We all know that managing payroll will be difficult for small enterprise homeowners. It’s time-consuming, complicated, and one fallacious step may end up in incorrect fee or penalties. And in case you’re going in regards to the course of manually, you allow plenty of room for human error (irrespective of how meticulous you’re).

However payroll doesn’t should be a headache. Whereas automated payroll software program generally is a game-changer within the digital realm, there are different methods you need to use to streamline the method extra effectively.

Whether or not you select to spend money on a devoted payroll resolution or not, be aware of the next steps and finest practices to make sure easy crusing in the case of managing payroll.

1. Set up a constant schedule to run payroll

Because the saying goes, consistency is essential. And with payroll, it’s no totally different. In case your pay intervals and pay dates are inconsistent, it may well trigger a multitude of issues with worker satisfaction, firm tradition, and even retention charges. To not point out, you’ll really feel scattered and disorganized too. Lose-lose.

However in case you set a daily payroll frequency—weekly, biweekly, semi-monthly, or month-to-month—you’ll be capable to maintain your geese in a row. Establishing a schedule is not going to solely make sure that your staff are glad, however your capacity to trace worker hours, calculate wages, deduct taxes, and ship fee can be a lot simpler. Now we’re speaking win-win!

If you happen to stick with your schedule, you’ll keep away from delays, errors, and sad staff.

2. Collect and confirm knowledge early whenever you run payroll

It’s tremendous vital that you’ve got correct worker data upfront to run payroll effectively. This implies double-checking particulars like hours labored, break day, and any pay price adjustments. With out that data sorted early on, you gained’t be capable to course of payroll appropriately. Plus, leaving these things till the final minute will trigger a payroll site visitors jam—and it’ll again up quick.

To simplify issues, get proactive about accumulating and validating payroll info effectively forward of time. Arrange clear procedures for workers to ship of their timesheets and attendance information on time. And don’t overlook to remain on high of any pay or deduction updates. Being organized and on the ball with payroll from the beginning helps prevent useful time and keep away from pricey errors.

3. Automate processes to streamline efforts to run payroll

We’ve already touched on automation, however there’s an entire vast world of automation ways and it’s vital to know the overarching advantages in the case of payroll.

On the high of the listing of payroll software program advantages is casting off that pesky guide knowledge entry. You most likely get a headache simply interested by it. Right here’s the deal: guide knowledge entry fills your plate to the brim. It’s a must to monitor hours and match them in opposition to schedules, calculate wages and taxes, and distribute funds all by yourself. That’s the other of ultimate for a busy enterprise proprietor.

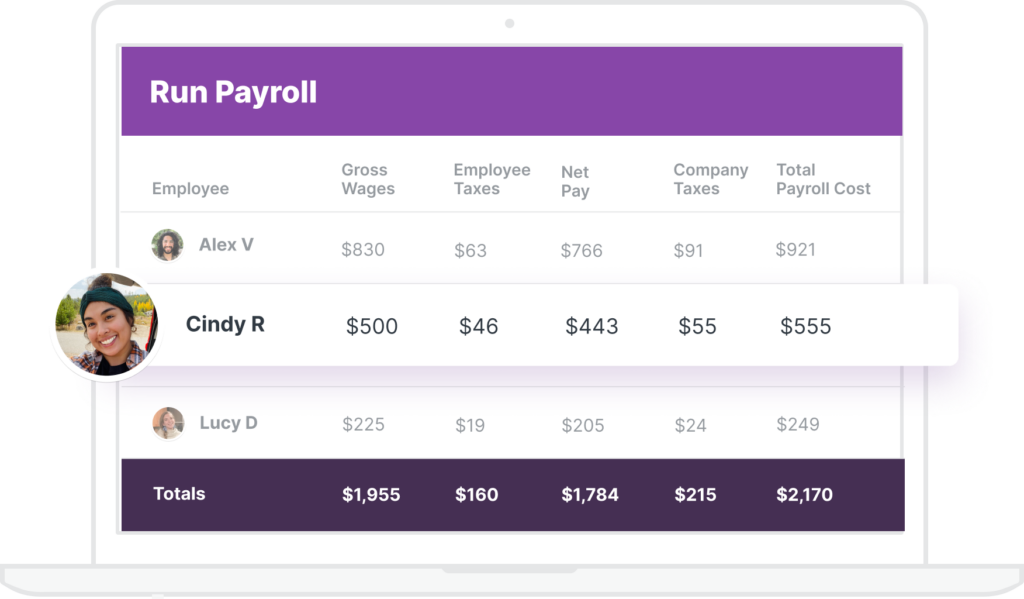

As an alternative, payroll software program handles all the mathematics for you. That not solely saves you a bunch of time but it surely eliminates the potential for human errors that may be damaging in additional methods than one. Plus, you can also make certain knowledge is 100% correct earlier than processing payroll.

