NiseriN

When on the lookout for a attainable funding, I wish to establish firms which have demonstrated the power to boost their dividend over a protracted time period. Ideally, the dividend development streak will cowl a number of recessionary intervals as this reveals that the corporate continued to boost its distribution even during times of financial turmoil.

Why there are numerous such firms within the extra recession-resistant sectors, like shopper staple or well being care, I’m particularly eager about these names that function within the extra cyclical areas of the economic system which have prolonged observe data for growing distributions to shareholders.

A majority of these firms are extra impacted by an financial downturn, however these with a number of a long time of dividend development have navigated such an occasion with out chopping or eliminating their funds to shareholders.

To me, this speaks to the general energy of the corporate.

One such title that I consider to be an particularly sturdy firm is Nationwide Gasoline Gasoline Firm (NYSE:NFG), which has raised its dividend for greater than 50 years even because it operates in one of the vital financial delicate sectors available in the market, vitality.

Firm Background and Latest Earnings Outcomes

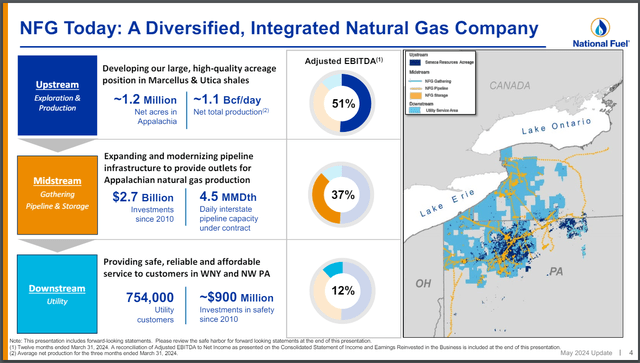

Nationwide Gasoline Gasoline is a diversified vitality firm which have 5 reportable enterprise segments, which embrace Exploration & Manufacturing, Pipeline & Storage, Gathering, Utility, and Vitality Advertising.

Nationwide Gasoline Gasoline Investor Relations

The corporate’s operations embrace upstream, midstream, and downstream property. Of those, the upstream enterprise is a very powerful to the corporate. In whole, Nationwide Gasoline Gasoline has greater than 1 million acres situated within the Marcellus and Utica shales and serves greater than 750,000 utility clients in western New York and northwestern Pennsylvania.

Nationwide Gasoline Gasoline reported earnings outcomes for the second quarter of fiscal yr 2024. Income for the interval fell 12.2% to $630 million, marking the fourth consecutive quarter of year-over-year declines. Regardless of decrease income, the corporate’s adjusted earnings-per-share of $1.79 in contrast was forward of the prior yr’s whole of $1.54 and was $0.33 higher than anticipated. The corporate has now topped the market’s estimates for earnings-per-share in 17 out of the final 20 quarters.

Nationwide Gasoline Gasoline offered replace steering for 2024 as properly. The corporate expects the common gasoline worth to be $2.00, down from $2.40, leading to a brand new projected adjusted earnings-per-share vary of $4.75 to $5.05, down from $4.90 to $5.20.

Earnings Takeaways

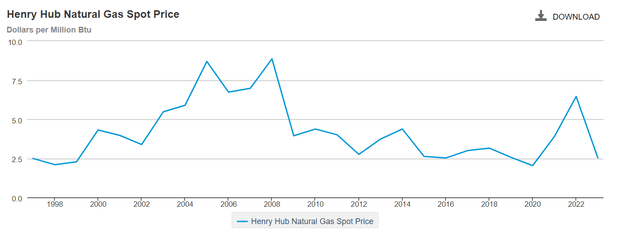

Nationwide Gasoline Gasoline’ fortunes are extremely correlated to the worth of pure gasoline, which will be unstable.

