Pixelimage

Blackstone Secured Lending (NYSE:BXSL) out-earned its dividend with web funding earnings within the fourth quarter which in flip led to the BDC reporting a 1% QoQ enhance in its web asset worth per share.

The BDC’s giant floating-rate debt portfolio continues to be producing high outcomes for Blackstone Secured Lending and BXSL is a uncommon BDC that I’m prepared to pay a premium for.

New funding commitments roared increased in 4Q-23 and the BDC has excellent credit score high quality, notably when in comparison with the credit score tendencies we have now seen for different BDCs this earnings season. Purchase.

My Ranking Historical past

Re-accelerating inflation charges within the fourth quarter and Blackstone Secured Lending’s giant floating-rate mortgage portfolio culminated in a Purchase inventory classification in October.

Blackstone Secured Lending continued to surpass its dividend pay-out with web funding earnings in 4Q-23, which was boosted by increased rates of interest.

Given the quantity of extra dividend protection, I anticipate one other dividend increase in 2024.

Portfolio And Credit score High quality

Two of my passive earnings BDC holdings have fairly severely disillusioned currently: Oaktree Specialty Lending Company (OCSL) and FS KKR Capital Corp (FSK), each of which triggered investor stampedes after they disclosed fairly substantial upticks of their non-accrual ratios for the latest quarter.

As such, I’ve realized that the credit score high quality pattern is now by far a very powerful metric for passive earnings buyers to comply with. Happily, Blackstone Secured Lending didn’t disappoint on this regard.

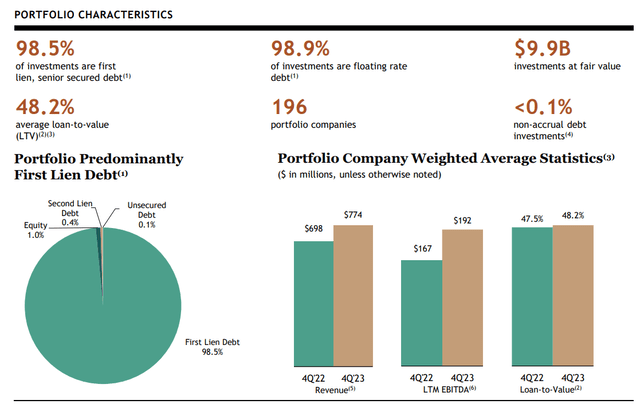

Blackstone Secured Lending is a Senior Secured Debt-focused BDC with appreciable publicity to First Liens. As a matter of truth, First Liens accounted for 99% of the BDC’s portfolio investments in 4Q-23 which I believe is a distinguishing attribute for Blackstone Secured Lending.

Most BDCs that I reviewed within the final 12 months have a tendency to include giant positions of Fairness, Subordinated Debt and Second Liens into their portfolio buildings to be able to increase their return potential. Since Blackstone Secured Lending doesn’t, the BDC stands out with a extra concentrated First Lien-centric funding portfolio.

Portfolio Traits (Blackstone Secured Lending)

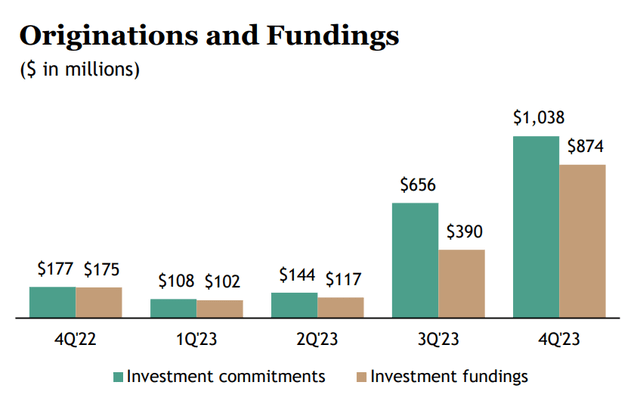

Blackstone Secured Lending’s funding commitments continued to surge within the fourth quarter, extending a pattern that began in 3Q-23. Decrease anticipated short-term rates of interest, which have weighed on enterprise spending and demand for brand spanking new loans, are behind the sharp uptick within the firm’s funding commitments.

Although repayments additionally elevated, the BDC is seeing sturdy portfolio progress: Blackstone Secured Lending’s portfolio worth as of the tip of 4Q-23 was $9.9 billion, reflecting a QoQ enhance of 4%.

Originations And Fundings (Blackstone Secured Lending)

As I discussed within the introduction, credit score high quality is now the place the music is taking part in, notably after Oaktree Specialty Lending and FS KKR Capital disillusioned on this regard: Oaktree Specialty Lending’s inventory bought off after the corporate reported an idiosyncratic lending efficiency for its most up-to-date quarter that led to a 4.2% non-accrual ratio. FS KKR Capital did even worse as its non-accrual ratio skyrocketed to five.5% in 4Q-23.

However Blackstone Secured Lending shone by way of mortgage efficiency in 4Q-23 because the BDC had just one debt funding on non-accrual standing in 4Q-23. The BDC now has credit score high quality that rivals that of Hercules Capital, Inc. (HTGC).

Hercules Capital had excellent credit score high quality within the final quarter with a non-accrual ratio of 0.0% primarily based on honest worth. Blackstone Secured Lending’s non-accrual ratio of 0.1% of debt investments, thus, compares to one of the best within the area.

