Two of probably the most scorching shares thus far in 2024 are Chipotle Mexican Grill (NYSE: CMG) and Nvidia (NASDAQ: NVDA). Certainly, each companies are thought of leaders of their respective industries.

Nevertheless, along with strong enterprise efficiency, these two firms share one thing else in frequent that’s fueling some heightened shopping for exercise. Particularly, each Nvidia and Chipotle have upcoming inventory splits scheduled for June.

With shares of every persevering with to soar, traders could also be hard-pressed as to which firm represents a extra compelling place in the long term.

Let’s break down the advantages and alternative prices of proudly owning every inventory, and assess which one seems just like the superior selection.

The case for and towards Nvidia

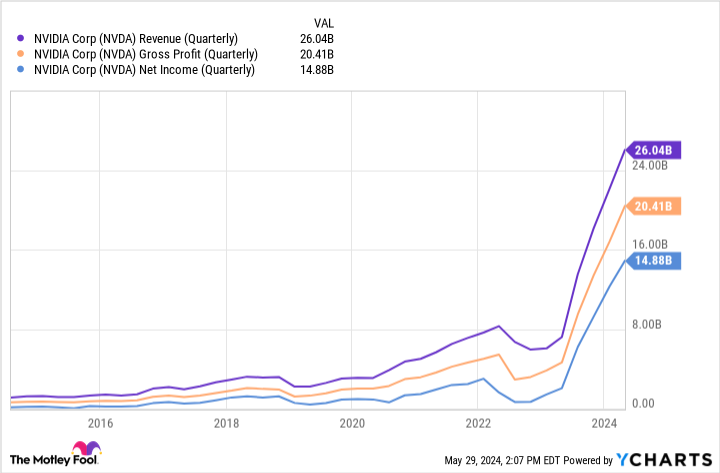

The chart under illustrates Nvidia’s income, gross revenue, and internet revenue during the last 10 years. Clearly, the final couple of years have witnessed outsized development in comparison with prior durations.

It is no secret that Nvidia is a significant participant within the synthetic intelligence (AI) realm. The corporate’s H100, A100, and Blackwell graphics processing items (GPU) are in excessive demand with prospects that embrace Tesla and Meta Platforms.

What’s actually notable in regards to the tendencies above is that Nvidia’s development is accelerating throughout each the highest and backside traces. By producing extra money circulation, Nvidia is ready to reinvest earnings into different development drivers and bolster its long-term roadmap.

Whereas that is all optimistic, there are some dangers that needs to be acknowledged. For now, Nvidia is estimated to have an 80% share of the AI chip market.

Nevertheless, rising competitors from Intel, Superior Micro Gadgets, and even huge tech corporations corresponding to Amazon and present prospects like Meta pose a risk. Every of those firms is creating its personal line of chips, which ought to ultimately encroach on Nvidia’s commanding lead.

The case for and towards Chipotle

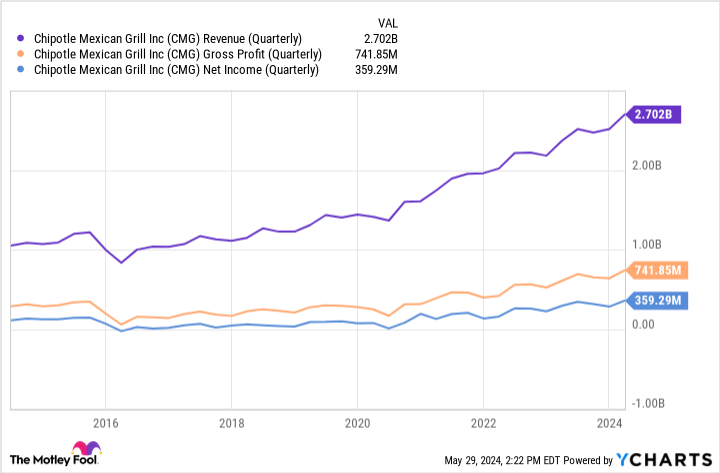

Chipotle is finest recognized for its tasty burrito wraps and bowls. With 40 million rewards members, Chipotle has undoubtedly constructed a loyal buyer following with robust model fairness.