U.S. Vitality Info Adminstration

Costs for pure gasoline peaked in early 2008 and have but to make a brand new excessive. The sharp improve in worth in 2022 correlates to the Russian invasion of Ukraine and the following sanctions positioned on that nation that restricted its capability to export pure gasoline.

The worth of pure gasoline hit a 3 yr low in mid-February of this yr as an unusually hotter winter saved a lid on demand.

The market has since corrected and on the present worth of $2.89 per MMBtu, pure gasoline sits properly off its of 52-week low of $1.48, however nonetheless 20% beneath its excessive of $3.63.

For its half, Nationwide Gasoline Gasoline doesn’t count on the latest worth to stay at this stage. The corporate forecasts that pure gasoline costs will common simply $2.00 per MMBtu for the rest of the fiscal yr (which ends September 30th). Beforehand, the corporate had estimated pure gasoline costs at $2.40.

Whereas quarterly income did decline by a double-digit determine, this represents a deacceleration in Nationwide Gasoline Gasoline’ top-line decreases. The final three quarters had seen income declines of 20.3%, 15.2%, and 14.7%, respectively, so the speed of drop year-over-year is displaying some indicators of slowing.

Hedging allowed the corporate to see only a 1% decline in common realized pure gasoline costs as pricing went from $2.58 to $2.56 in Q2. With out hedging, pure gasoline costs had been 29% decrease than the prior yr. Contemplating the place Nationwide Gasoline Gasoline expects common costs to be for the rest of the yr, this was a prudent transfer on administration’s half and helped soften the blow in the latest quarter.

Importantly, this weak spot was offset by good points in different companies. The Gathering section had earnings development of 18% and income improved 12%. This section operates roughly 400 miles of pipeline and connects with seven main pipelines, which offer Nationwide Gasoline Gasoline with shut a throughput of 1.4 billion cubic toes per day.

Pipeline & Storage was additionally a contributor to outcomes as income was up 14%, driving a 22% acquire in earnings. This section advantages from a pipeline community that has near 2,600 miles has a capability to move 3.4 billion cubic toes per day.

The Utility section had income development of 41% as the speed will increase from the corporate’s 2023 fee case settlement offered meaningfully to year-over-year good points. Consequently, earnings had been up 29%. Nationwide Gasoline Gasoline can also be concerned in fee case negotiations with New York regulators. The corporate is asking for a $320 million improve from the final fee case. Even with these fee will increase, Nationwide Gasoline Gasoline has a number of the lowest prices to utility clients in New York and Pennsylvania.

At the same time as pure gasoline costs are very low in the present day, Nationwide Gasoline Gasoline is properly positioned if costs are to ever recuperate. The Exploration & Manufacturing section has near 1.2 million acres in Pennsylvania with extra 4.5 trillion cubic toes of pure gasoline equal, which supplies Nationwide Gasoline Gasoline a long time of improvement stock at present manufacturing charges.

General, the quarter appeared as profitable as attainable with decrease pure gasoline costs. Hedging restricted the injury that falling pure gasoline costs induced on outcomes and most different elements of the enterprise carried out properly and noticed double-digit development for income and earnings. The income lower slowed from the final three quarters and earnings-per-share had been up 16%. The corporate did decrease its earnings-per-share forecast, however the brand new midpoint of $4.90 can be decrease by simply 5% from fiscal yr 2023. Given Pure Gasoline Gasoline’ capability to outperform earnings estimates, it might not be a shock for the corporate to ship greater than anticipated outcomes.