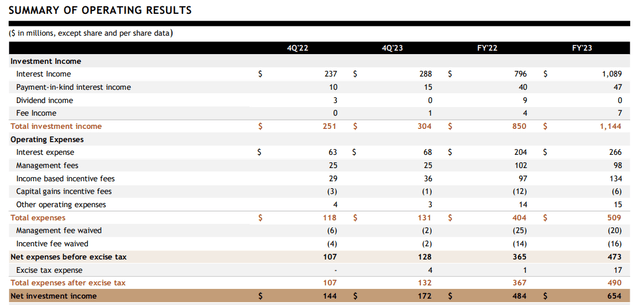

So far as Blackstone Secured Lending’s web funding earnings efficiency goes, the BDC, which is 99% floating-rate positioned, was expectantly strong. The BDC earned $288 million in curiosity earnings in 4Q-23, up 22% YoY, because of the central financial institution’s fee hikes over the course of the final 12 months. This equated to $172 million in web funding earnings, up 19% YoY.

Abstract Of Working Outcomes (Blackstone Secured Lending)

Dividend Protection Improved QoQ, Strong Margin Of Security Regardless of 10% Dividend Elevate

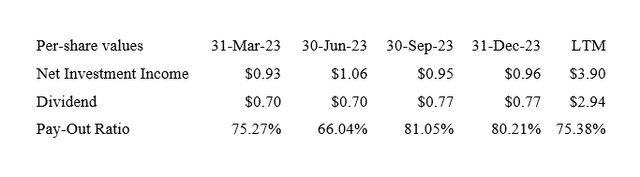

Blackstone Secured Lending earned $0.96 per share in web funding earnings in 4Q-23, up 7% YoY, because of the BDC’s guess on increased rates of interest that paid off for the BDC massive time.

The online funding earnings tailwind allowed Blackstone Secured Lending to boost its common dividend by a strong 10% in 3Q-23. The dividend increase explains why regardless of increased web funding earnings tied to the BDC’s floating-rate loans the dividend pay-out ratio ticked as much as the low-80%-range within the third quarter. BXSL exhibited a 75% pay-out ratio in 2023 which leaves room for extra dividend raises in 2024.

Dividend (Writer Created Desk Utilizing BDC Info)

A Premium That Is Price Paying

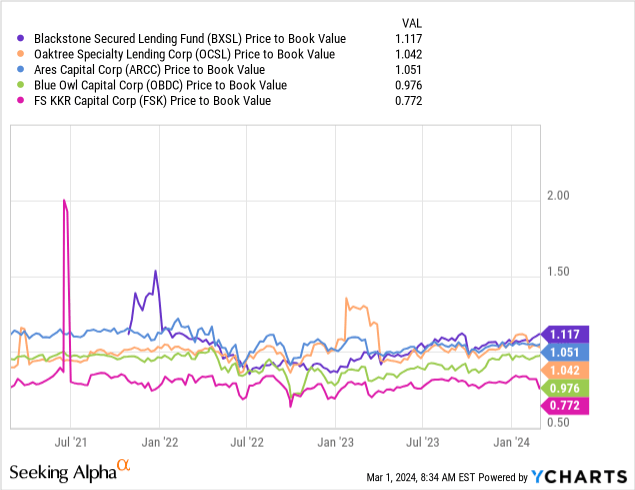

Blackstone Secured Lending rightfully sells at a premium to web asset worth. The 11% premium that passive earnings buyers presently should pay to safe a coated 10.4% dividend yield is instantly tied to the BDC’s excellent credit score high quality.

Blackstone Secured Lending’s web asset worth, with the assist of the elements mentioned on this article, rose 1% QoQ to $26.66.

I not often advocate a BDC that’s promoting at a premium to web asset worth, largely as a result of I like to spice up my whole return potential by way of capital good points. Within the case of Blackstone Secured Lending, nevertheless, I’m prepared to make an exception as a result of BDC’s strong credit score high quality standing and vital extra dividend protection.

Why Blackstone Secured Lending May See A Increased Or Decrease NAV A number of

For the reason that BDC’s credit score high quality is near-perfect, the important thing lever for Blackstone Secured Lending to develop its web funding earnings is the central financial institution’s fee coverage.

Although the financial institution stated that it was contemplating to decrease short-term rates of interest in 2024, a hotter-than-expected inflation report for January precipitated doubts in regards to the central financial institution’s timeline for fee cuts.

A decline in short-term rates of interest, nevertheless, would pose a web funding earnings problem for Blackstone Secured Lending since it’s closely reliant on floating-rate loans to its portfolio corporations.

My Conclusion

Blackstone Secured Lending’s 4Q-23 earnings have been fairly strong, notably within the context of different BDCs disappointing enormously with respect to their credit score tendencies.

The BDC coated its $0.77 per share per quarter dividend pay-out with web funding earnings and Blackstone Secured Lending’s web asset worth rose as effectively, because of increased curiosity earnings from floating-rate investments.

Blackstone Secured Lending is now promoting for an 11% premium to web asset worth, a premium that I believe is deserved.

Considering the BDC’s web funding earnings pattern, sturdy non-accrual place, and coated 10% yield, I’m preserving my inventory classification for BXSL at Purchase.