credit score report that features extra detailed info than that in your commonplace reviews, resembling employment historical past and present wage.

What is an efficient rate of interest on a mortgage?

mortgage price is one which permits you to comfortably afford the month-to-month funds, and the place the opposite particulars of the mortgage additionally suit your wants. Contemplate particulars such because the mortgage kind (i.e. whether or not the speed is fastened or adjustable), size of the mortgage, origination and lender charges and different prices. Be aware that refinance charges are typically greater than buy charges for a major residence.

Remember the fact that at present’s mortgage charges stay pretty excessive, traditionally talking. Freddie Mac’s common charges present what a borrower with a 20% down fee and a powerful credit score rating may have the ability to get in the event that they had been to talk to a lender this week.

In case you are making a smaller down fee, have a decrease credit score rating or are taking out a non-conforming (or jumbo mortgage) mortgage, you might even see a fair greater price. It’s additionally price noting that jumbo loans have the next down fee requirement than typical loans. Cash’s day by day mortgage price information reveals debtors with 700 credit score scores are discovering charges averaging above 8% proper now.

How are mortgage charges decided?

Lenders use a number of elements to set charges every day. Each lender’s method can be somewhat totally different however will issue within the present federal funds price (a short-term price set by the Federal Reserve), opponents’ charges and even what number of employees they’ve out there to underwrite loans. Your {qualifications} will even affect the speed you’re provided, naturally.

Typically, charges monitor the yields on the 10-year Treasury be aware. Common mortgage charges are often about 1.8 share factors greater than the yield on the 10-year be aware.

Yields matter as a result of lenders do not hold the mortgage they originate on their books for lengthy. As a substitute, to unlock cash to maintain originating extra loans, lenders promote their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are known as mortgage-backed securities, that are offered to buyers. Buyers will solely purchase these securities if they’ll earn a bit greater than they’ll on the federal government notes.

Your {qualifications} will even affect the speed you’re provided, as will the loan-to-value ratio (LTV). The LTV of your property is a technique lenders assess the quantity of threat posed by approving a mortgage and is calculated by dividing the utmost mortgage quantity you qualify for by the appraised residence worth.

get the perfect mortgage price

Buying round for the perfect mortgage price can imply a decrease price and large financial savings. On common, debtors who get a price quote from one further lender save $600 over the lifetime of the mortgage, in keeping with Freddie Mac. These financial savings go as much as $1,200 in the event you get three quotes. A bigger down fee quantity will even lead to a decrease rate of interest.

The finest mortgage lender for you’ll be the one that may provide the lowest price and the phrases you need. Your native financial institution or credit score union is one place to look. On-line lenders have expanded their market share over the previous decade and promise to get you pre-approved inside minutes.

Store round to check mortgage choices, charges and phrases, and ensure your lender has the kind of mortgage you want. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for instance. When you’re undecided a few lender’s credentials, ask for its NMLS quantity and seek for on-line critiques.

What is the distinction between rate of interest and APR on a mortgage?

Debtors typically combine up rates of interest and annual share charges (APR). That’s comprehensible since each charges confer with how a lot you’ll pay for the mortgage. Whereas comparable, the phrases are usually not synonymous.

An rate of interest is what a lender will cost on the principal quantity being borrowed. Consider it as the essential price of borrowing cash for a house buy.

An APR represents the whole price of borrowing cash and contains the rate of interest plus any charges, related to producing the mortgage. The APR will at all times be greater than the rate of interest.

For instance, a $300,000 mortgage with a 3.1% rate of interest and $2,100 in charges would have an APR of three.169%.

When evaluating charges from totally different lenders, have a look at each the APR and the rate of interest. The APR will characterize the true price over the complete time period of the mortgage, however you’ll additionally want to contemplate what you’re capable of pay upfront versus over time.

Present mortgage charges FAQ

When will mortgage charges go down?

Mortgage charges have been trending decrease after hitting a excessive of seven.08% final November. Whereas most specialists consider charges will finally transfer into the 5% vary, debtors ought to anticipate them to stay between 6% and seven% for the foreseeable future.

Ought to I lock in my mortgage price at present?

What are low cost factors on a mortgage?

Why is my mortgage price greater than common?

You will have a higher-than-average mortgage price for a variety of causes. Credit score scores, mortgage phrases, rate of interest varieties (fastened or adjustable), down fee measurement, residence location and mortgage measurement will all have an effect on the speed provided to particular person residence buyers. Among the best methods to decrease your price is to enhance your credit score rating.

Totally different mortgage lenders provide totally different charges. It is estimated that about half of all patrons solely have a look at one lender, primarily as a result of they have an inclination to belief referrals from their actual property agent. However procuring round for a lender will allow you to snag the bottom price on the market.

Ought to I refinance my mortgage when rates of interest drop?

Abstract of present mortgage charges

This week’s mortgage charges had been greater:

- The present price for a 30-year fixed-rate mortgage is 6.77%, up by 0.13 share factors week-over-week. This time final 12 months, the 30-year price averaged 6.32%.

- The present price for a 15-year fixed-rate mortgage is 6.12%, a rise of 0.22 share factors over the previous week. A 12 months in the past, the 15-year price averaged 5.51%.