NiseriN

Introduction

I noticed the next information headline on Searching for Alpha and determined to look beneath the hood of TeraWulf Inc. (NASDAQ:WULF) (the “Firm“).

TeraWulf inventory surges over 20% after highlighting low-cost standing, debt compensation”

Whereas I’m mildly bullish to impartial on Bitcoin (BTC-USD) (“Bitcoin“) within the short-term, I’ve been more and more cautious on a number of crypto miners, as famous in a latest article about Bitfarms Ltd. (BITF). Having reviewed the Firm’s most up-to-date monetary reporting supplies, I’m BEARISH on the Firm for a number of causes:

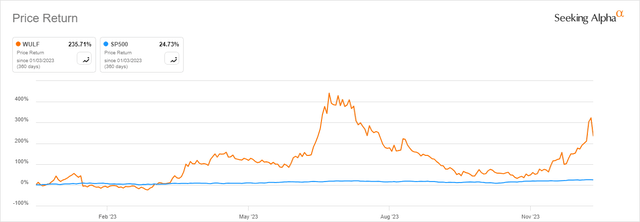

First, the Firm’s inventory soared in 2023 as proven within the chart beneath, and, in my opinion, a repeat of 2023’s stellar efficiency will not be doubtless, notably if the Firm can’t present a GAAP revenue (and it isn’t near doing that).

2023 Inventory Efficiency (Searching for Alpha)

Second, the Bitcoin halving anticipated to happen in April (the “Halving Occasion“) will trigger Bitcoin’s mining rewards to lower from 6.25 BTC to three.125 BTC, and certain end in a decrease hash fee, making it harder for the miners to generate income. Certainly, the Firm’s CEO has acknowledged that its value to mine bitcoin will enhance by greater than 40% after the Halving Occasion:

‘We estimate that our value to mine a bitcoin is among the many lowest in comparison with different publicly-listed bitcoin mining corporations at roughly $25,000 per bitcoin earlier than the halving and $37,000 after the halving,’ stated Chairman and CEO Paul Prager.”

Third, the Firm is closely reliant on elevating funds within the capital markets with a purpose to fund operations. On this regard, the desk beneath exhibits that widespread inventory excellent on the finish of 2021, 2022 and 2023, respectively, as per the Consolidated Statements of Stockholder Fairness included within the latest 2023 10-Ok Annual Report submitting (the “10K“) The chart additionally exhibits web proceeds from fairness issuances and whole annual income within the respective years. General, the shareholder dilution from 2021 to 2023 has been substantial. Furthermore, the desk beneath exhibits that, so far, inventory issuances are extra vital than precise working revenues when it comes to financing the Firm’s operations.

| Date | No. of Widespread Shares Excellent |

Web Proceeds (hundreds) |

Yearly Income (hundreds) |

| 12/31/2021 | 99,976,253 | $104,376 | $ 0* |

| 12/31/2022 | 145,492,971 | $47,326 | $15,033 |

| 12/31/2023 | 276,733,329 | $135,917 | $69,229 |

| Totals: | $287,619 | $84,262 |

*No income throughout start-up interval of February 8, 2021 to December 31, 2021

Fourth, for all of the discuss of the Firm being a low value producer in its earnings-call presentation, the Firm has an collected deficit of practically $260 million and its Consolidated Assertion of Operations for 2023 exhibits a web lack of $75 million.

Fifth, and I saved the worst for final, the Firm has $123 million of debt that must be paid off, renegotiated or refinanced in 2024. Even when the Firm is ready to keep afloat, will probably be on the expense of shareholders in favor of the Firm’s collectors. And additional materials dilution of fairness holders has already began to occur within the first quarter of 2024. Based on the 10K:

In February 2024, the Firm repaid $40.0 million of the principal stability of the Time period Loans, within the mixture….

The Firm doesn’t point out how a lot money it has on its stability sheet after the fee. The 10K does give a touch as to how the fee was made, nonetheless:

Moreover, if a enterprise want requires its use, the Firm has an energetic at-the-market gross sales settlement on the market of shares of Widespread Inventory having an mixture providing value of as much as $200.0 million (the “ATM Gross sales Settlement”), which had a remaining capability of $81.2 million and $29.8 million as of December 31, 2023 and March 19, 2024, respectively. The issuance of Widespread Inventory beneath this settlement could be made pursuant to the Firm’s efficient registration assertion on Type S-3 (Registration assertion No. 333-262226).

Briefly, it seems to be just like the Firm has issued an extra $51.4 million of widespread inventory within the first quarter of 2024, additional diluting shareholders with a purpose to make a debt fee.

***

For the foregoing causes, the Firm needs to be averted.

Transient Background

Per its latest earnings press launch, the Firm “owns and operates vertically built-in, environmentally clear bitcoin mining amenities in the US. Led by an skilled group of power entrepreneurs, the Firm at the moment has two Bitcoin mining amenities: the wholly owned Lake Mariner facility in New York, and Nautilus Cryptomine facility in Pennsylvania, a three way partnership with Cumulus Coin, LLC.” The mining operations of the Firm generate Bitcoin “powered by 95% zero carbon power sources together with nuclear, hydro, and photo voltaic with a objective of using 100% zero-carbon power.”

