lechatnoir/E+ by way of Getty Photos

Funding Thesis

Fiverr (NYSE:FVRR) delivers a less-than-satisfying outlook for 2024. Even when the corporate seems low-cost, I do not imagine this inventory is a compelling purchase.

And but, to be clear, it isn’t all dangerous. For one, Fiverr has a comparatively sturdy stability sheet. Additionally, the enterprise is evidently producing significant free money movement.

However on the similar time, the unavoidable truth is that its progress charges are truly fizzling out. Altogether, I discover it troublesome to cheer for this inventory. Due to this fact, I am sticking to the sidelines.

Speedy Recap

Again in December, I wrote a impartial evaluation of Fiverr the place I mentioned,

What I discover ironic is that I am one of many solely voices on In search of Alpha that hasn’t acquired a purchase ranking on this inventory. However I imagine that, eventually, extra analysts will come round to my aspect of the boat the place it is lonely and chilly. A minimum of for now.

Finally, the inventory may be very cheaply valued at 8x ahead free money flows. Few traders would argue the opposite. However I contend that an inexpensive inventory is not ok in and of itself. It wants to have the ability to develop its intrinsic worth sustainably. And it is on that latter facet that I’ve a problem with this firm’s inventory, and I am impartial on this title.

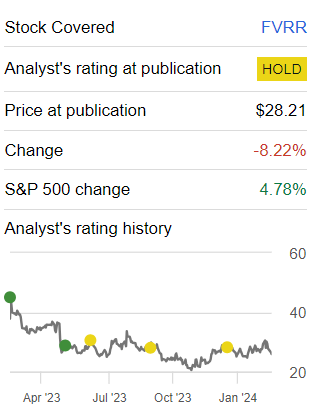

Creator’s work on FVRR

Since I made these feedback, the inventory has underperformed the S&P 500 (SPY). And even when Fiverr’s share value has a reduction rally within the coming days, over the subsequent twelve months, I imagine this inventory will proceed to underperform the S&P 500.

Fiverr’s Close to-Time period Prospects

Fiverr is a market that connects freelancers (often called sellers) with shoppers searching for a variety of digital providers. The platform permits people and companies to rent freelancers for a spread of duties equivalent to constructing web sites, graphic design, programming, and extra.

Regardless of challenges equivalent to a weak hiring surroundings, Fiverr innovated its merchandise and expanded its market share. The platform’s fundamentals remained strong, with a 1% y/y progress in general Gross Merchandise Quantity (“GMV”) outperforming U.S. job openings.

Fiverr notes in its shareholder letter the way it’s striving to maneuver upmarket, leading to progress in consumers with over $500 annual spend. The corporate has as soon as once more expanded its take price by means of initiatives like Promoted Gigs and Vendor Plus packages.

By the way, Fiverr’s dependancy to growing its take-rate places it on the opposite aspect of the desk to sellers. Though Fiverr has pledged to average the tempo at which it will increase its take charges in 2024, finally this technique finally ends up alienating its most profitable freelancers, who find yourself opening up their on-line retailers, with out having to offer Fiverr any of their take charges. Actually, as you possibly can think about, there isn’t any scarcity of other platforms.

Given this framework, let’s now talk about its fundamentals and why I am impartial on this inventory.

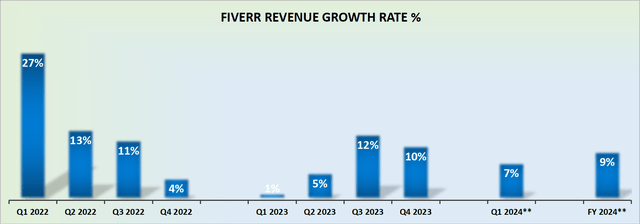

Income Progress Charges Reasonable

FVRR income progress charges

Fiverr guides for 7% on the highest line for the yr forward. Provided that Fiverr missed analysts’ income estimates for This fall 2023 by roughly 1%, I am inclined to imagine that Fiverr will not considerably outpace the excessive finish of its steering for 2024.

That being mentioned, to additional substantiate my competition, let’s presume that all through 2024 Fiverr’s prospects enhance and it really delivers 9% y/y progress for 2024.

Because the bar for 2024 was already low, on condition that Fiverr’s revenues solely grew by 7% y/y in 2023, one would have at the least anticipated Fiverr to develop its revenues within the low teenagers. However this does not look like the case, and the most effective that traders can realistically count on is single-digit progress charges.

It now seems to be within the distant previous the instances when Fiverr was a crowd-favorite that could possibly be counted on to ship sturdy income progress charges.

With this backdrop in thoughts, let’s now flip to debate its valuation.

FVRR Inventory Valuation — 12x Ahead EBITDA

On a optimistic notice, not solely did Fiverr’s adjusted EBITDA improve by 143% y/y in 2023 in contrast with 2022, however its outlook for 2024 factors to an roughly 36% y/y improve to roughly $80 million of adjusted EBITDA.

On the floor, this seems terrific. However then two vital concerns floor. Firstly, the tempo at which Fiverr’s EBITDA is growing seems to be quickly slowing down.

Secondly, on the opposite aspect of the coin, there’s solely thus far Fiverr can improve its underlying EBITDA profitability with out sturdy supportive topline progress.

Due to this fact, regardless that paying 12x ahead EBITDA seems low-cost, I’ve to marvel the place this inventory is actually providing traders a gorgeous risk-reward? I do not imagine that to be the case.

The Backside Line

In my evaluation, Fiverr’s 2024 outlook would not encourage confidence, main me to view the inventory as lower than compelling regardless of its obvious low valuation. Whereas the corporate does exhibit a sturdy stability sheet and generates notable free money movement, the waning progress charges concern me.

Fiverr’s initiatives to develop market share are noteworthy, however the growing take charges with the potential alienation of profitable freelancers raises a yellow flags.

Additional, the projected single-digit income progress charges for 2024 reinforce my cautious stance.