Dividend and Valuation Evaluation

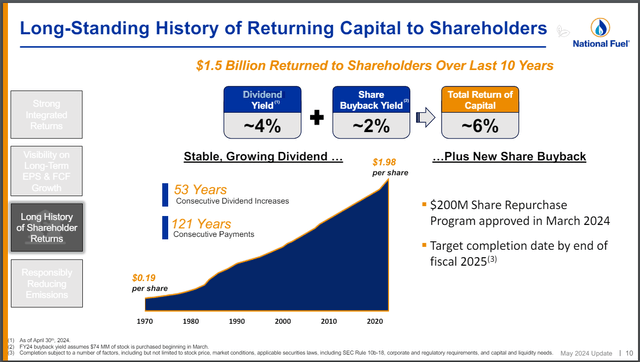

Regardless of its extra cyclical nature, Nationwide Gasoline Gasoline has elevated its dividend for 54 consecutive years, which qualifies the corporate as a member of the Dividend Kings Index. The corporate is extremely pleasant to shareholders.

Nationwide Gasoline Gasoline’ Investor Relations

In whole, the corporate has paid a dividend for greater than 120 years, one of many longest dividend development streaks available in the market. The present development streak encompasses a number of intervals of recessions, geopolitical upheaval, and even a pandemic and Nationwide Gasoline Gasoline has continued to not solely keep, however increase its dividend. This needs to be very comforting for shareholders.

The dividend has a CAGR of two.5% during the last decade and a pair of.4% for the final 5 years. Dividend development has been gradual over the long-term, however that development fee is beginning to pattern upwards. Shareholders simply acquired a 4% improve within the quarterly dividend on June 13th, 2024. This follows a 4.2% improve final summer time and a 4.4% improve in 2022.

Shares yield 3.7% based mostly on the brand new ahead annualized dividend of $2.06. The projected payout ratio for this yr is a really wholesome 42%.

Whereas Nationwide Gasoline Gasoline does have a utility part, the corporate’s reliance on pure gasoline for a lot of its enterprise makes it rather more of an vitality firm for my part.

For the time being, the vitality sector has a median trailing price-to-earnings ratio of 10.1 and a median ahead price-to-earnings ratio of 10.6.

Shares of the corporate closed Friday’s buying and selling session at $55, implying a ahead price-to-earnings ratio of 11.2. By this measure, shares of Nationwide Gasoline Gasoline are barely overvalued.

Nevertheless, the inventory has a five-year common trailing earnings a number of of 12.7 and a ahead common earnings a number of of 12.1. On a historic foundation, the inventory is undervalued.

Given Nationwide Gasoline Gasoline’ capability to proceed to boost its dividend even throughout weak financial intervals, I consider {that a} goal price-to-earnings ratio of 11 to 13 is suitable.

Utilizing the midpoint of this yr’s earnings steering, I’ve a worth goal vary of $54 to $64 for the inventory. On the low finish, the inventory might decline 3.6%, however might return as a lot as 14.3% if it had been to succeed in the excessive finish of my goal vary. Inclusive of the present yield, whole returns start to stretch into the high-teens.

Dangers to Funding Thesis

The largest threat to Nationwide Gasoline Gasoline is that pure gasoline costs might stay decrease for longer. The hotter than regular winter tremendously impacted pricing and, because of this, full-year steering from the corporate was lowered. This previous winter was, in actual fact, the warmest on document, with a lot of Nationwide Gasoline Gasoline’ space of operations seeing a few of its highest common temperatures ever. If future winters are related then long-term demand for pure gasoline will stay muted.

Moreover, state regulators might hamper growth. instance of that is the continued battle over the corporate’s proposed Northern Entry pipeline that might create a 99-mile system to move pure gasoline by way of western New York state to Canada. The challenge has been on maintain as ligation strikes ahead.

Ultimate Ideas

Nationwide Gasoline Gasoline is a Dividend King with a formidable historical past of elevating its funds to shareholders regardless of working in a really cyclical sector. Vitality costs, particularly pure gasoline, are largely tied to the well being of the economic system and demand for assets.

Demand for pure gasoline has been low because of hotter winter climate, which has resulted in lowered estimates for 2024. That stated, shares are fairly valued, might return double-digits, and supply a stable yield. Subsequently, I fee shares of Nationwide Gasoline Gasoline as a purchase because of potential returns and secure dividend.