The Firm seeks to supply trade main mining economics at scale. On the time of writing, the Firm had a market capitalization above $500 million and was buying and selling at $2.54.

Inventory Efficiency

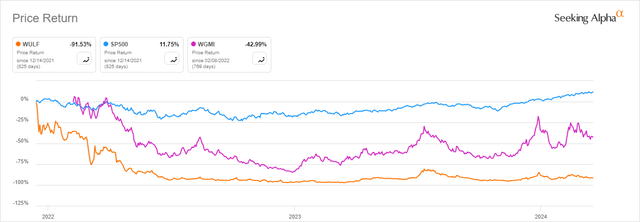

The Firm started buying and selling on the Nasdaq on December 14, 2021 beneath the image WULF. Since that point, as proven within the chart beneath, the Firm’s inventory value has 1) been on a steep downward trajectory, shedding greater than 90% of its worth, and a pair of) in a fabric trend, trailed each the S&P 500 and the Valkyrie Bitcoin Miners ETF (WGMI) (the “Bitcoin Miners ETF“).

Searching for Alpha

Whereas the Firm has not carried out properly, its inventory value not too long ago jumped after its most up-to-date incomes announcement. Beneath, I briefly overview some highlights of these earnings.

This fall 2023 Earnings

On March 19, 2024, the Firm reported monetary efficiency for the quarter ended, and 12 months ended, December 31, 2023. A couple of highlights from the Firm’s press launch are included beneath [all data from such press release]:

- Income elevated 360% to $69.2 million in 2023, as in comparison with $15.0 million in fiscal 2022 pushed by elevated bitcoin manufacturing and better common realized bitcoin costs throughout the interval.

- Reported money and money equivalents of $54.4 million as of December 31, 2023, as in comparison with $1.3 million at fiscal year-end 2022.

- Self-mined bitcoin manufacturing elevated 550% to three,407 in 2023, as in comparison with 524 in fiscal 2022.

On the plus aspect, it’s good to see the Firm’s manufacturing of Bitcoin has elevated materially 12 months over 12 months and debt goes down. Nevertheless, per Word 9 of the Firm’s audited monetary statements, the Firm has practically $123.5 million of debt due in 2024.

Overview of Stability Sheet

Chosen Stability Sheet Objects (in hundreds)

| Dec. 31, 2023 | Dec. 31., 2022 | Dec.31, 2021 | |

| Money | 54,439 | 1,279 | 43,448 |

| Digital Forex | 1,801 | 183 | —– |

| Whole Belongings | $378,106 | $317,687 | $264,911 |

| Lengthy-Time period Debt (LTD) | 56 | 72,967 | 94,627 |

| LTD due inside 1 12 months | 123,465 | 51,938 | —– |

| Whole Liabilities | $155,617 | $199,933 | $141,732 |

| Gathered Deficit | (259,895) | (186,474) | (95,683) |

| Whole Fairness | $222,489 | $117,754 | $123,179 |

Supply: Firm Web site (Monetary Info)

A few issues stand out in three years of stability sheet figures. First, whole money elevated by roughly $11 million from 2021 to 2023. In context, nonetheless, the corporate raised over $180 million in fairness proceeds throughout the interval as proven within the earlier desk.

Second, whereas the Firm has $123 million of long-term debt due in 2024, it has generated lower than $90 million of income in its first two full years of operations. Even with the $40 million debt pay down within the first quarter of 2024, the Firm has lots of wooden to cut to pay down that debt. If the Bitcoin value falls in a fabric means, the Firm will actually be in a bind.

Third, the Gathered Deficit (representing the cumulative quantity of web losses the Firm has generated since its formation) of practically $260 million now exceeds Whole Fairness. For sure, it will be significant for the Firm to start out producing some earnings and decreasing the deficit out of free money movement.

Dangers and Conclusion

The dangers of investing within the Firm are included within the linked 10K above. Specific issues about investing within the Firm, amongst others, are as follows:

First, the Firm has not been in a position to generate web earnings.

Second, the Firm relies on fairness and debt issuances to finance operations.

Third, the Halving Occasion will trigger a fabric enhance within the Firm’s working bills (i.e., prices of manufacturing Bitcoin).

Fourth, there are vital dangers that the Firm won’t be able to fulfill its debt obligations due in 2024, or if it does fulfill them, will probably be to the detriment of the widespread shareholders by way of (additional) materials dilution, a course of which has already began.

***

For the explanations set forth on this article above, the Firm needs to be averted for the foreseeable future. The Firm is at the moment being run for the good thing about its collectors. Given the Bitcoin bull market, nonetheless, I’d not quick it (right now), until it was a part of a pair commerce. Do your personal due diligence, nonetheless.