Hiroshi Watanabe/DigitalVision through Getty Pictures

MannKind Navigates PAH Market with Robust Q1 Earnings Surge

MannKind Company (NASDAQ:MNKD) is up 21.4% since my final look in February. Again then, my focus was on the corporate promoting 10% (1% of its 10% royalty) of its Tyvaso DPI stake for $150 million upfront (with an extra $50 million attainable). To me, this signaled that MNKD’s remaining Tyvaso DPI stake was price upwards of $1.8 billion. MannKind’s valuation at the moment was slightly below $1 billion, so this signaled some undervaluation. Subsequently, my ranking was purchase.

Recall that United Therapeutics (UTHR) developed Tyvaso DPI utilizing MannKind’s “technosphere expertise.” So, MannKind’s whole stake was 10% previous to promoting a small portion to Sagard Healthcare. Tyvaso DPI is utilized within the remedy of pulmonary arterial hypertension [PAH].

Final week, MannKind reported Q1 earnings. Let’s take a look. Whole revenues have been up 63% 12 months over 12 months to $66.26 million. Royalties associated to Tyvaso DPI have been up 94% to $22.65 million. The price of income/items bought was $18.598 million (a gross margin of 71.9%). R&D and SG&A bills have been $10 million and $22.329 million, respectively. Web earnings was $10.63 million (EPS 0.04), in comparison with a web lack of $9.795 million in Q1 2023.

United reported their Q1 earnings on Could 1. Tyvaso DPI recorded $227.5 million, up a formidable 92%. Regardless of various sufferers switching from nebulized Tyvaso to Tyvaso DPI (e.g., resulting from comfort), even the nebulized model is seeing 21% year-over-year development. So, Tyvaso is seeing important curiosity in a $7 billion PAH market with sufferers who usually require a mix of therapies.

The market is anticipated to be disrupted by Merck’s (MRK) Winrevair, which was accredited for PAH in March. Winrevair addresses vascular reworking by inhibiting activin signaling, which is a unique mechanism of motion than Tyvaso. Advantages have been seen in Winrevair medical trials, even in sufferers receiving a number of PAH therapies. So, whereas Winrevair is unlikely to eat into Tyvaso’s market share, which is especially helpful in bettering train capability, it’s anticipated to change into a cornerstone in PAH remedy.

On the authorized entrance, United continues to battle Liquida (LQDA) relating to their “generic model” of Tyvaso, Yutrepia (a dry powder model of treprostinil). Anticipated to launch later this 12 months, Yutrepia is anticipated to take market share away from Tyvaso DPI. To what extent, precisely, is the last word unknown. In my opinion, Yutrepia doesn’t present apparent benefits over Tyvaso DPI, and being second-to-market, the place Tyvaso DPI is comparatively entrenched, figures to create round an 80/20 market share favoring the entrenched drug (Tyvaso DPI) resulting from elements like first-mover benefit and model loyalty.

Monetary Well being

As of March 31, MannKind reported $193.27 million in money and money equivalents and $107.457 in short-term investments. Whole present property have been $383.1 million, whereas whole present liabilities (owed inside 12 months) have been $99.896 million. That is good for a present ratio of practically 4, indicating MannKind can moderately cowl short-term obligations.

MannKind has some notable long-term liabilities on the stability sheet, together with $227.2 million in senior convertible notes, $137.4 million in legal responsibility for the sale of future royalties, and $94.2 million in financing legal responsibility. Because of this, whole liabilities ($710.8 million) outweigh whole property ($480.879 million), implying that the corporate is considerably leveraged, which can elevate issues about monetary stability.

As a result of the corporate was worthwhile final quarter, a historic money runway estimate based mostly solely on burn charge is much less related. Nonetheless, it is very important notice that any sudden modifications in income or will increase in short-term money owed may have a big influence on MannKind’s means to stay solvent. Stability in profitability doesn’t assure future monetary well being if exterior elements or operational prices change unexpectedly.

Throughout a February earnings name, MannKind straight addressed analyst and investor issues about its stability sheet. Relating to the royalty deal:

A lot of you requested, may we’ve bought extra? Why did not we promote extra? And the fact is, we did not must promote extra. We needed to ensure we have been comfy with carrying the extent of debt and money on the stability sheet to manage our future.

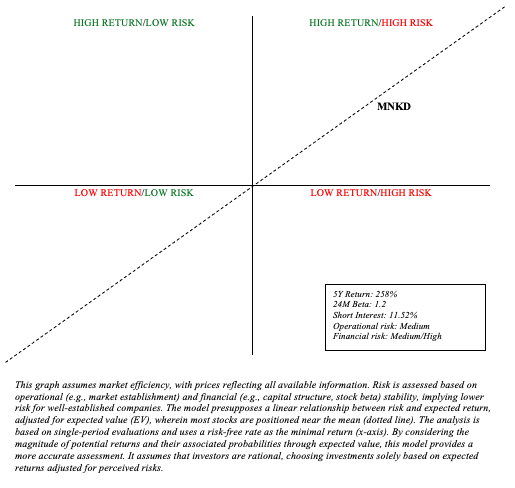

Threat Reward Evaluation and Funding Advice

When weighing threat and reward, there’s a important monetary threat transferring ahead. It’s clear, nonetheless, that the corporate is content material with its present stability sheet, and there aren’t any important short-term issues. Moreover, MannKind’s Tyvaso DPI stake mitigates monetary threat (assessed as “medium/excessive”).

Writer’s visible illustration

Operationally, I stay bullish on Tyvaso DPI’s prospects within the PAH market, regardless of the latest approval of Winrevair and the anticipated arrival of Yutrepia. Moreover, MannKind’s technosphere expertise, as a platform, could present some optionality, as seen in different developments like their inhaled insulin product, Afrezza (though this has procured little NPV).

All in all, MannKind stays a purchase, however it’s most likely most applicable for a barbell portfolio technique, by which an investor allocates 90% of funds to low-risk investments, like Treasuries and broad-market ETFs, and the remaining 10% to high-alpha investments, like MNKD.