Subsequent up is the flexibility to combine payroll with time monitoring and accounting methods. It makes tax calculations, submitting, and direct deposits a breeze. No extra sorting by separate applications and leaving room for errors.

You may use automated instruments, like Homebase, to create a chosen timeline for accumulating knowledge, processing payroll, and distributing paychecks. You’ll be capable to monitor hours labored, extra time, and PTO, which is able to routinely funnel into payroll processing and get paychecks into pockets. Multi function place with a number of simple steps.

4. Keep knowledgeable about payroll legal guidelines and rules

We will’t overlook in regards to the authorized aspect of issues. It’s a must to keep on high of federal, state, and native payroll legal guidelines as a small enterprise. And let’s be trustworthy, authorized necessities can simply fall to the underside of the precedence listing when you could have so many issues to juggle.

There are plenty of i’s to dot and t’s to cross in the case of following payroll guidelines like minimal wage, extra time, hours labored, and recordkeeping necessities. It’s like juggling and driving a unicycle on the similar time.

Staying present with payroll legal guidelines and rules is essential to keep away from severe penalties. And that is one other space the place automated payroll software program may very well be possibility. It simplifies processes, which helps you to calculate hours and wages precisely, pay and file your taxes, distribute and file kinds, and retailer time card information. Plus, you’ll get notified when legal guidelines change.

5. Talk clearly with staff about payroll issues

The reality is, in case you don’t inform your staff precisely what you want from them to make payroll seamless (and get them paid sooner) you’re going to run into some main roadblocks. Late clock-ins or failure to clock in in any respect, not submitting timesheets, and lacking or incorrect private info … you get the image. Because the boss, it’s your job to offer clear pointers on how and when to get these items carried out.

Have there been any adjustments to payroll insurance policies or procedures? Your staff have to know this as effectively.

And don’t overlook: communication is a two-way avenue. In case your staff have considerations or questions in regards to the payroll course of, chat with them one-on-one and work out the place yow will discover an answer. Your staff are the oil on the wheels that make your corporation flip!

6. Preserve correct information and documentation

Retaining exact and well-organized information is important whenever you’re dealing with payroll. You want a dependable methodology for storing and accessing all of your payroll docs—worker information, timesheets, tax papers, and fee historical past. Being in every single place with paper trails or random digital information could cause pointless hurdles.

Arrange a central system for protecting information secure and simple to seek out. This not solely retains delicate data safe but additionally offers you a transparent report of the whole lot everytime you want it. Maintain your information neat and tidy, following pointers to be sure to don’t lose something vital.

Listed below are some methods to securely retailer and entry payroll data:

- Use an internet database that’s accessible anytime, from wherever, with computerized backups to guard your knowledge.

- Arrange a digital doc administration system with safe cloud storage, model management, and easy accessibility with search capabilities.

- Leverage safe cloud storage options like Google Drive, Dropbox, or OneDrive.

- Maintain bodily, printed paperwork in binders or file cupboards and set up them by worker, pay interval, or 12 months for straightforward entry.

- Monitor worker information, timesheets, and different knowledge utilizing safe spreadsheet templates, make sure that to arrange entry controls and backup procedures.

Whichever methodology you select, don’t overlook to incorporate clear guidelines for protecting paperwork so that you’re at all times on the appropriate aspect of the legislation. This makes the whole lot simpler, cuts down on errors, and retains you compliant.

7. Put together for payroll throughout holidays and particular occasions

Ah sure, the magical moments of the vacation season—equal elements thrilling and extremely busy. If you happen to don’t plan forward, the vacations might affect your payroll schedule and interrupt pay dates. Slightly than letting your pay interval lengthen to after a vacation or workplace closure, get forward of the sport and modify your payroll schedule to accommodate prematurely. Your staff will thanks!

If you happen to make adjustments to your payroll schedule, make sure that your staff are within the loop forward of time. Individuals need and have to know after they’ll receives a commission. And never solely will your staff admire it, however you gained’t have to fret about it when you’re having fun with the vacations.

However generally the surprising strikes (like pure disasters, a pandemic, or IT points), so how will you be ready for interruptions which will have an effect on payroll? Enter stage left: a payroll contingency plan. Right here’s easy methods to construct one:

- Backup all of your payroll knowledge in a number of locations so that you don’t lose important info.

- Cross-train your staff on the fundamentals of payroll and your software program options.

- Maintain reserves of money to be used in emergencies.

Implement an easier payroll course of

Mastering these savvy methods may also help make managing payroll smoother and fewer anxious. And whereas there are totally different strategies to creating this work, some firms lean in the direction of an automatic resolution.

We all know what you is likely to be considering—new software program is dear and takes time and coaching. However you’ll be glad to listen to that payroll software program at Homebase is free and extremely simple to arrange. Just some steps and also you’re in.

The Homebase app is designed for small companies like yours to make payroll and different administration duties easier than ever. So now that you just’re prepared to reduce stress and guarantee your staff are paid precisely and on time utilizing these methods, let’s get you began.