(Reuters) – A take a look at the day forward in U.S. and international markets by Samuel Indyk

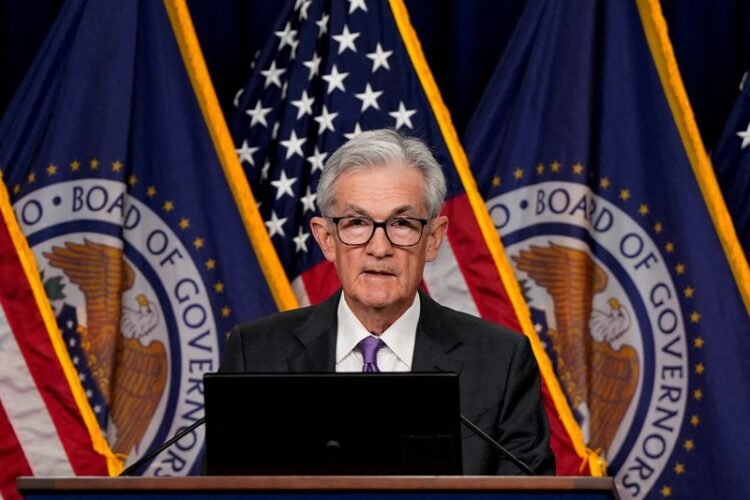

The wobbly begin for markets within the second quarter may worsen on Wednesday. Federal Reserve Chair Jerome Powell is because of ship a speech, and markets are doubting whether or not the central financial institution will proceed with easing coverage as early as June.

Cash market merchants are at odds with the Fed – and most analysts – relating to the timing of the primary rate of interest lower and the size of easing this yr.

Markets are nonetheless not absolutely pricing a lower till July, though they’re banking on a roughly-65% likelihood of a lower in June. In the meantime, they’ve additionally lowered their expectations for 3 cuts in 2024, however with inflation sticky and financial knowledge sturdy, the Fed is perhaps slowly coming round to that view themselves.

“I believe the larger danger could be to start lowering the funds price too early,” Federal Reserve Financial institution of Cleveland President Loretta Mester stated on Tuesday, though she would not rule out a June lower if upcoming inflation knowledge met her forecasts for an extra decline.

Powell, in reference to Friday’s private consumption expenditures knowledge, stated the inflation studying was “alongside the traces of what we wish to see”.

His feedback on Wednesday shall be scrutinized for extra clues on whether or not the June confab is the suitable time to begin loosening coverage.

The controversy over the timing of the primary price lower has saved Treasury yields elevated, posing a risk to the fairness rally that has made U.S. shares more and more costly whereas hitting file highs.

On Tuesday, the benchmark 10-year Treasury yield hit its highest stage in 4 months, whereas the S&P 500 has slipped nearly 1% to begin the quarter.

Buyers may even be looking forward to the influence on provide chains after the strongest quake in 25 years hit Taiwan, disrupting the semiconductor sector particularly.

“We consider this might result in provide disruptions within the tech provide chain,” Barclays analysts stated in a notice.

Taiwan Semiconductor, a significant provider to Apple and Nvidia, initially evacuated some fabrication vegetation, though later added that workers have been returning to work. Its shares slipped 1.3% in Taipei.

Elsewhere, knowledge releases on Wednesday embody the ADP’s report of private-sector payrolls, a precursor to Friday’s official nonfarm payrolls readout, and the ISM providers index for March.

Again to Wall Avenue and inventory index futures are signalling one other cautious begin, with S&P and Nasdaq futures edging down.

The greenback stays elevated, with the yen close to 152, near its weakest stage in a long time and maintaining merchants on edge for intervention from Japanese officers.

Key developments that ought to present extra route to U.S. markets afterward Wednesday:

* Fed’s Powell, Bowman, Goolsbee, Barr and Kugler resulting from communicate

* ADP nonfarm non-public employment, ISM non-manufacturing

* U.S. Treasury to public sale four-month payments

(Reporting by Samuel Indyk; Modifying by Bernadette Baum)