takasuu/iStock through Getty Photographs

Japanese Authorities Bond (“JGB”) yields have risen to a 13-year-high, whereas the Japanese yen has fallen to a 34-year low.

Each are a results of the Financial institution of Japan (“BOJ”) remaining behind the curve when it comes to normalizing their financial coverage.

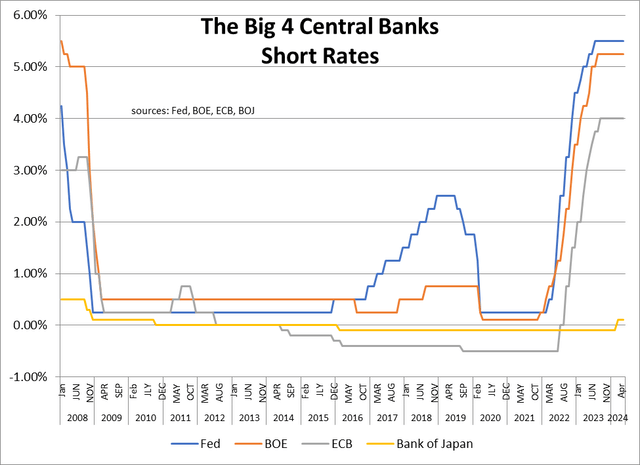

Whereas the Financial institution of Japan ended their Unfavorable Curiosity Fee Coverage in March, the rise of their Coverage Fee to 0.0-0.1% nonetheless leaves the BOJ woefully behind the remainder of the developed world.

Fed, BOE, ECB, BOJ

With brief charges on the Fed of 5.5%, the Financial institution of England (“BOE”) at 5.25% and the European Central Financial institution (“ECB”) at 4.0%, the yield gaps are so broad buyers are promoting Japan to purchase into the upper yielding markets.

That is placing strain on each JGB yields and the Yen, regardless of speak of the Fed easing someday this yr and expectation of the ECB chopping charges as quickly as this week.

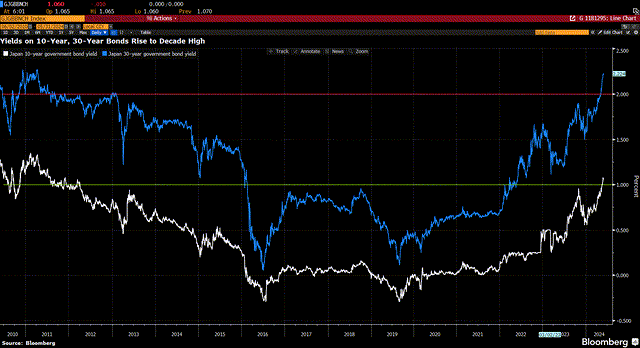

Japanese Authorities Bond Yields

The 30-year JGB yield hit 2.22%, whereas the benchmark 10-year JGB yield reached 1.09%, each their highest degree since 2011.

Bloomberg

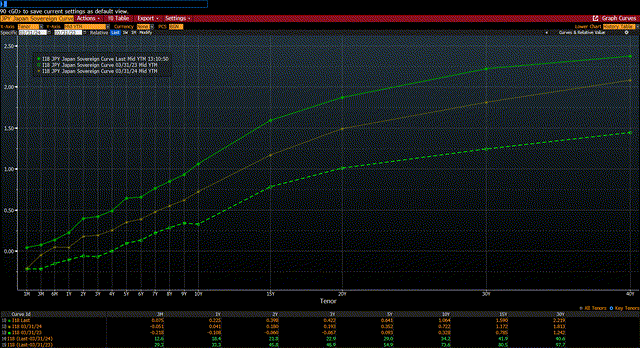

A lot of the current spike in yields has come underneath the tenure of BOJ Governor Kazuo Ueda. In truth, your complete JGB yield curve has shifted considerably increased throughout his watch.

Ueda started his time period in April 2023. Since then, 1-year JGB yields have risen 33 foundation factors, 10-year JGB yields have risen 74 foundation factors and 30-year JGB yields have risen 98 foundation factors. The ten foundation factors of BOJ tightening to this point is inadequate.

The market is clamoring for extra.

Bloomberg

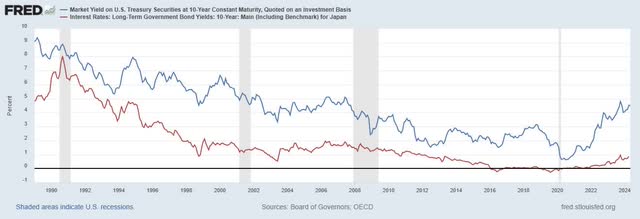

JGB Yield Hole with US Treasuries

Even with the current spike in 10-year JGB yields, their yield hole with 10-year US Treasuries (US10Y) has expanded to 350 foundation factors.

FRED

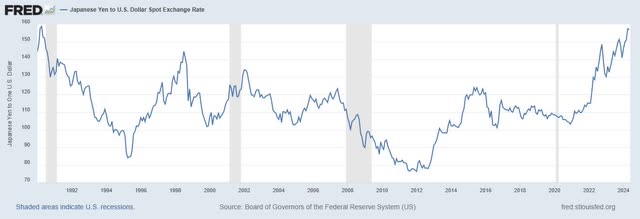

The Japanese Yen

The broad yield differentials have led to an outflow from Japan, inflicting the yen to weaken to its lowest degree since 1990.