One of many ways in which Chipotle has been in a position to seize the eye of so many customers is because of the firm’s investments in digital gross sales methods.

Much like Nvidia, Chipotle has been in a position to fund an especially worthwhile operation. Its digital gross sales channels have helped gasoline significant margin enlargement, which in flip has flowed to the bottom-line. Though these monetary outcomes are encouraging, Chipotle inventory does carry some danger.

Macroeconomic components corresponding to inflation and rates of interest can influence nearly any enterprise. Whereas Nvidia is definitely not immune to those components, I’d argue {that a} restaurant chain corresponding to Chipotle is extra inclined.

Shopper discretionary tendencies are extremely delicate and might fluctuate from yr to yr. I would encourage traders to consider that dynamic because it pertains to long-term development prospects.

And the winner is?

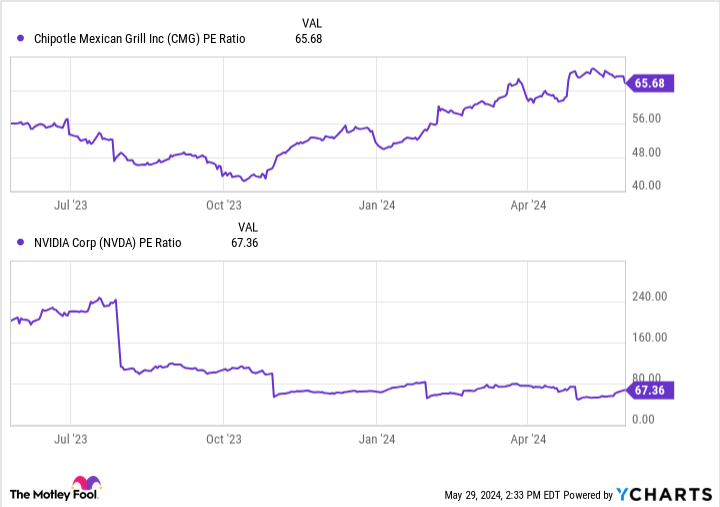

The ultimate piece of this evaluation revolves round valuation. As seen within the chart under, the price-to-earnings (P/E) ratio of Chipotle and Nvidia illustrate vastly completely different tendencies.

During the last yr, Chipotle’s P/E has risen significantly — now sitting at 65.7. In contrast, Nvidia’s P/E is much decrease than it was a yr in the past.

One other means of that is understanding that, whereas every inventory has risen sharply within the final yr, shares of Nvidia are technically cheaper than they had been 12 months in the past. Why? As a result of the corporate’s earnings development is outpacing the acceleration of the inventory worth.

On the finish of the day, Chipotle and Nvidia are two very completely different companies.

The very fact of the matter is that Chipotle’s fast-casual eating is a luxurious buy. Whereas the working outcomes above point out that the corporate can develop, it is necessary to do not forget that Chipotle sells burritos — it isn’t precisely a proprietary enterprise.

Quite the opposite, Nvidia sells a product that companies of all sizes want. And whereas competitors exists, I believe that there are stronger longer-term secular tailwinds fueling AI versus the meals trade. If something, Chipotle may turn out to be a buyer of Nvidia as the corporate doubles down on its know-how investments.

Said in another way, AI is so prolific that its functions span a wide range of trade sectors, together with meals and beverage. I do not suppose the alternative is true, although. I do not see many the reason why Nvidia would ever be a Chipotle buyer.

Contemplating the expansion narrative surrounding AI, coupled with Nvidia’s enticing valuation, I believe the corporate is the higher possibility in comparison with Chipotle.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $671,728!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 28, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Chipotle Mexican Grill, Meta Platforms, Nvidia, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Nvidia vs. Chipotle: Which Might Be the Higher Inventory-Break up Inventory to Purchase Now and Maintain for the Subsequent 10 Years? was initially revealed by The Motley Idiot