FRED

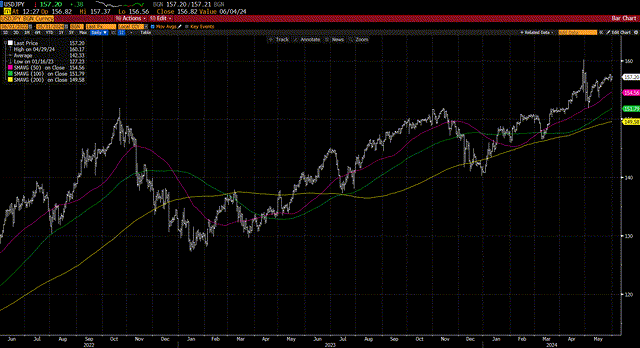

The selloff within the yen has been notably acute since Ueda grew to become BOJ Governor. When he took over the BOJ in April 2023, the yen stood at 133 to the greenback. It has subsequently weakened by 15.2%.

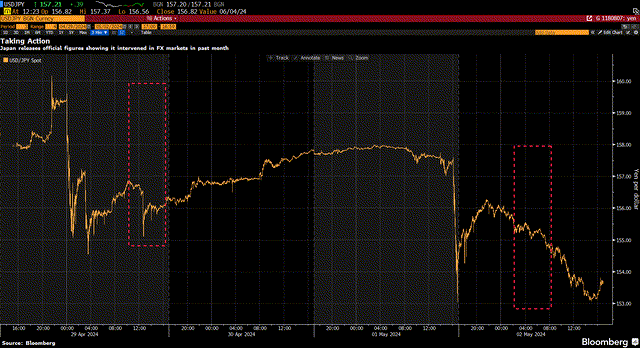

Foreign money Intervention

The BOJ was so involved concerning the devaluation of the yen, they took the rare step of intervening within the foreign money markets to offer help on the degree of 160 Yen to the greenback. On two separate days, April 29th and Might 2nd, the BOJ spent an all-time excessive 9.8 trillion yen ($62.2 billion) to defend the foreign money.

Bloomberg

The short-term impact was to trigger the yen to rally to 152, a 5.2% transfer, however over the following month it fell to 157, giving again 3.2% of the acquire.

The BOJ’s transfer exceeded their earlier document of 9.2 trillion yen ($60.5 billion) of help throughout their final intervention in October 2022, after they stepped in with the yen buying and selling at 152.

Bloomberg

BOJ Coverage Uncertainty

The BOJ has been transferring glacially of their coverage normalization, which has led to the weak spot within the JGB market and the yen.

Ueda has hinted that extra must be finished, however the lack of readability has precipitated the weak spot.

Many are speculating that a further rate of interest hike is coming in both June or July.

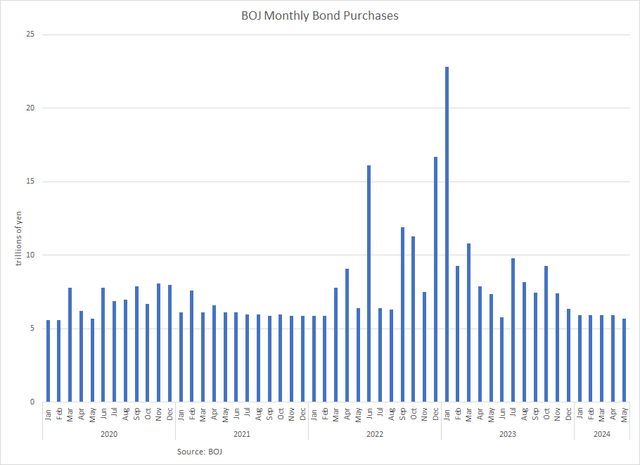

Moreover, there may be uncertainty concerning the BOJ’s plan to scale back bond purchases. When the BOJ exited their Unfavorable Curiosity Fee Coverage in March, Ueda was cautious to sign that coverage would stay accommodating. They’d proceed with JGB purchases in broadly the identical quantity as earlier than.

Nevertheless, BOJ has slowly been chopping again on their JGB purchases. They purchased 6.0 trillion yen of JGBs in February, 5.9 trillion yen of JGBs in March and April, and 5.7 trillion yen of JGBs in Might. Final month’s JGB purchases have been the smallest quantity since Might 2020.

BOJ

What has gone unnoticed, is that the BOJ’s JGB holdings are maturing on the fee of 70 trillion yen per yr. This interprets to a month-to-month runoff of 5.8 trillion yen. Consequently, if the BOJ continues to pare again their month-to-month purchases, opposite to their coverage of being accommodating, they’re truly lowering their JGB holdings.

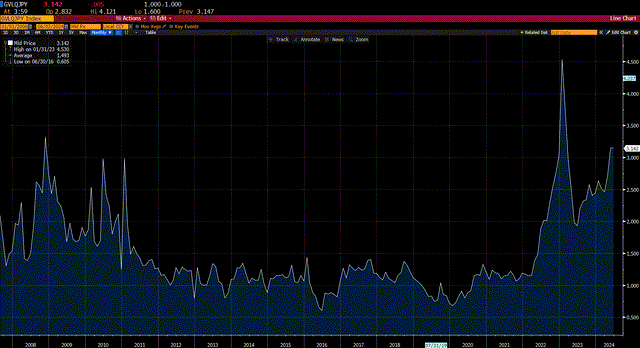

Liquidity

The bond sell-off has contributed to a liquidity downside within the JGB market, as measured by the Bloomberg JGB Liquidity Index.

Liquidity has deteriorated to the extent seen throughout the Nice Monetary Disaster of 2008. The one interval that was worse was when the BOJ stunned the market in December 2022 by doubling their Yield Curve Management Band and tripling their JGB purchases to defend the band towards speculators.

Bloomberg

Conclusion

The Financial institution of Japan has been gradual to normalize their financial coverage, and it has precipitated each the JGB market and the yen to unload. Extra tightening is critical to stem the outflows. The BOJ must act extra shortly and with extra readability.

Editor’s Word: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.